This has been a great time for gold investors—the precious metal is up 72% over the last year, with analysts pointing to geopolitical tensions such as the U.S. blockade of Venezuela and Russia’s war on Ukraine, as well as softening monetary policies from the Federal Reserve, as the cause.

“The latest leg of the rally has been driven by the market pricing in an increasingly gold-friendly 2026 outlook, with lower rates and a potentially softer dollar acting as tailwinds for the bullion,” Global X ETFs senior investment analyst Trevor Yates told CBS.

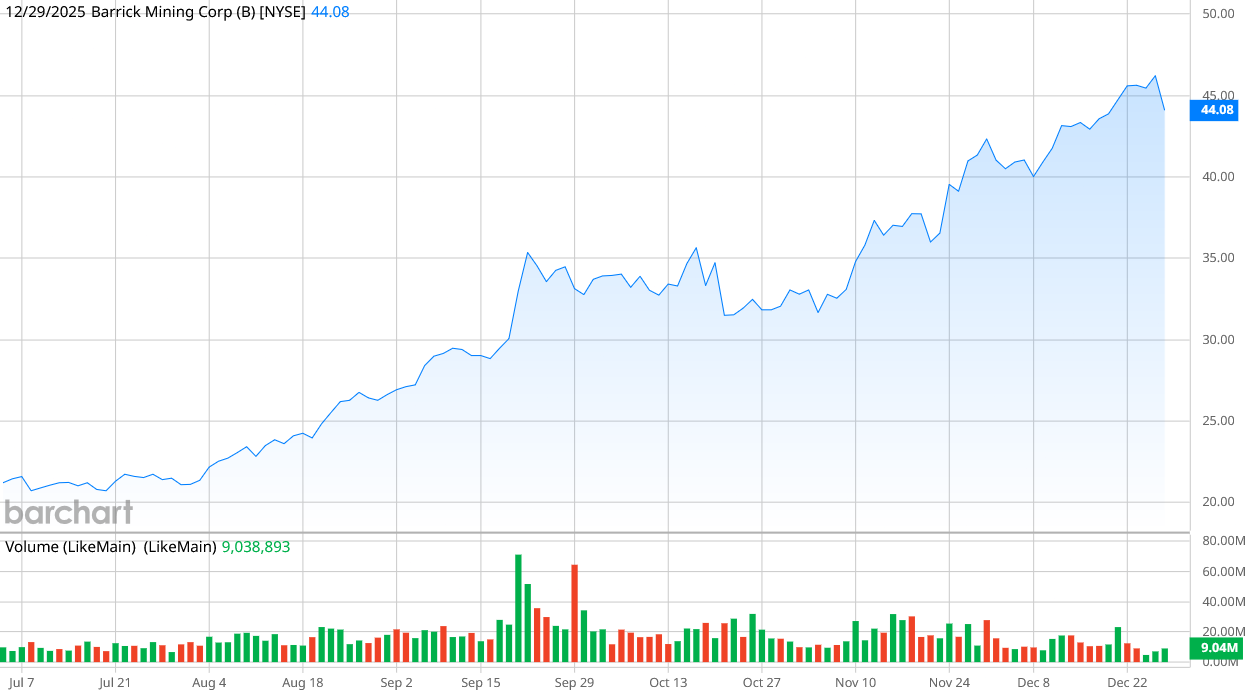

Against this backdrop and with gold at all-time highs, let’s consider the prospects of gold mining stock Barrick Mining (B), which has also seen a giant run higher in recent weeks.

About Barrick Mining Stock

Barrick Mining, which is headquartered in Toronto, Canada, is a mining and development company that mines for gold and copper. The company has mining operations in 17 countries and five continents—gold operations are in Nevada as well as Tanzania, the Congo, Mali, Papua New Guinea, Argentina, and the Dominican Republic. The company’s copper mines are in Saudi Arabia, Zambia, and Chile. The company has a market capitalization of $76.5 billion.

Shares are up a whopping 184% in 2025 as the increase in gold prices has been a windfall for Barrick investors. The stock is by far outperforming the S&P 500 ($SPX), which is up nearly 16% on the year, as well as the VanEck Gold Miners ETF (GDX), which is up 164% in 2025.

As the stock increased, so has the price-to-earnings ratio, which currently is at 21.8. The stock’s P/E traded around 15 for most of the year, so shares are currently at a premium.

Barrick Mining also pays a modest dividend of 1.5%, or $0.70 annually per share. With a payout ratio of only 20.7%, the dividend is sustainable, and the company increased the payout by 16% in its most recent disbursement, which was Dec. 15.

Barrick Mining Beats on Earnings

Barrick had a solid third quarter, with revenues of $4.18 billion, up 23% from a year ago—a result of the surge in gold prices. Net earnings were $1.3 billion, up 170% from a year ago, and free cash flow of $1.47 billion was up 233% from last year. Barrick posted earnings per share of $0.58, which was a marked improvement from EPS a year ago of $0.30 and was a penny better than analysts expected.

Gold production was 829,000 ounces (31.34 tons), up 4% from the previous quarter, and copper production was 55,000 metric tons, or 7% lower than the second quarter.

However, the company’s performance was overshadowed by a change in leadership. CEO Mark Bristow stepped down Sept. 29 in what was described by The Globe and Mail as a “power struggle” with Chairman John Thornton.

“The relationship between Bristow and Thornton had been frayed for a number of years,” Pierre Lassonde, co-founder and chairman emeritus of Franco-Nevada Corp., the world’s biggest mining royalty firm, told the Toronto-based newspaper.

Barrick appointed Chief Operating Officer Mark Hill as interim CEO. Hill has said he will focus on improving performance at the company’s mines in Nevada and the Dominican Republic.

In addition to increasing the dividend, Barrick repurchased $589 million in shares during the quarter and reiterated its full-year guidance for gold production between 3.15 million and 3.5 million ounces, tracking near the lower end of the range.

What Do Analysts Expect for B Stock?

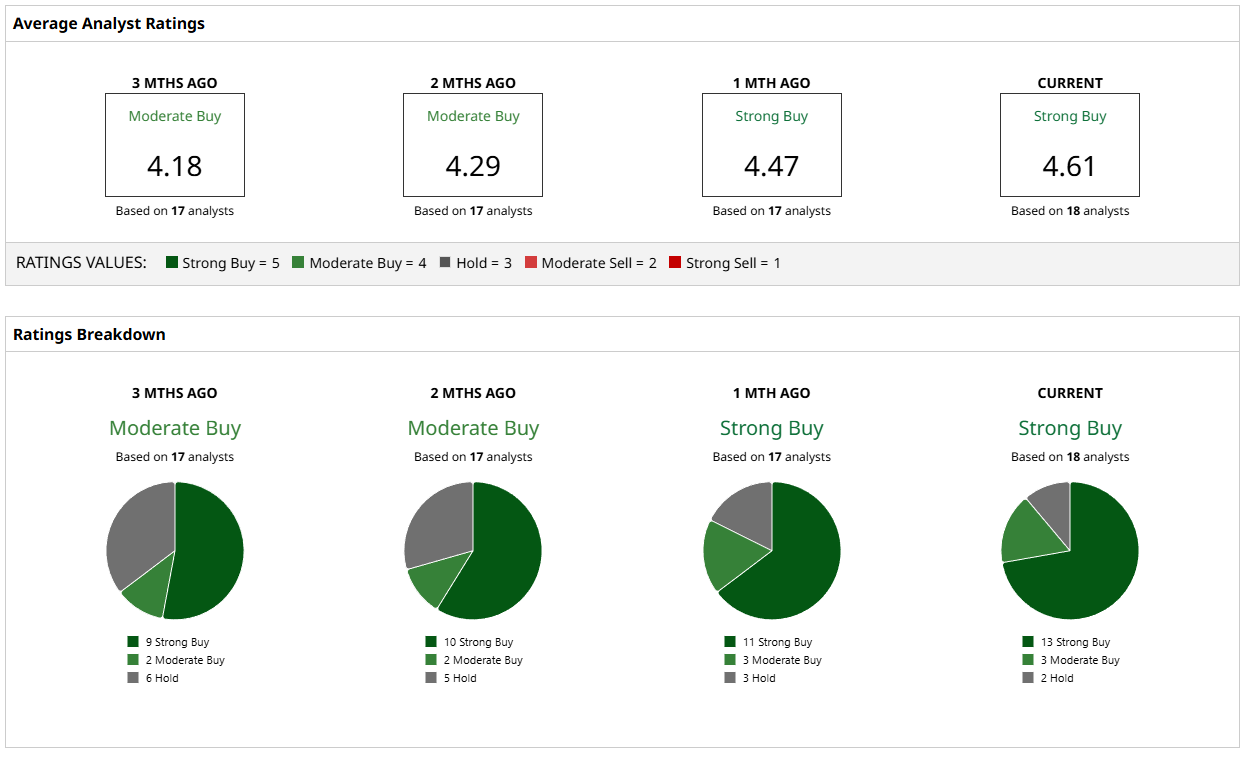

Barrick Mining has a “Strong Buy” rating from analysts surveyed by Barchart—and that sentiment has been getting stronger by the month. Of 18 analysts who cover the stock, 13 of them have “Strong Buy” ratings and three others have “Moderate Buy” ratings. The other two analysts recommend holding, but no analyst has a “Sell” rating.

However, analysts also don’t predict much more movement in the stock price—the mean target of $47.84 is only 8.5% higher than the stock’s current level, and the most bullish target of $56.16 suggests only a 27% gain.

Barrick had a great 2025, and I respect the analysts’ opinions, but I’m not expecting Barrick to have a great 2026. The investment firm Capital Economics predicts that gold prices will fall from $4,500 to $3,500 by the end of next year. Such a swing would have a considerable impact on Barrick’s revenue and profits.

I would consider taking profits at this point from Barrick Mining.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend-Yielding Gold Stock Is Up 184% in 2025. Should You Bet on Higher Gold Prices in 2026?

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?