NRG Energy, Inc. (NRG) is a Texas-based integrated power company that supplies electricity and energy services to residential, commercial, and industrial customers. Valued at a market cap of $33.8 billion, it operates a diverse portfolio of power generation assets, including natural gas, coal, nuclear, and renewable facilities.

Over the past 52 weeks, NRG has delivered a standout performance in the utilities space. Shares of NRG have soared 90.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.5%. Further, on a YTD basis, the stock is up 86.2%, compared to SPX’s 15.1% return.

Zooming in further, it has notably outpaced the Utilities Select Sector SPDR Fund’s (XLU) 15.1% rise over the past 52 weeks and 17.4% uptick on a YTD basis.

On Sept. 26, NRG shares jumped 3.4% after its subsidiary, NRG Cedar Bayou 5 LLC, closed a $561.9 million credit deal to fund 60% of a 721-MW natural gas plant in Chambers County, Texas. The financing package comes with requirements tied to project costs, a commercial-operation deadline of December 1, 2028, and standard prepayment and default terms, signaling strong lender confidence in the project’s execution.

For the current fiscal year, ending in December, analysts expect NRG’s EPS to grow 22.7% year over year to $8.15. The company’s earnings surprise history is mixed. It surpassed the consensus estimates in three of the last four quarters, while missing on another occasion.

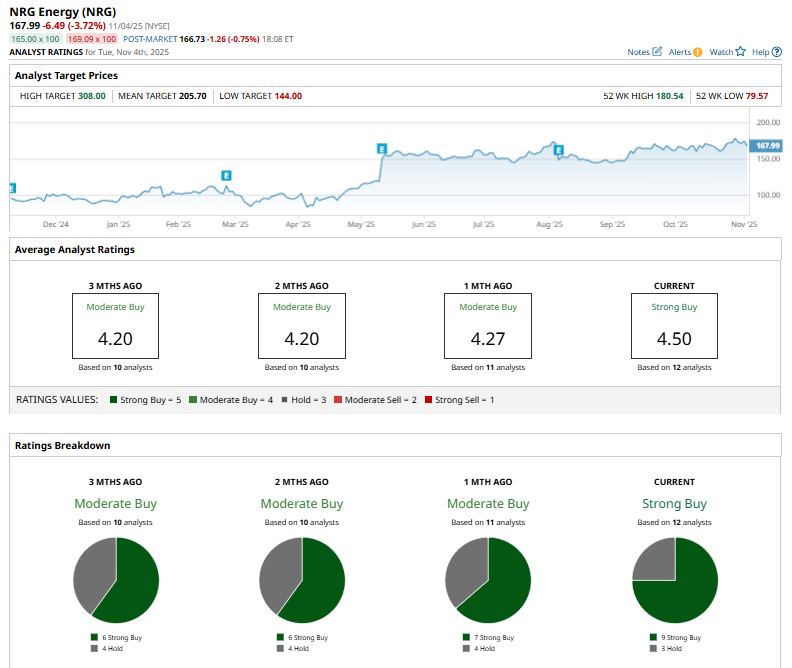

Among the 12 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on nine “Strong Buy” and three “Hold” ratings.

The configuration is more bullish than one month ago, with seven analysts suggesting a “Strong Buy.”

On Oct. 28, Morgan Stanley (MS) analyst Stephen Byrd reiterated an “Equal-Weight” rating on NRG Energy and cut the price target from $145 to $144.

The mean price target of $205.70 represents a 22.4% premium from NRG’s current price levels, while the Street-high price target of $308 suggests an upside potential of 83.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Volatility Alert: 10 Stocks Showing High IV Percentile

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?