Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Silgan Holdings (NYSE: SLGN) and the best and worst performers in the industrial packaging industry.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8%.

In light of this news, share prices of the companies have held steady as they are up 3.6% on average since the latest earnings results.

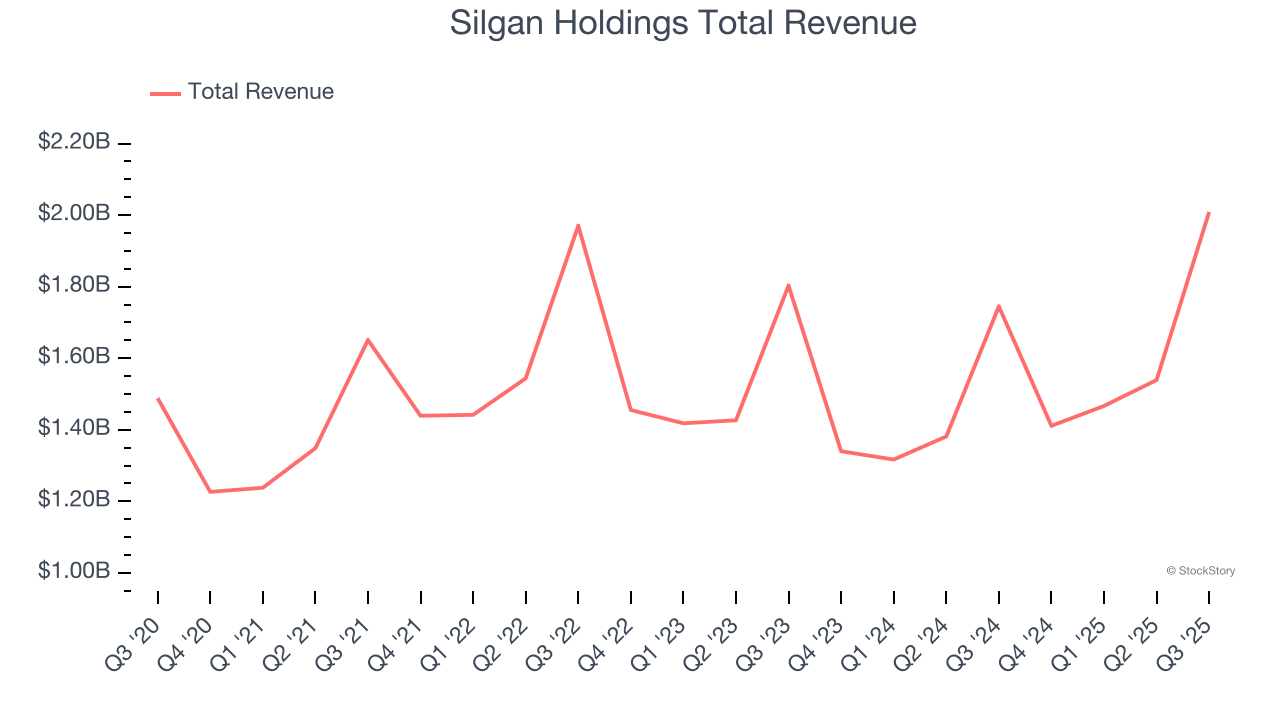

Silgan Holdings (NYSE: SLGN)

Established in 1987, Silgan Holdings (NYSE: SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $2.01 billion, up 15.1% year on year. This print exceeded analysts’ expectations by 3.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ revenue estimates.

"Our third quarter results continued to exhibit the success of our strategic growth initiatives, the resilience of our business through dynamic customer and end market conditions and the benefits of our disciplined capital deployment model, as we delivered 11% Adjusted EBITDA growth in the quarter. The strength and focus of our teams, our market leading innovation and the power of our diverse portfolio continue to set us apart in the markets we serve, and our long-term customer partnerships continue to strengthen as we expand our capabilities across consumer packaging," said Adam Greenlee, President and CEO.

Silgan Holdings scored the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 9.7% since reporting and currently trades at $40.37.

Is now the time to buy Silgan Holdings? Access our full analysis of the earnings results here, it’s free for active Edge members.

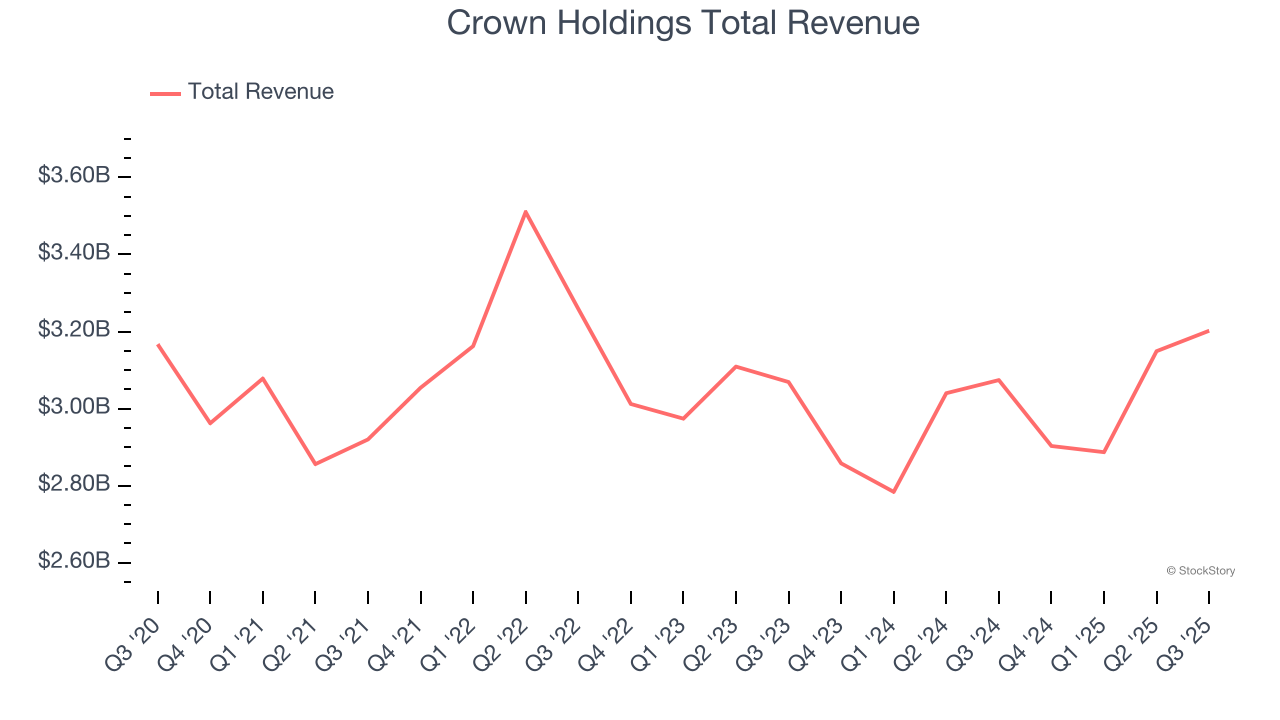

Best Q3: Crown Holdings (NYSE: CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE: CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $3.20 billion, up 4.2% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $102.97.

Is now the time to buy Crown Holdings? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: International Paper (NYSE: IP)

Established in 1898, International Paper (NYSE: IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $6.22 billion, up 32.8% year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

International Paper delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 10.9% since the results and currently trades at $39.39.

Read our full analysis of International Paper’s results here.

Graphic Packaging Holding (NYSE: GPK)

Founded in 1991, Graphic Packaging (NYSE: GPK) is a provider of paper-based packaging solutions for a wide range of products.

Graphic Packaging Holding reported revenues of $2.19 billion, down 1.2% year on year. This result beat analysts’ expectations by 1.3%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ sales volume estimates but a significant miss of analysts’ adjusted operating income estimates.

Graphic Packaging Holding had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 3.8% since reporting and currently trades at $15.06.

Avery Dennison (NYSE: AVY)

Founded as Kum Kleen Products, Avery Dennison (NYSE: AVY) is a manufacturer of adhesive materials, display graphics, and packaging products, serving various industries.

Avery Dennison reported revenues of $2.22 billion, up 1.5% year on year. This number met analysts’ expectations. Aside from that, it was a mixed quarter as it also produced a decent beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is up 11.2% since reporting and currently trades at $181.88.

Read our full, actionable report on Avery Dennison here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.