As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the processors and graphics chips industry, including Intel (NASDAQ: INTC) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 0.6% below.

Luckily, processors and graphics chips stocks have performed well with share prices up 28.7% on average since the latest earnings results.

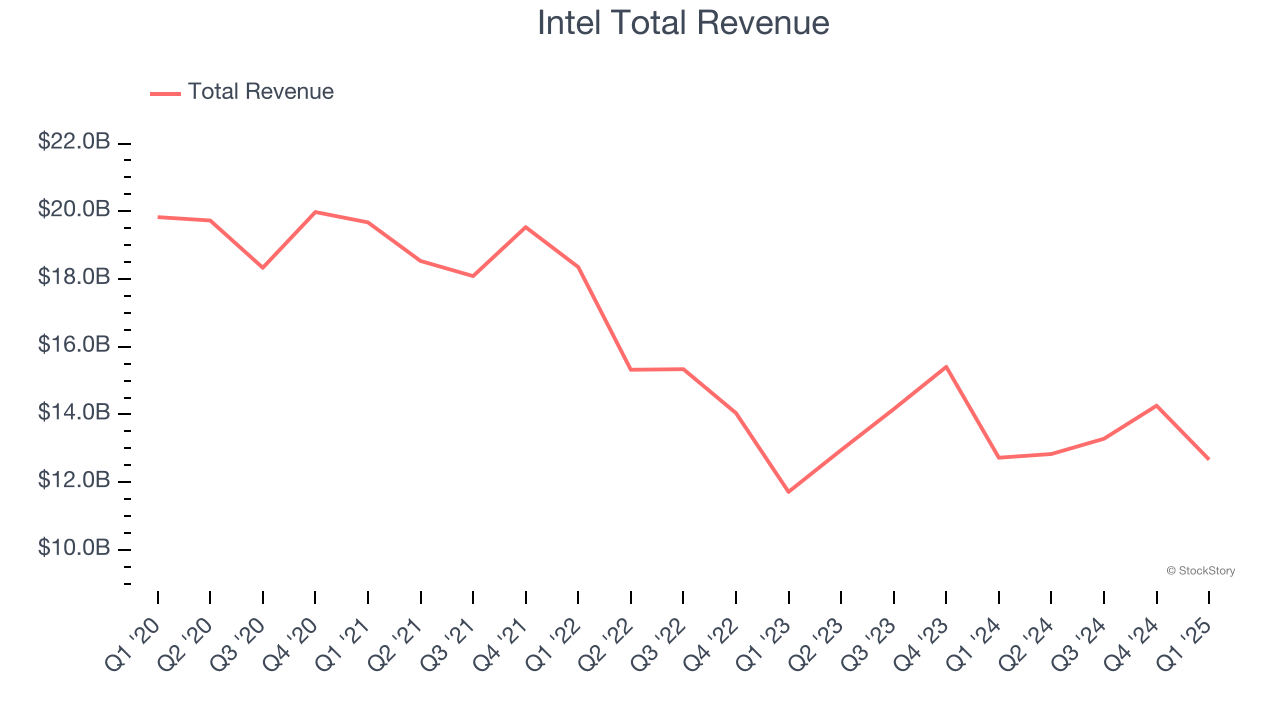

Intel (NASDAQ: INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is a leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $12.67 billion, flat year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EPS estimates but an increase in its inventory levels.

“The first quarter was a step in the right direction, but there are no quick fixes as we work to get back on a path to gaining market share and driving sustainable growth,” said Lip-Bu Tan, Intel CEO.

Interestingly, the stock is up 10.8% since reporting and currently trades at $23.80.

Is now the time to buy Intel? Access our full analysis of the earnings results here, it’s free.

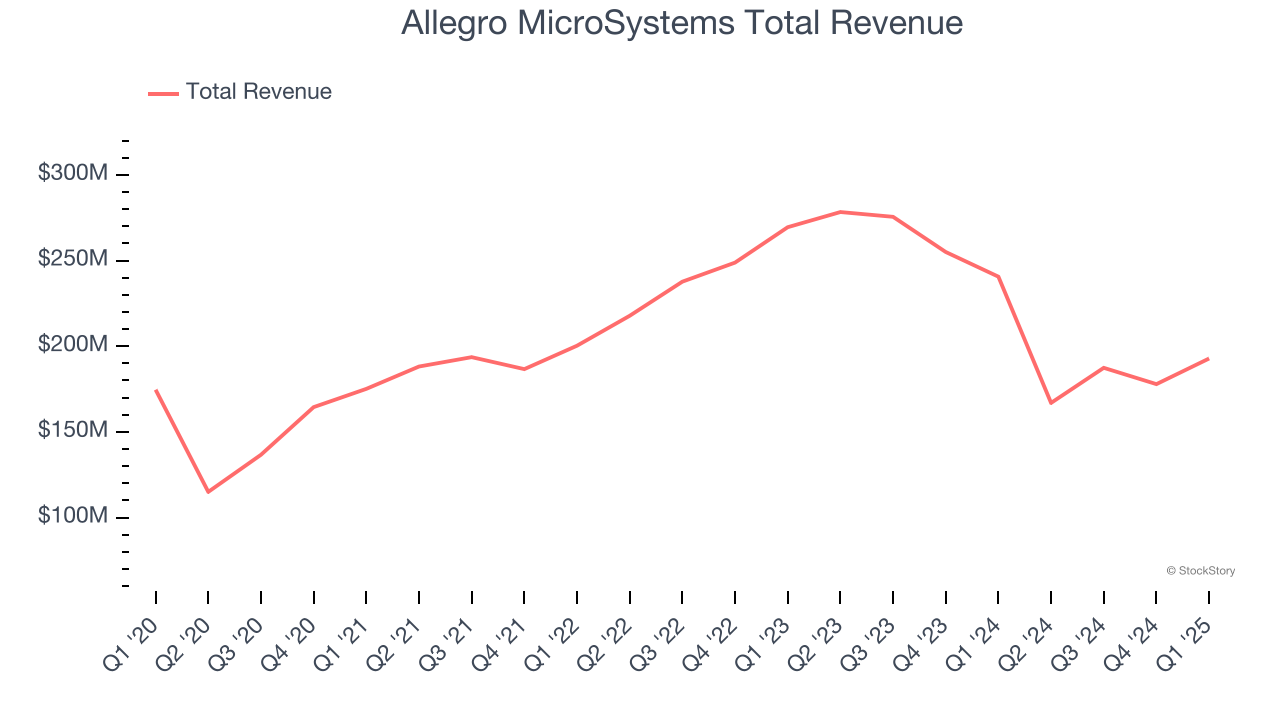

Best Q1: Allegro MicroSystems (NASDAQ: ALGM)

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Allegro MicroSystems reported revenues of $192.8 million, down 19.9% year on year, outperforming analysts’ expectations by 4.3%. The business had a very strong quarter with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 106% since reporting. It currently trades at $38.48.

Is now the time to buy Allegro MicroSystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Lattice Semiconductor (NASDAQ: LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ: LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $120.2 million, down 14.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted an increase in its inventory levels and a slight miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 2.3% since the results and currently trades at $54.26.

Read our full analysis of Lattice Semiconductor’s results here.

Qorvo (NASDAQ: QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $869.5 million, down 7.6% year on year. This result beat analysts’ expectations by 2.2%. It was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 45.3% since reporting and currently trades at $90.99.

Read our full, actionable report on Qorvo here, it’s free.

Nvidia (NASDAQ: NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ: NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $44.06 billion, up 69.2% year on year. This print topped analysts’ expectations by 1.8%. Overall, it was a strong quarter as it also put up a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

Nvidia pulled off the fastest revenue growth among its peers. The stock is up 21.7% since reporting and currently trades at $164.04.

Read our full, actionable report on Nvidia here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.