What a time it’s been for Live Nation. In the past six months alone, the company’s stock price has increased by a massive 48.4%, reaching $133.32 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Live Nation, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're cautious about Live Nation. Here are three reasons why we avoid LYV and a stock we'd rather own.

Why Is Live Nation Not Exciting?

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

1. Weak Growth in Events Points to Soft Demand

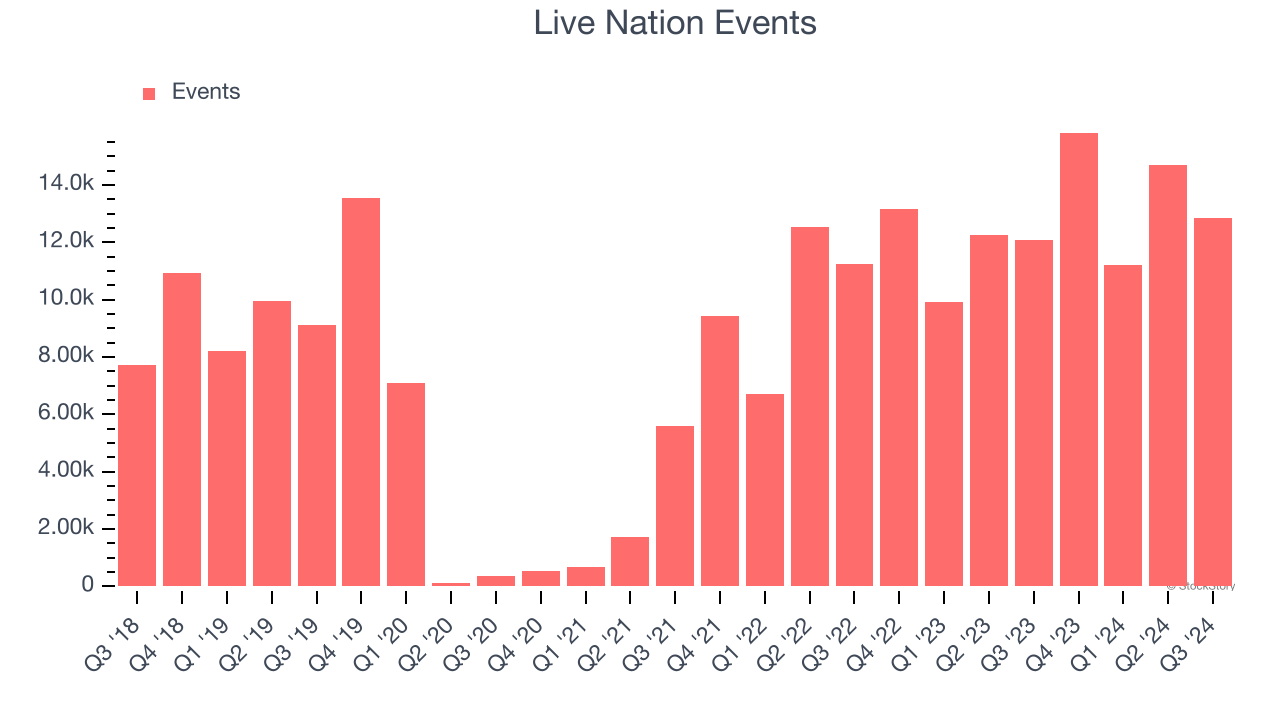

Revenue growth can be broken down into changes in price and volume (for companies like Live Nation, our preferred volume metric is events). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Live Nation’s events came in at 12,834 in the latest quarter, and over the last two years, averaged 18.9% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Weak Operating Margin Could Cause Trouble

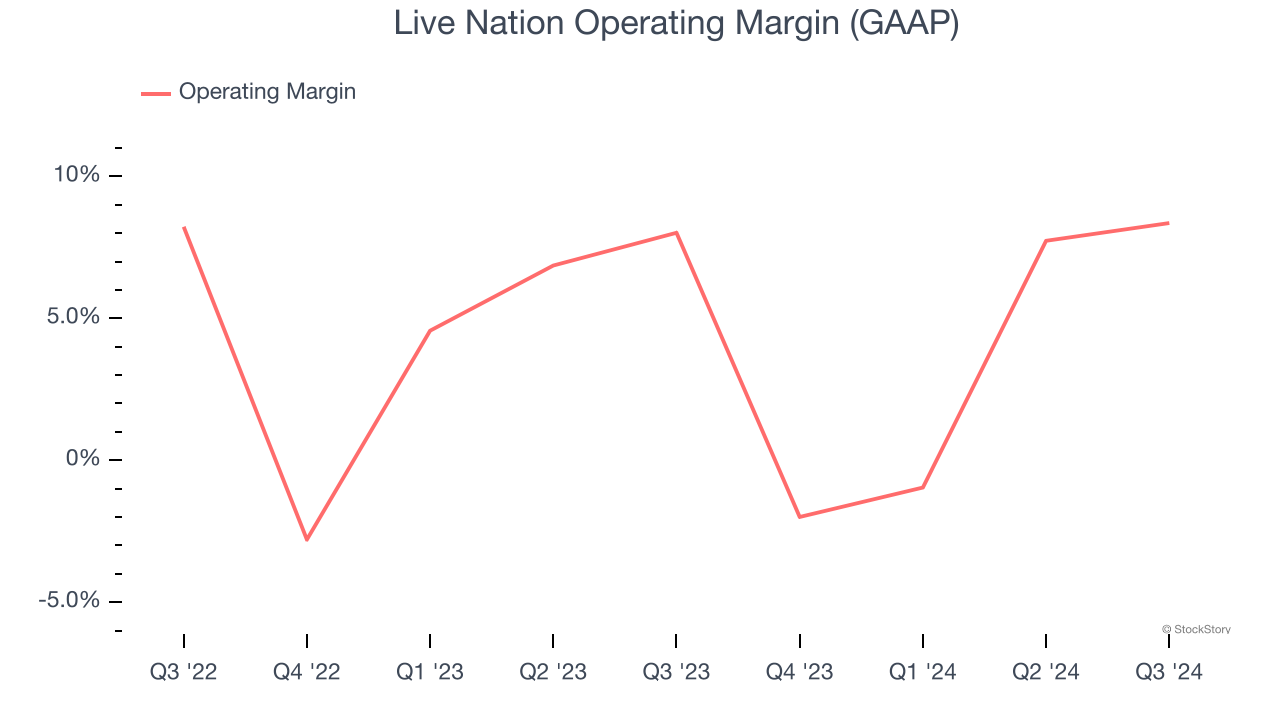

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Live Nation’s operating margin might have seen some fluctuations over the last 12 months but has remained more or less the same, averaging 4.5% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Live Nation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Live Nation isn’t a terrible business, but it isn’t one of our picks. After the recent surge, the stock trades at 68.4× forward price-to-earnings (or $133.32 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of Live Nation

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.