For much of the artificial intelligence (AI) boom, Nvidia (NVDA) has stood at the top, dominating data center GPUs and being the first choice for anything AI. However, the next phase of the AI race may not just be for a single winner. As demand shifts from GPUs to full-stack computing solutions such as CPUs, AI accelerators, and software ecosystems, Advanced Micro Devices (AMD) is emerging as a serious challenger.

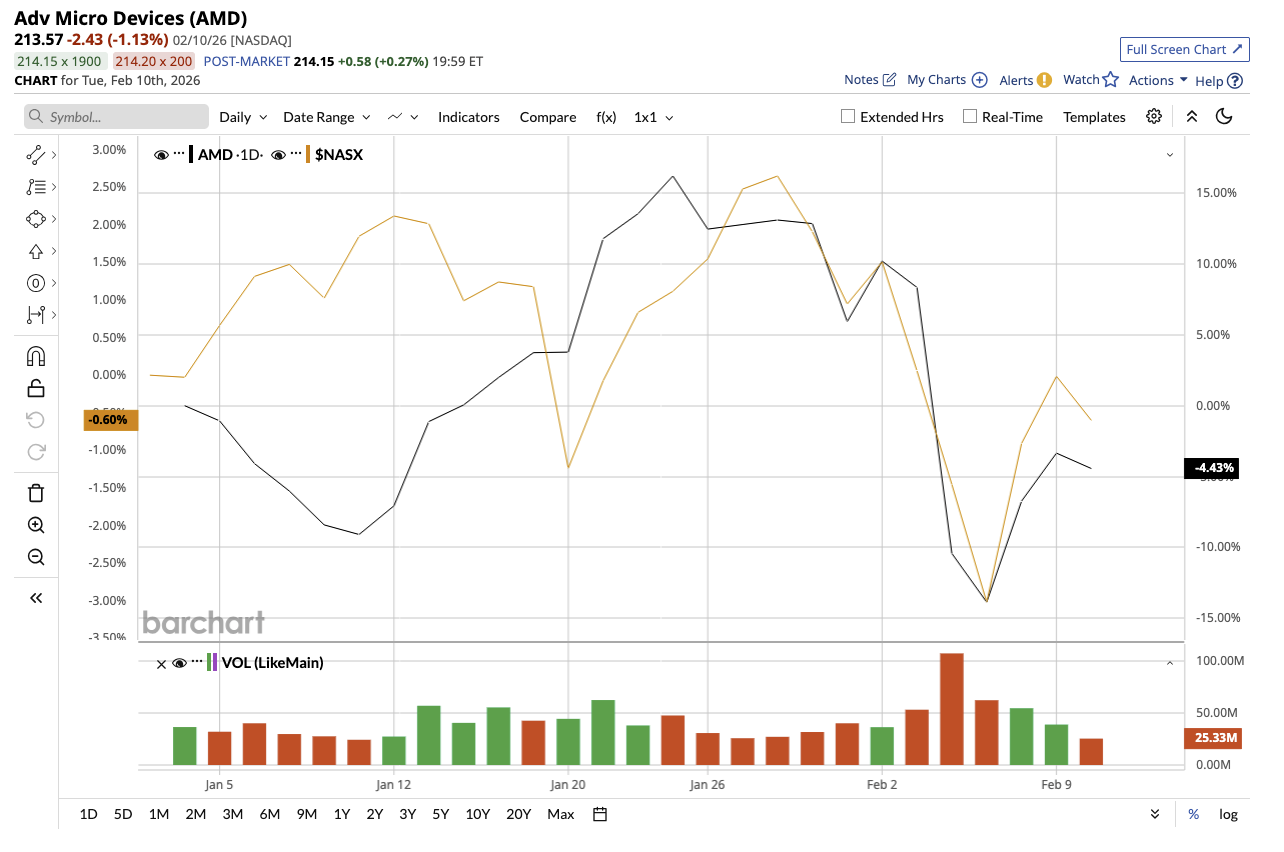

AMD entered 2025 with strong momentum and exited the year strengthening its case that it could be the next semiconductor winner. AMD stock has gained 85% in the past year, outperforming the tech-heavy Nasdaq Composite Index ($NASX) gain of 15%. So far this year, AMD stock is down roughly 4%.

Let's find out whether AMD stock is a good buy now on the dip.

Data Center and AI Represent AMD’s Growth Engine

Valued at $348 billion, AMD designs high-performance processors and graphics chips used in data centers, personal computers, gaming consoles, and AI systems. In the fourth quarter, revenue rose 34% year-over-year (YOY) to $10.3 billion, driven by record sales of EPYC server processors, Ryzen CPUs, and Instinct accelerators. Diluted earnings rose 40% YOY to $1.53 per share. The data center segment became the company's key growth engine. Q4 data center revenue climbed 39% YOY to $5.4 billion, driven by robust EPYC server processor demand and accelerated MI350 series GPU shipments. The adoption of fifth-generation EPYC Turin CPUs surged, “accounting for more than half of the total server revenue,” while fourth-generation EPYC processors remained in high demand.

Notably, hyperscaler demand remained high, with over 230 new AMD-powered instances launched throughout the quarter. Over the course of the year, hyperscalers added more than 500 AMD-based instances, bringing the overall number of EPYC cloud instances up by more than 50% to nearly 1,600. Looking ahead, AMD anticipates continued high server demand as hyperscalers increase infrastructure to support AI and enterprises modernize data centers for emerging AI workflows. Additionally, the ramp of MI350 series shipments and additional MI308 sales to customers in China contributed to the growth of the data center AI business.

On the software side, AMD expanded the ROCm ecosystem, allowing for speedier deployment and better performance across a wider range of workloads. Management noted that customer interest in AMD's next-generation MI400 series and Helios platform is growing. Last quarter, AMD announced a multi-generational partnership with OpenAI to deploy 6 gigawatts of Instinct GPUs. The company believes the launch of MI400 and Helios represents a major inflection point and expects data center revenue to grow more than 60% annually over the next three to five years, with AI revenue scaling to tens of billions of dollars annually by 2027.

Looking ahead, AMD is also developing the MI500 series using the cDNA6 architecture and advanced two-nanometer process technology with HBM4e memory. AMD plans to release MI500 in 2027, aiming for another significant boost in AI performance for next-generation multimodal models.

AMD’s Other Segments Are Going Equally Strong

AMD’s Client segment revenue rose 34% to a record $3.1 billion, driven by strong demand across multiple generations of Ryzen desktop and mobile processors. Meanwhile, Gaming revenue increased 50% YOY to $843 million, supported by strong demand for Radeon RX 9000 series GPUs and higher channel sellout during the holiday period. AMD also launched FSR4 Redstone, its latest AI-powered upscaling technology.

The Embedded segment's revenue increased 3% YOY to $950 million as demand strengthened in the test and measurement and aerospace markets. AMD closed $17 billion in embedded design wins in 2025, bringing the total since acquiring Xilinx to more than $50 billion. The firm ended the quarter with a sturdy balance sheet holding $10.6 billion in cash and equivalents.

For the full year, revenue grew 34% to $34.6 billion, with more than $7.6 billion added from data center and client revenue growth. Gross margin reached 52%, and EPS rose 26% YOY to $4.17, even as the company continued investing heavily in AI and data center initiatives.

2026 and Beyond Could Be Exceptional

AMD expects strong growth to continue into 2026, driven by increased adoption of EPYC CPUs, expanding Instinct deployments, continued client share gains, and a return to growth in embedded markets. For Q1 2026, the company expects revenue of around $9.8 billion (plus or minus $300 million), representing roughly 32% YOY growth at the midpoint.

Looking further ahead, AMD sees revenue growth above a 35% compound annual growth rate (CAGR) over the next three to five years, expanding operating margins, and annual EPS exceeding $20 within its strategic timeframe. Analysts forecast AMD’s earnings to increase by 60% in 2026, followed by another 58% in 2027. AMD stock is valued at 37.9 times forward earnings, compared to its historical average of 93 times.

AMD’s expanding portfolio, from Helios AI infrastructure in the cloud to Ryzen processors powering edge and PC AI, positions the company to capture growth across the entire AI compute stack, making it a strong contender to Nvidia.

Is AMD Stock a Buy, Hold, or Sell Now?

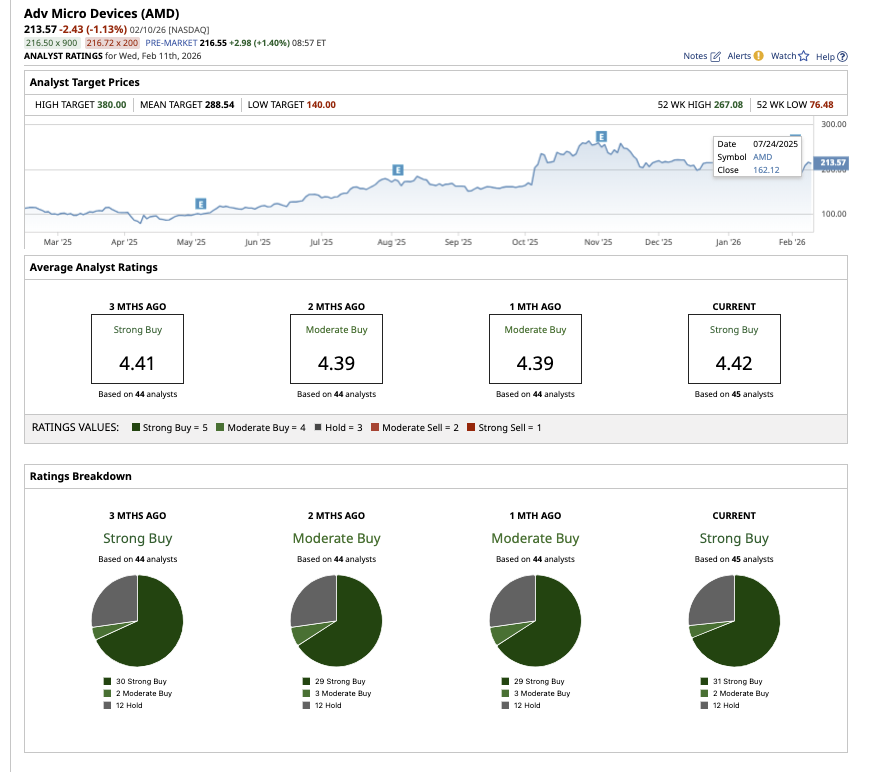

Overall, the consensus for AMD stock has changed from a “Moderate Buy” one month ago to a “Strong Buy” consensus now. Of the 45 analysts covering AMD, 31 rate it a “Strong Buy,” while two recommend a “Moderate Buy,” and 12 recommend a “Hold.” Based on the average price target of $288.54, analysts see potential upside of about 40% over the next 12 months. Furthermore, the high target of $380 implies a potential price increase of 84% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart