The semiconductor industry is the cornerstone of the global economy, underpinning the technology sector with products ranging from smartphones and computers to automobiles and advanced artificial intelligence applications. This sector witnessed a significant surge in stock prices in recent years, fueled by the increasing demand for semiconductors and a global chip shortage. However, recent months have seen a noticeable decline in chip stock prices, prompting investors to question whether this dip presents a buying opportunity or a warning sign of more challenging times ahead.

Geopolitical Headwinds and Trade Uncertainty

The semiconductor industry operates within a complex geopolitical landscape, and recent events have introduced significant uncertainties. The ongoing trade tensions between the United States and China and the potential for stricter export restrictions on semiconductor technology have cast a shadow over the sector's future.

The Biden Administration's policies, particularly regarding China's access to advanced chips, have raised concerns about potential disruptions to global supply chains. These concerns are further compounded by former President Trump's pronouncements regarding Taiwan and the suggestion that the nation should bear a greater financial burden for its defense by the U.S.

Given Taiwan's role as a semiconductor powerhouse and home to Taiwan Semiconductor Manufacturing Corporation (NYSE: TSM) (TSMC), the world's largest contract chipmaker, any disruption to its operations could send shockwaves throughout the industry. The potential ramifications of these geopolitical tensions are particularly pronounced for companies like ASML Holding (NASDAQ: ASML), the sole supplier of extreme ultraviolet (EUV) lithography machines essential for manufacturing the most advanced semiconductors.

Company Performance and Market Dynamics

While geopolitical factors loom large, individual company performance and market dynamics also play a crucial role in shaping investor sentiment. Taiwan Semiconductor Manufacturing, with its recent stock price reflecting an over 7% decline, illustrates this complex interplay of forces. Boasting a market capitalization of around $900 billion and a price-to-earnings (P/E) ratio of 33.17, TSMC remains a dominant force in the industry. However, its dependence on the Chinese market, accounting for a significant portion of its revenue, exposes the company to potential risks should trade restrictions tighten.

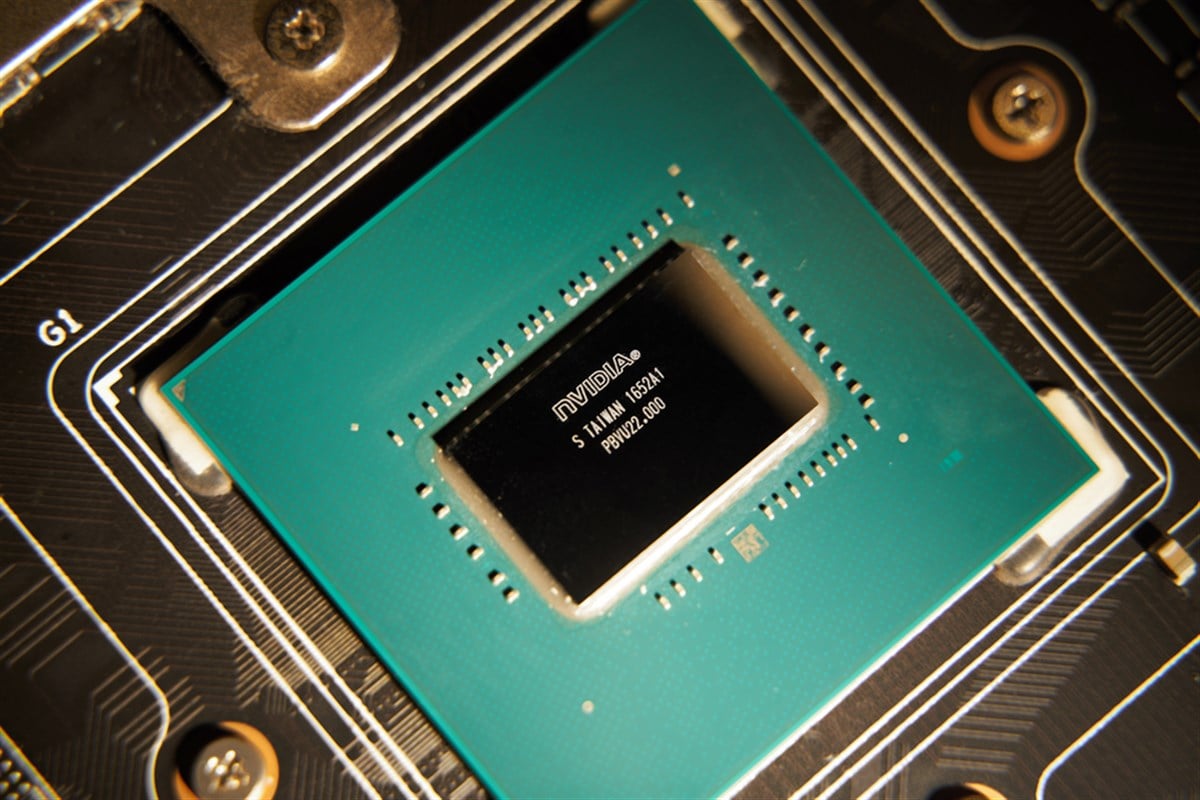

Similarly, NVIDIA (NASDAQ: NVDA), a leading manufacturer of graphics processing units (GPUs) vital for AI development and data centers, faces its own set of challenges. Despite a market capitalization of $2.9 trillion and a P/E ratio of 69.29, NVIDIA's stock price represents over a 6% decline. While the company benefits from the surging demand for AI technology, the ongoing chip shortage and potential economic slowdown pose potential headwinds.

In contrast, Intel (NASDAQ: INTC), a major player in the CPU market, has experienced a modest stock price increase of around 2%. With a market capitalization of $149 billion and a P/E ratio of 36.48, Intel is strategically positioning itself to capitalize on the U.S. Chips Act, aiming to revitalize domestic semiconductor manufacturing and reduce reliance on foreign suppliers. The company's efforts to expand its foundry business, directly competing with TSMC and Samsung (OTCMKTS: SSNLF), represent a significant strategic shift with the potential to reshape the industry landscape.

ASML Holding (NASDAQ: ASML) is trading down over 11%. With a market capitalization of $372 billion, it holds a unique and critical position within the semiconductor ecosystem. As the sole provider of EUV lithography machines, ASML's technology is indispensable for producing the most advanced chips. However, the company's reliance on the Chinese market, accounting for a substantial portion of its revenue, makes it vulnerable to the escalating trade war and potential export restrictions.

Qualcomm (NASDAQ: QCOM), a leading supplier of mobile processors, faces similar challenges. Its stock price is down around 8%, and its market capitalization is $216.41 billion. Qualcomm's significant exposure to the Chinese market, a major consumer of its products, raises concerns about the impact of ongoing trade disputes.

Likewise, Micron Technology (NASDAQ: MU), a major manufacturer of memory chips, finds itself navigating the same turbulent waters. Micron Technology stock is down around 7%, and its market capitalization is $133 billion. Micron's reliance on the Chinese market for a substantial portion of its revenue amplifies the potential consequences of escalating trade tensions.

Macroeconomic Factors and Government Intervention

Beyond the immediate impact of geopolitical events and company-specific factors, the semiconductor industry remains sensitive to broader macroeconomic trends. Interest rate fluctuations, inflationary pressures, and global economic growth all shape demand and investor sentiment. The current global economic slowdown and its potential to dampen demand for semiconductors present a significant challenge for the industry.

In response to these challenges, governments worldwide increasingly intervene in the semiconductor market, recognizing the sector's strategic importance. The U.S. Chips Act, for example, aims to bolster domestic semiconductor manufacturing and reduce reliance on foreign suppliers. These government initiatives can reshape the industry landscape, influencing investment decisions and mitigating risks associated with geopolitical tensions and economic uncertainty.

The recent decline in chip stock prices presents potential risks and rewards for investors. Geopolitical tensions, trade uncertainties, and macroeconomic headwinds contribute to market volatility. However, the semiconductor industry remains strategically important, driven by relentless technological innovation and increasing demand for advanced computing power. Investors must carefully assess the interplay of these factors and conduct thorough due diligence before making investment decisions. While presenting challenges, the chip market continues to offer long-term growth potential for those willing to navigate its complexities.