Gaming products and services provider Light & Wonder (NASDAQ: LNW) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.5% year on year to $797 million. Its GAAP profit of $1.20 per share was 23.4% above analysts’ consensus estimates.

Is now the time to buy Light & Wonder? Find out by accessing our full research report, it’s free.

Light & Wonder (LNW) Q4 CY2024 Highlights:

- Revenue: $797 million vs analyst estimates of $800.8 million (3.5% year-on-year growth, in line)

- EPS (GAAP): $1.20 vs analyst estimates of $0.97 (23.4% beat)

- Adjusted EBITDA: $315 million vs analyst estimates of $310 million (39.5% margin, 1.6% beat)

- Operating Margin: 21.1%, in line with the same quarter last year

- Free Cash Flow Margin: 9.3%, down from 13.9% in the same quarter last year

- Market Capitalization: $8.56 billion

Company Overview

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

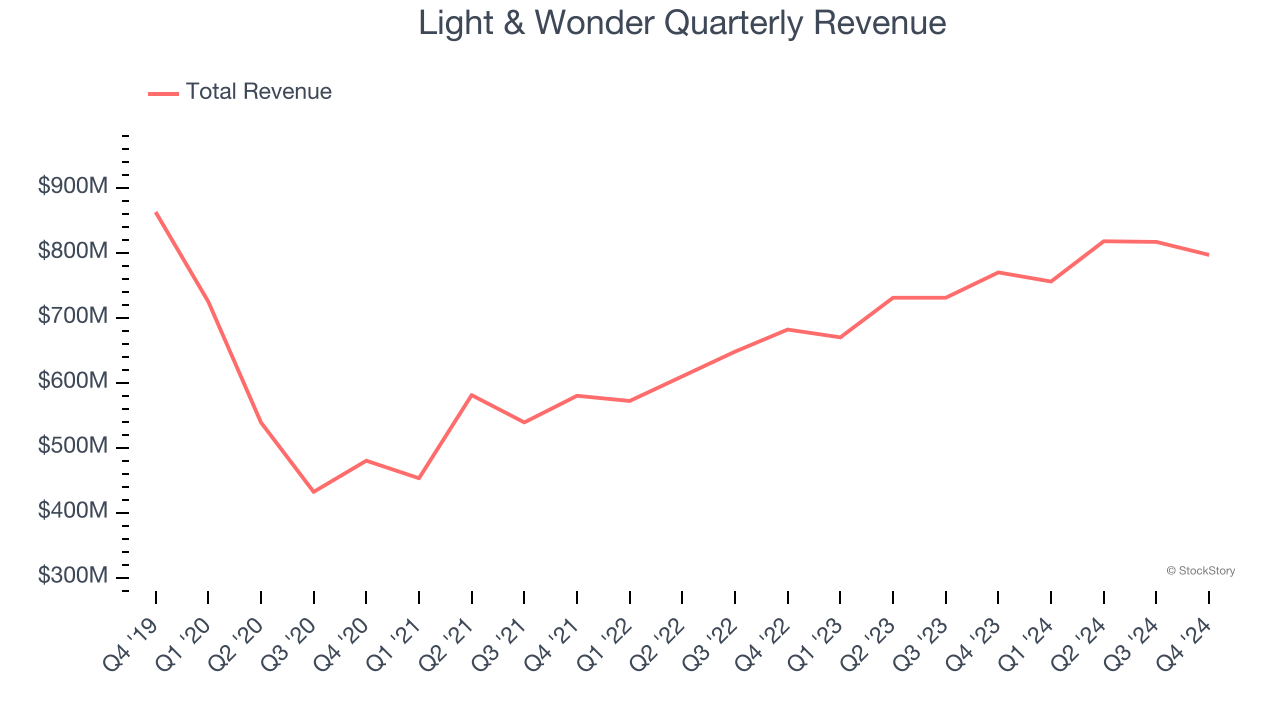

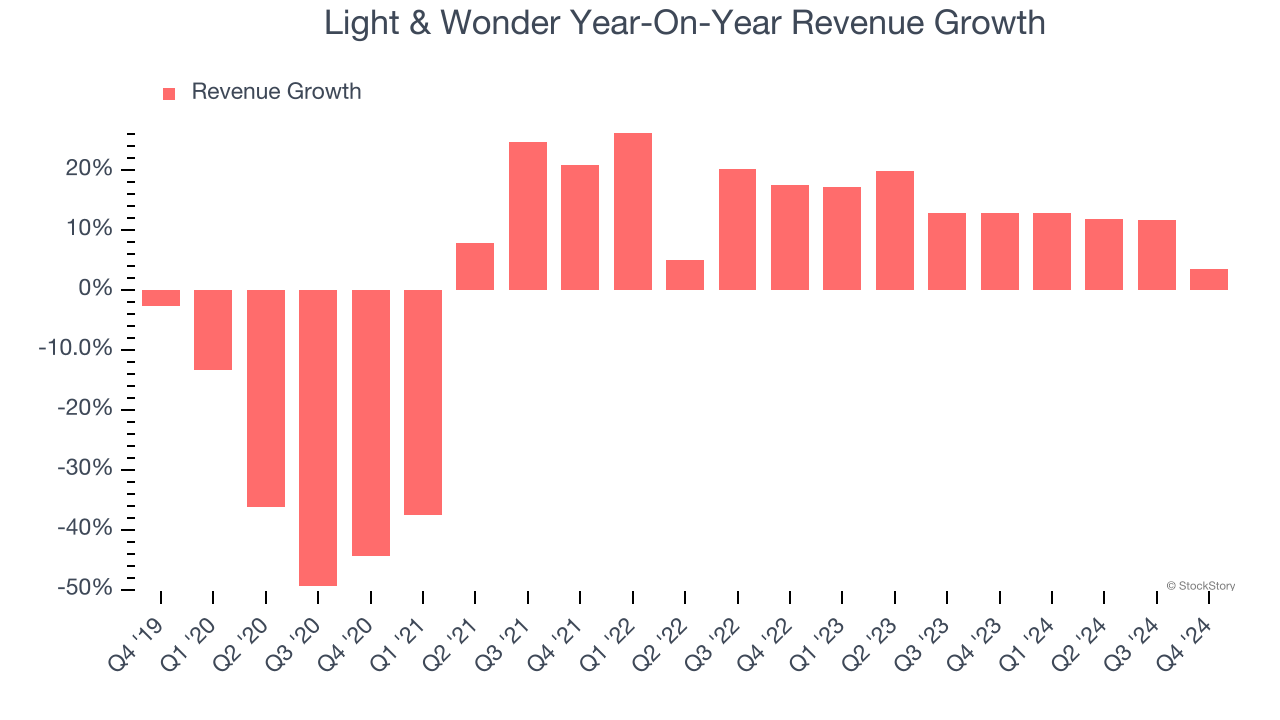

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Light & Wonder’s demand was weak and its revenue declined by 1.3% per year. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Light & Wonder’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Gaming, Social Gaming, and iGaming, which are 64.6%, 25.6%, and 9.8% of revenue. Over the last two years, Light & Wonder’s revenues in all three segments increased. Its Gaming revenue (slot machines, casino games) averaged year-on-year growth of 13.8% while its Social Gaming (free-to-play games) and iGaming (digital games) revenues averaged 10.9% and 11.9%.

This quarter, Light & Wonder grew its revenue by 3.5% year on year, and its $797 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

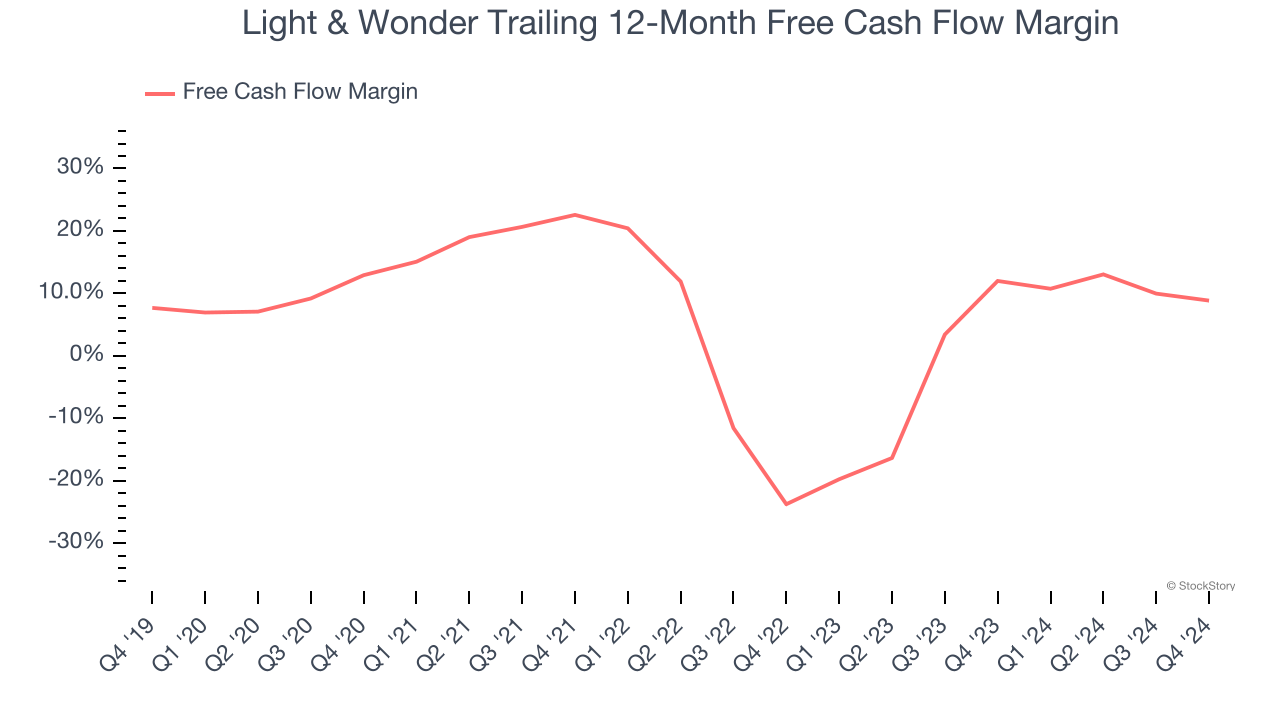

Light & Wonder has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.3% over the last two years, slightly better than the broader consumer discretionary sector.

Light & Wonder’s free cash flow clocked in at $74 million in Q4, equivalent to a 9.3% margin. The company’s cash profitability regressed as it was 4.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Light & Wonder’s Q4 Results

We enjoyed seeing Light & Wonder beat analysts’ EPS and EBITDA expectations this quarter. On the other hand, its iGaming revenue missed. Overall, this quarter was mixed but still had some key positives. The stock remained flat at $101.60 immediately following the results.

So do we think Light & Wonder is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.