Safety certification company UL Solutions (NYSE: ULS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.1% year on year to $783 million. Its GAAP profit of $0.49 per share was 9.9% above analysts’ consensus estimates.

Is now the time to buy UL Solutions? Find out by accessing our full research report, it’s free for active Edge members.

UL Solutions (ULS) Q3 CY2025 Highlights:

- Revenue: $783 million vs analyst estimates of $771.2 million (7.1% year-on-year growth, 1.5% beat)

- EPS (GAAP): $0.49 vs analyst estimates of $0.45 (9.9% beat)

- Adjusted EBITDA: $217 million vs analyst estimates of $197.5 million (27.7% margin, 9.9% beat)

- Operating Margin: 19.9%, up from 17.8% in the same quarter last year

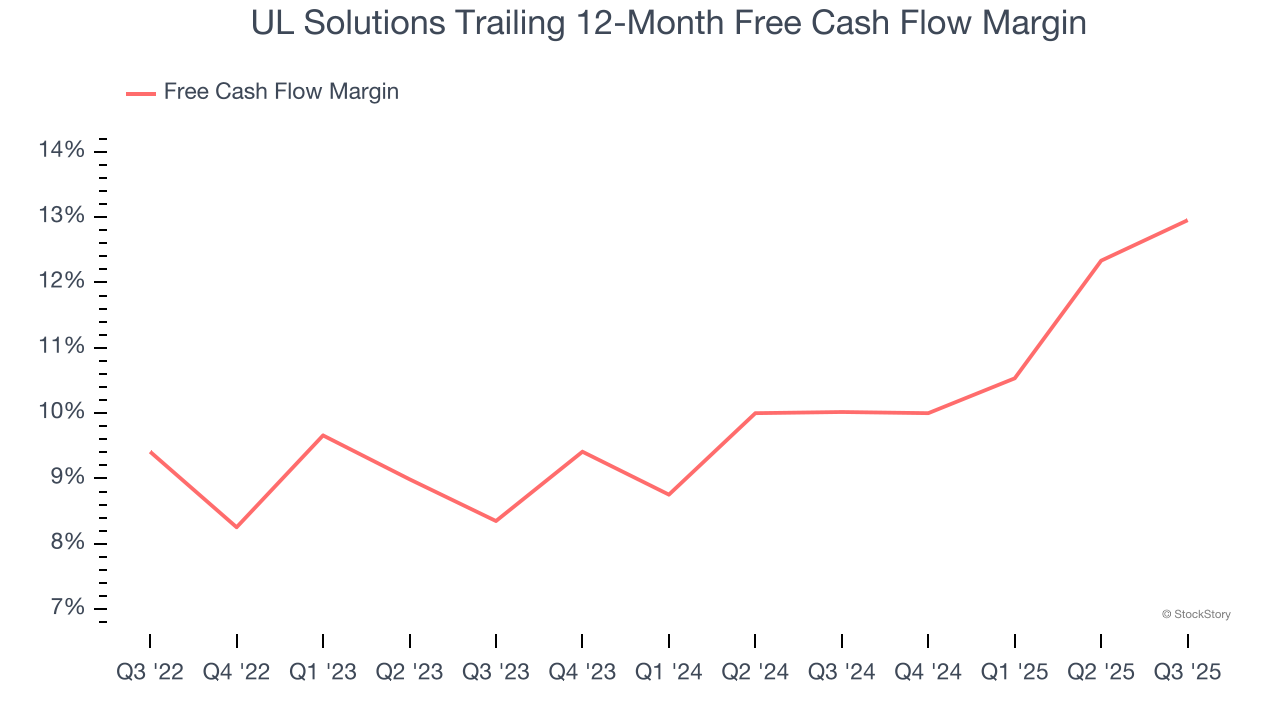

- Free Cash Flow Margin: 13.9%, up from 11.5% in the same quarter last year

- Market Capitalization: $15.79 billion

Company Overview

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE: ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $3.00 billion in revenue over the past 12 months, UL Solutions is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

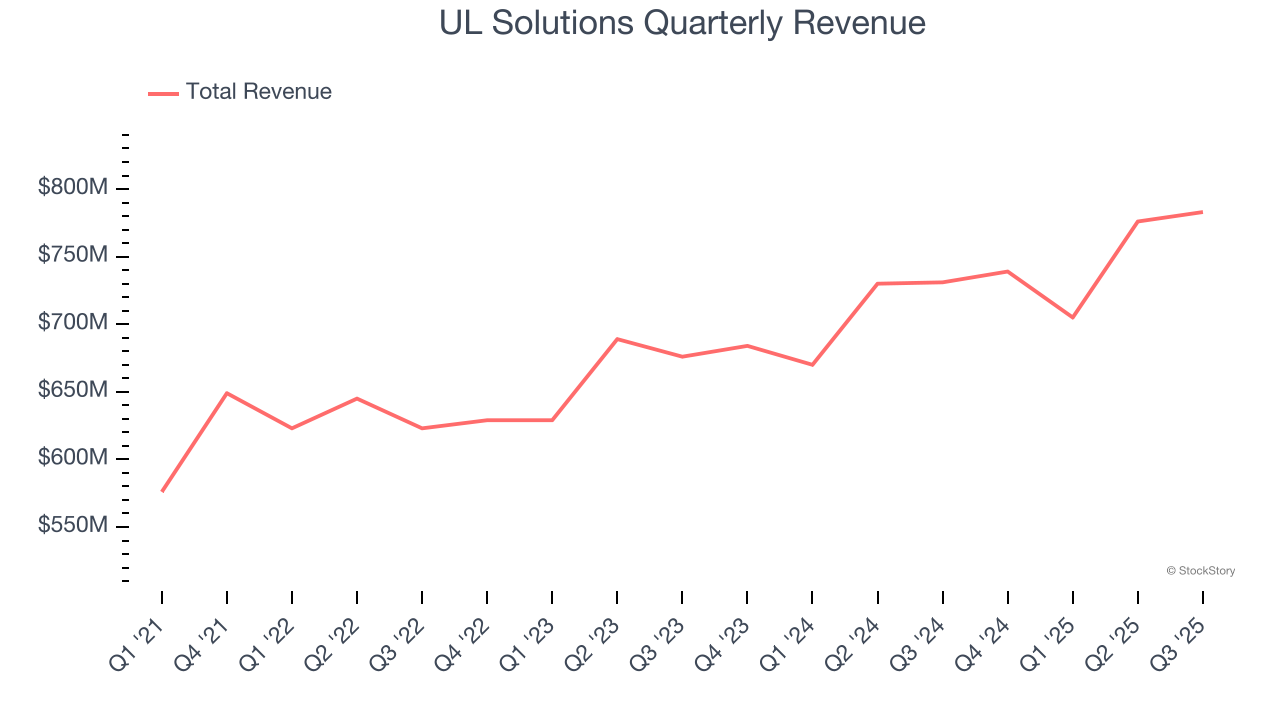

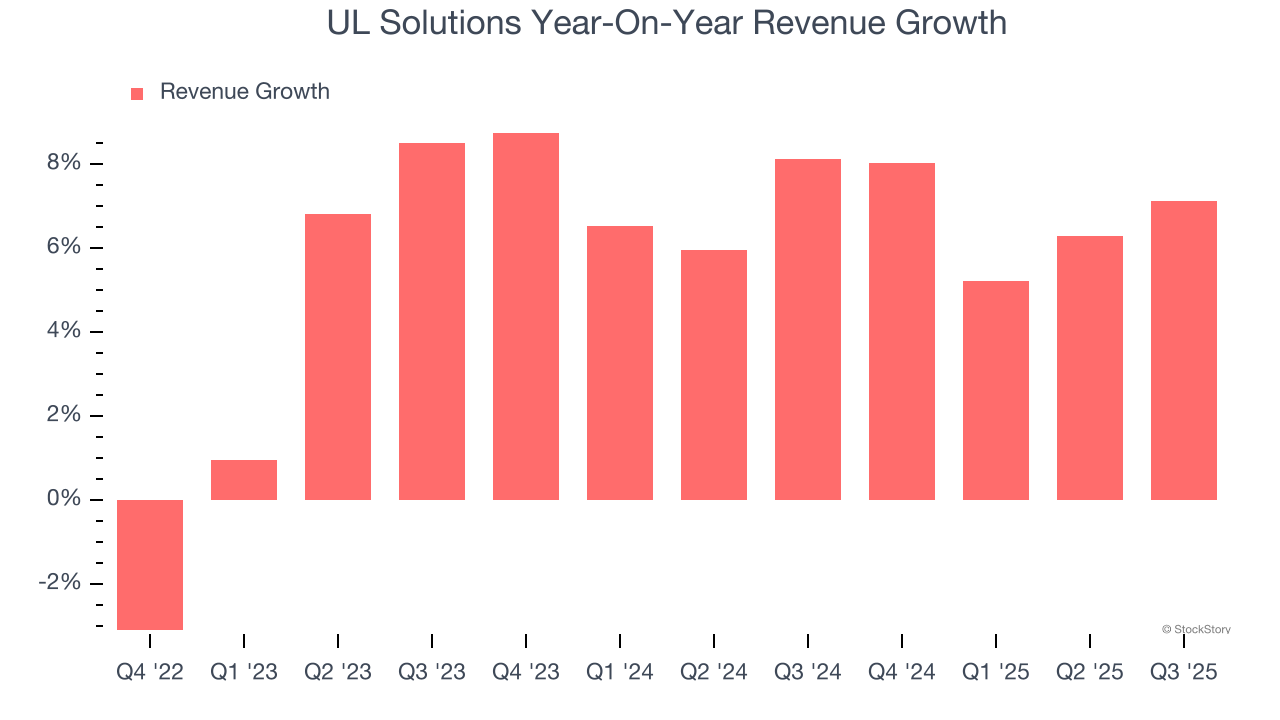

As you can see below, UL Solutions’s sales grew at a mediocre 4.3% compounded annual growth rate over the last three years. This shows it couldn’t generate demand in any major way and is a tough (but perhaps misleading) starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. UL Solutions’s annualized revenue growth of 7% over the last two years is above its three-year trend, suggesting some bright spots.

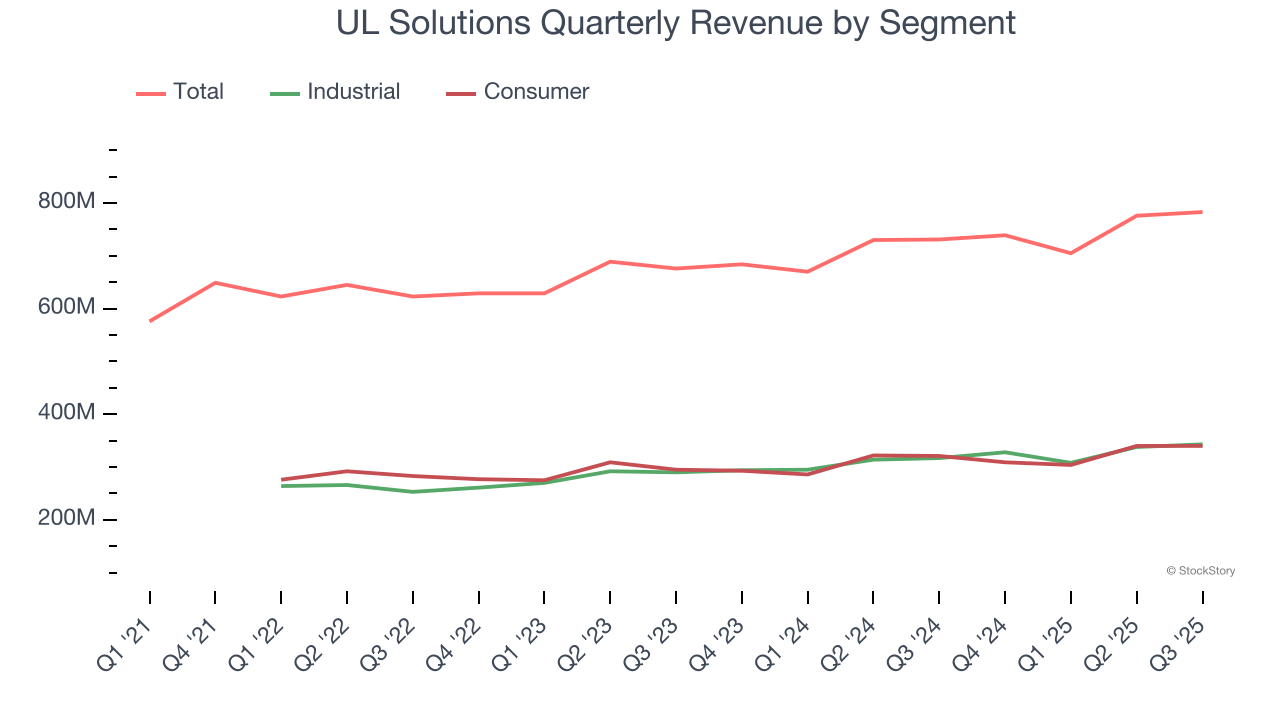

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Industrial and Consumer, which are 43.8% and 43.4% of revenue. Over the last two years, UL Solutions’s Industrial revenue averaged 8.8% year-on-year growth while its Consumer revenue averaged 5.8% growth.

This quarter, UL Solutions reported year-on-year revenue growth of 7.1%, and its $783 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, similar to its two-year rate. Still, this projection is above the sector average and indicates the market is baking in some success for its newer products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

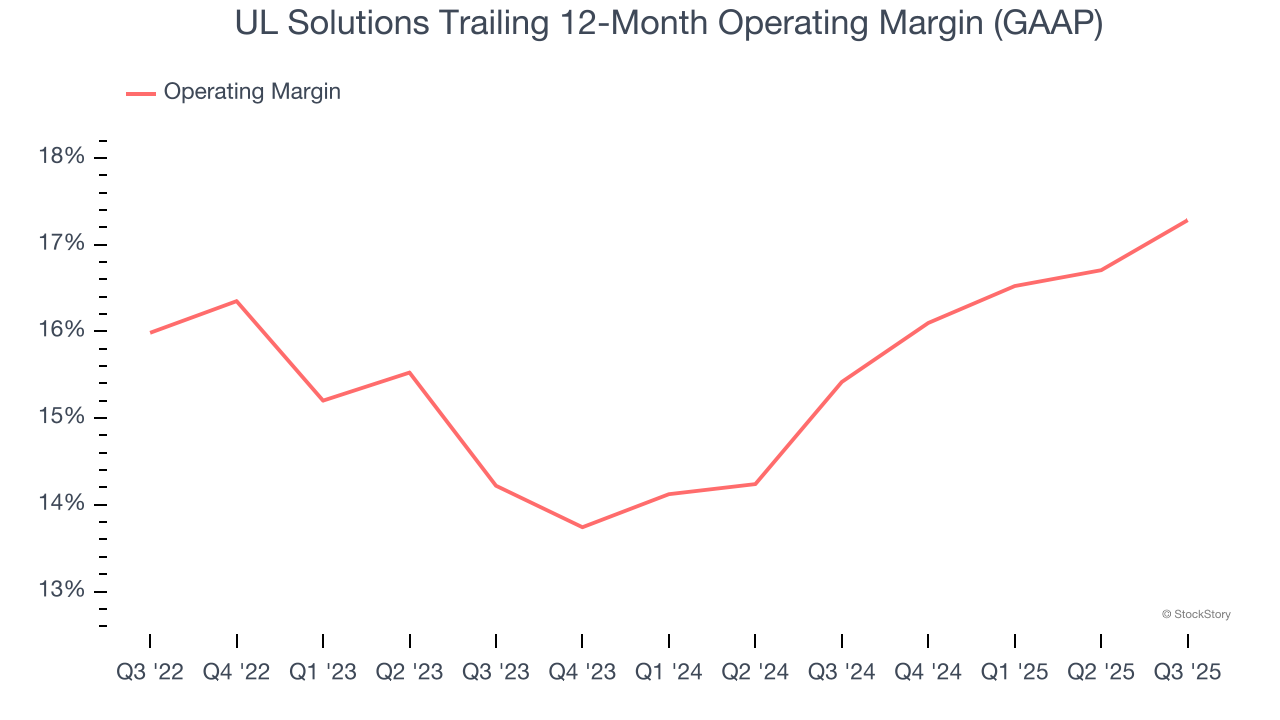

UL Solutions has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.5%.

Looking at the trend in its profitability, UL Solutions’s operating margin rose by 1.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, UL Solutions generated an operating margin profit margin of 19.9%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

UL Solutions has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.7% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that UL Solutions’s margin expanded by 3.5 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

UL Solutions’s free cash flow clocked in at $109 million in Q3, equivalent to a 13.9% margin. This result was good as its margin was 2.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from UL Solutions’s Q3 Results

It was good to see UL Solutions beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $79 immediately after reporting.

UL Solutions put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.