Nio stock (NIO) closed more than 3.5% higher on Dec. 30, 2025, after Beijing confirmed plans to offer consumer trade-in subsidies worth up to $8.92 billion next year. The move is China’s latest attempt to push back against deflationary pressure and a softer economy, and the National Development and Reform Commission said the program will help “optimize the implementation of new economic and social organizations.”

Still, the pop in the stock does not change the bigger picture. Nio shares are still down more than 35% from their year-to-date (YTD) high on Oct. 2, and the stock has been in a clear downtrend over the past three months.

China matters here because it accounted for 57% of all battery electric vehicle registrations worldwide in the first quarter of 2025. At the same time, competition at home is getting tighter, with the top 10 manufacturers controlling about 95% of China’s NEV sector.

That is why Nio missing China’s top 10 passenger car sellers list in November is a red flag. It shows how hard the company’s road is getting as the price war intensifies, EV sales growth in China slows, and pressure rises from both major automakers and fast-moving newer rivals.

With Beijing’s $8.92 billion subsidy lifeline, can Nio turn this stimulus-fueled bounce into sustained momentum, or will 2026 expose the structural cracks that have kept the stock underwater for most of 2025? Let’s find out.

What Nio’s 2025 Numbers Really Signal for 2026

Nio builds and sells EVs with a strong focus on higher-end models, backed by its software and its Battery-as-a-Service program plus a large battery swap-station network. It is also trying to grow faster by moving into the mass market with its Onvo and Firefly sub-brands.

Over the past 52 weeks, the stock is up about 6%, and it has jumped about 40% in the last six months, a possible sign that the market is leaning more toward a comeback story than writing the company off.

That shift is tied to better, but still not fully steady, results. In Q3 2025, total revenue was about RMB 21.8 billion (around $3.1 billion), and vehicle sales were RMB 19.2 billion, up in the mid-teens year-over-year (YoY) and up in the high teens from Q2, showing the newer products are starting to move the needle.

Deliveries came in at 87,071 vehicles, up 40.8% YoY, made up of 36,928 Nio vehicles, 37,656 Onvo vehicles, and 12,487 Firefly vehicles, which points to the multi-brand plan turning into real volume.

On profitability, vehicle margin rose to 14.7%, and overall gross margin improved to 13.9%, both well above last year, helped by tighter costs, in-house tech like the NS9031 chip and SkyOS, and better scale that is starting to reduce pricing pressure.

Loss from operations and net loss were each about one-third smaller than a year earlier, and Nio ended the quarter with about RMB 36.7 billion ($5.1 billion) in cash and equivalents. This gives it room to keep spending through a tough 2026 price war instead of having to pull back right away.

Are Nio’s Growth Engines Strong Enough?

Nio’s biggest push to make it through 2026 is Onvo. The Onvo sub-brand is built for China’s mass-market family segment. Nio unveiled the L90 three-row electric SUV on July 31, 2025, and it delivered 10,575 units in its first full month in August. That early demand helped lift total monthly deliveries above 30,000 vehicles for consecutive months. The plan is direct and ambitious: price Onvo to compete head-on with Tesla’s (TSLA) Model Y while using Nio’s premium battery-swap network to stand out. That gives Nio a shot at the roughly 15-million-unit annual market in the RMB 100,000 to RMB 300,000 range, which is where China’s EV price war is most intense. Management expects Onvo, along with the recently launched Firefly micro-EV brand, to drive most of Nio’s volume growth in 2026.

Supporting that effort is Nio’s Battery-as-a-Service (BaaS) model and its swap network, strengthened by a strategic partnership announced in March 2025 with CATL, the world’s largest EV battery maker, to jointly expand what is already the biggest passenger-vehicle battery swap ecosystem. The goal is not only to reduce charging anxiety but also to make the swap network a platform other brands and automakers can use, creating a revenue stream beyond just selling cars. On the product side, Nio also broadened its lineup across 2025, launching nine new models, including refreshed ES6, EC6, ET5, and ET5T versions in May, each featuring its in-house NS9031 smart driving chip and SkyOS operating system. Together, these in-house systems cut about RMB 10,000 per vehicle in costs while improving its driver-assist and smart-driving features.

Wall Street’s Split Verdict

The company set the bar high to close out 2025. It guided for Q4 deliveries of 120,000 to 125,000 vehicles, which would be about 65.1% to 72.0% higher than the same quarter last year, and Q4 revenue of RMB 32,758 million to RMB 34,039 million (about $4.60 to $4.78 billion), up roughly 66.3% to 72.8% from Q4 2024. Wall Street is penciling in a current-quarter loss of about $0.07 per share and a full-year 2025 loss of $1.03. Based on those numbers, the YoY EPS improvement works out to about 85.11% for the quarter and 31.79% for full-year 2025.

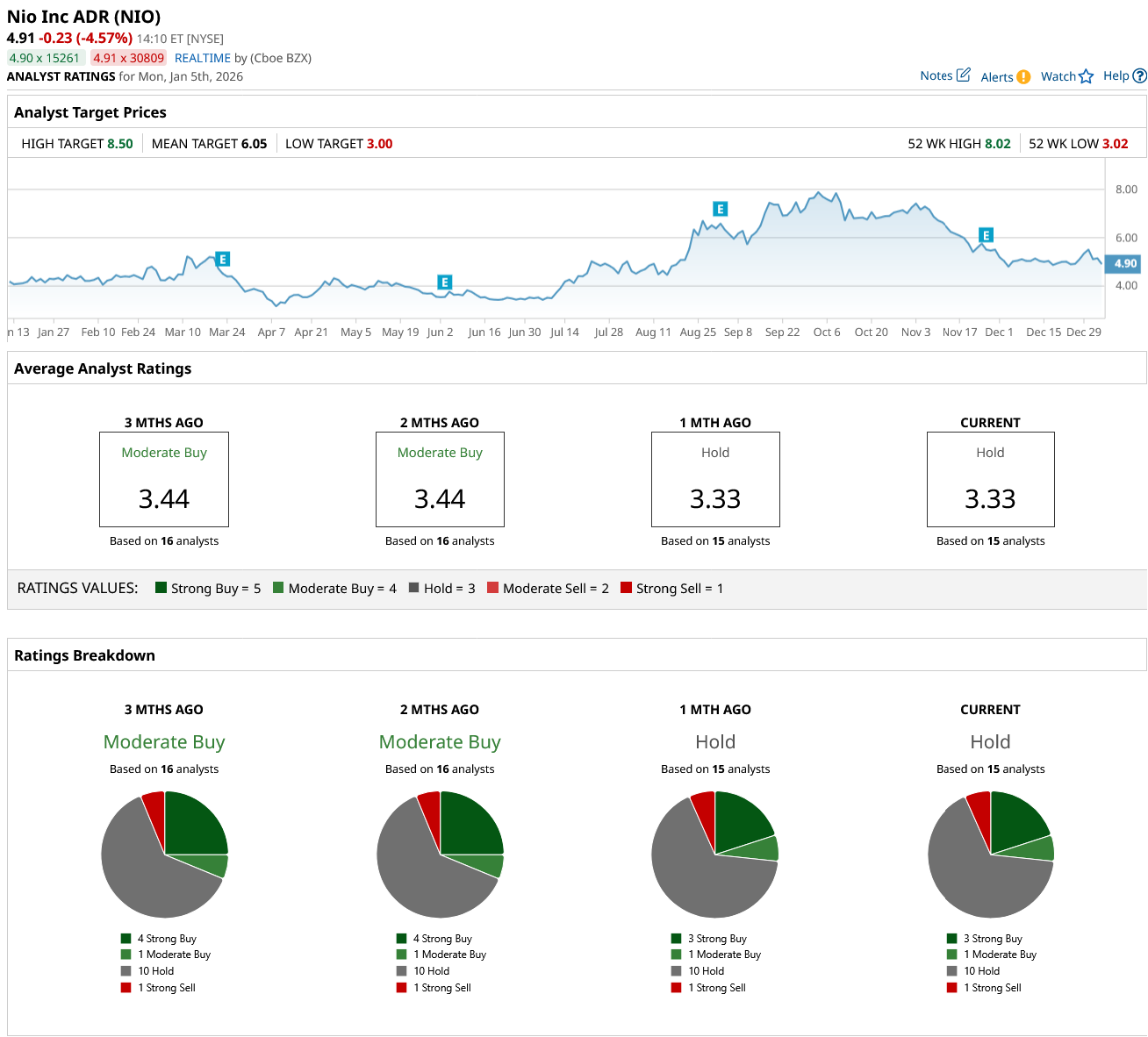

Citi stood out as the most bullish voice in October 2025, raising its price target to a street-high $8.60 and sticking with a “Buy” rating. Citi’s main points were Nio’s battery EV product strength, its proprietary battery swap network, and the idea that a clearly separated three-brand lineup deserves a premium compared with mass-market players competing mostly on price. J.P. Morgan took a similar step earlier in 2025, upgrading Nio to “Overweight” with an $8 price target, pointing to better execution and rising institutional interest after the Hong Kong capital raise. However, Nio still missed China’s top-10 passenger-car list in November despite record volumes.

Still, the broader message from analysts is restraint. The 15 analysts tracked here rate the stock a consensus “Hold,” and the average price target is $6.05. With the stock at $5, that is about 21% upside.

Conclusion

In the end, Nio looks more like a speculative survivor than a clear long-term winner. The company has real assets in its battery swap moat, three-brand lineup, and accelerating revenue and delivery growth, but it is still fighting for scale in a market where the top 10 already control almost everything. And Nio itself did not crack China’s November top-10 passenger-car list. With Beijing’s subsidies, improving margins, and a still‑intact balance sheet, Nio probably survives 2026, but unless it can convert volume into sustained profitability, the stock is more likely to grind sideways with volatility than stage a durable re‑rating higher.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Halliburton Stock Just Pushed into Overbought Territory Amid Venezuela Tumult. Is There Still Time to Buy HAL?

- Betting on Popular 2025 ETFs Could Produce Wicked Results in 2026. Don’t Get Caught Chasing the Hype.

- Warren Buffett’s Legacy Includes an Emphasis on Industrials. This ETF Reminds Us Why.

- 2025 Wasn’t an Easy Year for Tesla Stock, but Baird Says It’s a ‘Core Holding’ for 2026 Anyways