HSBC has identified Oracle (ORCL) and Salesforce (CRM) among 11 U.S. stocks positioned to outperform during the upcoming earnings season. The investment bank cited strong competitive advantages and exposure to artificial intelligence tailwinds that could drive sustained growth.

Analyst Nicole Inui has selected companies across sectors such as consumer, healthcare, and technology with a focus on outlook for 2026, margin pressures, and AI-related expenses.

Oracle and Salesforce are two enterprise software giants that continue to widen their AI moat amid a rapidly evolving tech landscape. With a robust backlog, Oracle offers strong future revenue visibility to investors, given that its cloud infrastructure and autonomous database capabilities remain critical as enterprises race to deploy AI applications at scale.

Meanwhile, Salesforce recently launched Agentforce, an agentic layer built into its platform, evolving beyond traditional CRM software. The integration of AI agents capable of autonomously handling tasks from sales to service positions at Salesforce to capture growing enterprise demand for intelligent automation.

Oracle and Salesforce are navigating a market where AI infrastructure spending continues to accelerate despite a volatile macroeconomy. Oracle's cloud database offerings and Salesforce's AI-powered customer engagement tools address critical needs as businesses seek to gain a competitive advantage through technology adoption.

Investors face the question of whether these stocks can translate their technological leadership into financial results that justify current valuations.

Is Oracle a Good Stock to Buy Today?

Oracle ended fiscal Q2 of 2026 with remaining performance obligations of $523 billion, up 433% year-over-year (YoY). In the quarter ended in November, the database behemoth added $68 billion in new customer contracts, including Meta (META) and Nvidia (NVDA).

Total cloud revenue hit $8 billion, up 33% YoY and above the 24% growth reported in the prior-year period. Cloud infrastructure sales rose 66% to $4.1 billion, with GPU-related revenue surging 177% as Oracle continues to outpace competitors in the race to capture AI infrastructure spending.

The company now operates 147 live customer-facing regions, with 64 more planned, and delivered close to 400 megawatts of data center capacity to customers during the quarter.

Oracle's Supercluster in Abilene, Texas, is progressing on schedule, with deployment of more than 96,000 Nvidia Grace Blackwell GB200s. It also began delivering AMD (AMD) MI355 capacity, showcasing its multi-vendor approach to meeting surging demand for AI infrastructure.

Major customers like Uber (UBER) scaled to more than 3 million cores on Oracle Cloud Infrastructure, while Temu reached nearly 1 million cores for Black Friday and Cyber Monday traffic.

The applications business showed steady momentum, with cloud applications revenue growing 11% to reach a $16 billion annualized run rate. Fusion ERP grew 17%, while industry-specific cloud applications combining hospitality, construction, retail, and other verticals surged 21%.

Management expressed confidence that application growth will accelerate as the company completes a major sales reorganization designed to drive cross-selling between back-office Fusion products and industry-specific applications.

Looking ahead, Oracle expects total cloud revenue growth of 37% to 41% in the third quarter, with total revenue climbing 16% to 18%. The tech heavyweight raised its fiscal 2027 revenue expectations by $4 billion, citing a massive contract backlog, though fiscal 2026 guidance remains unchanged at $67 billion.

Capital expenditures are now expected to be $15 billion higher than previously forecast as Oracle invests aggressively to convert its record backlog into revenue. It aims to leverage flexible financing options, including customer-supplied chips and vendor leasing arrangements, to minimize borrowing needs.

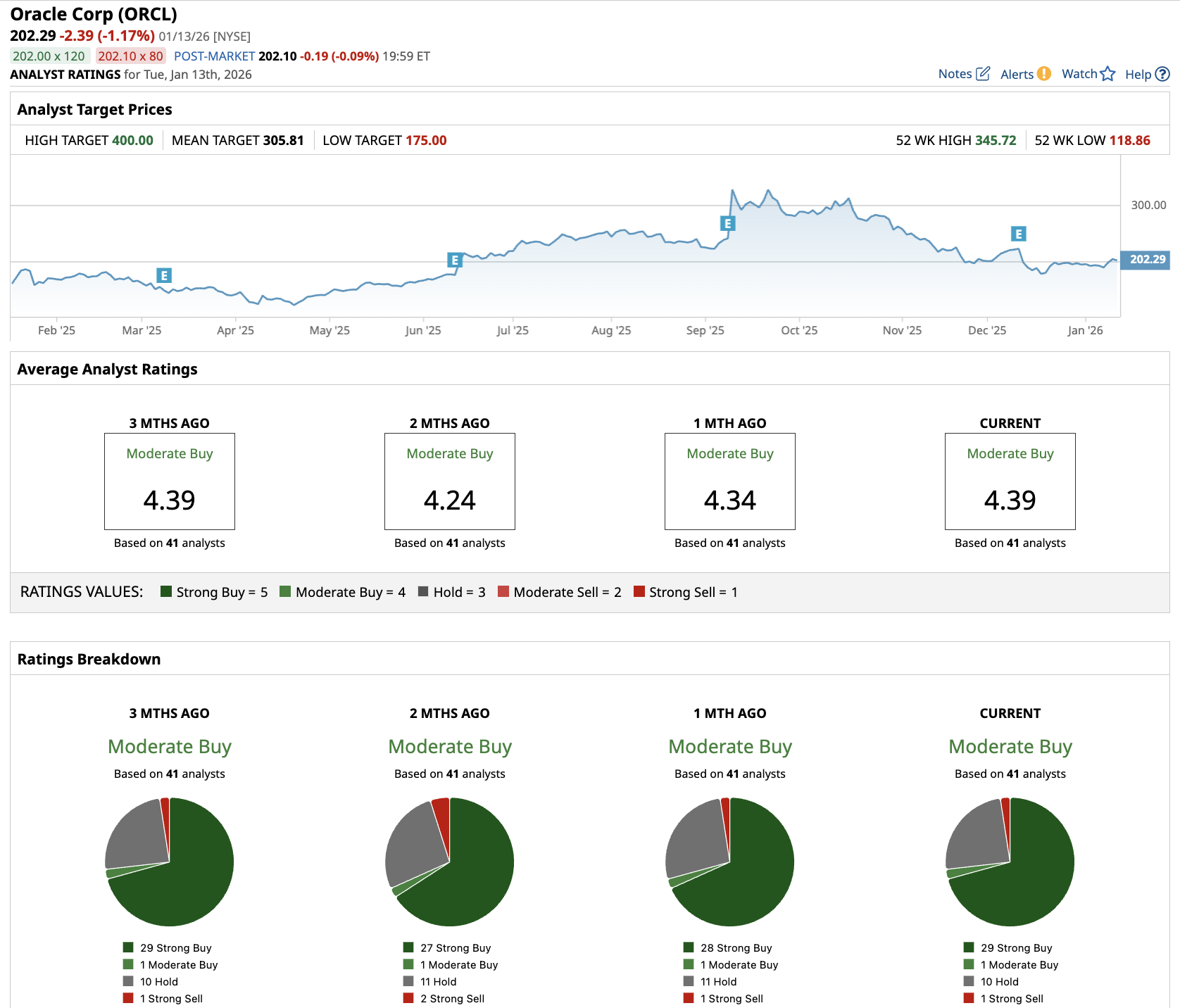

Is ORCL Stock Undervalued?

Analysts tracking Oracle forecast adjusted earnings to increase from $6 per share in fiscal 2025 to $20.47 per share in fiscal 2030. If ORCL stock trades at 25x forward earnings, which is similar to its current multiple, it could more than double over the next three years.

Out of the 41 analysts covering ORCL stock, 29 recommend “Strong Buy,” one recommends “Moderate Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average Oracle stock price target is $305.81, above the current price of $202.

The Bull Case for Investing in CRM Stock

Salesforce also delivered a solid performance in Q3 as the Agentforce platform continues to gain traction. In Q3, it reported revenue of $10.26 billion, up 9% YoY, while RPOs grew 11% to $29.4 billion.

The AI agent platform, Agentforce, reached $540 million in annual recurring revenue, growing 330% YoY and becoming the fastest-growing product in Salesforce history. The company closed over 18,500 Agentforce deals with 9,500 paid transactions, up 50% quarter-over-quarter (QoQ).

Notably, customers are using the technology at scale: Agentforce processes 3.2 trillion tokens through the company's large language model gateway and powers 1.2 billion AI interactions across customer deployments.

Customer adoption is accelerating beyond initial pilots. More than 50% of new Agentforce bookings came from existing customers expanding their investments and refilling consumption credits.

Companies in production with Agentforce jumped 70% QoQ, with major brands such as Williams-Sonoma (WSM), Uber, and General Motors (GM) deploying agents to handle everything from customer service inquiries to employee productivity tools.

The company introduced agentic enterprise license agreements (AELAs), which provide all-you-can-eat pricing for customers committing to comprehensive AI transformations across their organizations. Combined AgentForce and Data 360 annual recurring revenue reached nearly $1.4 billion, growing 114% YoY.

The data foundation business is now approaching $10 billion in scale when combining Data 360, MuleSoft, and the recently acquired Informatica. This infrastructure layer is proving critical as enterprises realize they cannot successfully deploy AI agents without unified, federated data and the deterministic workflows already embedded in Salesforce applications.

Salesforce expanded its sales force by 23% to capitalize on surging demand. Its operating cash flow rose 17% YoY to $2.3 billion and is on track to generate $15 billion in 2025.

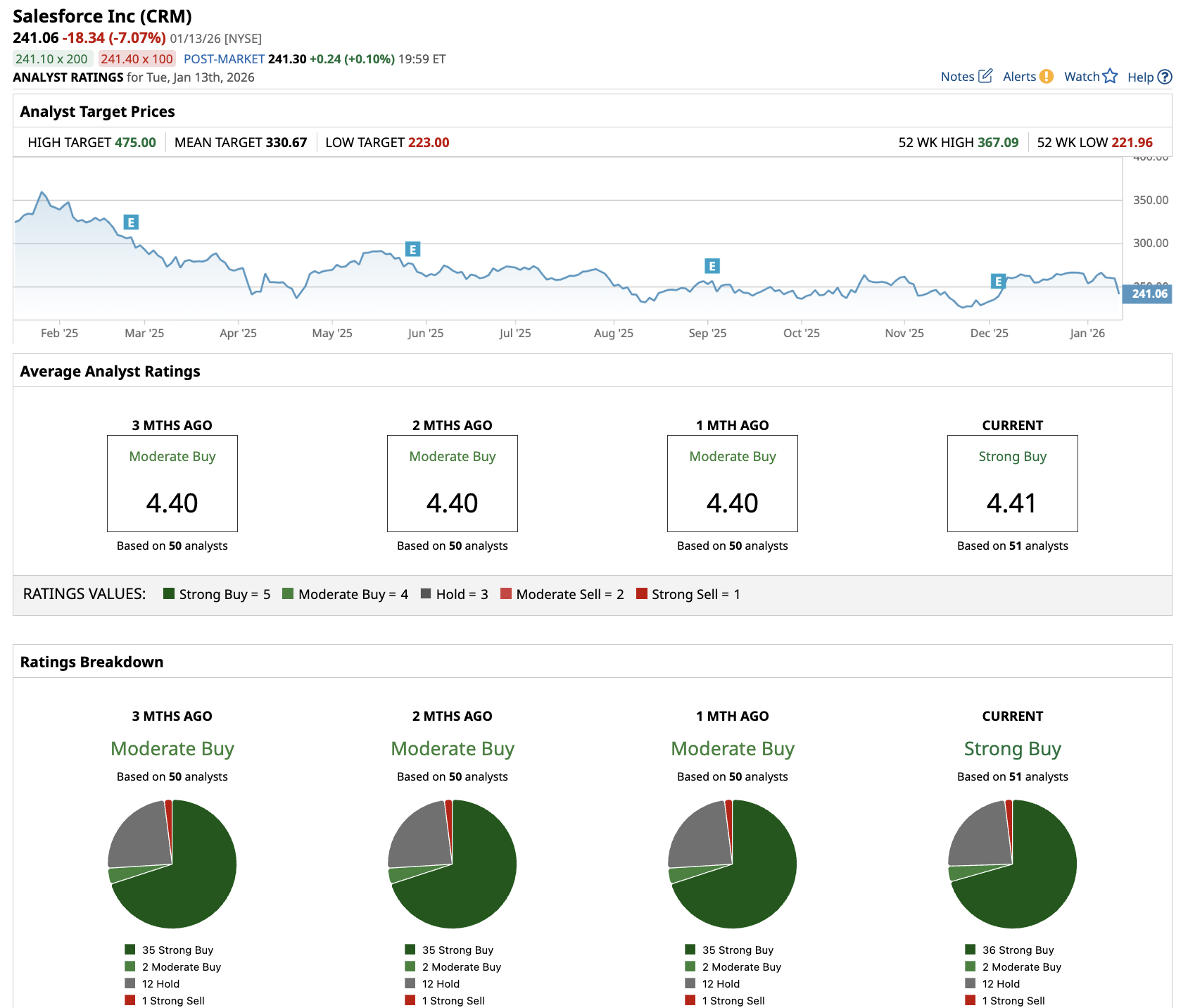

Is CRM Stock Undervalued?

Analysts tracking CRM forecast free cash flow to increase from $12.43 billion in fiscal 2025 (ended in January) to $20.5 billion in fiscal 2030. If CRM stock trades at 16.3x forward FCF, which is similar to its current multiple, it could gain close to 50% over the next three years.

Out of the 51 analysts covering CRM stock, 36 recommend “Strong Buy,” two recommend “Moderate Buy,” 12 recommend “Hold,” and one recommends “Strong Sell.” The average CRM stock price target is $330.67, above the current price of $241.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Devon Energy Unusual Call Option Activity - Investors Expecting a Dividend Hike?

- As Trump Casts Doubt on the Netflix-Warner Bros. Discovery Deal, How Should You Play NFLX Stock?

- Broadcom CEO Hock Tan Just Sold $24 Million Worth of AVGO Stock. Should You Dump Shares Too?

- HSBC Says These 2 AI Stocks Are Likely to Be Earnings Winners. Should You Buy Them Now?