For the better part of the last decade, Intel (INTC) has been the punching bag of the semiconductor world. We’ve watched the company miss the mobile revolution, stumble on manufacturing, and get humiliated by Advanced Micro Devices (AMD) in the data center. But in early 2026, the charts and the headlines are telling a different story — one that some would call the “Silicon Renaissance.”

Intel earnings are up late next week. What’s next for this volatile mainstay of the tech space, which has been added to and removed from the Dow 30 during my career?

INTC shares have surged to a 21-month high near $47, bolstered by a KeyBanc upgrade and news that its server CPUs for 2026 are already "mostly sold out.” The key driver for bulls is the 18A process node. At CES 2026 last week, Intel showcased "Panther Lake" — the first consumer chips built on this 1.8nm architecture — proving they might finally be closing the performance gap with Taiwan Semiconductor (TSM).

Intel has transitioned from a struggling legacy giant into a national champion for U.S. semiconductor sovereignty. By separating its manufacturing arm (Foundry) from its design arm, it has attracted massive interest from hyperscalers, like Amazon and Meta. KeyBanc now believes Intel could credibly become the No. 2 global foundry supplier, leapfrogging Samsung.

INTC is overextended. Chasing a stock that has risen 27% to start 2026 is a "momentum trap" if you don't have a plan. The daily chart below still has room, but the air is getting thin.

This weekly view shows a clear breakout above a trendline that goes all the way back to 2021. That’s a big deal in a bullish way, but in this market environment, the AI trade basket goes out with the proverbial bathwater.

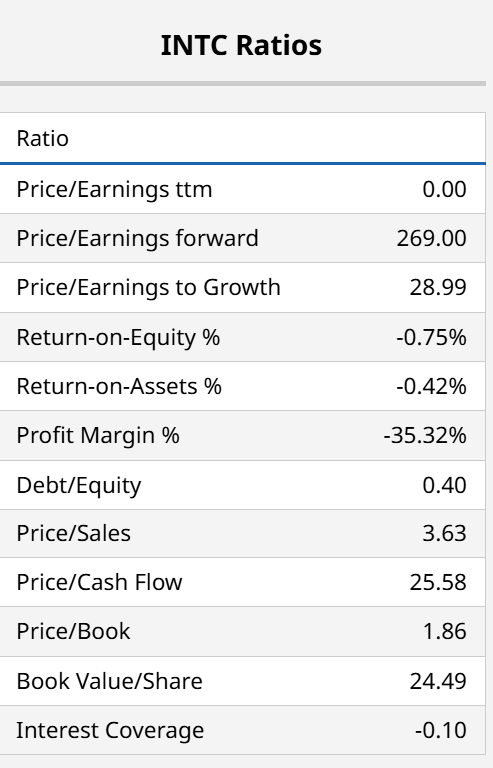

This table shows the comeback and also reflects that INTC is essentially back at square one, operationally and stock price-wise. It trades where it did in 2019. But the momentum in its business, at least based on the U.S. government’s stake, is better than it has been in some time. It's been reignited. But still, it’s way up in price.

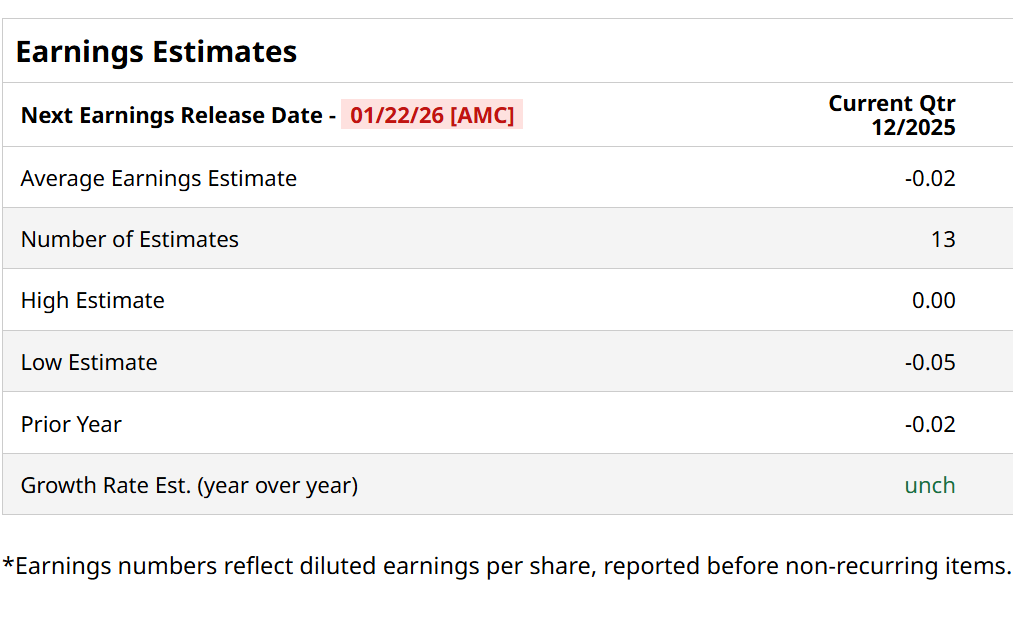

Below, we can see there’s some growth to accomplish, into that massive trailing 29x price-to-earnings-to-growth (PEG) ratio.

But at “only” 3.6x trailing sales, the forward-looking potential corrects some of the sloppy backward-looking fundamental data. So, where do I land? INTC has more visible upside, but it's late in the game, and the easier money has been made. Tread carefully here, even if the comeback may not be over.

Rob Isbitts is a semi-retired fund manager and advisor. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Is Back From the Brink, But It Only Gets Tougher From Here. How Should You Play INTC in 2026?

- Cathie Wood Is Trimming Her Palantir Stake Again. How Should You Play PLTR in January 2026?

- As Trump Unveils His ‘Great Healthcare Plan,’ How Should You Play UnitedHealth Stock?

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’