Billionaire investor Stanley Druckenmiller’s Duquesne Family Office had initiated a position in social media giant Meta Platforms (META) in the third quarter of 2025, buying 76,000 shares of the Facebook operator. However, Druckenmiller has ditched Meta, according to the latest 13F filing, shedding approximately 76,000 shares.

Meta has faced rising questions about its rising capital expenditures related to artificial intelligence (AI). The company expects its capex to nearly double this year, compared to 2025. While Meta seeks to stay ahead of the AI boom, AI itself is facing concerns about a potential bubble.

Given that Druckenmiller has opened a position in financial giant Goldman Sachs (GS), the investor is likely seeking stability, suggesting skepticism about Meta’s near-term profitability amid surging capex for AI infrastructure.

What should you do with Meta Platforms at this juncture?

About Meta Platforms Stock

Meta Platforms, headquartered in Menlo Park, California, operates a suite of popular apps, including Facebook for social networking, Instagram for visual sharing, WhatsApp for secure messaging, and Messenger for instant communication. The company advances AI to enhance user experiences across its platforms, powering content recommendations, real-time translation, and safety moderation tools.

Additionally, Meta develops Ray-Ban Meta smart glasses that blend augmented reality with everyday wear, enabling hands-free photo capture, voice commands, and AI-assisted interactions. This integrated ecosystem drives global connectivity and innovation in social technology. The company has a massive market capitalization of $1.62 trillion.

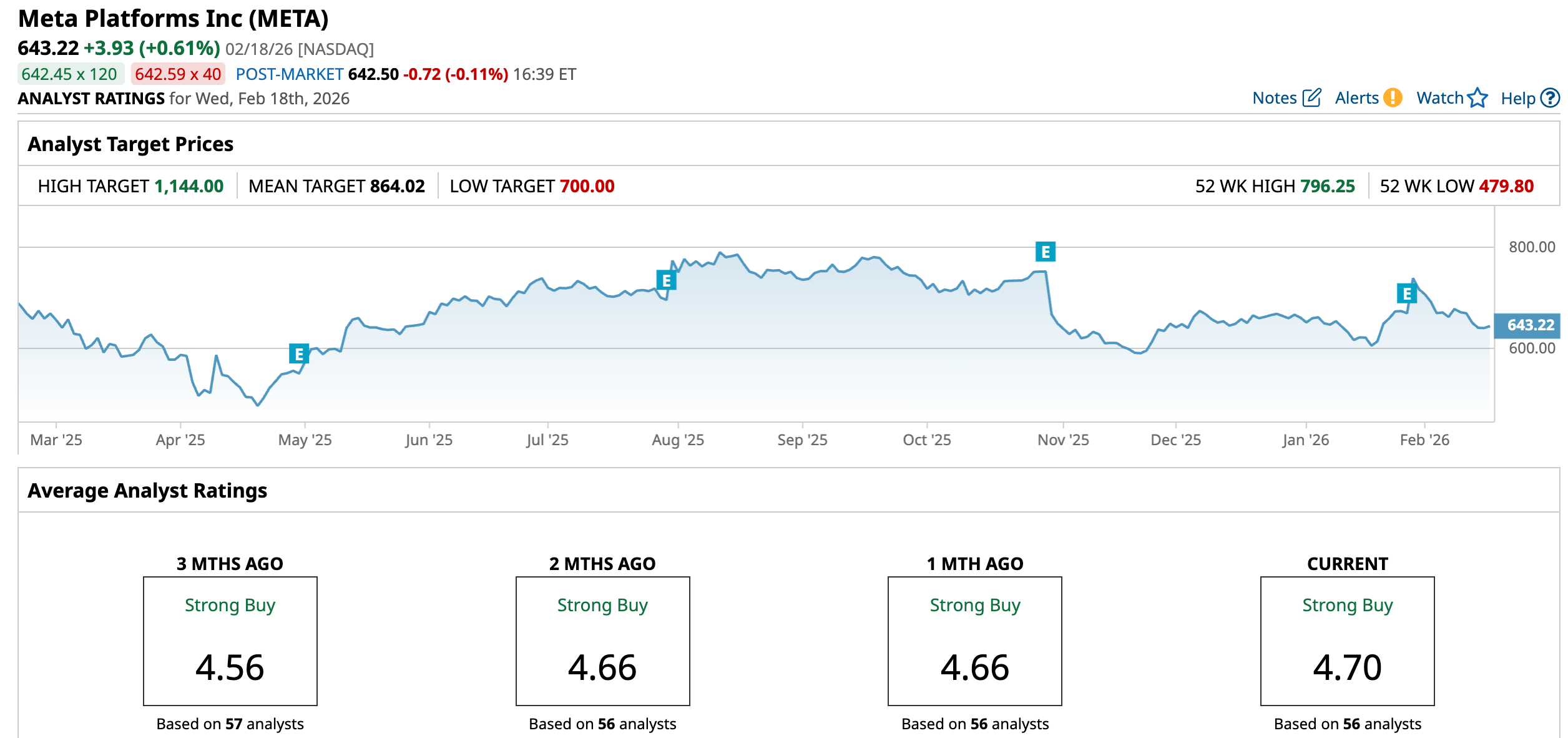

Concerns about high AI spending have made investors cautious about the stock. Meta’s stock has declined 10.2% over the past 52 weeks and 2.56% year-to-date (YTD). The stock reached a 52-week high of $796.25 in August 2025 but is down 23.8% from that level. Just for comparison, the Roundhill Magnificent Seven ETF (MAGS), consisting of Meta and its Magnificent 7 peers, is up 11.92% over the past 52 weeks.

On a forward-adjusted basis, Meta’s price-to-earnings ratio of 21.56x is higher than the industry average of 14.21x.

Meta Platforms’ Stock Surged Due To Better-Than-Expected Q4 Results

Meta’s stock climbed 10.4% intraday on Jan. 29, after the company reported stronger-than-expected results for the fourth quarter of fiscal 2025 on Jan. 28. Its total revenues increased by 24% year-over-year (YOY) to $59.89 billion, which was higher than the $58.59 billion that Wall Street analysts had expected.

However, this top line growth could only partially translate into bottom line gains, as Meta’s costs and expenses climbed 40% from the prior-year period. Meta’s EPS increased 11% YOY to $8.88, higher than the $8.23 that Street analysts had expected.

The daily active people (DAP) across its family of apps averaged 3.58 billion in December 2025, reflecting a 7% YOY increase. Fourth-quarter ad impressions over the family of apps increased by 18% from the prior-year period, while the average price per ad grew 6% YOY.

Meta’s revenue from its family of apps increased 25% YOY to $58.94 billion, while its Reality Labs segment’s revenue dropped by 12% YOY to $955 million. The latter segment is also accruing operating losses for the company. However, Meta’s total income from operations grew 6% YOY to $24.75 billion.

The company expects its full-year 2026 total expenses to range from $162 billion to $169 billion. The majority of expense growth is expected to be driven by infrastructure costs, including third-party cloud spend, higher depreciation, and higher infrastructure operating expenses. Capital expenditures, including principal payments on finance leases, are projected to be in the $115 billion–$135 billion range, driven by increased investment in Meta Superintelligence Labs and its core business.

Wall Street analysts are cautiously optimistic about Meta’s future earnings. They expect the company’s EPS to climb by 3.7% YOY to $6.67 for the current quarter. However, for the current year, EPS is projected to decline slightly YOY to $29.67, followed by a 13.9% increase to $33.79 in fiscal 2027.

Here’s What Analysts Think About Meta Platforms’ Stock

This month, Argus Research, led by analyst Joseph Bonner, maintained a bullish “Buy” rating on Meta and an $800 price target, reflecting consistent positive sentiment around the stock. Last month, Guggenheim analyst Michael Morris maintained a “Buy” rating on the stock and raised the price target from $800 to $850.

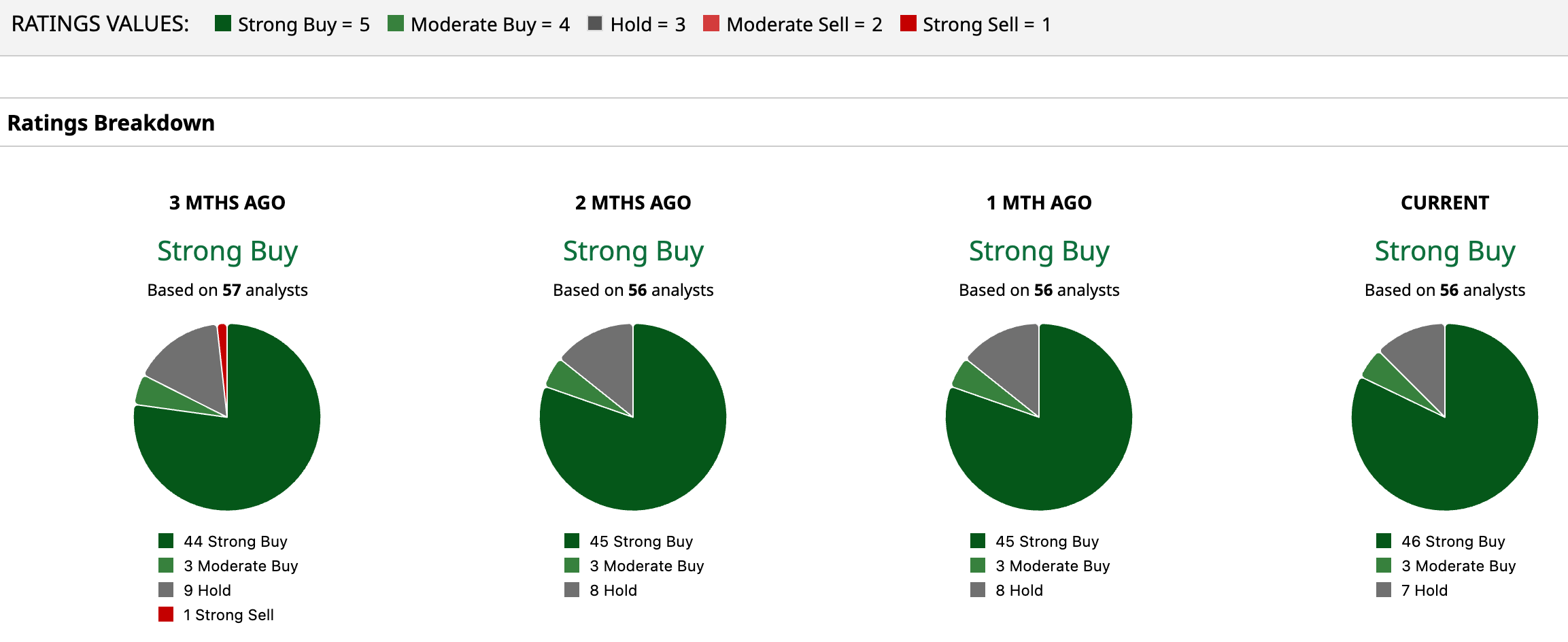

Meta has been in the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating. Of the 56 analysts rating the stock, a majority of 46 analysts have rated it a “Strong Buy,” three analysts suggest a “Moderate Buy,” while seven analysts are playing it safe with a “Hold” rating. The consensus price target of $864.02 represents a 34.33% upside from current levels. The Street-high price target of $1,144 indicates a 78% upside.

Key Takeaways

Despite the softness in the stock, analysts remain bullish on Meta’s long-term prospects. Given the robustness of the company’s core operations, the stock might still be a buy for investors willing to tolerate near-term volatility.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stanley Druckenmiller Ditched Meta Platforms Stock. Should You?

- Moderna Jumps Above 20-Day Moving Average on FDA Flu Vaccine Review. Should You Buy MRNA Stock Here?

- This Is the Cloud’s Olympic Moment. Will It Medal or Bust?

- Cadence Stock Is Challenging Its 50-Day Moving Average After Earnings. Should You Buy CDNS Here?