One thing I like about Barchart’s Top 100 Stocks to Buy list is that it reminds me that stocks are expensive relative to historical norms.

However, there’s still a lot of optimism that stocks will continue to rally into 2026 -- the S&P 500 has gained 35% since the index’s April lows -- suggesting that any correction will be part of a healthy market.

“Executives are cautioning about an equity market drop of more than 10% in the next 12 to 24 months. That’s hardly a warning, it’s simply a description of normal market behavior,” stated Bloomberg Macro Strategist Skylar Montgomery Koning.

This optimism leads me to today’s commentary about yesterday’s biggest movers on Barchart’s top 100 stocks to buy list.

Royalty Management Holding Corp. (RMCO) moved up 51 spots to 30th place; Estrella Immunopharma (ESLA) did the same, rising 51 spots to 18th place.

Both are penny stocks trading below $5. Both are to be avoided at all costs if you’re at all risk-averse. Here’s why.

Royalty Management’s SPAC Heritage

Royalty Management went public on Nov. 6, 2023, almost two years to the day. It came to the public markets through its combination with American Acquisition Opportunity Inc., an Indiana-based SPAC (special purpose acquisition company).

The SPAC raised $100 million in March 2021 to find an operating business to combine with within 12 months of its IPO offering.

Although the prospectus stated it could combine with any business in any industry (standard boilerplate legalese), it focused its search on companies with land and resource holdings.

The management team of the sponsor, American Opportunity Ventures LLC, all work at American Resources Corporation (AREC), a small-cap producer of rare-earth and critical-mineral concentrates.

Given all the interest in rare earth and critical minerals, AREC stock is up 953% from its 38-cent low in April. That’s helped attract investors to Royalty Management and RMCO stock.

The SPAC had to extend the 12 months to effect a combination from March 2022 to September 2022. It announced a combination with Royalty Management on June 28, 2022. Tom Sauve, the president of American Resources, runs Royalty Management.

Notably, only $14.1 million in cash was recorded on Royalty Management’s balance sheet, with its shareholders receiving 11.1 million shares at $10 a share, representing 45.7% of the stock in the combined business.

I say notably because $90 million of the funds raised by the SPAC were redeemed at its March 21, 2022, special meeting to extend the search for a combination. That’s about 85% of the IPO proceeds.

RMCO stock closed Monday’s trading at $3.56, valuing its equity at $52.4 million. As of June 30, its balance sheet had assets of $16.9 million.

The holding company’s biggest revenue generator is RMC Environmental Services LLC, its wholly owned subsidiary that runs a clean fill landfill facility in Indiana. Through the first six months, the unit’s revenue was $2.2 million, up from $364,120 in 2024.

This hodgepodge of investments may someday justify an enterprise value of $55 million. I don’t see it happening anytime soon.

However, an even bigger concern is the lack of arms-length management. Historical performance for most SPACs has been mediocre at best. The SPAC's combination with a related party is hardly the type one expects from a SPAC IPO.

I don’t see the attraction. Royalty Management has meme stock written all over it.

Estrella Immunopharma More Like a SPAC

Estrella Immunopharma’s stock is up 108% in the past month and 273% over the past year.

As a result, the U.S.-based clinical-stage biopharmaceutical company developing T-cell therapies for blood cancers and solid tumours has a market cap of nearly $112 million. Of the two stocks, I could see risk-tolerant investors at least taking a closer look at ESLA.

It also went public through a SPAC combination on Oct. 2, 2023. The biopharma company combined with TradeUP Acquisition Corp., which raised $40 million from its July 2021 IPO. Its target was early-stage companies with transformative technologies. It had 18 months to complete a combination. It announced the combination on Oct. 2, 2022, closing the transaction a year later.

The value of the combined company’s equity was nearly $400 million, with $45.4 million in cash from TradeUP’s trust account rolling onto Estrella’s balance sheet. However, due to redemptions, less than $10 million got rolled in.

Estrella’s shareholders owned 81.6% of the combined company. TradeUP’s founders held 3.6% and its shareholders held the remainder.

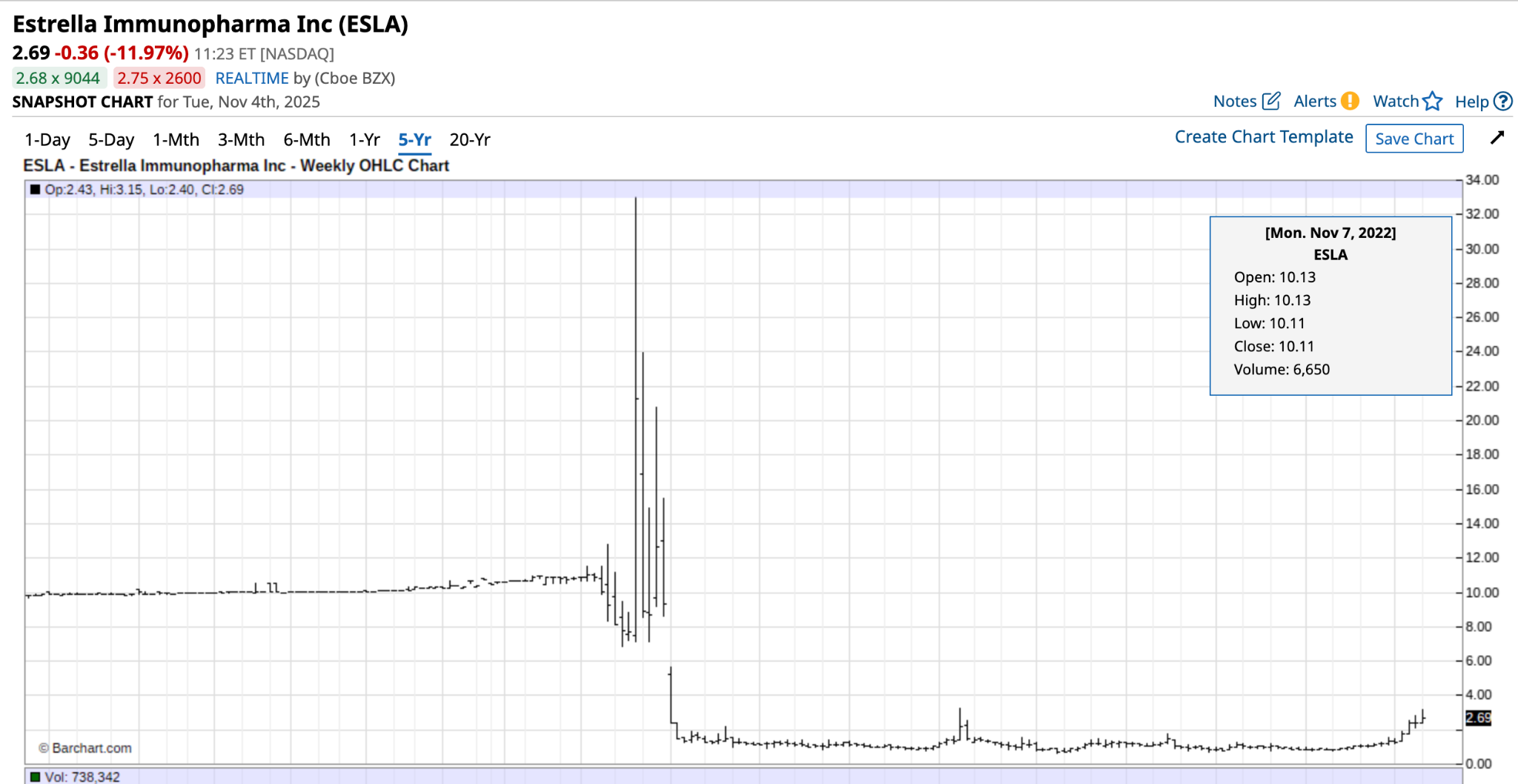

This combination was a much more traditional SPAC transaction. However, as you can see from the chart, it hasn’t been a good deal for Estrella shareholders. The share price is basically back to where it was in October 2023.

Source: Barchart

A big reason: Estrella is pre-revenue.

In the six months ended June 30, it had an operating loss of $7.65 million, of which 84% was research and development, and 16% was corporate overhead. R&D increased 71% in the first half of 2025. Its accumulated deficit was $31.6 million. That’s sure to grow as it approaches commercialization.

Yesterday, the company announced good news about its EB103 T-cell therapy.

“[Estrella] today announced the successful completion of the second dose cohort in Phase I portion of its STARLIGHT-1 Phase I/II clinical trial of EB103, a CD19-redirected ARTEMIS® T-cell therapy to treat patients with Advanced B-Cell Non-Hodgkin’s Lymphomas (NHL), the company’s press release stated.

I'm not going to lie to you. The above paragraph flew over my non-scientific head. What I do know is that pre-revenue biopharma companies are a crapshoot.

If I were a really aggressive investor and understood T-cell therapy drug development and commercialization, I might be tempted to bet a small amount on Estrella. I can’t say the same about Royalty Management.

And if you’re at all risk-averse, you’re better off buying a Powerball ticket.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Royal Caribbean’s (RCL) Options Implosion Offers Up a Massive Informational Arbitrage Trade

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?