DALLAS, TX / ACCESSWIRE / November 8, 2023 / Envela Corporation (NYSE American:ELA) ("Envela" or the "Company") today reported financial results for its third quarter ended September 30, 2023. The Company posted revenue for the third quarter of $36.3 million, and quarterly earnings per diluted share of $0.06.

John Loftus, Chairman and CEO of Envela said, "During the quarter we made progress advancing our long-term growth strategy, particularly on the consumer side of our business where we executed a key strategic acquisition and added additional strength to our management team. Revenue decreased in the quarter primarily due to the timing of certain recycling orders from major electronics companies as well as reduced sales of lower margin goods on the consumer side of our business. That said, margins improved sequentially reflecting both a deliberate focus on revenue mix and cost discipline.

"We believe that success should be measured by the value created for shareholders over the long term, and we are committed to investing prudently but aggressively to grow our infrastructure, brand, and customer base as we build a stronger business with enhanced scale. To that end, we are diversifying our retail portfolio, with our robust balance sheet enabling the acquisition of jewelry manufacturer Steven Kretchmer, Inc. during the quarter which broadens our offerings in the luxury jewelry space. We are targeting the addition of four new stores in 2024. We do not expect our growth to be linear, but our end markets have strong tailwinds, and we are optimistic about the long-term growth opportunity for Envela."

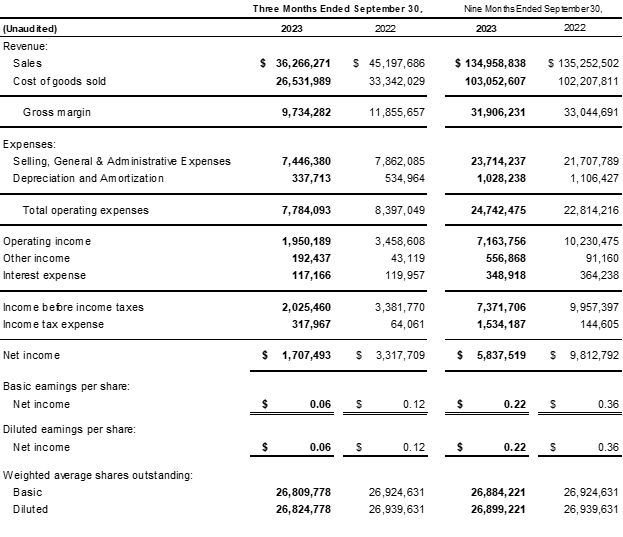

Third Quarter 2023 Consolidated Operating Highlights

- Revenue was $36.3 million compared to $45.2 million in the third quarter of 2022.

- Gross profit decreased to $9.7 million, or 26.7% of revenue, compared to $11.9 million, or 26.3% of revenue for the third quarter of 2022.

- Selling, general and administrative expenses as a percentage of sales increased to 20.4% or $7.4 million, compared to 17.5% or $7.9 million. This increase is primarily due to increased investments in the growth of the consumer segment of the business.

- Operating income decreased to $2.0 million, or 5.5% of revenue, compared to $3.5 million, or 7.7% of revenue for the third quarter of 2022.

- Net income was $1.7 million, or $0.06 per basic and diluted share, compared to $3.3 million, or $0.12 per basic and diluted share in the third quarter of 2022. Last year, the company did not pay taxes due to a valuation allowance associated with the deferred tax asset reflecting net operating losses brought over from prior years. Due to the strong profitability of the business, the valuation allowance was written off as of December 31, 2022. In the third quarter of 2023, the Company had $318 thousand of federal income tax expense compared to $64 thousand in the third quarter of last year.

- EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) was $2.3 million, or 6.3% of revenue, compared to $4.0 million, or 8.8% of revenue in the third quarter of 2022.

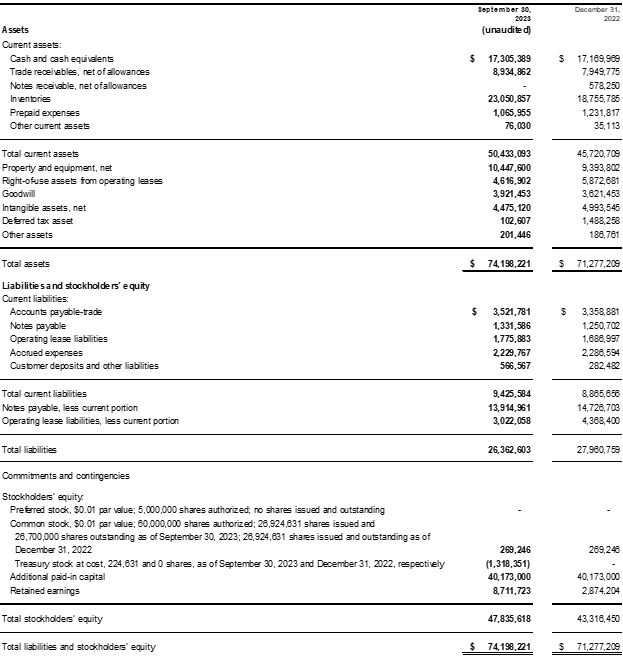

- Cash and cash equivalents grew to $17.3 million at September 30, 2023, compared to $17.2 million at December 31, 2022 and $15.0 million at September 30, 2022.

- Total stockholders' equity grew to $47.8 million at September 30, 2023, compared to $43.3 million at December 31, 2022 and $37.4 million at September 30, 2022.

Consumer Division Operating Highlights

- Envela has increased its store locations to 8 from 7 at September 30, 2022, adding one location with the purchase of jewelry manufacturer Steven Kretchmer in September 2023. The Company has signed a lease for a new location in the Scottsdale area and is targeting 4 new stores by the end of 2024.

- Envela continues to build its e-commerce offerings and initiatives with an expanded online presence. The Company has increased its online SKUs 39% during the third quarter.

- Consumer Division revenue was $26.9 million for the third quarter of 2023, a decrease of 11.7% compared to revenue of $30.4 million in the prior-year quarter.

- Consumer Division gross margins increased to 13.4% in the third quarter of 2023 compared to 12.3% in the prior-year quarter, reflecting product mix and a focus on higher margin sales.

- Operating expenses increased 8.3% to $2.7 million in the third quarter of 2023 compared to $2.5 million in the prior-year quarter, primarily reflecting increased personnel to support the long-term growth of the business and the reclassification of overhead expenses.

- Consumer Division pre-tax operating income in the third quarter of 2023 was $888 thousand, a decrease of 26.0% compared to $1.2 million in the prior-year quarter. The resulting consumer pre-tax operating margin was 3.3% for the third quarter of 2023, decreasing slightly from the 4.0% margin for the prior-year quarter.

Commenting on the Consumer Division, Mr. Loftus stated, "I'm confident that our retail expansion will generate strong returns for our investors over time, particularly given the uncertain economy and unprecedented levels of consumer debt driving more consumers to sell their unwanted jewelry and bullion products. The new store we opened up in Frisco, TX a few years ago has performed exceptionally well, and our goal is to replicate its performance at the new stores planned for the Phoenix market. Furthermore, we continue to methodically expand our online presence with increased SKUs during the quarter primarily for bullion, and over time we plan to expand SKUs for our pre-owned jewelry as well as our exclusive jewelry lines."

Commercial Division Operating Highlights

- During the third quarter, the commercial division continued to support and build upon its long-term partnerships with a range of global Fortune 500 companies and local businesses.

- Commercial Division revenue was $9.4 million for the third quarter of 2023, a decrease from revenue of $14.8 million in the prior-year quarter reflecting timing of certain orders and customary quarter-to-quarter fluctuations. Envela remains confident in the long- term growth prospects for its commercial division given its strong customer base of leading electronics companies, re-commerce industry tailwinds and the opportunity to drive consolidation in a fragmented industry.

- Commercial Division gross margins increased to 65.5% in the third quarter of 2023 compared to 54.9% in the prior-year quarter, reflecting product mix and a focus on higher margin sales.

- Operating expenses decreased 13.6% to $5.1 million in the third quarter of 2023 compared to $5.9 million in the prior-year quarter.

- Commercial Division pre-tax operating income in the third quarter of 2023 was $1.0 million, a decrease of 53.0% compared to $2.2 million in the prior-year quarter. The resulting consumer pre-tax operating margin was 10.9% for the third quarter of 2023, decreasing from 14.8% margin for the prior-year quarter.

Commenting on the Commercial Division, Mr. Loftus stated, "Our Commercial Division has long-term relationships with some of the leading technology companies in the world. Although we see fluctuations in volumes -- particularly given we are still a relatively small company -- our long-term outlook remains positive given strong industry tailwinds. The global e-waste problem continues to worsen due to the shortening life cycles for electronics and the push for new technologies with increased efficiency. In turn, this provides a tremendous opportunity for Envela to continue to be a re-commerce partner of choice."

Balance Sheet, Cash Flow and Liquidity

- Cash and cash equivalents increased to $17.3 from $17.2 million at December 31, 2022.

- The Company reduced its long-term debt to $13.9 million at September 30, 2023 compared to $14.7 million at December 31, 2022.

- Total shareholders' equity increased to $47.8 million at September 30, 2023 compared to $43.3 million at December 31, 2022.

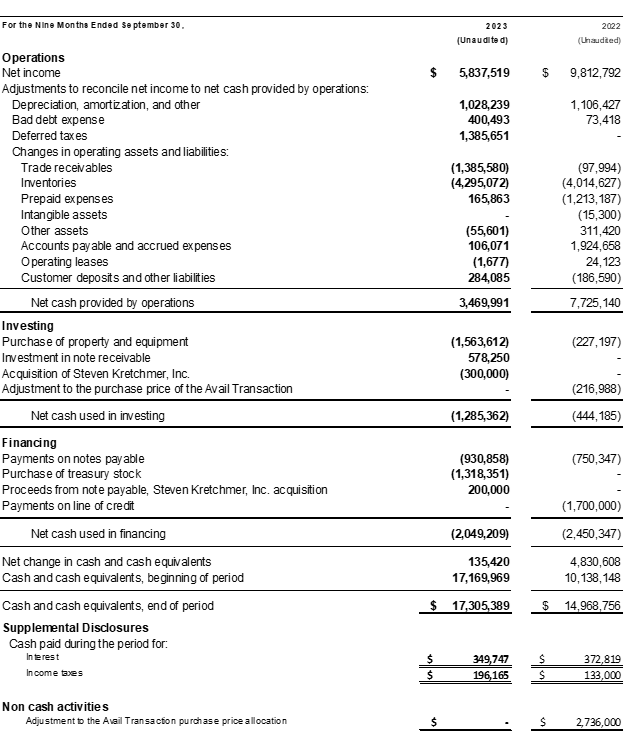

- For the nine-month period ended September 30, 2023, consolidated operating cash flows totaled $3.5 million.

- Working capital at September 30, 2023 increased to $41.0 million from $36.9 million at December 31, 2022.

Share Repurchase Program

During the quarter ended September 30, 2023, the Company repurchased 197,210 shares of common stock at an average cost of $5.70. Since the beginning of the share repurchase program in March of 2023, Envela has spent more than $1.3 million to purchase 224,631 shares of common stock under the 1,000,000 share repurchase program authorized through March 31, 2026.

About Envela

Envela a leading provider of re-commerce services at the forefront of the circular economy. The company is comprised of primarily two key business segments: Consumer and Commercial. The Consumer segment operates retail stores and online sites that offer premium brands and luxury hard assets, while the Commercial segment provides personalized re-commerce solutions to meet the needs of various clients, including Fortune 500 companies. At Envela, we execute with passion, and with meticulous attention to detail, trying not to be all things to all people, but remaining focused on what we know best.

At Envela, we Reuse, Recycle, and Reimagine. To learn more, visit Envela.com and follow our social media channels on Twitter, Instagram, Facebook, and LinkedIn.

Forward-Looking Statements

This press release includes statements that may constitute "forward-looking" statements, including statements regarding acquisitions, financial outlook, and the potential future success of business lines and strategies. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, market conditions and other risks detailed in the Company's periodic report filings with the Securities and Exchange Commission. By making these statements, the Company undertakes no obligation to update these statements for revisions or changes after the date of this release except as required by law.

Investor Relations Contact:

John Nesbett/ Jennifer Belodeau

ir@envelacorp.com

972-587-4030

Envela Corporation

Condensed Consolidated Statements of Operations

The accompanying notes are an integral part of these condensed consolidated financial statements.

Envela Corporation

Condensed Consolidated Balance Sheets

The accompanying notes are an integral part of these condensed consolidated financial statements.

Envela Corporation

Condensed Consolidated Statement of Cash Flows

The accompanying notes are an integral part of these condensed consolidated financial statements.

SOURCE: Envela Corporation

View source version on accesswire.com:

https://www.accesswire.com/801411/envela-reports-third-quarter-2023-financial-results