Sport boat manufacturer MasterCraft (NASDAQ: MCFT) fell short of the market’s revenue expectations in Q4 CY2025 as sales only rose 1.9% year on year to $64.57 million. Its non-GAAP profit of $0.10 per share was 39.1% below analysts’ consensus estimates.

Is now the time to buy MasterCraft? Find out by accessing our full research report, it’s free.

MasterCraft (MCFT) Q4 CY2025 Highlights:

- Revenue: $64.57 million vs analyst estimates of $68.93 million (1.9% year-on-year growth, 6.3% miss)

- Adjusted EPS: $0.10 vs analyst expectations of $0.16 (39.1% miss)

- Adjusted EBITDA: $4.52 million vs analyst estimates of $5.45 million (7% margin, relatively in line)

- Operating Margin: 5.8%, up from 0.3% in the same quarter last year

- Market Capitalization: $376.6 million

Company Overview

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

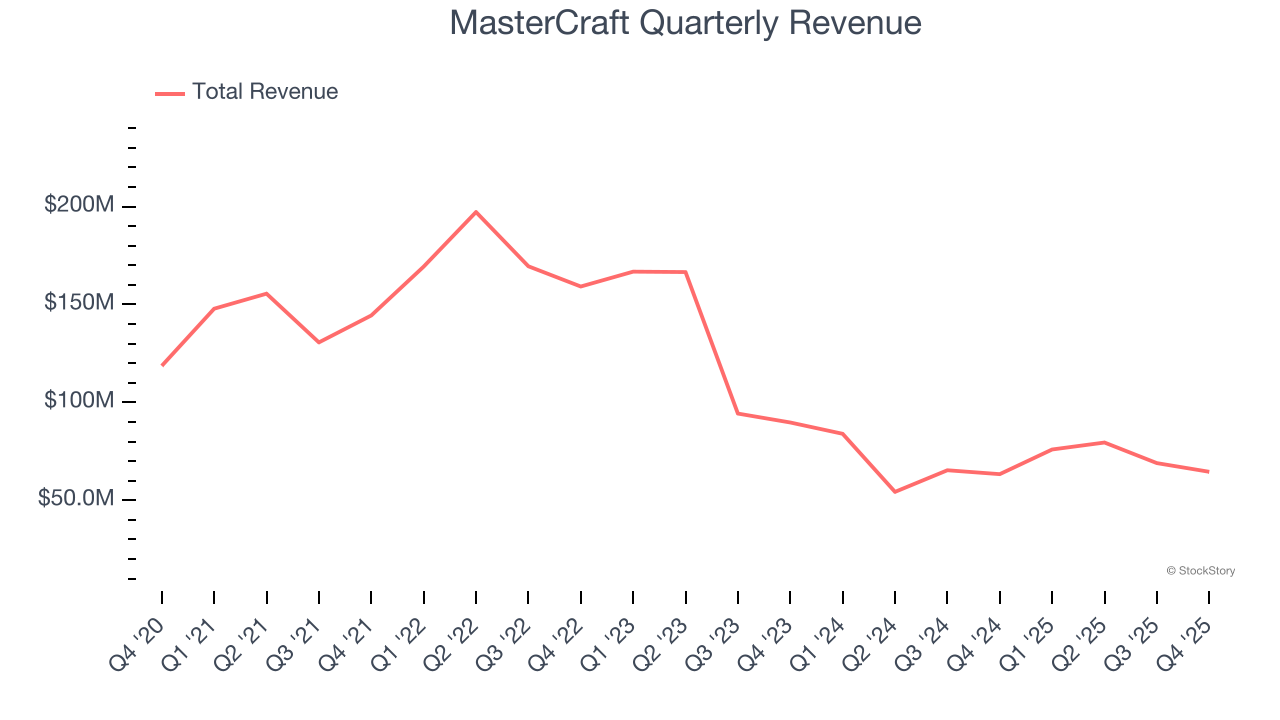

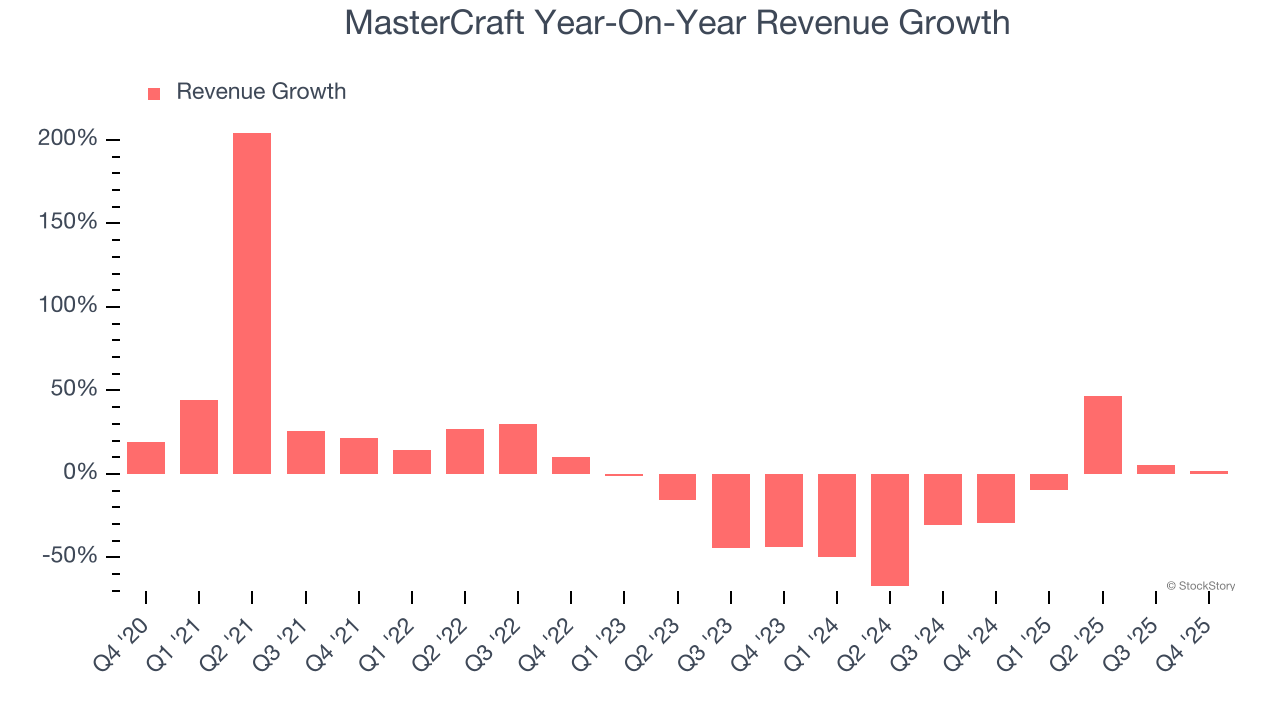

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. MasterCraft’s demand was weak over the last five years as its sales fell at a 5.1% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. MasterCraft’s recent performance shows its demand remained suppressed as its revenue has declined by 25.3% annually over the last two years.

This quarter, MasterCraft’s revenue grew by 1.9% year on year to $64.57 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

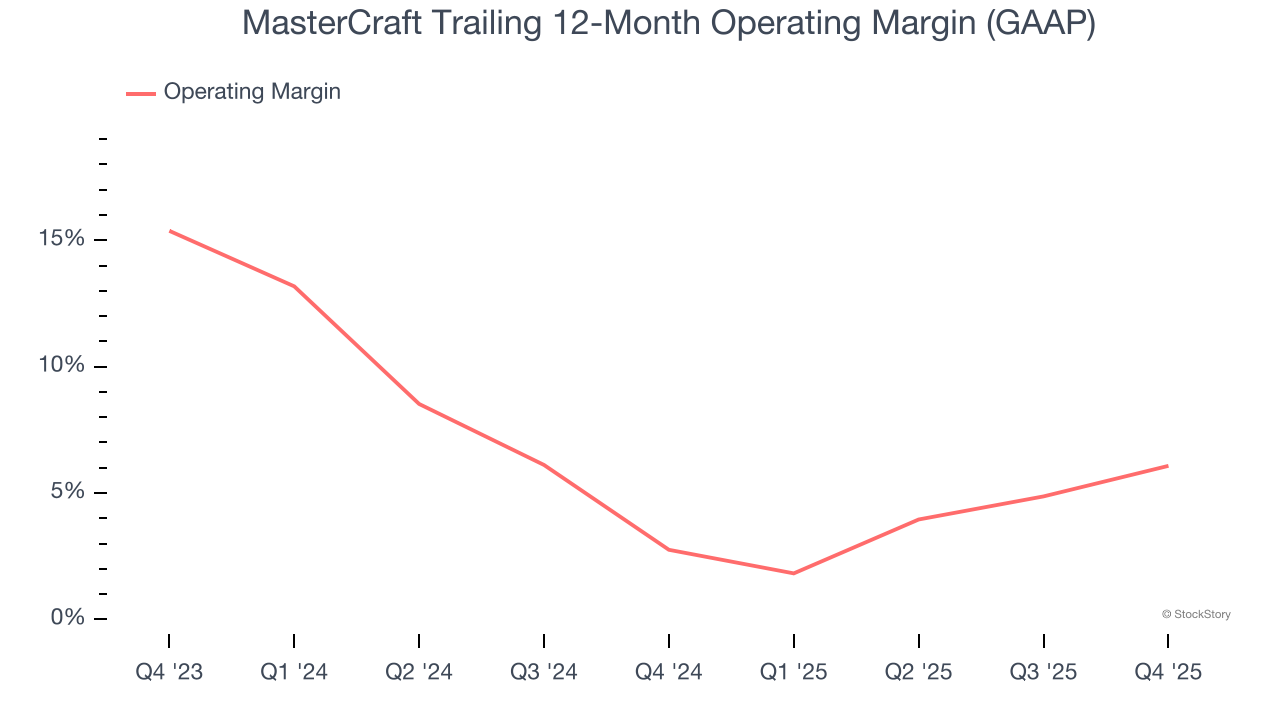

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MasterCraft’s operating margin has been trending up over the last 12 months and averaged 4.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, MasterCraft generated an operating margin profit margin of 5.8%, up 5.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

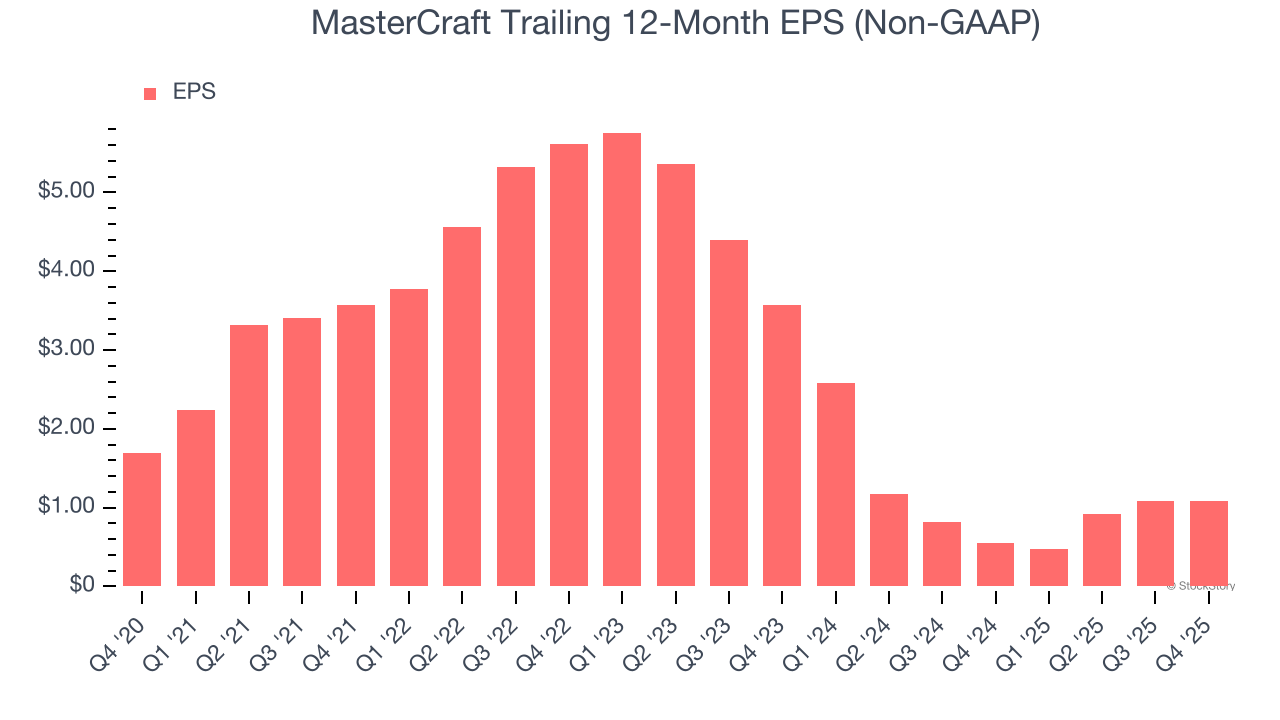

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for MasterCraft, its EPS declined by 8.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, MasterCraft reported adjusted EPS of $0.10, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects MasterCraft’s full-year EPS of $1.08 to grow 21.3%.

Key Takeaways from MasterCraft’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 2.1% to $23.60 immediately following the results.

Big picture, is MasterCraft a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).