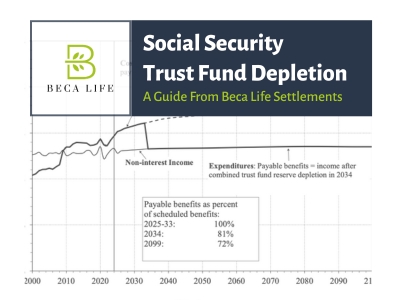

Toms River, NJ - A new analysis of the 2025 Social Security Board of Trustees report shows recent legislative action has sped up the date of the trust fund depletion to the fourth quarter of 2032, and the combined funds will deplete in calendar year 2034. An August 2025 update from Social Security’s Chief Actuary, Karen Glenn, also figured into this analysis. Without congressional action, 20% automatic benefit cuts could go into effect for all Social Security recipients.

In January 2025, the Social Security Fairness Act was passed, and later the One Big Beautiful Bill Act (OBBBA) was enacted in July. Together, these bills included $368.6 billion in program expenditures over the next ten years while also reducing revenue streams.

A full analysis prepared by Yehuda Tropper, CEO of Beca Life Settlements, highlights that recent well-intentioned legislation has inadvertently worsened Social Security's financial outlook. Yehuda Tropper stated:

“We are approaching the closest Social Security has come to insolvency since the early 1980s crisis. The 75 year actuarial deficit is now $25 trillion; however, this is a solvable problem if Congress takes decisive action.”

Key points:

-

Timeline acceleration: The Old-Age and Survivors Insurance trust fund depletion sped up a few months to Q4 2032 and combined OASI and DI are expected to deplete in Q1 2034.

-

Immediate aftermath: After depletion, Social Security would only be able to pay 77-81% of the benefits that would be generated by the payroll taxes that would keep coming in.

-

Legislative action: The Social Security Fairness Act is projected nearly $200 million to the shortfall over 10 years and the OBBBA will contribute $168.6 million through tax revenue lost on benefits.

-

Demographic pressure: Lower birth rates continue to create pressure on the worker-to-beneficiary ratio.

The analysis indicated if a typical retiree expected to access $2,000 per month, that would go down to $1,600 if automatic cuts began. A PensionBee report estimates that a hypothetical 23% cut in Social Security benefits would require roughly $138,000 in additional savings to offset the loss.

Considering 69 million Americans rely on Social Security, this would likely push millions of seniors into financial hardship.

While the projections appear dire, historical precedent suggests congressional action is likely before cuts materialize. For example, during the Social Security crisis of 1983, bipartisan reforms put the program on solid financial ground for decades.

The full analysis includes a breakdown of the possible solutions Congress could reach, including increasing the payroll tax, changes to the benefit formula, and increasing the retirement age, each of which would bring its own political and economic consequences.

The full text is available here: https://medium.com/@press_52522/social-securitys-2025-trustees-report-what-retirees-need-to-know-2a6e8af501f0.

Beca Life Settlements is an educational resource for seniors interested in selling their life insurance policy for cash—a process called a “life settlement.” Founders Yehuda Tropper and Chaim Tropper bring deep industry knowledge and hands-on expertise to life settlements. They've reviewed thousands of policies, advised hundreds of seniors, and built strong relationships with brokers and buyers to help clients make smart, informed decisions.

Media Contact

Company Name: Beca Life Settlements

Contact Person: Yehuda Tropper

Email: Send Email

Phone: +1 848-456-8333

Address:1815 Lakewood Road Suite 107

City: Toms River

State: NJ

Country: United States

Website: https://medium.com/@press_52522/social-securitys-2025-trustees-report-what-retirees-need-to-know-2a6e8af501f0