Over the past six months, NBT Bancorp’s stock price fell to $40.81. Shareholders have lost 5.2% of their capital, which is disappointing considering the S&P 500 has climbed by 21.3%. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy NBTB? Find out in our full research report, it’s free for active Edge members.

Why Do Investors Watch NBT Bancorp?

Tracing its roots back to 1856 when it first opened its doors in Norwich, New York, NBT Bancorp (NASDAQ: NBTB) is a community-oriented financial institution providing banking, wealth management, and insurance services to individuals and businesses across the northeastern United States.

Three Things to Like:

1. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect NBT Bancorp’s net interest income to rise by 16.6%, an improvement versus its 11.6% annualized growth for the past two years.

2. Increasing Net Interest Margin Juices Financials

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, NBT Bancorp’s net interest margin averaged 3.4%. On the bright side, it climbed by 22 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

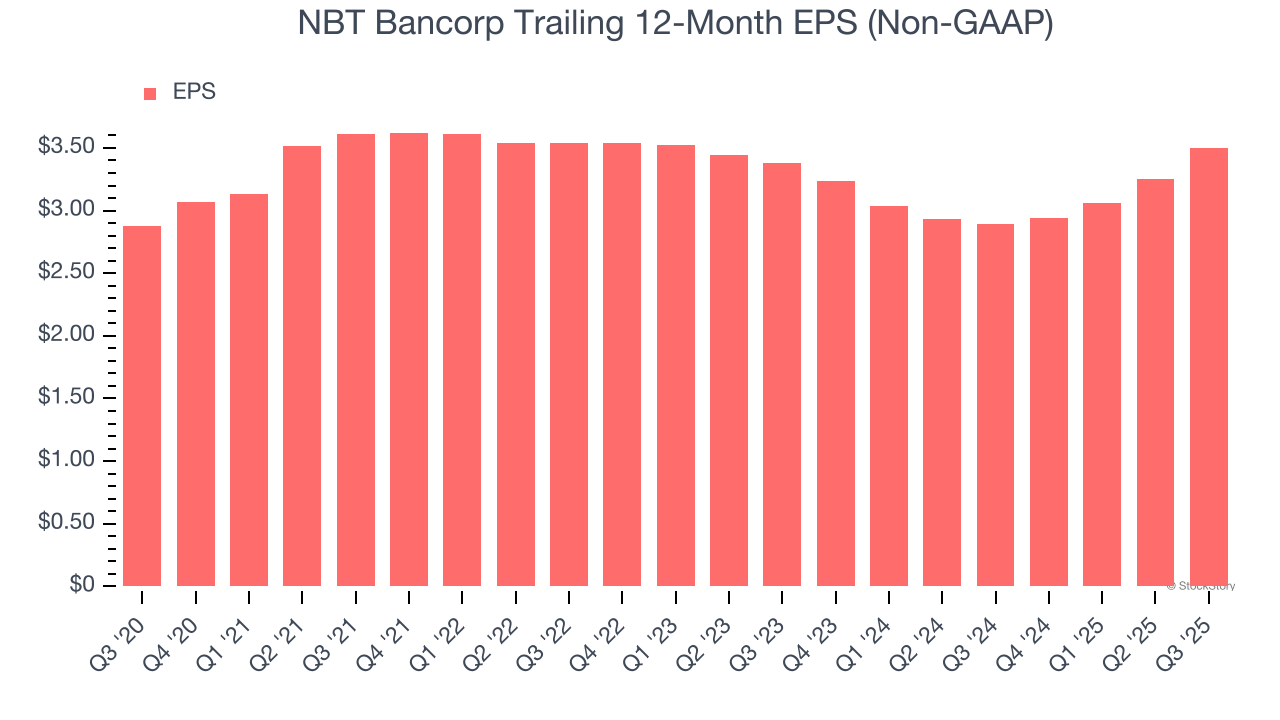

3. EPS Surges Higher Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

NBT Bancorp’s EPS grew at a remarkable 1.8% compounded annual growth rate over the last two years. This performance was better than most banking businesses.

Final Judgment

NBT Bancorp possesses several positive attributes. With the recent decline, the stock trades at 1.1× forward P/B (or $40.81 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than NBT Bancorp

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.