Lantheus’s stock price has taken a beating over the past six months, shedding 32.6% of its value and falling to $52.75 per share. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy LNTH? Find out in our full research report, it’s free for active Edge members.

Why Does Lantheus Spark Debate?

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

Two Things to Like:

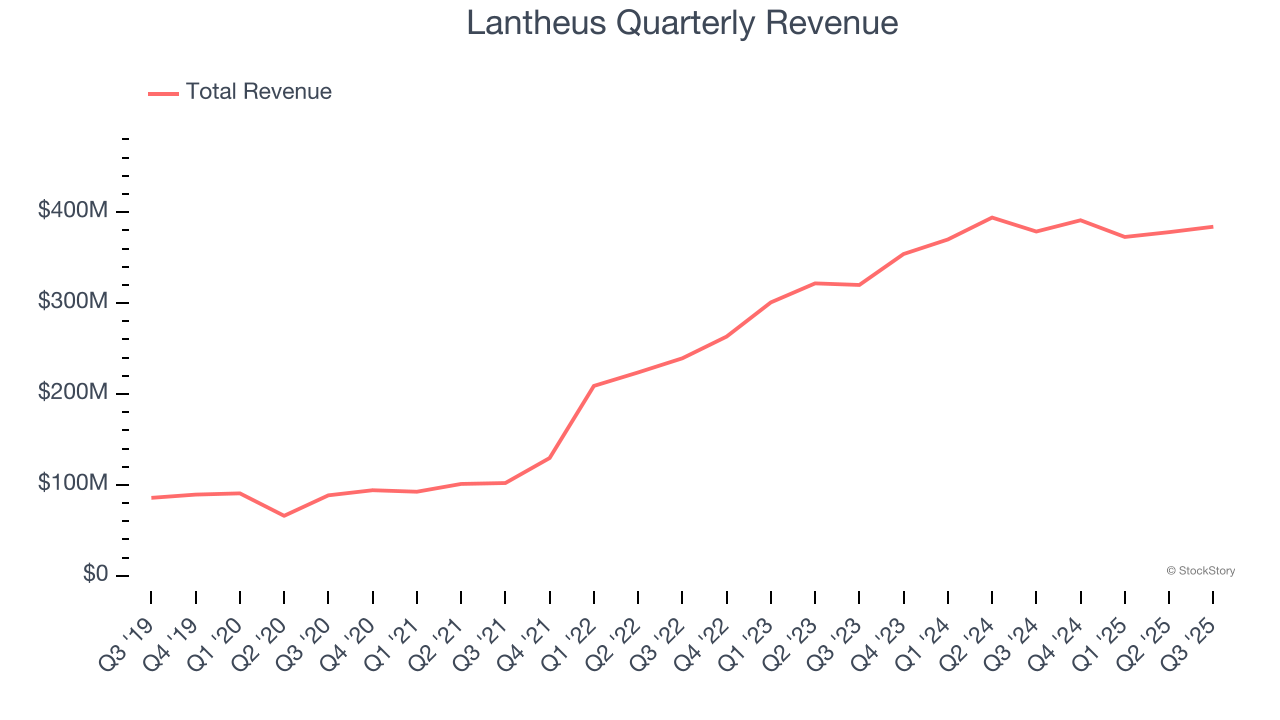

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Lantheus’s 35.5% annualized revenue growth over the last five years was incredible. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

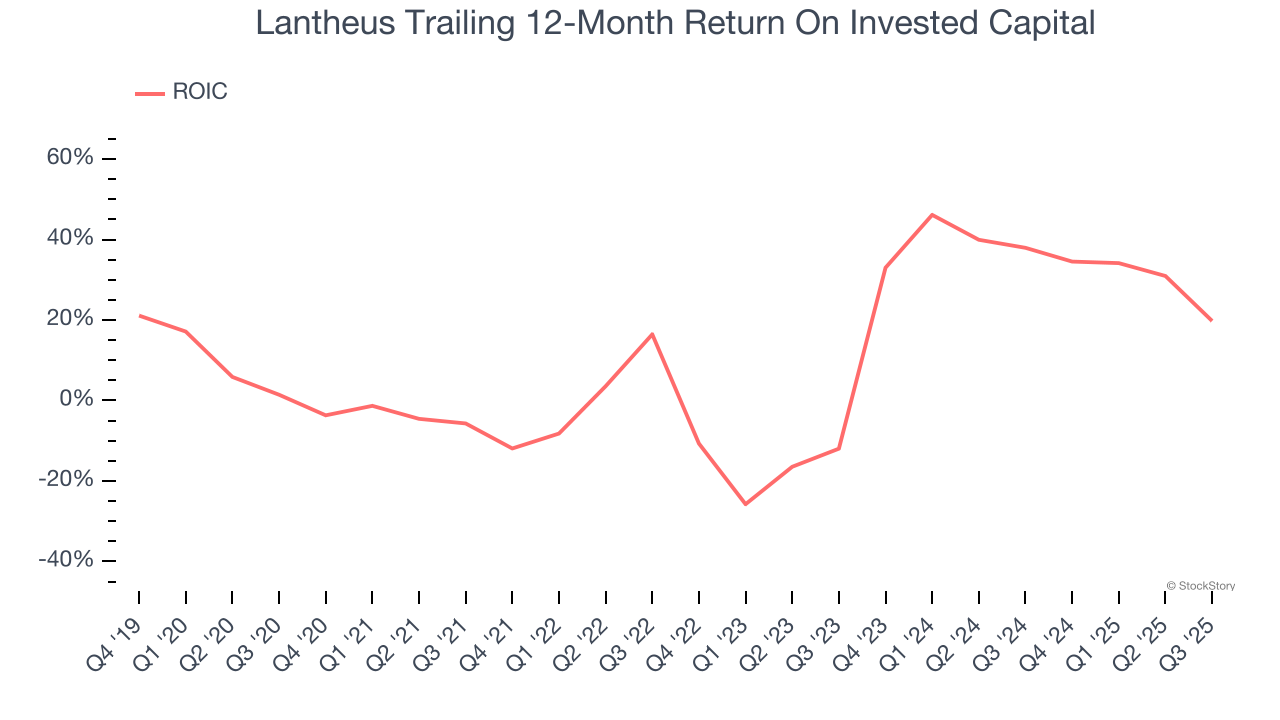

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Lantheus’s ROIC has increased. This is a great sign when paired with its already strong returns, but we also recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Lantheus’s revenue to drop by 3.7%, a decrease from its 35.5% annualized growth for the past five years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

Lantheus’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 10.5× forward P/E (or $52.75 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Lantheus

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.