Since June 2024, Lancaster Colony has been in a holding pattern, posting a small loss of 4.3% while floating around $178.60. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Is now the time to buy Lancaster Colony, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're swiping left on Lancaster Colony for now. Here are two reasons why there are better opportunities than LANC and a stock we'd rather own.

Why Is Lancaster Colony Not Exciting?

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ: LANC) sells bread, dressing, and dips to the retail and food service channels.

1. Less Negotiating Power with Suppliers

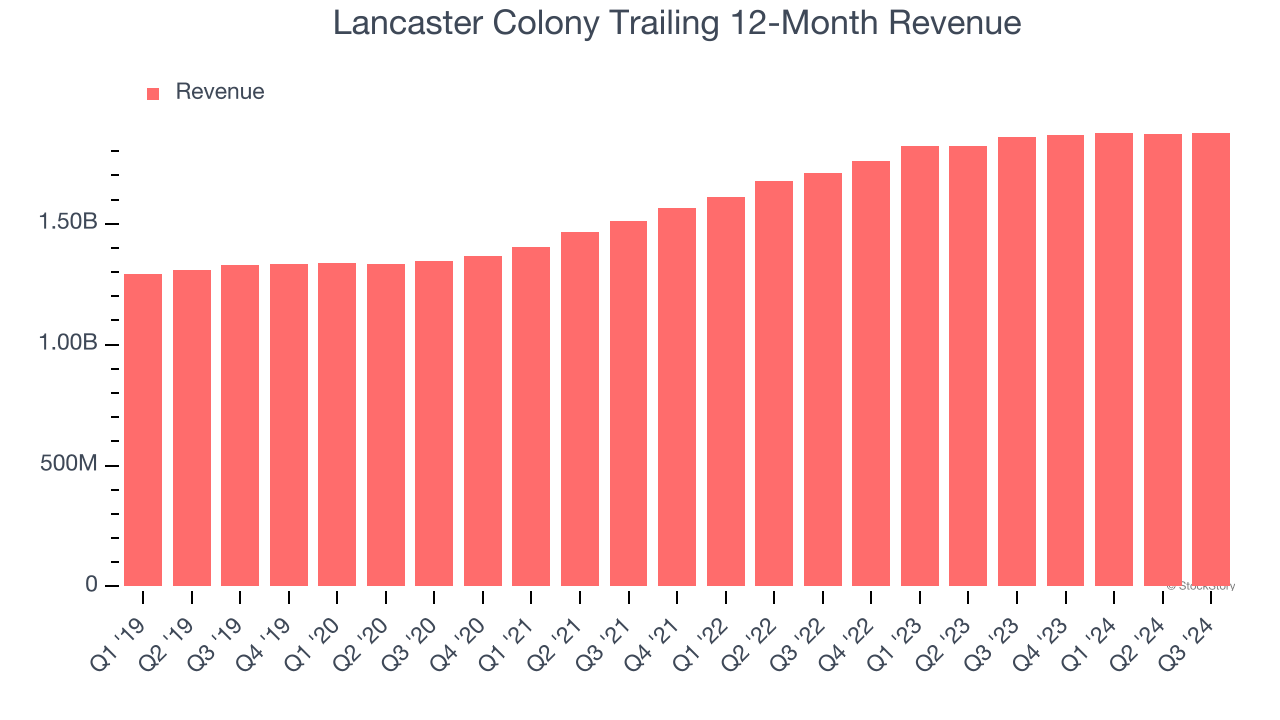

Lancaster Colony is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

2. Low Gross Margin Reveals Weak Structural Profitability

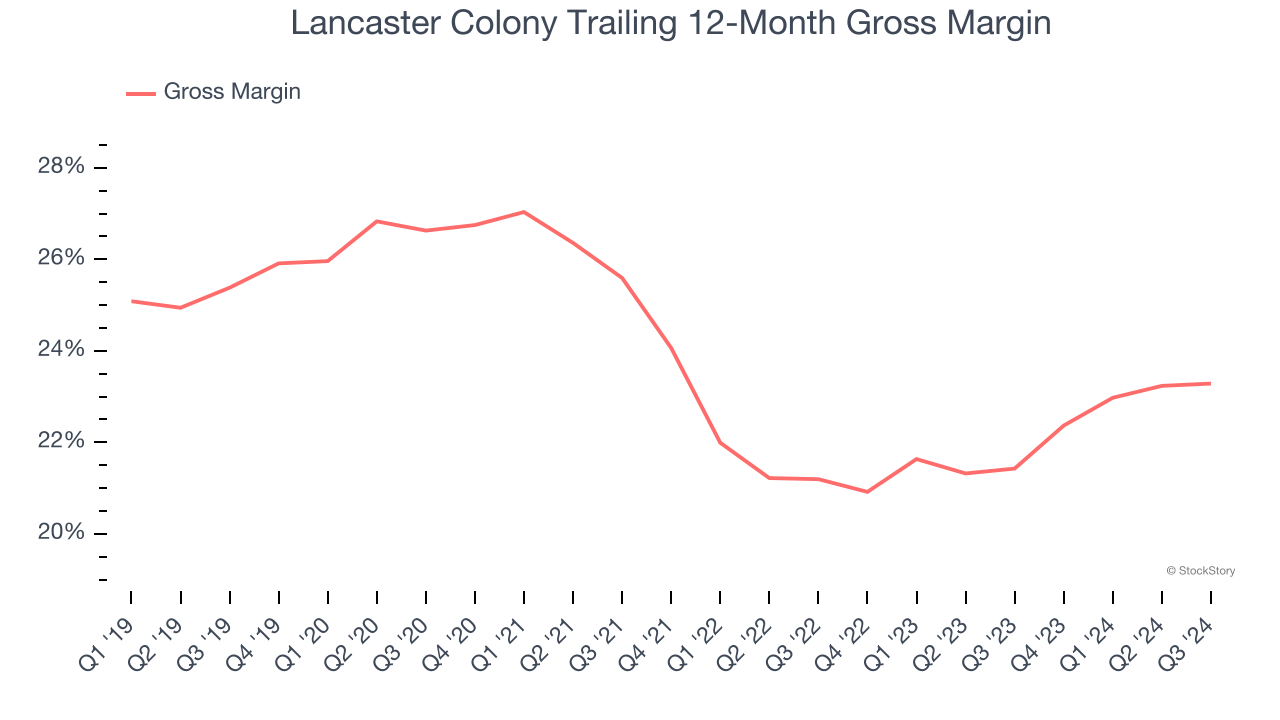

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Lancaster Colony has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 22.4% gross margin over the last two years. That means Lancaster Colony paid its suppliers a lot of money ($77.64 for every $100 in revenue) to run its business.

Final Judgment

Lancaster Colony’s business quality ultimately falls short of our standards. With its shares underperforming the market lately, the stock trades at 26.1× forward price-to-earnings (or $178.60 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Lancaster Colony

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.