Nvidia (NVDA) has taken a calculated step deeper into the artificial intelligence (AI) software stack. On Dec. 15, the semiconductor giant acquired SchedMD, a Utah-based software company specializing in open-source workload management for high-performance computing and AI.

SchedMD develops Slurm, or Simple Linux Utility Resource Management, the dominant job scheduler for high-performance computing clusters. Slurm enables thousands of computers to function as a single system, directly shaping efficiency, throughput, and cost control.

Nvidia will continue to develop and distribute Slurm as open-source, vendor-neutral software. Slurm already powers more than half of the top 10 and top 100 systems on the TOP500 supercomputer list, highlighting its entrenched position. It also supports Nvidia’s most advanced hardware, reinforcing platform cohesion.

The deal underscores the growing importance of software within Nvidia’s broader strategy, reinforcing its proprietary CUDA platform, a standard relied upon by most developers. In light of this development, let's evaluate the appropriate stance on NVDA stock.

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia leads global markets in graphics processors and accelerated computing platforms. The company's technology anchors gaming, data centers, and AI. With a market capitalization of nearly $4.4 trillion, Nvidia’s GPUs, networking, and software stack now form critical infrastructure for cloud computing, high-performance systems, and enterprise-scale innovation.

Nvidia’s stock performance reflects the strategic positioning. Shares of NVDA have climbed 36% over the past 52 weeks and accelerated with a 28% gain in the last six months. Over the same periods, the Roundhill Magnificent Seven ETF (MAGS) has risen about 21% and 28%, highlighting NVDA stock’s sustained outperformance on a longer time horizon.

The valuation remains elevated but defensible. NVDA stock trades at 41 times forward earnings and 33.7 times sales, levels that exceed industry averages. However, Nvidia's forward earnings multiple sits below Nvidia’s own five-year average multiple, implying the market still assigns a relative discount despite stronger scale, margins, and structural growth visibility.

Nvidia Surpasses Q3 Earnings

On Nov. 19, Nvidia shares rose almost 2.9% after the company reported fiscal 2026 third-quarter results that exceeded Wall Street expectations and delivered stronger-than-expected fourth-quarter guidance. Revenue grew 62% year-over-year (YOY) to $57.01 billion, surpassing analyst estimates of $54.92 billion. Adjusted EPS increased 60% to $1.30, topping the Street’s forecasts of $1.25.

Data center revenue continued to anchor Nvidia’s growth engine. The segment generated $51.2 billion in sales, marking a 66% YOY increase. Networking, purpose-built for AI and now the world’s largest, delivered $8.2 billion in revenue, surging 162% YOY as NVLink, InfiniBand, and Spectrum-X Ethernet scaled rapidly.

Gaming revenue reached $4.3 billion, up 30% from a year ago, reflecting resilient consumer and PC upgrade demand. Automotive revenue climbed to $592 million, a 32% YOY increase.

CFO Colette Kress highlighted Nvidia’s Blackwell Ultra as the top-selling chip, while CEO Jensen Huang noted that cloud GPUs are sold out as compute demand accelerates exponentially across training and inference, fueling rapid AI ecosystem expansion across industries and countries.

That being said, for the fourth quarter, management expects total revenue of $65 billion, plus or minus 2%. Meanwhile, analysts forecast Q4 fiscal 2026 EPS to rise 69.4% YOY to $1.44. For the full fiscal 2026, the bottom line is projected to increase 50% to $4.41. Looking ahead to fiscal 2027, analysts expect EPS growth of 54% to $6.79.

What Do Analysts Expect for Nvidia Stock?

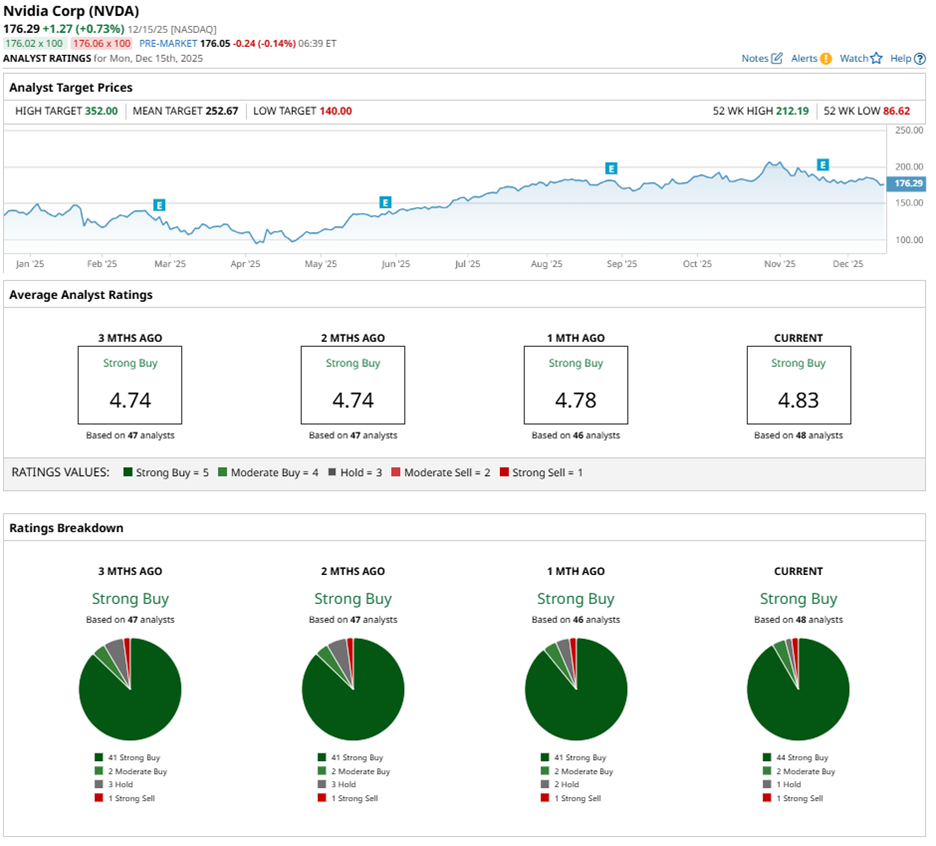

NVDA stock continues to command strong analyst conviction, reflected in its overall “Strong Buy” consensus rating. Among 48 covering analysts, 44 recommend a “Strong Buy,” two assign a “Moderate Buy,” one maintains a “Hold,” and one issues a “Strong Sell" rating.

The average price target of $255.56 points to potential upside of 40% from current levels. Meanwhile, Evercore ISI’s Street-high target of $352, paired with an “Outperform” rating, implies a potential gain of 92%, reflecting a more bullish long-term view on Nvidia’s growth trajectory.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Oracle Fans Love the New TikTok Deal. But Does It Really Change the Bull Case for ORCL Stock?

- Will Tesla Stock Lose Its ‘Elon Musk Premium’ After the SpaceX IPO? And You Should Sell TSLA Here?

- Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

- Valero (VLO) Stock Just Triggered a Rare Quant Signal the Options Market Is Missing