Cambridge, Massachusetts-based Moderna, Inc. (MRNA) is a biotechnology company that provides messenger RNA medicines. Valued at a market cap of $17.2 billion, the company gained global prominence with its COVID-19 vaccine and continues to expand its pipeline across infectious diseases, oncology, rare diseases, and autoimmune conditions.

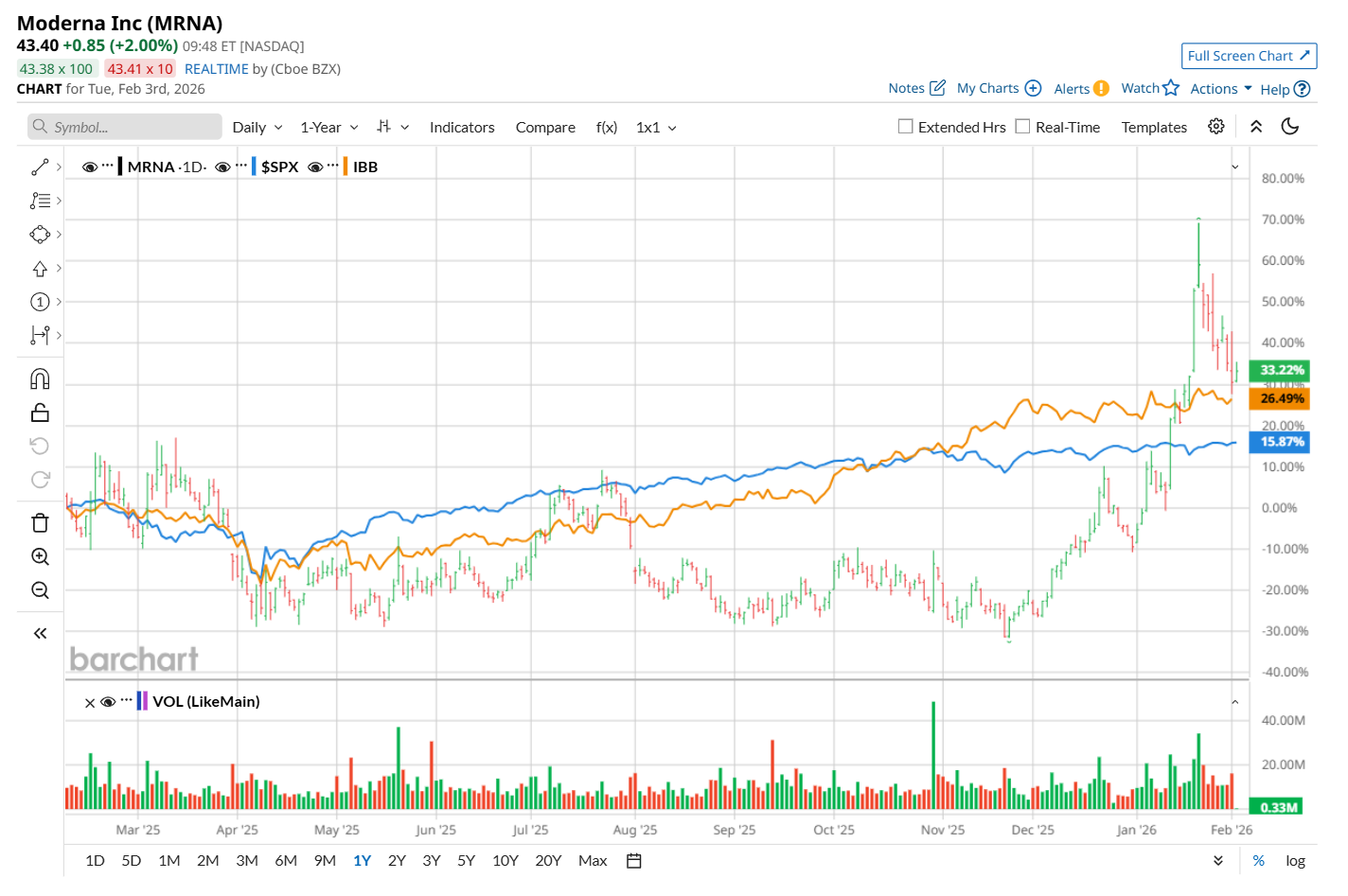

This biotechnology company has outperformed the broader market over the past 52 weeks. Shares of MRNA have rallied 19.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. Moreover, on a YTD basis, the stock is up 47.9%, compared to SPX’s 1.9% uptick.

However, narrowing the focus, Moderna has lagged behind the iShares Biotechnology ETF’s (IBB) 26.2% rise over the past 52 weeks. Nonetheless, it has notably outpaced IBB’s 3.1% YTD return.

On Jan. 21, shares of Moderna surged 15.8% after the company, in collaboration with Merck & Co., Inc. (MRK), reported encouraging results from a five-year follow-up study of their experimental skin cancer vaccine. The mid-stage trial showed that the vaccine, when combined with Merck’s immunotherapy drug Keytruda, reduced the risk of recurrence or death by a sustained 49% in patients with high-risk melanoma. The announcement underscored the vaccine’s promising long-term potential in cancer immunotherapy, bolstering investor confidence.

For the current fiscal year, ending in December, analysts expect MRNA’s loss per share to narrow by 10.9% year over year to $7.90. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

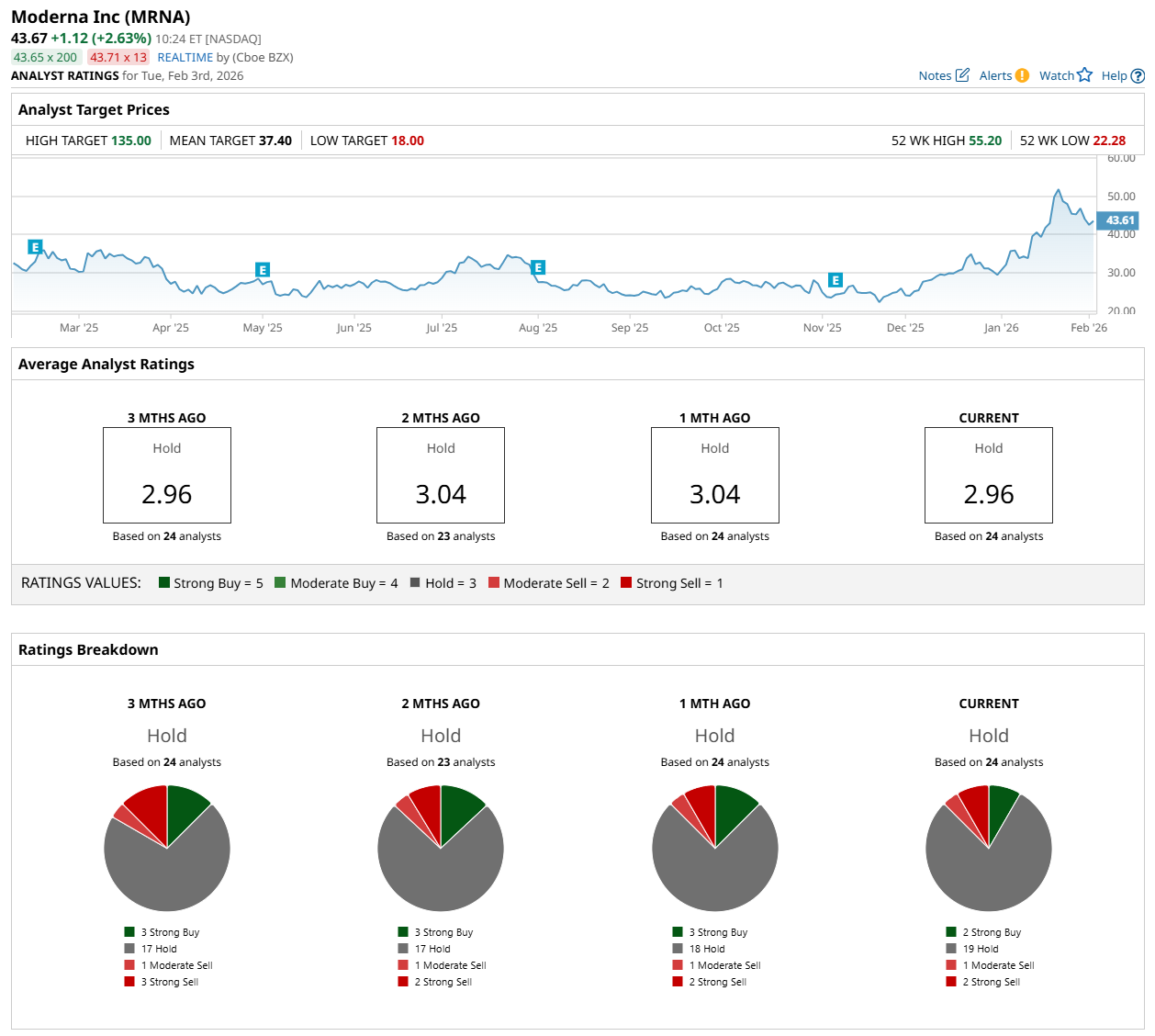

Among the 24 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy,” 19 “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration is more bearish than a month ago, with three analysts suggesting a “Strong Buy” rating.

On Jan. 30, Edward Tenthoff from Piper Sandler Companies (PIPR) maintained a “Buy” rating on MRNA, with a price target of $63, indicating a 44.3% potential upside from the current levels

While the company is trading above its mean price target of $37.40, its Street-high price target of $135 suggests an ambitious 209.1% premium from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart