Alphabet Inc. (GOOG) is a technology conglomerate and the parent of Google, headquartered in Mountain View, California. Alphabet operates across diverse segments, including Google Services (search, advertising, Chrome, YouTube, and more), Google Cloud (cloud infrastructure and AI), and Other Bets (emerging technologies and ventures). The company has grown into one of the world’s most valuable firms, with a market cap of around $4.1 trillion, reflecting its dominant position in digital advertising, cloud computing, and artificial intelligence innovations.

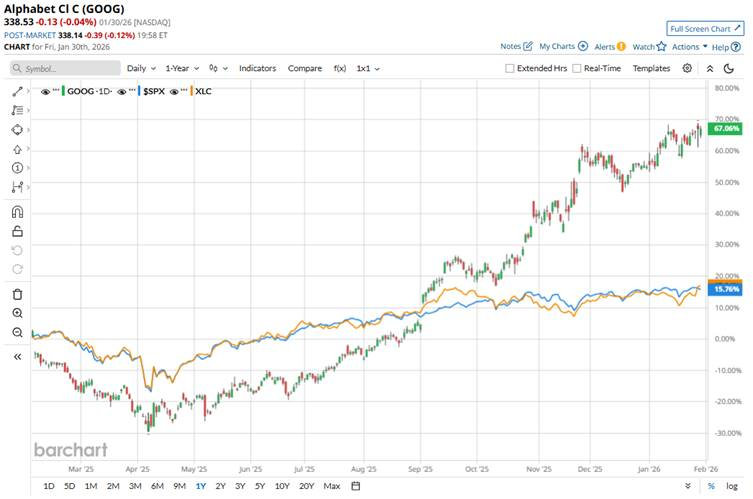

Shares of this tech giant have outperformed the broader market over the past year. GOOG has gained 67.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. In 2026, GOOG surged 7.9%, compared to the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, GOOG’s outperformance is also apparent compared to the State Street Communication Services Select Sector SPDR ETF (XLC). The exchange-traded fund has gained about 17.8% over the past year and 2% on a YTD basis.

Alphabet’s stock has climbed sharply due to strong investor confidence in its leadership in artificial intelligence and cloud computing and robust financial performance. The company’s AI initiatives, especially its Gemini models and AI-powered advertising products, have driven revenue growth and wider monetization expectations, while Google Cloud has delivered steady growth. Alphabet also benefited from positive antitrust rulings that eased regulatory uncertainty.

For the fiscal year ended in December 2025, analysts expect GOOG’s EPS to grow 31.5% to $10.57 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

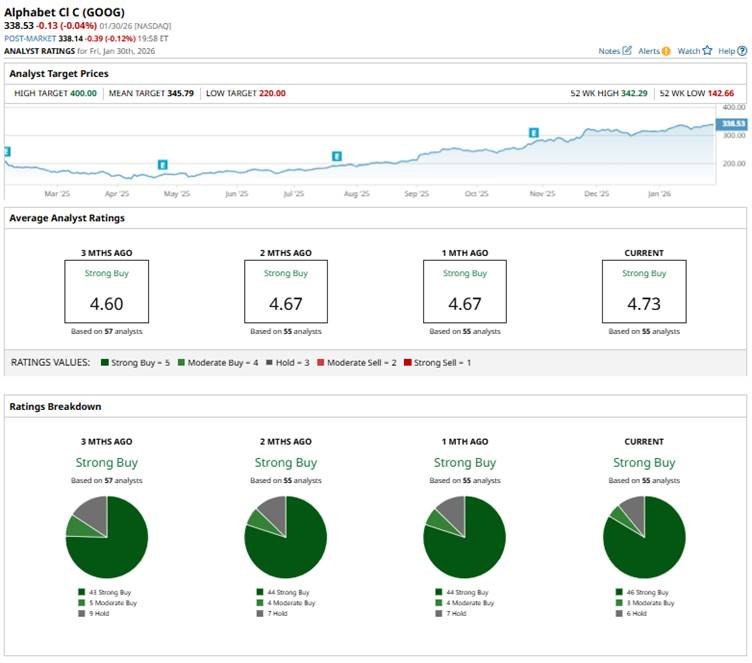

Among the 55 analysts covering GOOG, the consensus is a “Strong Buy.” That’s based on 46 “Strong Buy” ratings, three “Moderate Buys,” and six “Holds.”

This configuration is more bullish compared to one month ago, when there were 44 “Strong Buy” ratings.

Last month, TD Cowen reiterated a “Buy” rating and $355 price target on Alphabet (GOOG), highlighting accelerating expansion at its autonomous vehicle unit Waymo.

The mean price target of $345.79 represents a 2.1% premium to GOOG’s current price levels. The Street-high price target of $400 suggests a notable upside potential of 18.2%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart