Adobe Inc. (ADBE), headquartered in San Jose, California, provides digital marketing and media solutions. Valued at $140.5 billion by market cap, the computer software company offers a line of application software products, type products, and content for creating, distributing, and managing information.

Shares of this technology giant have underperformed the broader market considerably over the past year. ADBE has declined 35.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.4%. In 2025, ADBE stock is down 26.4%, while SPX is up 14.3% on a YTD basis.

Narrowing the focus, ADBE has also lagged behind the iShares Expanded Tech-Software Sector ETF (IGV). The exchange-traded fund has gained about 11.9% over the past year. Moreover, the ETF’s 9.2% gains on a YTD basis outshine the stock’s double-digit losses over the same time frame.

ADBE's underperformance stems from concerns over slowing digital media annual recurring revenue (ARR) growth, raising worries about future expansion. Investors are also uneasy about Adobe's perceived lag in AI investments, which may result in missing out on opportunities to expand its user base and drive growth.

On Sep. 11, ADBE shares closed up marginally after reporting its Q3 results. Its adjusted EPS of $5.31 beat Wall Street expectations of $5.17. The company’s revenue was $6 billion, beating Wall Street forecasts of $5.9 billion. ADBE expects full-year adjusted EPS in the range of $20.80 to $20.85, and expects revenue to range from $23.65 billion to $23.70 billion.

For the current fiscal year, ending in November, analysts expect ADBE’s EPS to grow 14.2% to $17.02 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

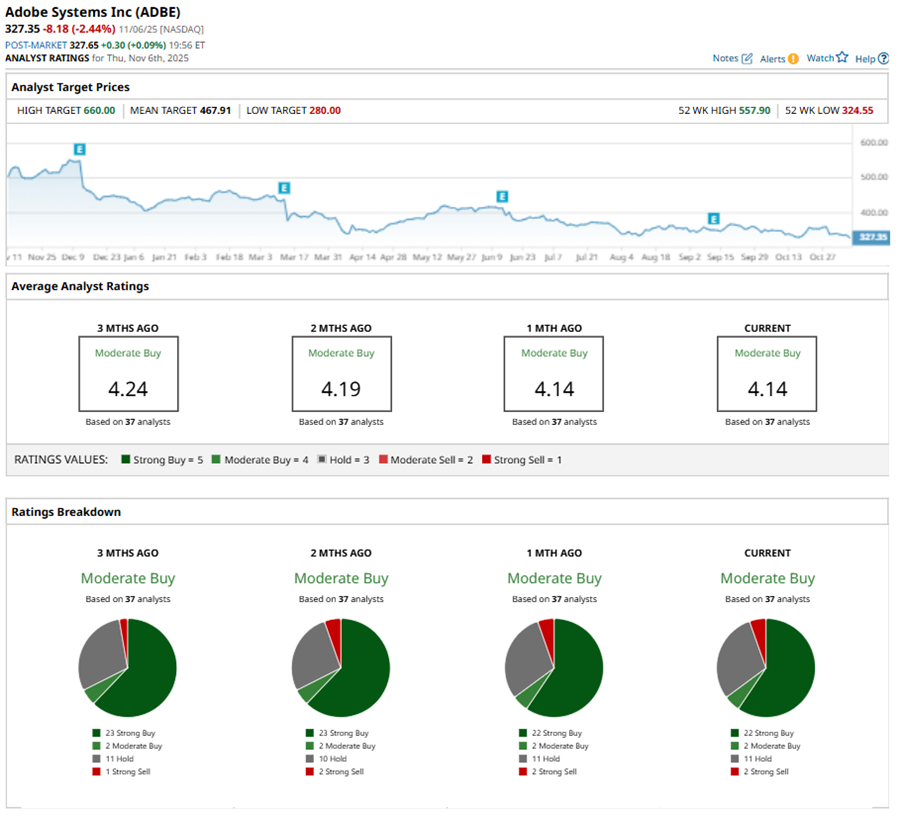

Among the 37 analysts covering ABDE stock, the consensus is a “Moderate Buy.” That’s based on 22 “Strong Buy” ratings, two “Moderate Buys,” 11 “Holds,” and two “Strong Sells.”

This configuration is less bullish than two months ago, with 23 analysts suggesting a “Strong Buy.”

On Oct. 30, D.A. Davidson analyst Gil Luria maintained a “Buy” rating on ADBE and set a price target of $500, implying a potential upside of 52.7% from current levels.

The mean price target of $467.91 represents a 42.9% premium to ABDE’s current price levels. The Street-high price target of $660 suggests an ambitious upside potential of 101.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock 2026 Prediction: Can NVDA’s Gravity-Defying Rally Continue?

- These 3 Tech Stocks Have Been Red-Hot in 2025 but Their Charts Are Screaming ‘Danger’

- Stock Index Futures Slip as Valuation and Economic Concerns Persist, U.S. Confidence Data on Tap

- Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?