As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at perishable food stocks, starting with Flowers Foods (NYSE: FLO).

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 10 perishable food stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 8.2%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Flowers Foods (NYSE: FLO)

With Wonder Bread as its premier brand, Flower Foods (NYSE: FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

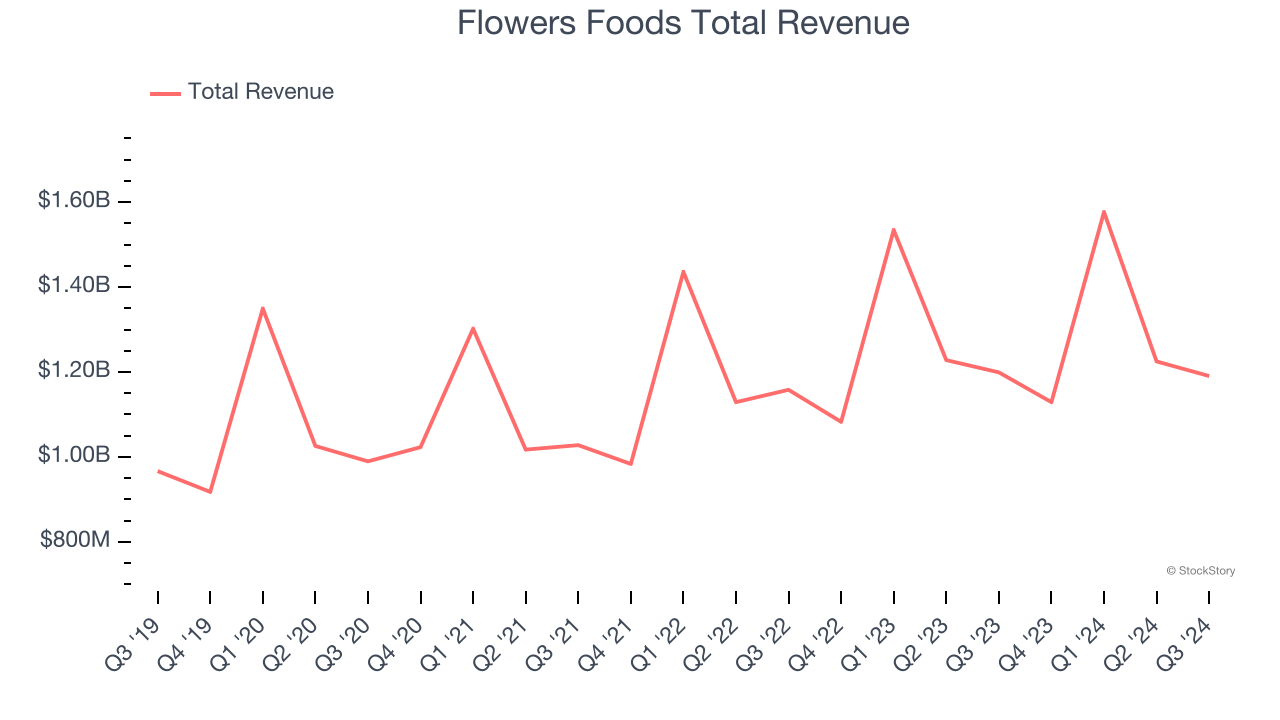

Flowers Foods reported revenues of $1.19 billion, flat year on year. This print fell short of analysts’ expectations by 0.7%, but it was still a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but a miss of analysts’ organic revenue estimates.

"Strong performance by our leading brands and successful execution of our cost initiatives and portfolio strategy drove better-than-expected earnings in the third quarter," said Ryals McMullian, chairman and CEO of Flowers Foods.

Flowers Foods delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 6.8% since reporting and currently trades at $20.52.

Is now the time to buy Flowers Foods? Access our full analysis of the earnings results here, it’s free.

Best Q3: Mission Produce (NASDAQ: AVO)

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

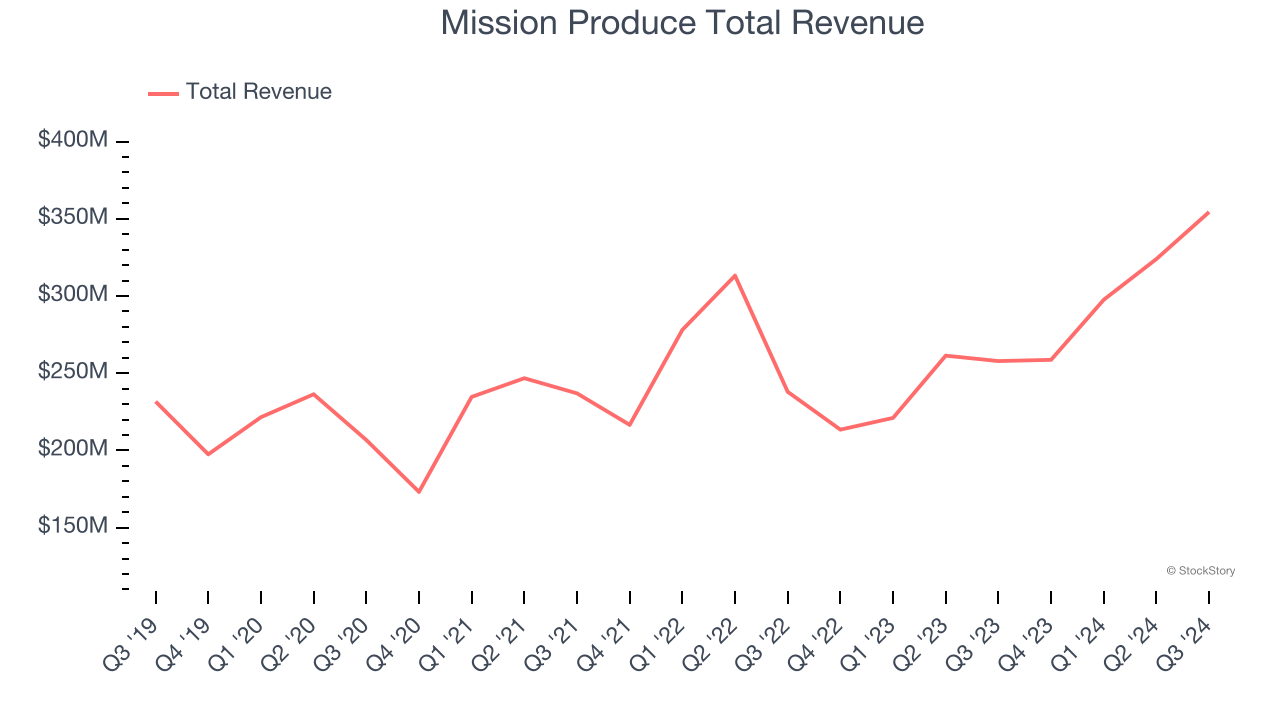

Mission Produce reported revenues of $354.4 million, up 37.4% year on year, outperforming analysts’ expectations by 63.5%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

Mission Produce scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 17.6% since reporting. It currently trades at $14.49.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Cal-Maine (NASDAQ: CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $785.9 million, up 71.1% year on year, exceeding analysts’ expectations by 11.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 33.7% since the results and currently trades at $102.74.

Read our full analysis of Cal-Maine’s results here.

Tyson Foods (NYSE: TSN)

Started as a simple trucking business, Tyson Foods (NYSE: TSN) is one of the world’s largest producers of chicken, beef, and pork.

Tyson Foods reported revenues of $13.57 billion, up 1.6% year on year. This number beat analysts’ expectations by 1%. It was an exceptional quarter as it also logged a solid beat of analysts’ gross margin and EBITDA estimates.

The stock is down 1.8% since reporting and currently trades at $57.74.

Read our full, actionable report on Tyson Foods here, it’s free.

Vital Farms (NASDAQ: VITL)

With an emphasis on ethically produced products, Vital Farms (NASDAQ: VITL) specializes in pasture-raised eggs and butter.

Vital Farms reported revenues of $145 million, up 31.3% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 5% since reporting and currently trades at $38.75.

Read our full, actionable report on Vital Farms here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.