With a market cap of $507.5 billion, Exxon Mobil Corporation (XOM) is a global energy company engaged in the exploration, production, and sale of crude oil, natural gas, petrochemicals, and specialty products. The company operates through segments including Upstream; Energy Products; Chemical Products; and Specialty Products, while also pursuing lower-emission technologies and sustainable fuels under the Exxon, Esso, and Mobil brands.

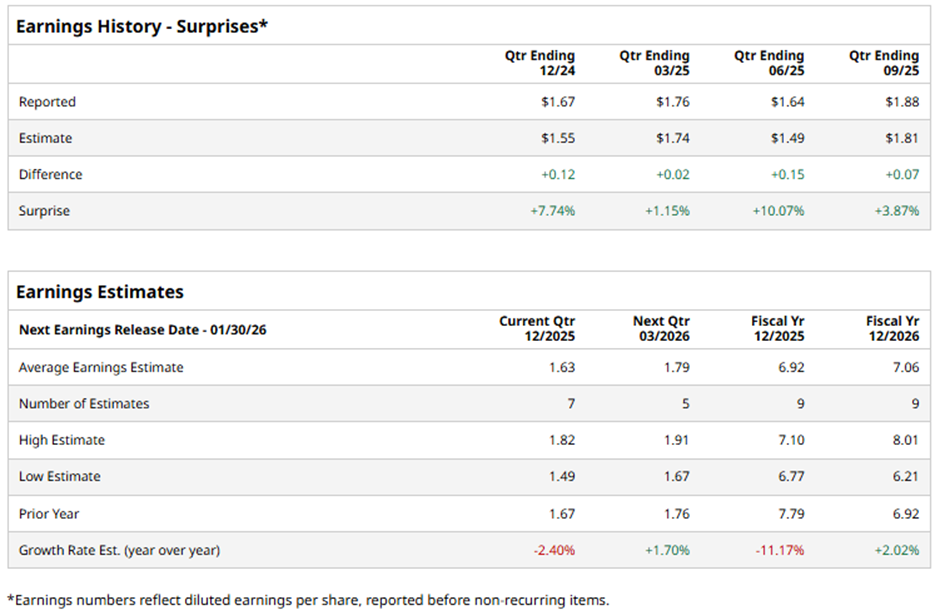

The Spring, Texas-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict the oil giant to report an adjusted EPS of $1.63, down 2.4% from $1.67 in the previous year's quarter. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts project Exxon Mobil to report adjusted EPS of $6.92, a decline of 11.2% from $7.79 in fiscal 2024. Nevertheless, the company’s adjusted EPS is projected to rise over 2% year-over-year to $7.06 in fiscal 2026.

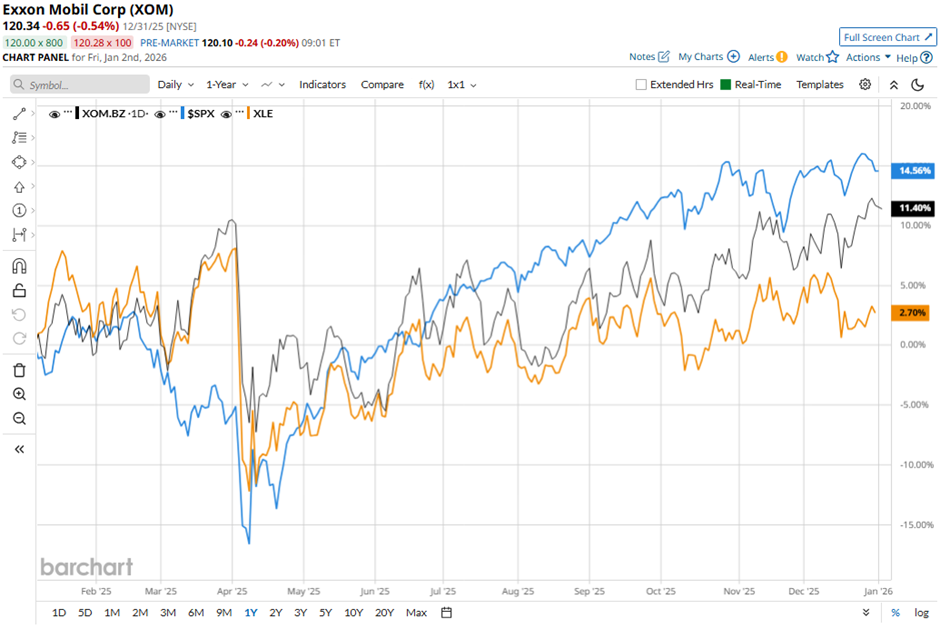

XOM stock has increased 12% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.4% gain. However, the stock has outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 3.1% return over the same period.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.88, shares of XOM fell marginally on Oct. 31 as the company reported revenue of $85.29 billion, below forecasts. Investors also focused on weakness in key segments, including a $1.4 billion year-over-year decline in Chemical Products earnings and lower base volumes, which overshadowed the positive production and cash-flow headlines.

Analysts' consensus rating on XOM stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 27 analysts covering the stock, opinions include 14 "Strong Buys," one "Moderate Buy," and 12 "Holds." The average analyst price target for Exxon Mobil is $131.58, suggesting a potential upside of 9.3% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As MicroStrategy Buys $109 Million of Bitcoin, Should You Buy MSTR Stock?

- Wall Street’s Radial Framework Potentially Exposes a Mispriced Opportunity in Ambarella (AMBA) Stock Options

- A $1 Billion Catalyst Just Hit Coupang. How Should You Play CPNG Stock Here?

- Alphabet Soars — Is GOOGL Stock Still a Buy for 2026?