Let’s dig into the relative performance of Rush Street Interactive (NYSE: RSI) and its peers as we unravel the now-completed Q1 gaming solutions earnings season.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 2.4%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q1: Rush Street Interactive (NYSE: RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE: RSI) is an operator of digital gaming platforms.

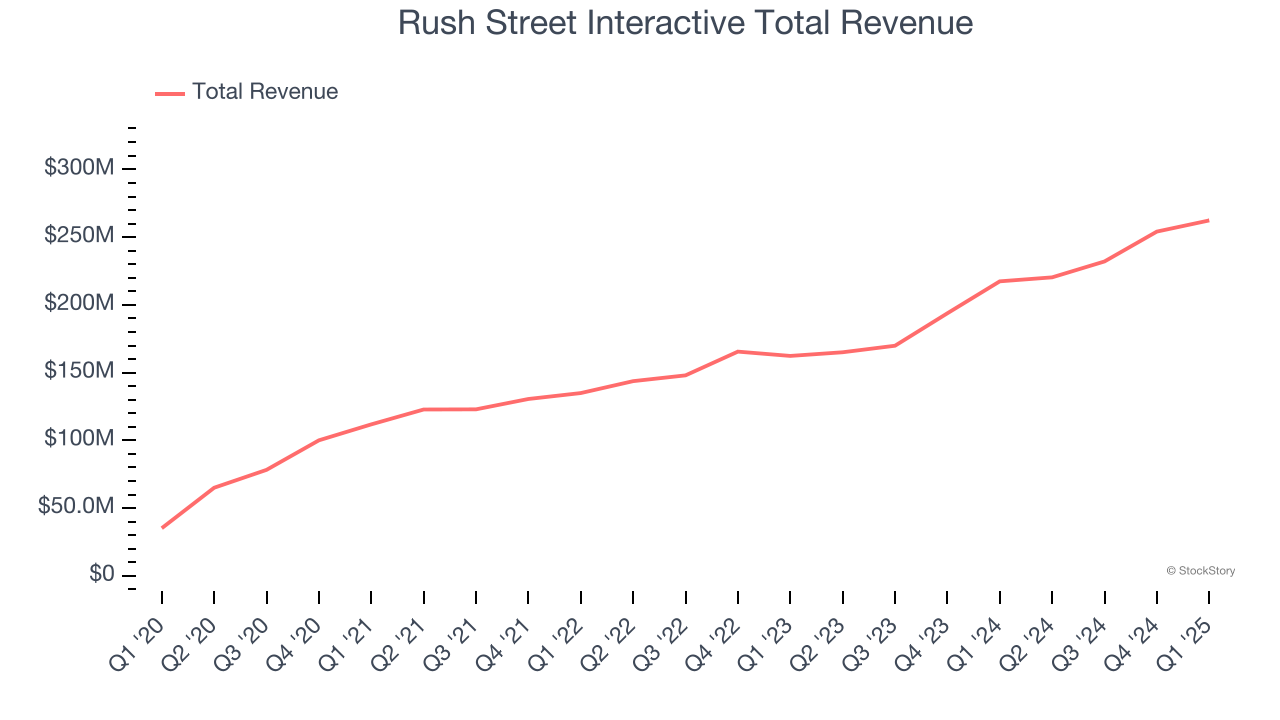

Rush Street Interactive reported revenues of $262.4 million, up 20.7% year on year. This print exceeded analysts’ expectations by 0.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Richard Schwartz, Chief Executive Officer of RSI, said, “We have started 2025 with strong momentum, building on our success from recent years. Our first quarter revenue increased by 21% year-over-year to $262 million, and our Adjusted EBITDA reached a record $33 million, nearly double that of Q1 2024. These strong results are driven by our commitment to innovation and enhancing the quality of our player experience, alongside efficient acquisition and retention of high-value players. The consistency and durability of our business, particularly in online casino, is reflected in our execution and performance and is the foundation of the optimism we have for sustaining our momentum going forward.”

Rush Street Interactive scored the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 3.1% since reporting and currently trades at $11.74.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free.

DraftKings (NASDAQ: DKNG)

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

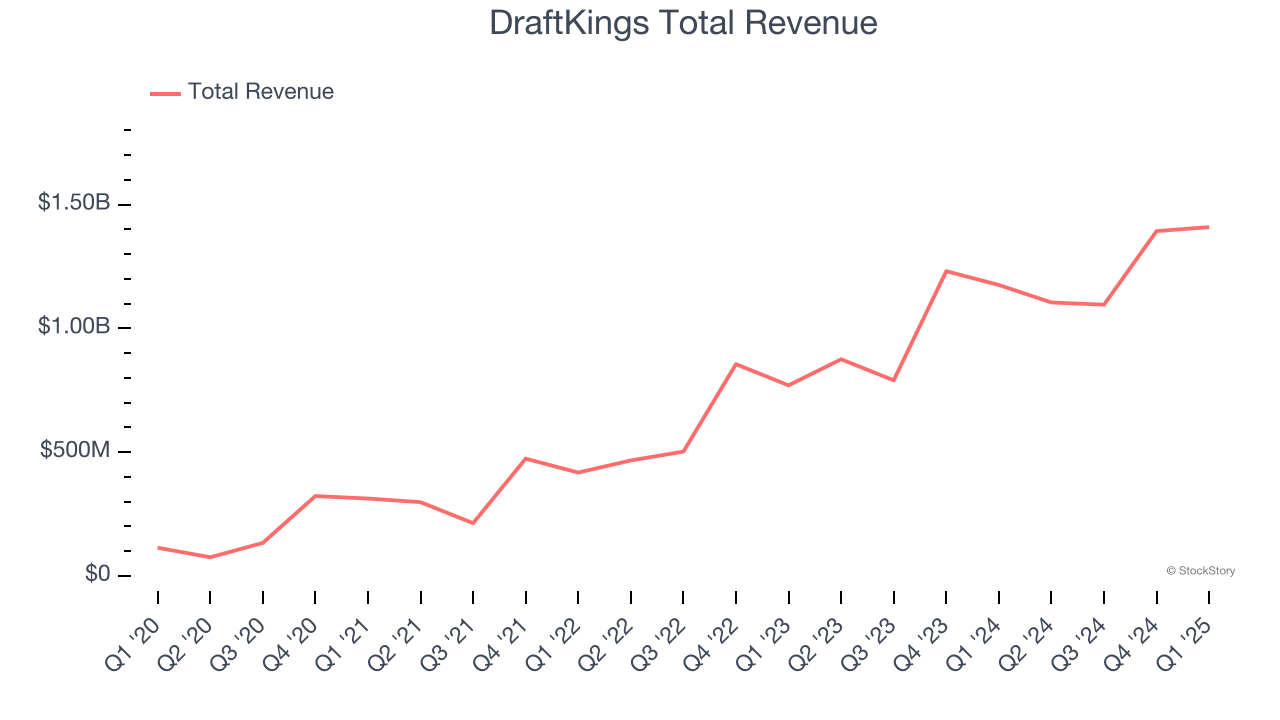

DraftKings reported revenues of $1.41 billion, up 19.9% year on year, falling short of analysts’ expectations by 3.1%. The business performed better than its peers, but it was unfortunately a slower quarter with full-year EBITDA guidance missing analysts’ expectations.

The market seems content with the results as the stock is up 2.2% since reporting. It currently trades at $36.18.

Is now the time to buy DraftKings? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Light & Wonder (NASDAQ: LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Light & Wonder reported revenues of $774 million, up 2.4% year on year, falling short of analysts’ expectations by 4.3%. It was a softer quarter as it posted a miss of analysts’ Gaming revenue and EPS estimates.

As expected, the stock is down 13% since the results and currently trades at $81.49.

Read our full analysis of Light & Wonder’s results here.

Accel Entertainment (NYSE: ACEL)

Established in Illinois, Accel Entertainment (NYSE: ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $323.9 million, up 7.3% year on year. This number topped analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EPS estimates and a decent beat of analysts’ video gaming terminals sold estimates.

Accel Entertainment scored the biggest analyst estimates beat among its peers. The stock is up 5.9% since reporting and currently trades at $11.40.

Read our full, actionable report on Accel Entertainment here, it’s free.

Churchill Downs (NASDAQ: CHDN)

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Churchill Downs reported revenues of $642.6 million, up 8.7% year on year. This print met analysts’ expectations. Aside from that, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 8.4% since reporting and currently trades at $96.28.

Read our full, actionable report on Churchill Downs here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.