As we say goodbye to 2025, investors will be looking for new stocks to invest in for 2026- perhaps as a result of rebalancing, tax loss harvesting, or deploying idle capital.

But not all stocks are equal. Some offer (the hope of) growth, while others offer income. Income provides a hedge against fear as investors tend to “hold on longer” to income investments- regardless of volatility. If this is you, then you might be pleased to read about my five best dividend stocks to start a position in, as we enter 2026.

The qualities I'm looking for in the following stocks

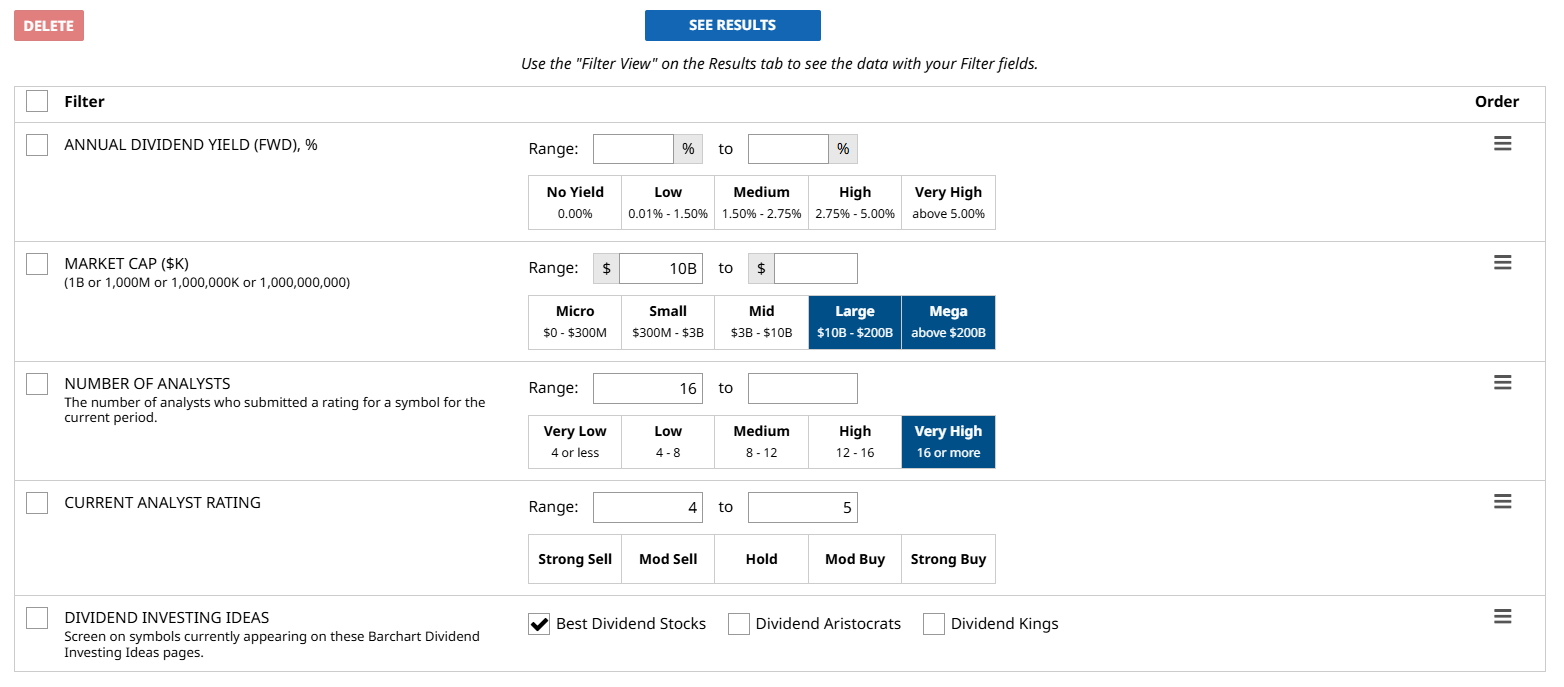

- Annual Dividend Yield (FWD): I intentionally left this blank to see the full range of forward dividend yields across companies.

- Market Capitalization: I set the market cap to $10 billion and higher (Large to Mega). Generally speaking, companies with higher market capitalization are more resilient to macroeconomic factors, which is a critical factor for dividend investing.

- Number of Analysts: I’m only looking for dividend stocks that have more than 16 analysts covering them. More analysts mean a more reliable consensus.

- Current Analyst Rating: 4 to 5, which means a Moderate Buy rating that’s very close to a strong buy, and a Strong Buy rating.

- Best Dividend Ideas: I selected “Best Dividend Stocks” to utilize Barchart’s list of compelling dividend stocks.

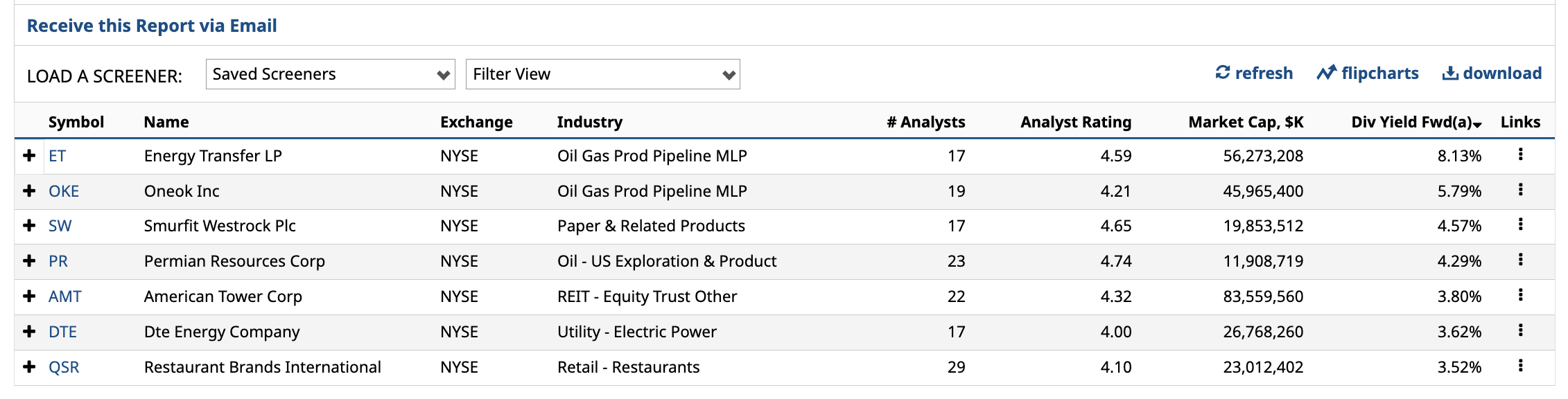

After running the filters, I was left with seven companies.

Then, I sorted them out from highest to lowest forward dividend yield, and within the top five, I purposely skipped Smurfit Westrock Plc (SW) and American Tower Corp (AMT). The former is a relatively new player compared to the rest, and I only want those with proven history, while the latter has been on a steep five-year share-price decline.

From there, I got my top five most compelling dividend stocks to invest in 2026.

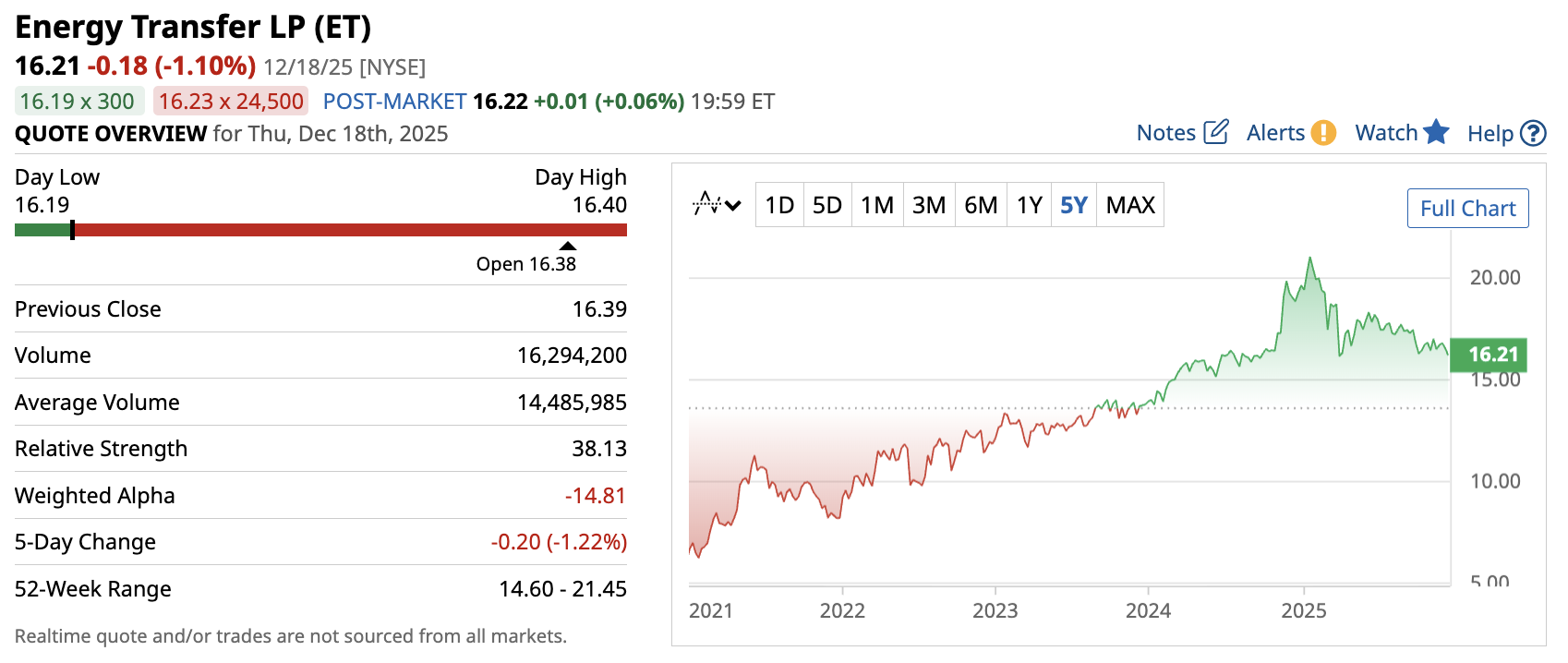

Energy Transfer LP (ET)

First on my list is Energy Transfer LP. It’s one of the biggest pipeline companies here in the United States. The company delivers natural gas and other energy products from coast to coast through its extensive pipeline network. The business is particularly strong in Texas and the surrounding regions, where most of the U.S.'s energy is produced.

For the full-year 2024, the company’s revenue rose 5% to around $82.7 billion, while net income jumped 28% to around $4.4 billion, or $1.29 in basic earnings per share, compared to the same period last year. Right now, the company’s market cap is around $56.3 billion, while its shares trade at $16.21 per share with a generally upward trajectory.

In terms of dividends, Energy Transfer pays an annualized dividend of $1.33 per share, or $0.333 per quarter. This translates to a remarkably high forward yield of 8.2%. The company’s dividend payout ratio is 99.18% of its earnings, which is typical for a Master Limited Partnership (MLP).

A total of 17 analysts rate Energy Transfer a Strong Buy with a score of 4.59 out of 5, and this rating has been relatively stable over the past 3 months. The high price target is $25 per share, which suggests more than 54% upside potential from current levels.

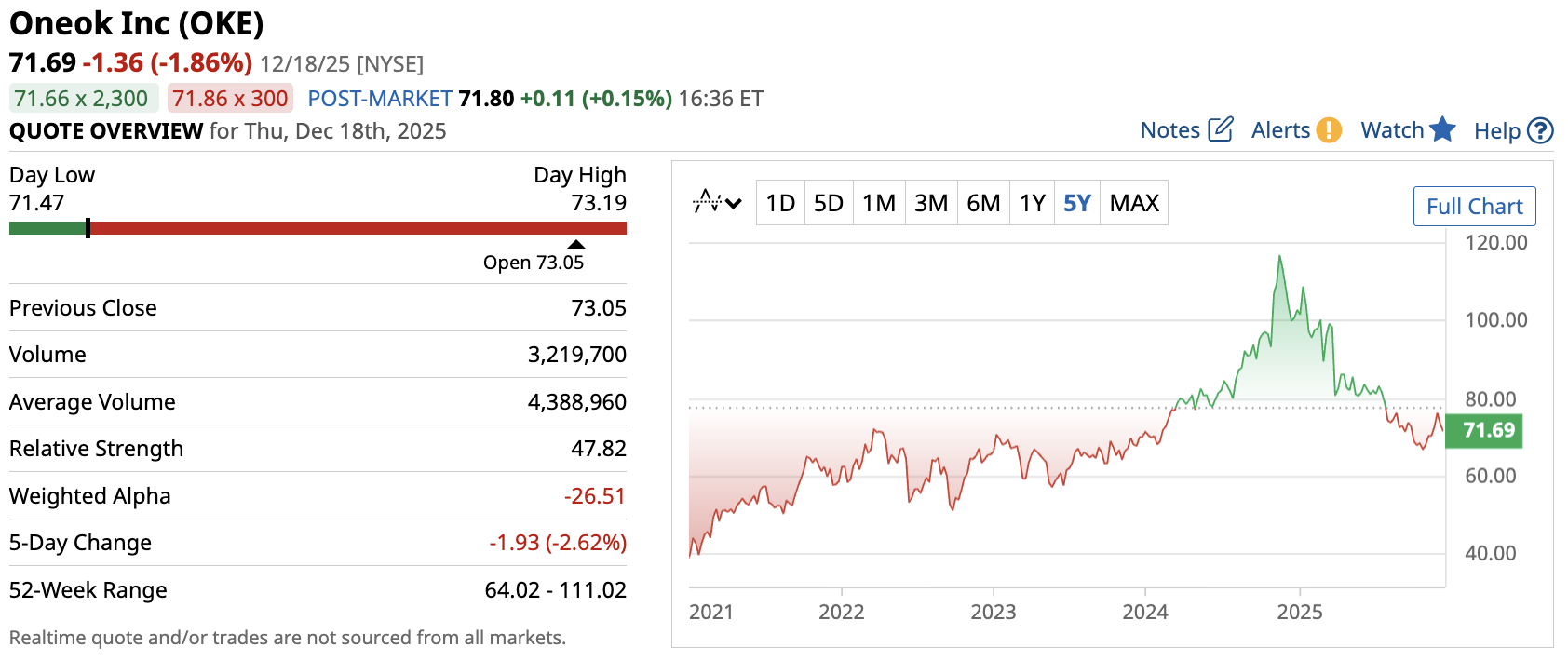

Oneok Inc (OKE)

The next dividend stock on my list is also a gas-related company, Oneok Inc. It also operates pipelines with a focus on natural gas liquids- this is what comes out alongside natural gas during production. These liquids are used to manufacture our everyday products, such as plastics and chemicals. Like other pipeline operators, Oneok doesn’t really care if prices go up or down. It just charges tolls for moving products.

In fiscal 2024, the company’s revenue rose roughly 22.7% to around $21.7 billion, while its bottom line rose 14% to around $3 billion, or $5.32 per share (basic). Oneok’s market cap is nearly $46 billion, and its stock trades at $71.69 per share.

On the dividend front, the company pays an annualized dividend of $4.12 per share, or $1.030 per quarter, yielding 5.75%. The company’s payout ratio is 75.43%, also relatively high, but it’s only possible because of the stability of its earnings.

A consensus of 19 analysts rates Oneok a Moderate Buy with a score of 4.21 out of 5, and this rating has also been fairly stable over the past 3 months. The high price target for Oneok stock is $114 per share, which represents roughly 59% upside from current levels.

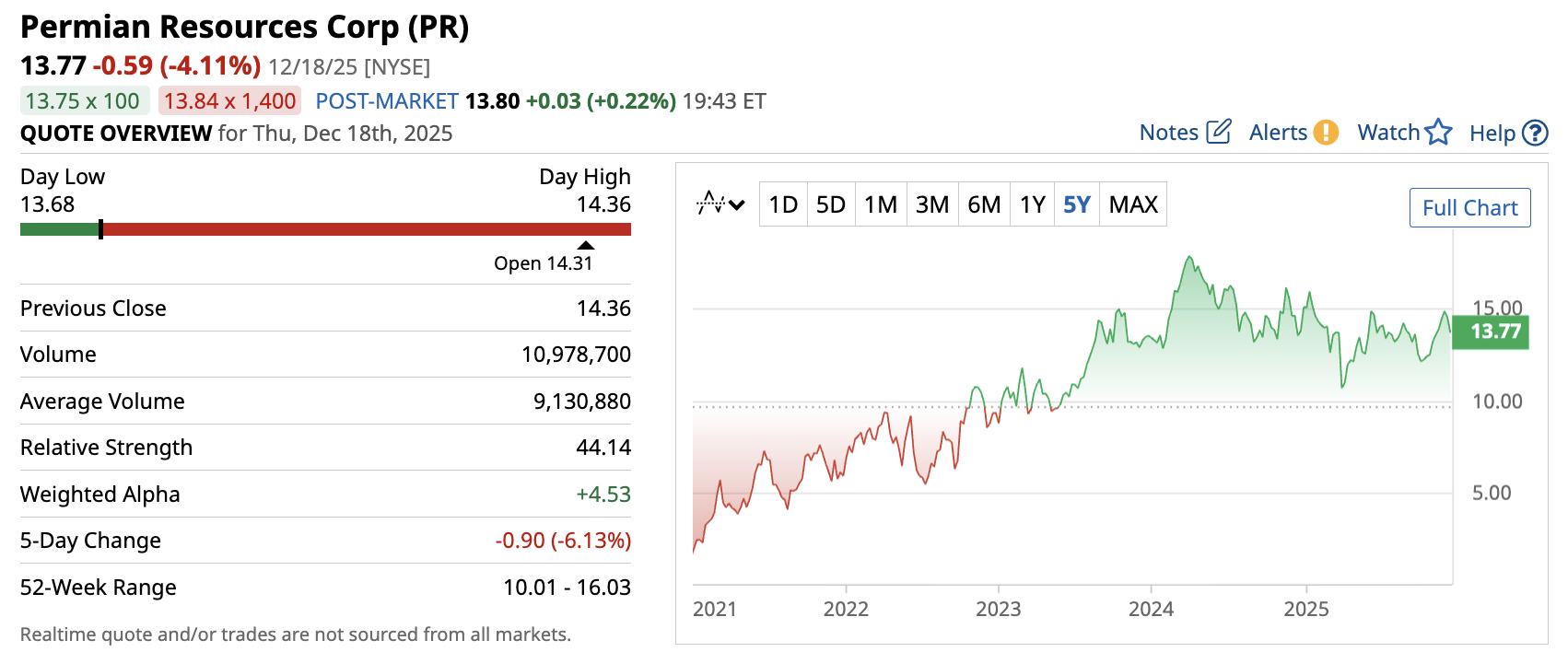

Permian Resources Corp (PR)

Permian Resources Corp. also has an anchor position on one of my best dividend stock lists. This company drills for oil and gas in the Permian Basin in West Texas and New Mexico. Unlike the first two pipeline companies, this one actually pumps oil and gas out of the ground. In fact, the Permian is one of the most productive oil regions in the world. Its fortunes are directly tied to oil and gas prices, and it makes more money when prices rise.

For the full-year 2024, the company’s revenue rose 60% to around $5 billion, while net income surged 106% to around $985 billion, or $1.54 in basic earnings per share. Permian’s market cap as of now is nearly $12 billion, with a stock trading at $13.77 per share, which is also in an upward trend.

The company pays an annualized dividend of $0.60 per share, paid quarterly at $0.15 per share, which translates to a forward yield of 4.35%. Meanwhile, the payout ratio is 40% of its earnings, so it's within a very acceptable range.

A total of 24 analysts collectively rate Permian Resources a Strong Buy with a near-perfect score of 4.74 out of 5. Like the others, this has been relatively stable over the past 3 months. The high price target is $23 per share, or 67% more than where it is now

DTE Energy Company (DTE)

The following dividend stock is DTE Energy Company, a traditional electricity and gas utility that primarily serves Michigan. It generates electricity, delivers it to homes and businesses, and also provides natural gas service. As a heavily regulated business, it basically has a monopoly in its territory, but regulators pretty much control how much profit it can make.

DTE Energy’s 2024 annual revenue declined 2% to $12.4 billion, driven by cyclical demand. Meanwhile, net income rose marginally to $1.4 billion, or $6.78 per share (basic). Today, the company’s market cap is $26.8 billion, and its stock trades at $129.90 per share.

As for its dividends, the company pays an annualized rate of $4.66 per share, or $1.165 every quarter, translating to a forward yield of nearly 3.6%. Its payout ratio is 60% of earnings, providing a balance between growing the business and rewarding shareholders.

The average rating for DTE Energy from 17 analysts is a Strong Buy with a score of 4 out of 5, and this has also been relatively stable over the past 3 months. The high price target is $158 per share, reflecting up to 22% upside from current levels.

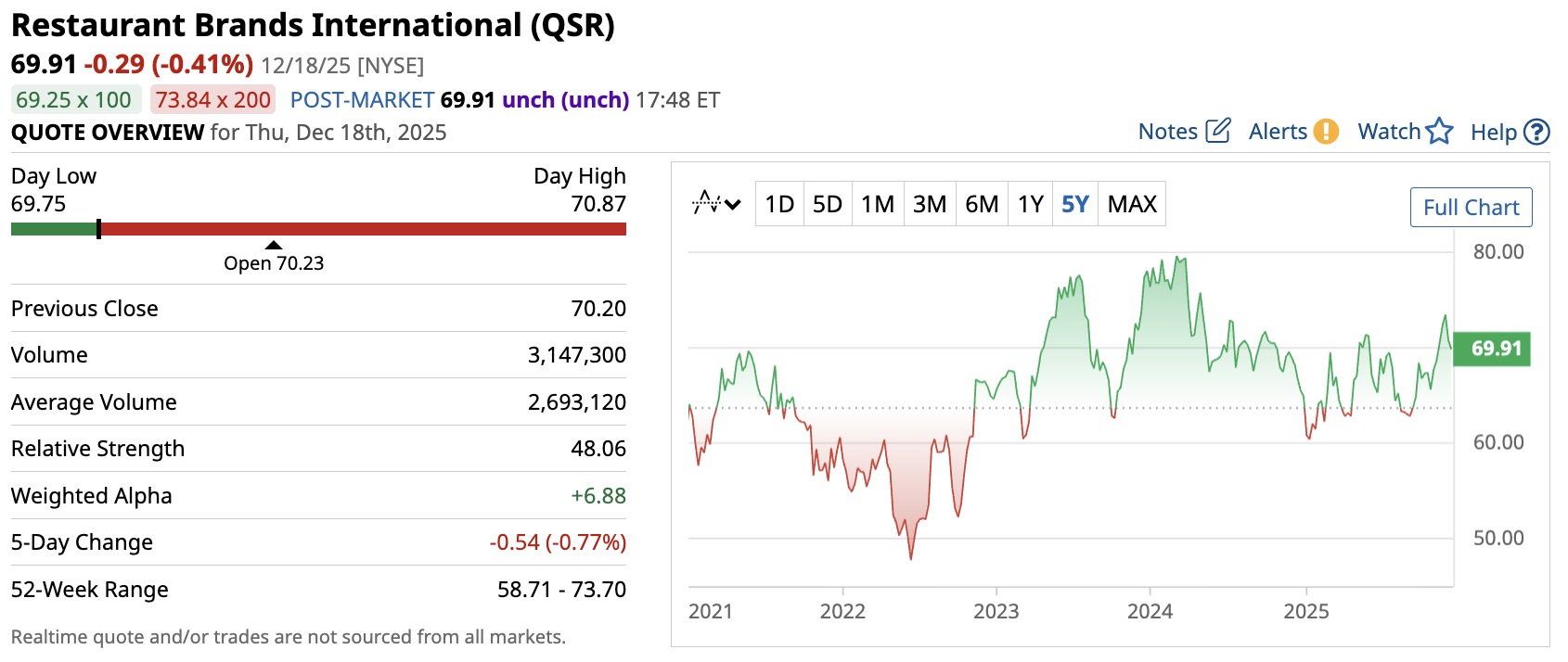

Restaurant Brands International (QSR)

The last (but not least) dividend company on my list is a conglomerate, Restaurant Brands International, better known as RBI. It owns Burger King, Popeyes, Firehouse Subs, Tim Hortons, and more. Instead of running most locations itself, it primarily operates as a franchisor, licensing its brands to franchisees who operate the individual restaurants.

Last year, RBI’s revenue rose 17% to $8.4 billion; however, its net income declined 14% to around $1 billion, or $3.21 per share (basic). The conglomerate’s market cap now stands at around $23 billion, with its share price trading at $69.91.

Meanwhile, the company pays an annualized dividend of $2.48, or $0.62 every quarter. This translates to a forward yield of just over 3.5%. The company’s payout ratio is 49.40%, which is also within a very acceptable range.

The average rating for RBI is a Moderate Buy with a score of 4.10 out of 5, according to a consensus of 29 analysts, and this rating has been relatively stable over the past 3 months. The highest price target is $96 per share, implying about 37% upside.

Final Thoughts

These five companies are among the best dividend stocks to consider as we head into 2026. The dividend yields are attractive, the stocks’ trajectories are positive, and the fundamentals appear solid. That said, it’s worth noting that the market can surprise even the best of us, so it’s important to review these companies from different angles. All things being equal, I believe these dividend companies will please investors seeking stable and substantial returns next year and beyond.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart