Over the past six months, Kulicke and Soffa has been a great trade, beating the S&P 500 by 21.5%. Its stock price has climbed to $46.76, representing a healthy 35.4% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Kulicke and Soffa, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Kulicke and Soffa Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Kulicke and Soffa. Here are three reasons you should be careful with KLIC and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

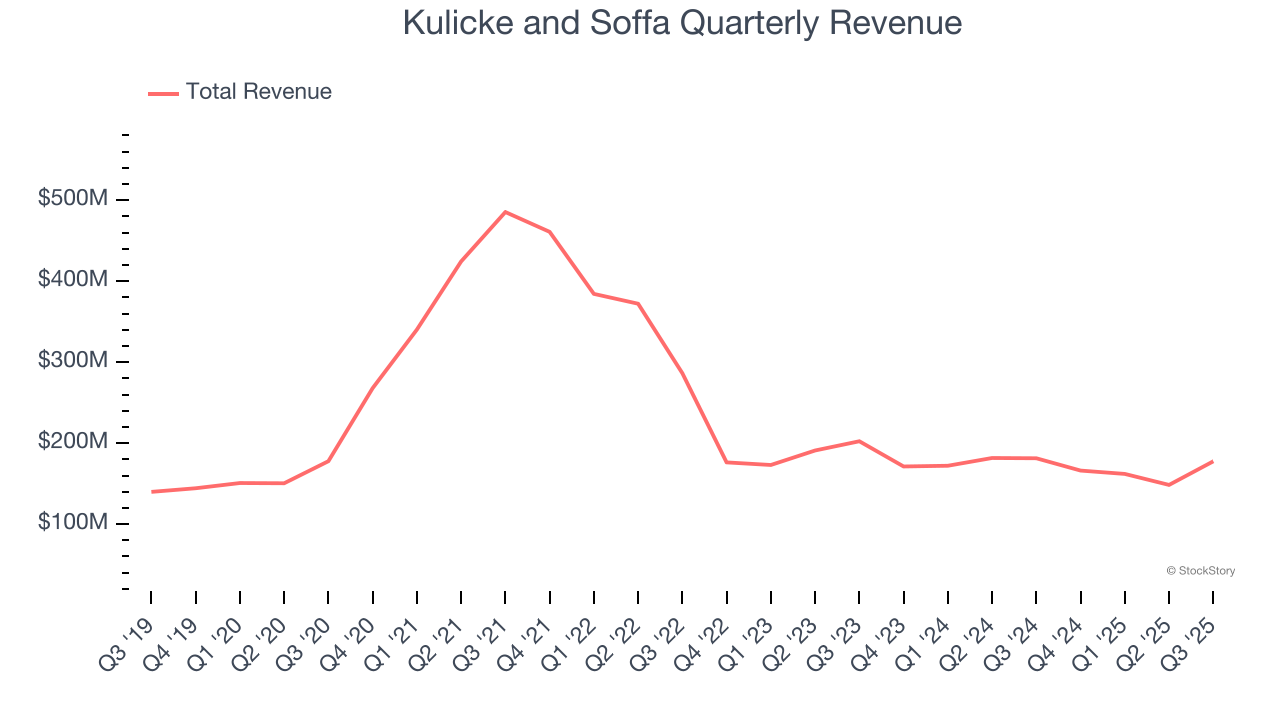

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Kulicke and Soffa struggled to consistently increase demand as its $654.1 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a lower quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Shrinking Operating Margin

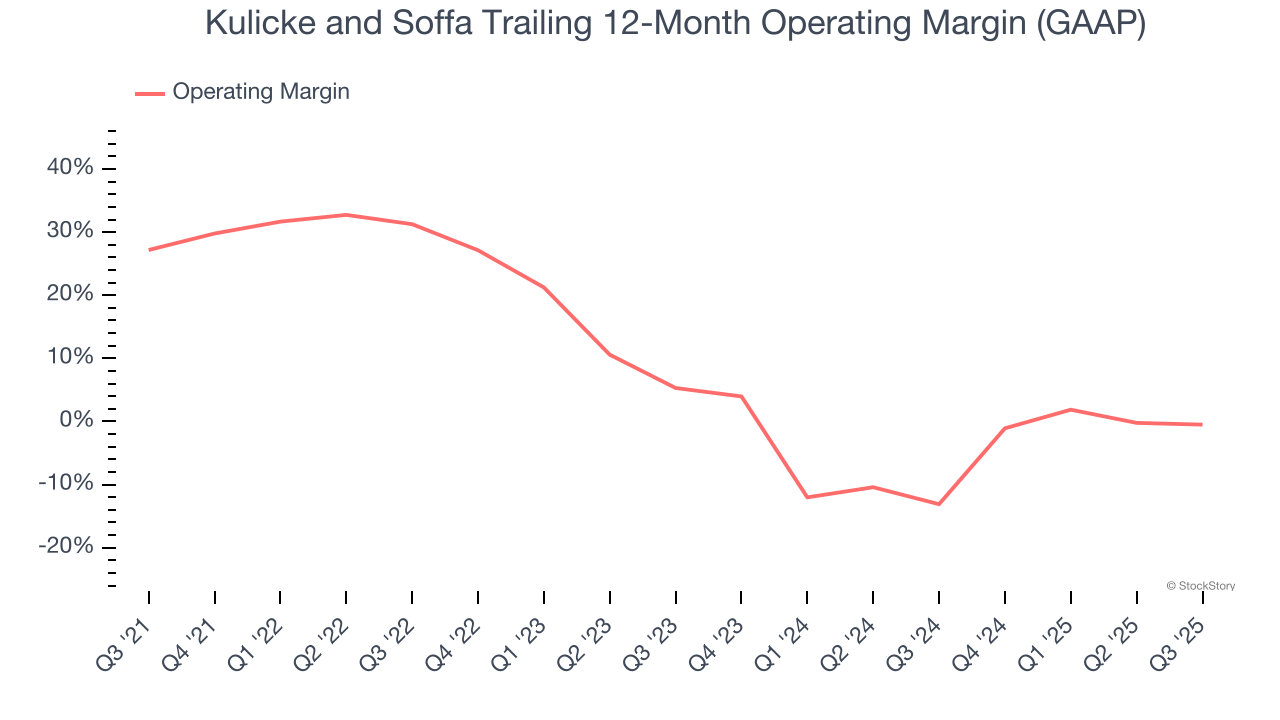

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Kulicke and Soffa’s operating margin decreased by 27.7 percentage points over the last five years. Kulicke and Soffa’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was breakeven.

3. EPS Trending Down

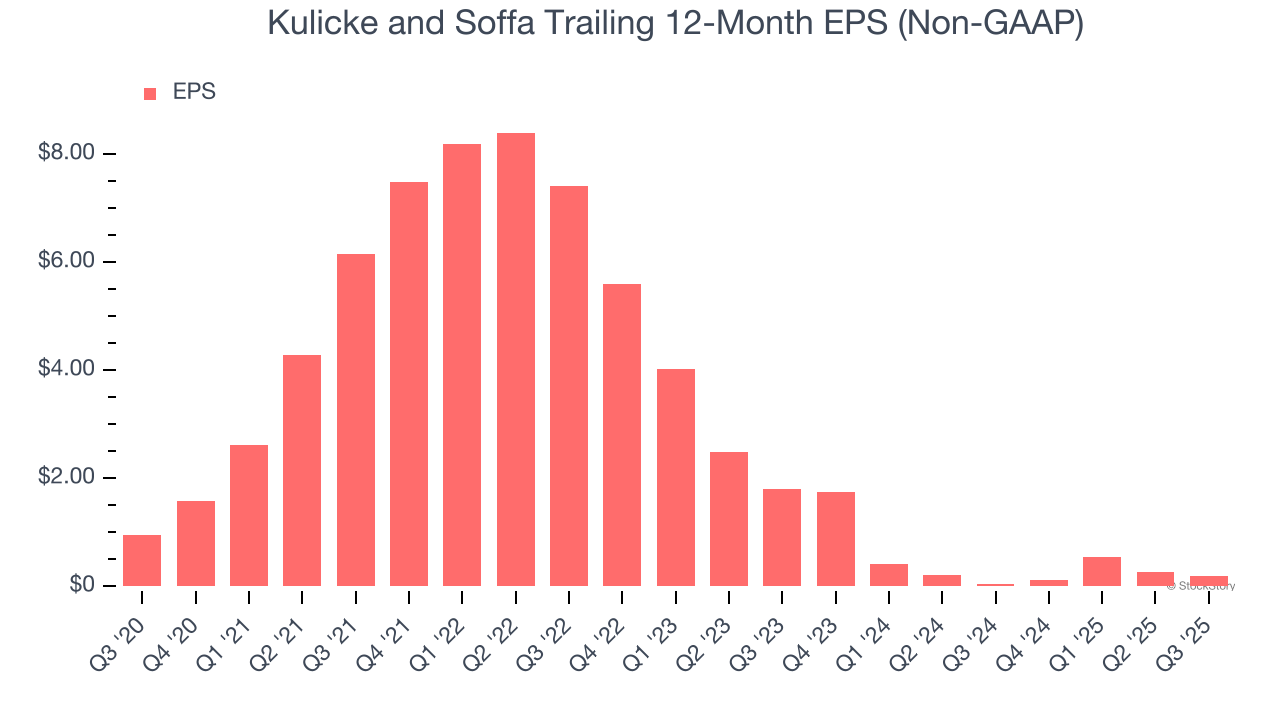

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Kulicke and Soffa, its EPS declined by 26.9% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Kulicke and Soffa isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 31.8× forward P/E (or $46.76 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.