Over the last six months, Procter & Gamble’s shares have sunk to $147.27, producing a disappointing 7.3% loss - a stark contrast to the S&P 500’s 19.8% gain. This might have investors contemplating their next move.

Following the drawdown, is now a good time to buy PG? Find out in our full research report, it’s free for active Edge members.

Why Does PG Stock Spark Debate?

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE: PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Two Positive Attributes:

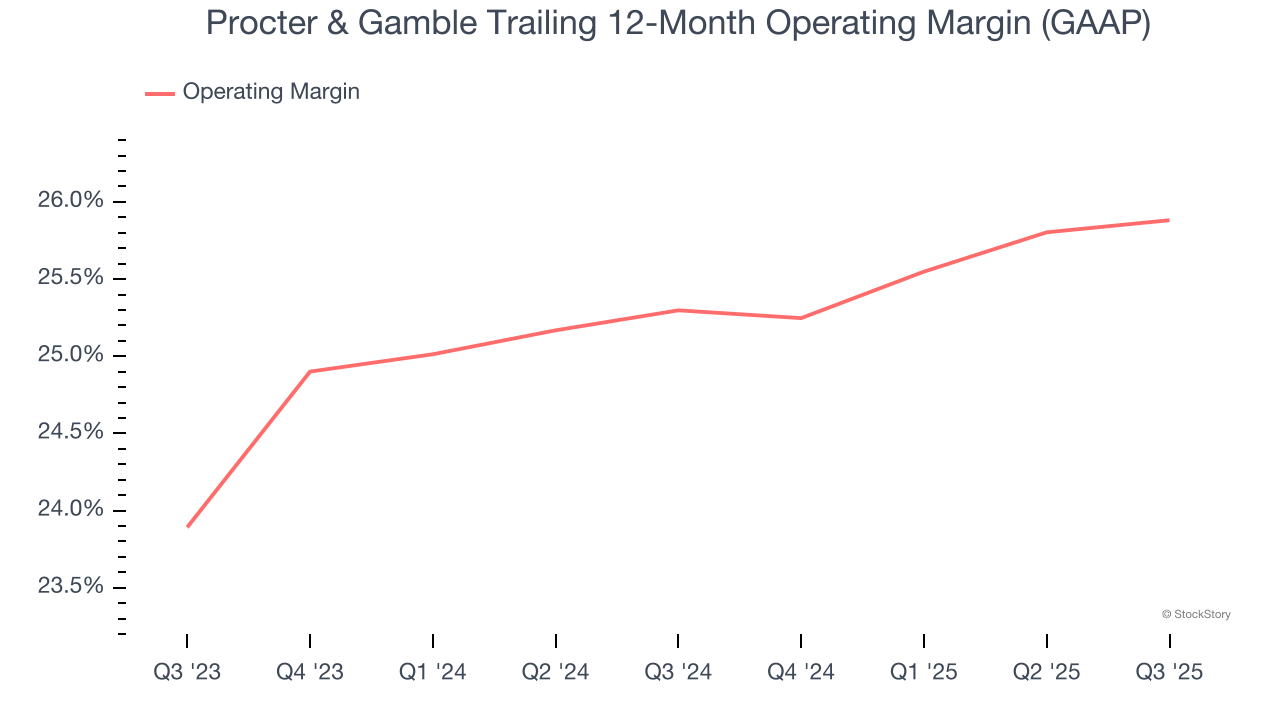

1. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Procter & Gamble’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 25.6% over the last two years. This profitability was elite for a consumer staples business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

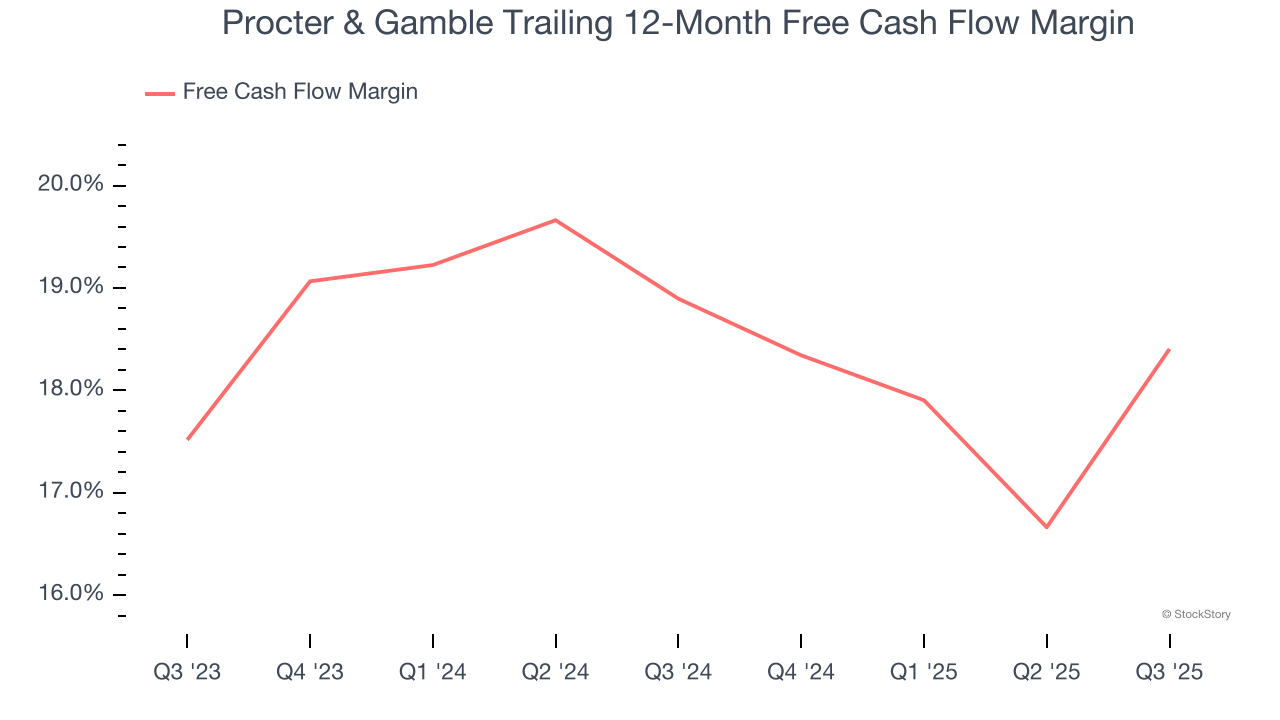

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Procter & Gamble has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 18.6% over the last two years.

One Reason to be Careful:

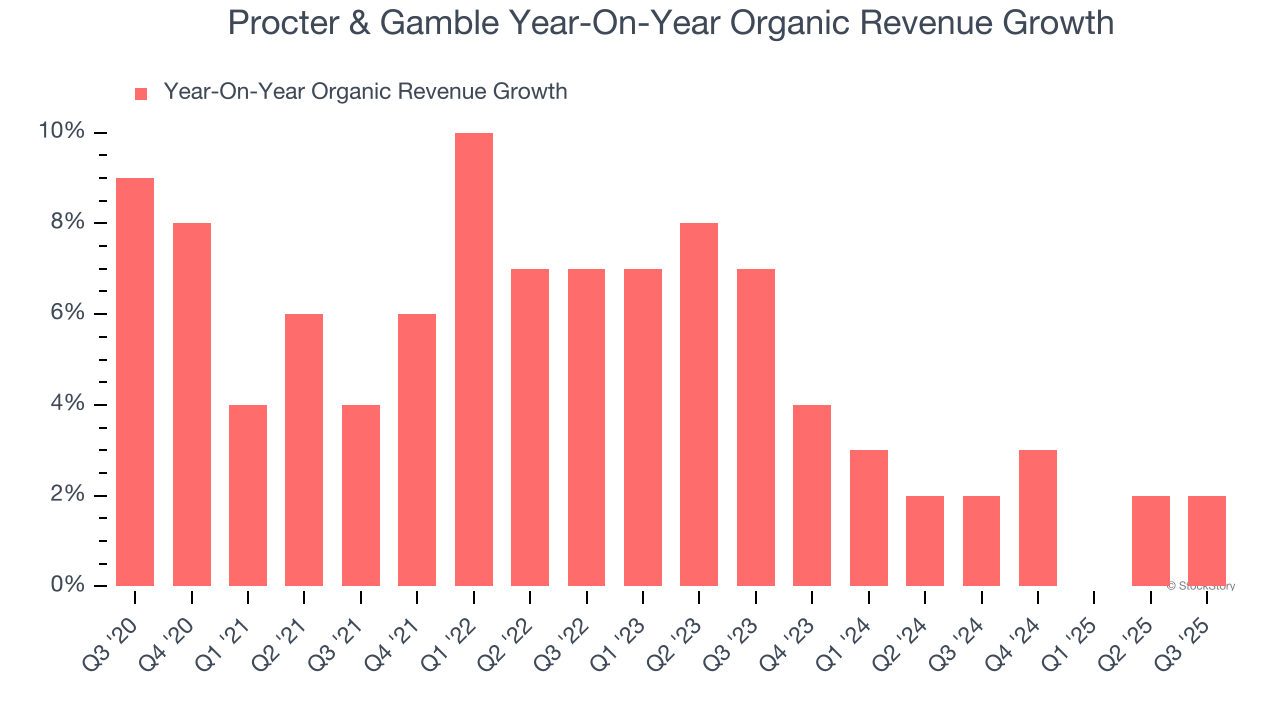

Slow Organic Growth Suggests Waning Demand In Core Business

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Procter & Gamble’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 2.3%.

Final Judgment

Procter & Gamble’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 20.7× forward P/E (or $147.27 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.