Engine manufacturer Cummins (NYSE: CMI) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 1.1% year on year to $8.54 billion. Its GAAP profit of $4.27 per share was 14.9% below analysts’ consensus estimates.

Is now the time to buy Cummins? Find out by accessing our full research report, it’s free.

Cummins (CMI) Q4 CY2025 Highlights:

- Revenue: $8.54 billion vs analyst estimates of $8.11 billion (1.1% year-on-year growth, 5.3% beat)

- EPS (GAAP): $4.27 vs analyst expectations of $5.02 (14.9% miss)

- Adjusted EBITDA: $1.37 billion vs analyst estimates of $1.34 billion (16% margin, 2.4% beat)

- Operating Margin: 9.5%, in line with the same quarter last year

- Free Cash Flow Margin: 11.6%, up from 10.4% in the same quarter last year

- Market Capitalization: $83.6 billion

“Cummins delivered strong operational results in the fourth quarter and full year despite continued weakness in North America truck markets. Our Distribution and Power Systems segments achieved record full-year sales and profitability as a result of disciplined execution and robust demand for data center backup power,” said Jennifer Rumsey, Chair and CEO of Cummins.

Company Overview

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE: CMI) offers engines and power systems.

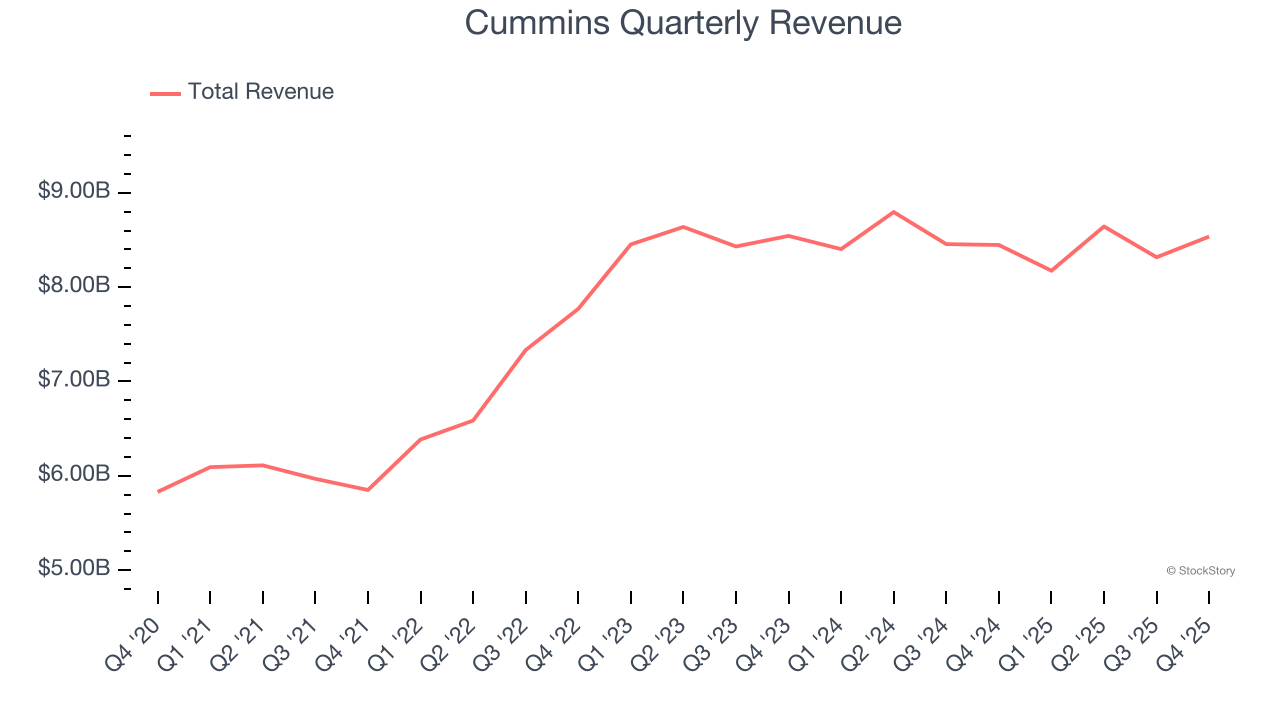

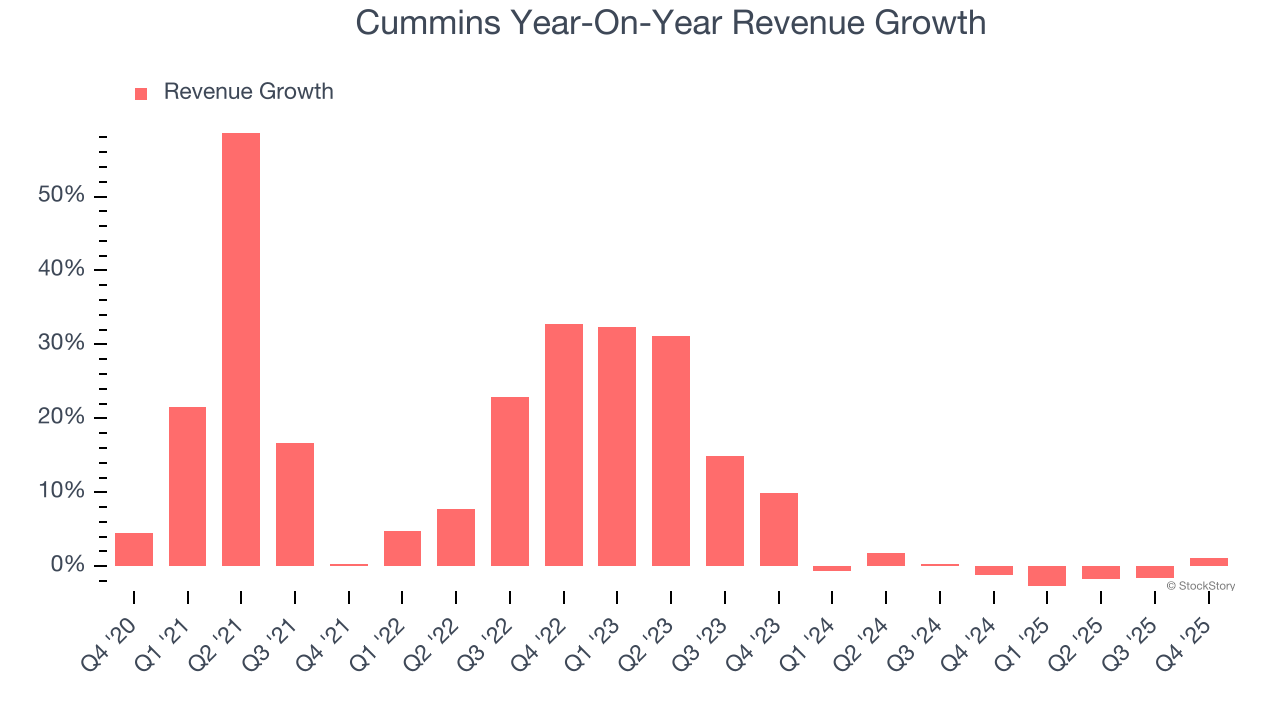

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Cummins’s sales grew at an impressive 11.2% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Cummins’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years. We also note many other Heavy Transportation Equipment businesses have faced declining sales because of cyclical headwinds. While Cummins’s growth wasn’t the best, it did do better than its peers.

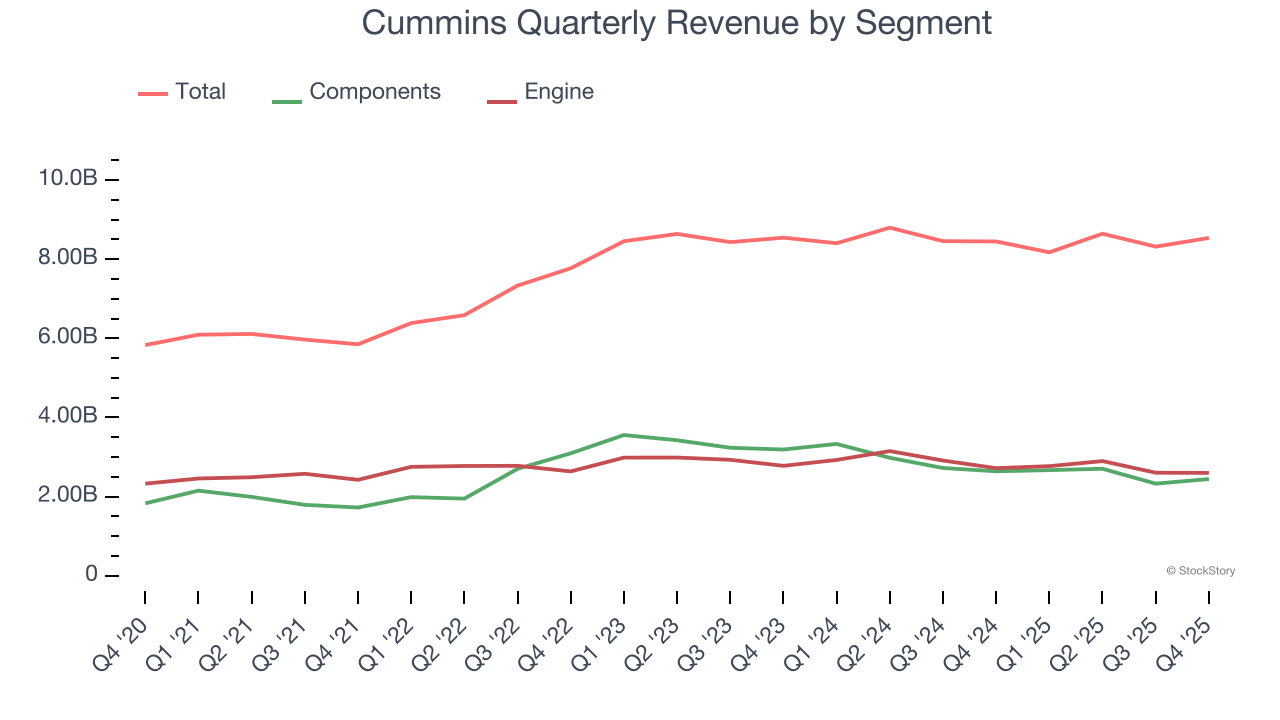

We can better understand the company’s revenue dynamics by analyzing its most important segments, Components

and Engine

, which are 28.6% and 30.5% of revenue. Over the last two years, Cummins’s Components

revenue (axles, brakes, drivelines) averaged 12.9% year-on-year declines while its Engine

revenue (diesel and gas-powered engines) averaged 3.4% declines.

This quarter, Cummins reported modest year-on-year revenue growth of 1.1% but beat Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

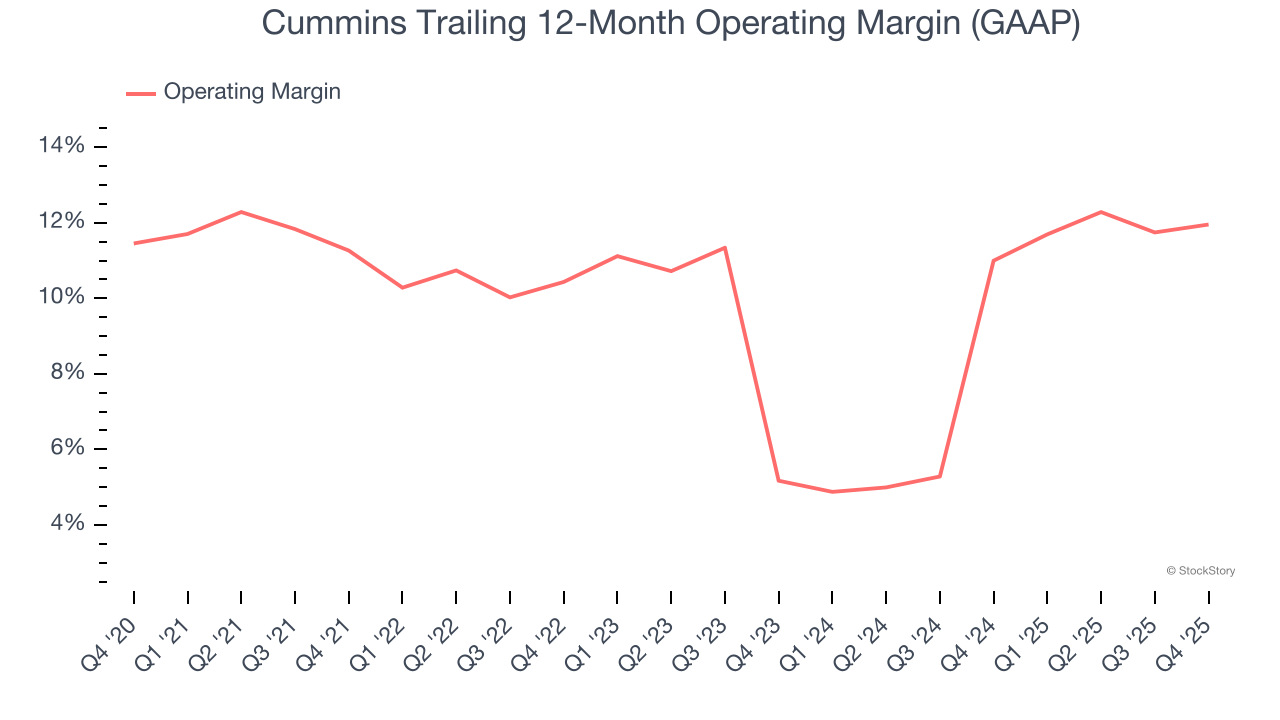

Cummins’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9.9% over the last five years. This profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Cummins’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Cummins generated an operating margin profit margin of 9.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

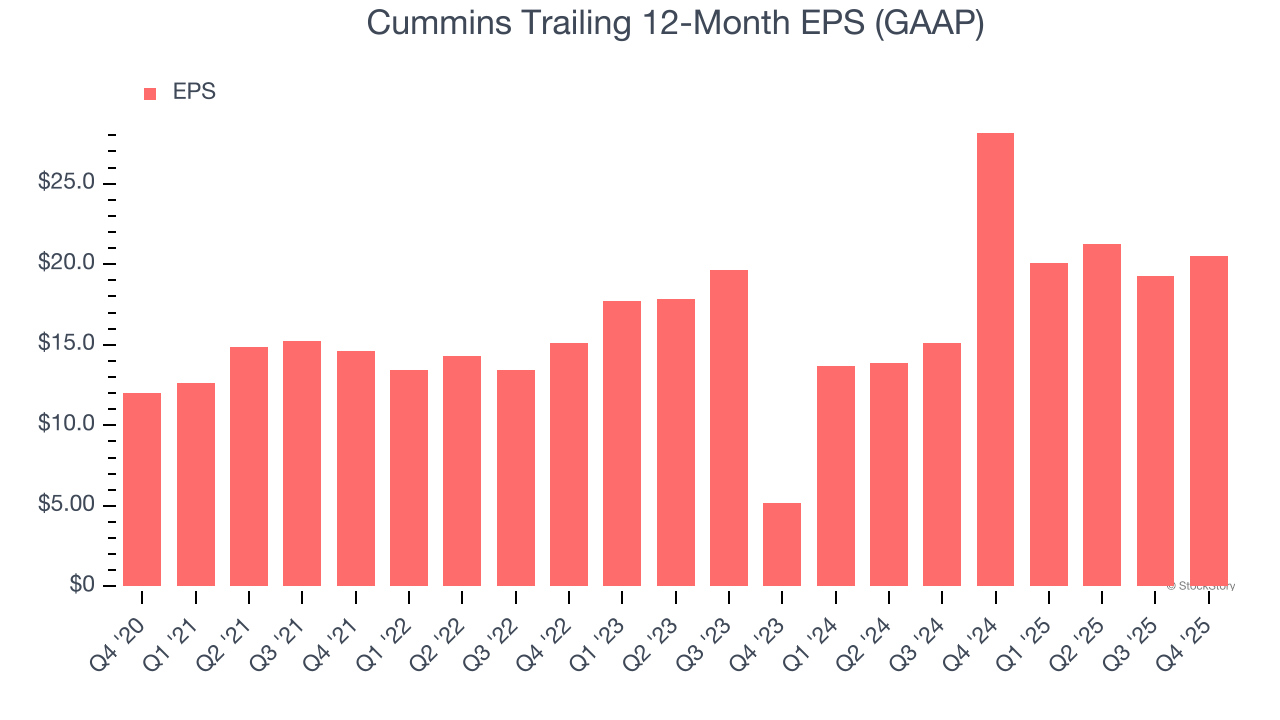

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Cummins’s solid 11.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Cummins’s two-year annual EPS growth of 99% was fantastic and topped its flat revenue.

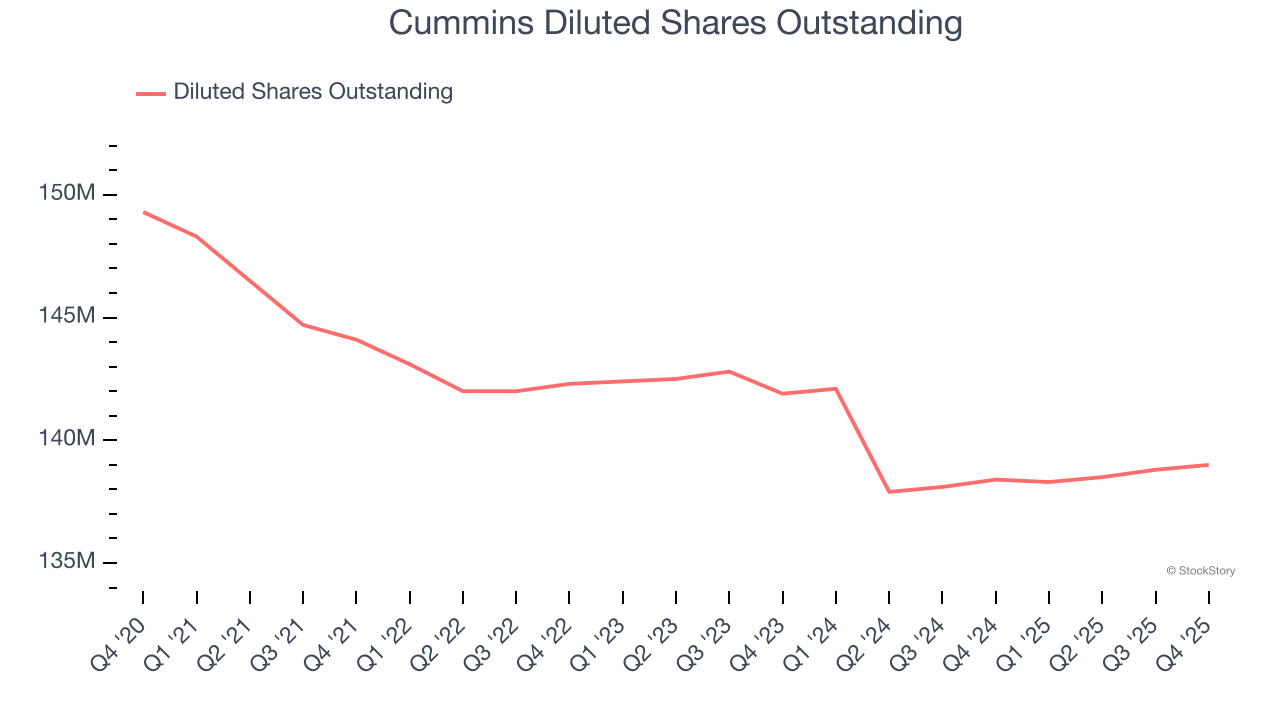

We can take a deeper look into Cummins’s earnings quality to better understand the drivers of its performance. While we mentioned earlier that Cummins’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Cummins reported EPS of $4.27, up from $3.02 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Cummins’s full-year EPS of $20.52 to grow 21.4%.

Key Takeaways from Cummins’s Q4 Results

We were impressed by how significantly Cummins blew past analysts’ revenue expectations this quarter. We were also glad its Components revenue topped Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.4% to $597.43 immediately following the results.

Is Cummins an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).