CSG trades at $78.47 and has moved in lockstep with the market. Its shares have returned 20.7% over the last six months while the S&P 500 has gained 16.3%.

Is now the time to buy CSG, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think CSG Will Underperform?

We're cautious about CSG. Here are three reasons why CSGS doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

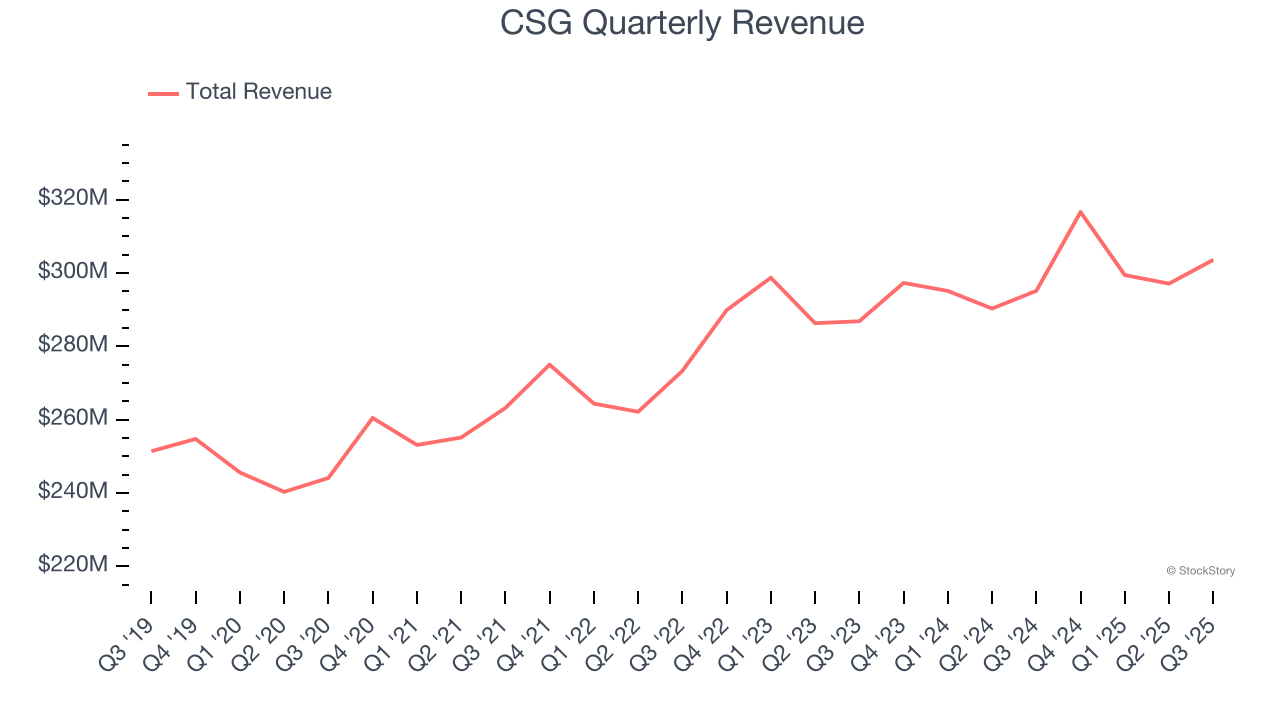

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, CSG’s 4.3% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the business services sector.

2. Fewer Distribution Channels Limit its Ceiling

With $1.22 billion in revenue over the past 12 months, CSG is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CSG’s revenue to rise by 1.7%, close to its 4.3% annualized growth for the past five years. This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

Final Judgment

CSG falls short of our quality standards. That said, the stock currently trades at 15.7× forward P/E (or $78.47 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than CSG

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.