Raytheon Corp (RTX) reported strong free cash flow (FCF) for Q4 and 2025 before the market opened today. Moreover, it projected strong FCF for 2026. Based on this, RTX could be worth 10% more at $217.00 or higher. Buying long-dated in-the-money (ITM) call options could work for investors, as this article will show.

RTX is up today at $198.17, up over 2.0%. It's still below a recent peak of $201.92 reached on January 16. RTX has moved up +17,5% from a recent low of $168.45 on Dec. 3. This article will show why it could go higher, based on the company's projections.

Strong Revenue and Free Cash Flow (FCF)

Raytheon's revenue, earnings, and free cash flow (FCF) results exceeded analysts' expectations. For example, analysts forecast $87 billion in revenue for 2025, but it came in at $88.6 billion. That was 1.83% higher than expectations.

Moreover, the aerospace and defense company reported a strong outlook for both revenue and free cash flow, which should benefit RTX stock's potential upside.

In fact, Raytheon is one of the very few companies that not only reports its FCF but also provides full-year projections for FCF.

It reported $3.195 billion in FCF for Q4, bringing the full-year 2025 FCF to almost $8 billion ($7.94 billion according to Stock Analysis). That was 75% higher than last year ($4.534 b) and even 51% higher than the previous quarter's trailing 12-month (TTM) figure ($5.237 b), according to Stock Analysis.

However, Raytheon also projected that in 2026, FCF could rise to between $8.25 billion and $8.75 billion, on its own revenue forecast of $92 billion to $93 billion.

Implied FCF Margins

This means that Raytheon expects its FCF margins to stay high. For example, in Q4, the $3.2 billion in FCF it generated represented a record 13.18% of its quarterly $24.2 billion.

That was significantly higher than last year's 2.3% FCF margin, although lower than the Q3 17.9% FCF margin, according to Stock Analysis.

However, for the full year, its $7.94 billion in FCF was almost 9% of sales (8.96%) compared to just 6.09% over the last 12 months (LTM) as of Q3. This shows that Raytheon is squeezing out more cash from its operations.

And if the company's top projections for $8.75 billion come true, that could represent 9.4% of its projected $93 billion in sales at the high end. That could push its target price (TP) higher than today's price.

Target Prices (TPs) for RTX Stock

For example, right now, Raytheon's market capitalization is $265 billion, according to Yahoo! Finance. So, over the last year, its $8 billion in FCF represents a FCF yield of 3.0%.

So, applying that to the company's projection of $8.75 billion in FCF (at the high end), the market cap could rise to:

$8.75 b FCF 2026 est. / 0.03 = $291.667 billion

That represents a potential rise in its market cap of 10% (i.e., $291.66b / $265.0b), and RTX's target price (TP) could be $218:

1.10 x $198.17 = $217.99 per share

But, if the company's FCF continues to surge like this, the market likely will improve the FCF yield metric. For example, the 3.0% FCF yield is also equal to multiplying FCF by 33.33 (1/0.03 = 33.33x).

So, if we assume that the market could push the FCF multiple to 40x:

$8.75 b FCF 2026 est. x 40 = $350 billion

That means RTX stock could rise by 32% (i.e., $350b/$265b -1 = 0.32). So, RTX's TP could rise to $261.58 per share (i.e., 1.32 x $198.17).

So, on average, RTX could be worth between $218 and $262 over the next year.

Analysts have not reached these conclusions. The average of 22 analysts surveyed by Yahoo! Finance is just $202.83. I expect that after they review these excellent Raytheon results, they will hike their TPs.

The bottom line here is that RTX stock looks undervalued based on the company's strong results.

One way for a long-term investor to play this is to buy long-dated in-the-money (ITM) call options.

Buying Long-Dated ITM Calls

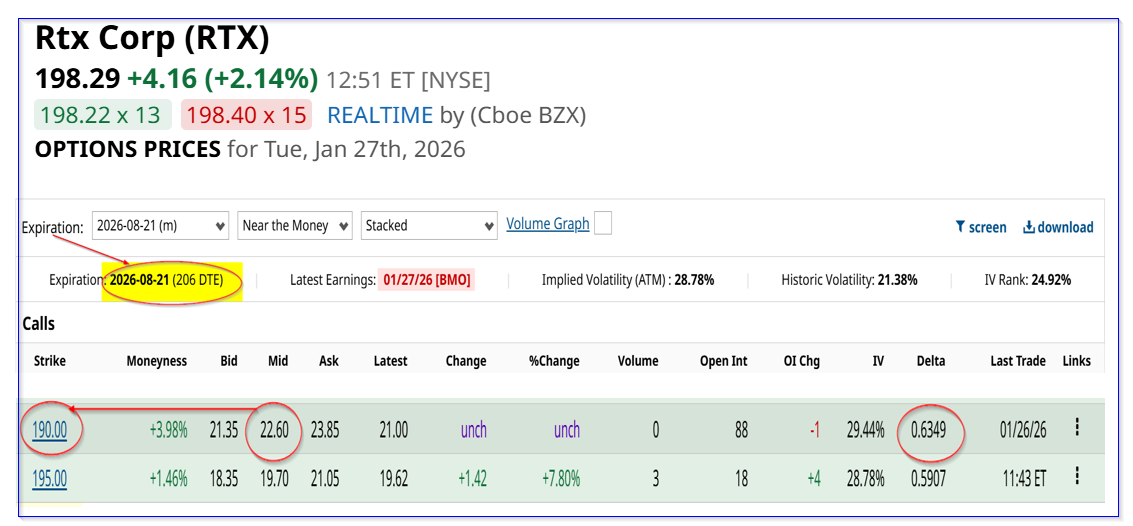

For example, the Aug. 21, 2026, expiry period shows that the $190.00 call option has a midpoint premium cost of $22.60. That would cost an investor $2,260 for 100 shares, whereas 100 shares at today's price cost 19,829.

In other words, an investor could buy 9 call options representing 900 shares for 20,340, almost equal to the same cost as owning 100 shares today.

So, if RTX rises to $235 by Aug. 21, the intrinsic value of the call option will be $45.00 (i.e., $235.00-$190.00). So, the profit will be:

$45.00 profit - $22.60 cost of call options = $22.40 per call or $2,240 for 9 calls = $20,160 profit

That represents almost a 100% return (i.e., $20,160/$20,340 cost = 0.99).

The owner of 100 shares would make $36.71 ($235.00 - $198.29), or $3,671 for 100 shares costing $19,289, for a 19% profit over 8 months.

In other words, the long-dated in-the-money (ITM) call option return would be over 5.2x greater than owning RTX shares. The return could also be higher if the option holder sells before expiration, since there would be extrinsic value left in the call option price.

Moreover, investors could sell out-of-the-money puts or calls in 1-month or shorter periods, to help reduce the cost of the long-dated calls.

The bottom line is that when a company projects its own FCF, and you can estimate a higher price target, it makes sense to buy in-the-money long-dated call options.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Volatility Skew is Sending a Very Clear Message About Newmont’s (NEM) Golden Rally

- Raytheon's Strong Free Cash Flow and FCF Margin Could Push RTX Stock Higher

- Options Flow Alert: Institutional Money Loading Up on Google Stock

- SoFi Technologies (SOFI) is Flashing an Intriguing Quant Setup Ahead of Q4 Earnings