Over the past six months, Matrix Service’s shares (currently trading at $11.74) have posted a disappointing 13.7% loss, well below the S&P 500’s 11.5% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Matrix Service, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Matrix Service Not Exciting?

Even though the stock has become cheaper, we're cautious about Matrix Service. Here are three reasons we avoid MTRX and a stock we'd rather own.

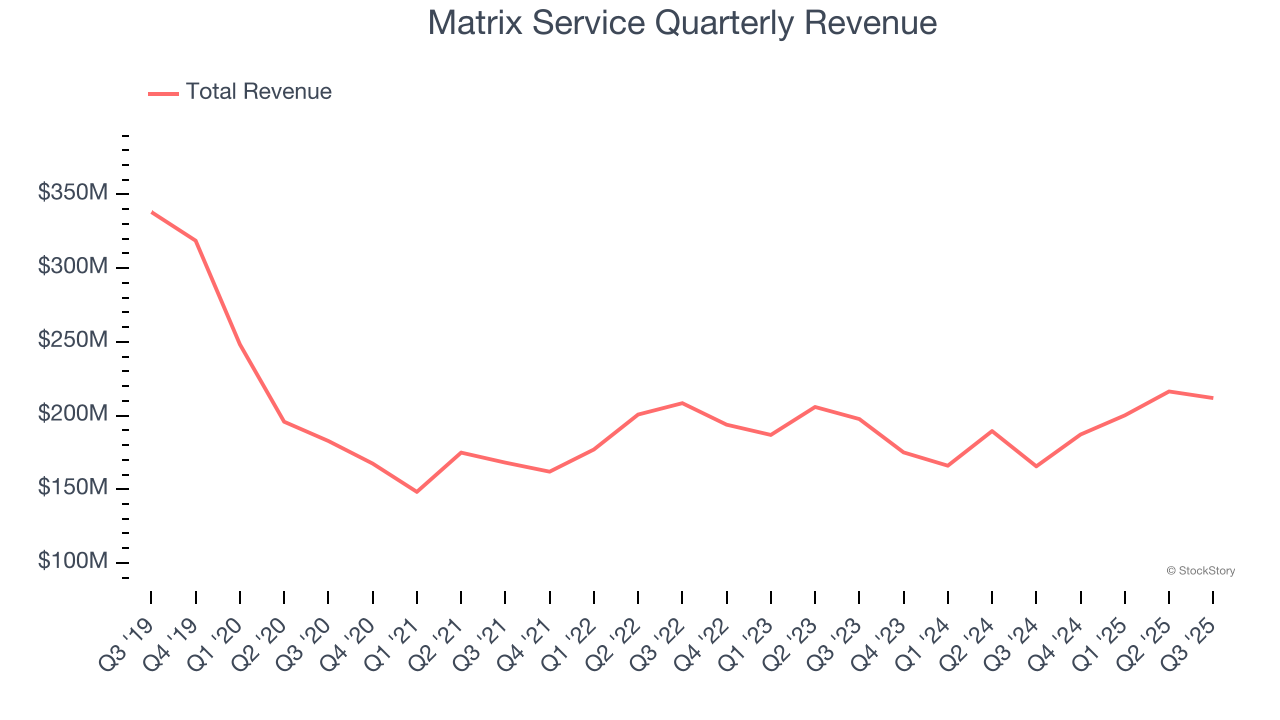

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Matrix Service’s demand was weak and its revenue declined by 2.9% per year. This was below our standards and is a sign of lacking business quality.

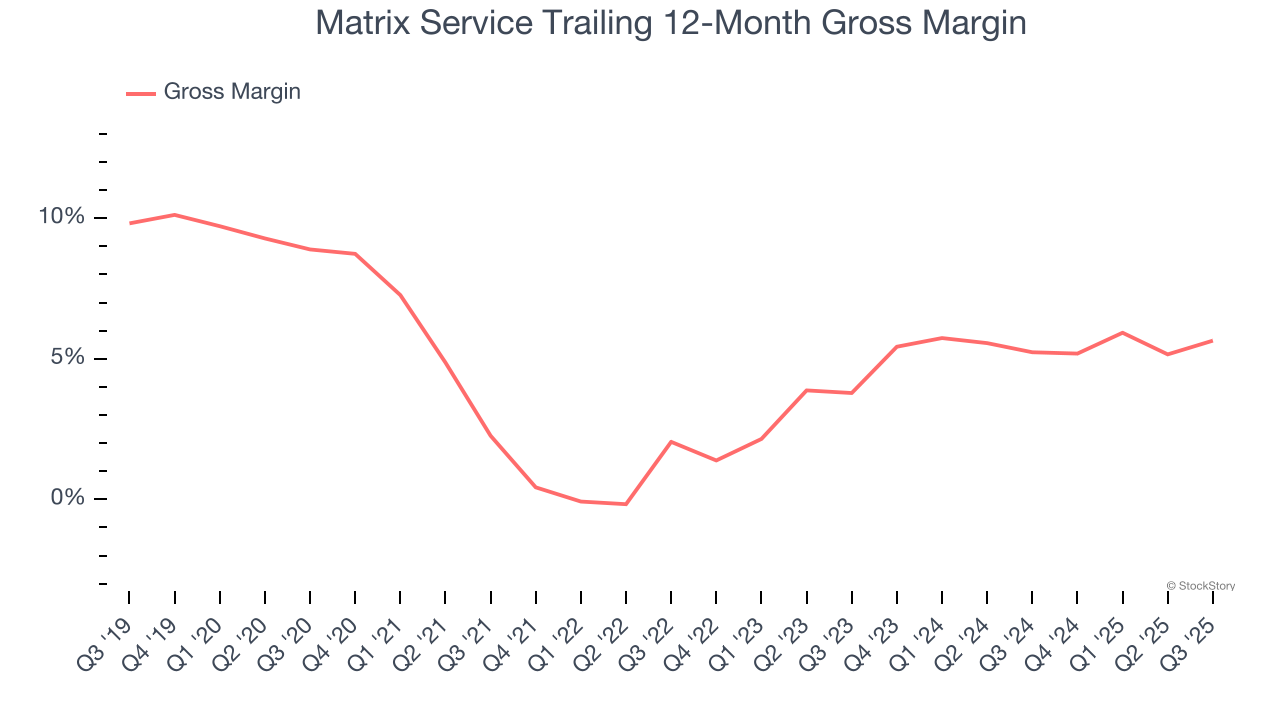

2. Low Gross Margin Reveals Weak Structural Profitability

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Matrix Service has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 3.8% gross margin over the last five years. That means Matrix Service paid its suppliers a lot of money ($96.16 for every $100 in revenue) to run its business.

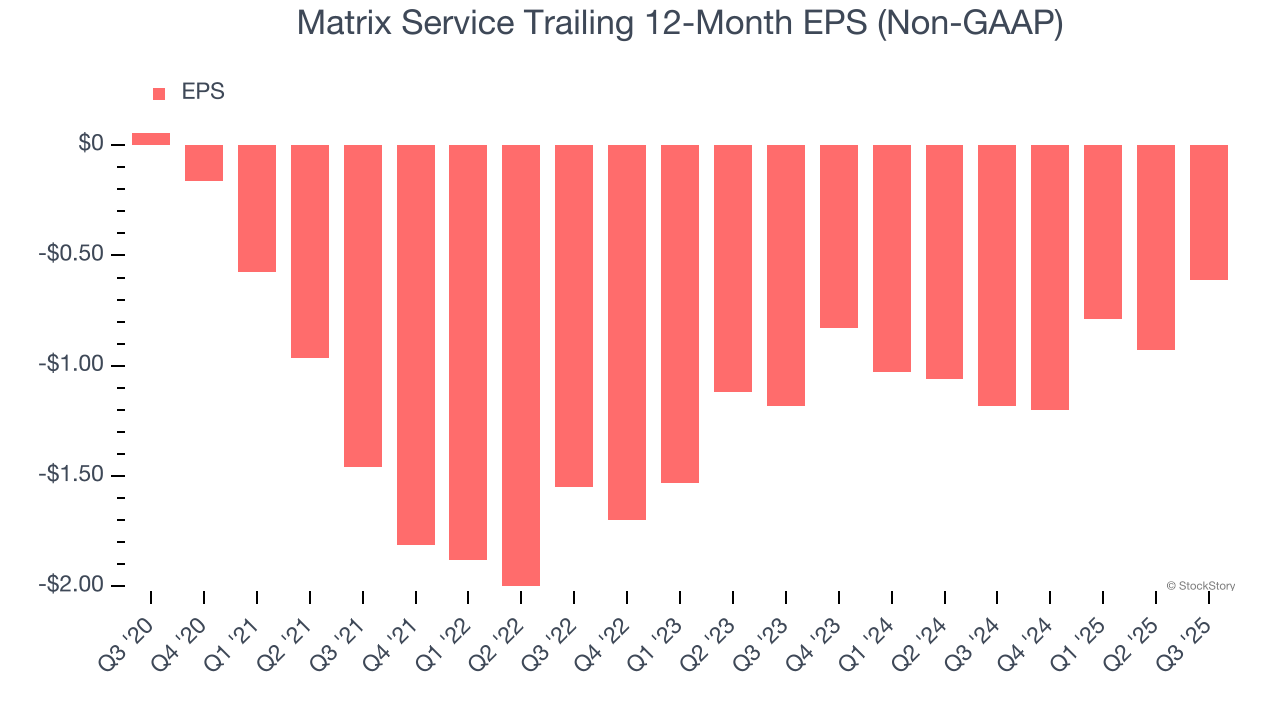

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Matrix Service, its EPS declined by 66.3% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Matrix Service isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 23× forward P/E (or $11.74 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Matrix Service

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.