Seattle, Washington-based Starbucks Corporation (SBUX) is the world’s largest specialty coffee roaster and retailer. With a global footprint of tens of thousands of stores across more than 87 countries, it currently holds a market cap of $96.2 billion. Founded in 1971, Starbucks operates primarily through company-operated and licensed retail stores offering premium coffee, espresso beverages, teas, food items, packaged goods, and merchandise under brands such as Starbucks Coffee, Teavana, Seattle’s Best Coffee and Starbucks Reserve, while also selling ready-to-drink and grocery-channel products. The coffee giant is expected to announce its fiscal first-quarter earnings for 2025 in the near future.

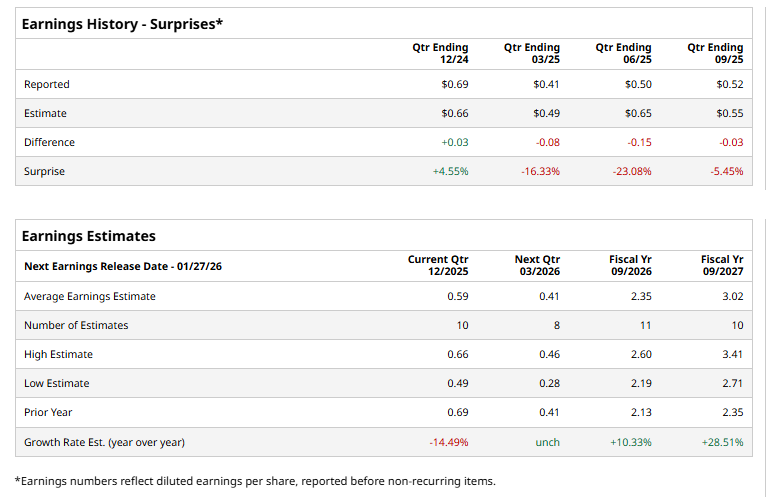

Ahead of the event, analysts expect SBUX to report a profit of $0.59 per share on a diluted basis, down 14.5% from $0.69 per share in the year-ago quarter. The company beat consensus estimates in only one of the last four quarters, while missing the forecast on three other occasions.

For the current year, analysts expect SBUX to report EPS of $2.35, up 10.3% from $2.13 in fiscal 2025. Moreover, its EPS is expected to rise 28.5% year over year to $3.02 in fiscal 2027.

SBUX stock has decreased 5.9% over the past year, lagging behind the S&P 500 Index’s ($SPX) 14.8% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.6% rally over the same time frame.

Starbucks’ stock has lagged the broader market over the past year, driven by operational, financial, and sentiment-related factors, with the company’s share price declining roughly 10–14% while major indices posted gains. Key factors include persistent labor unrest and historic employee strikes, which have represented the longest and most widespread work stoppages in Starbucks’ history and raised investor concerns about operational disruption, rising wage and scheduling costs, and reputational risks that could depress sales and margins.

At the same time, Starbucks has faced slowing comparable store sales and transaction declines, higher labor and commodity costs, and the financial impact of restructuring initiatives, including store closures and layoffs, under its “Back to Starbucks” turnaround plan, which have weighed on profitability and near-term earnings expectations.

Analysts’ consensus opinion on SBUX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 34 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” 12 give a “Hold,” two advocate a “Moderate Sell,” and three recommend a “Strong Sell.”

SBUX’s average analyst price target is $92.48, indicating an ambitious potential upside of 9.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Giant Yielding 4.5% Is Wall Street’s Top Telecom Pick for 2026

- Have a MERRY Christmas With These 9 Unusually Active Options

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?