Contrarian investors have always had a way of making headlines, and few names stand taller in that category than Michael Burry. Known for his legendary bet against the 2008 housing market crash, Burry has since become a barometer for market excess, often sounding alarms when optimism peaks. His latest move has quite shocked Wall Street, with a massive short position against Palantir Technologies (PLTR), one of 2025’s hottest AI stocks.

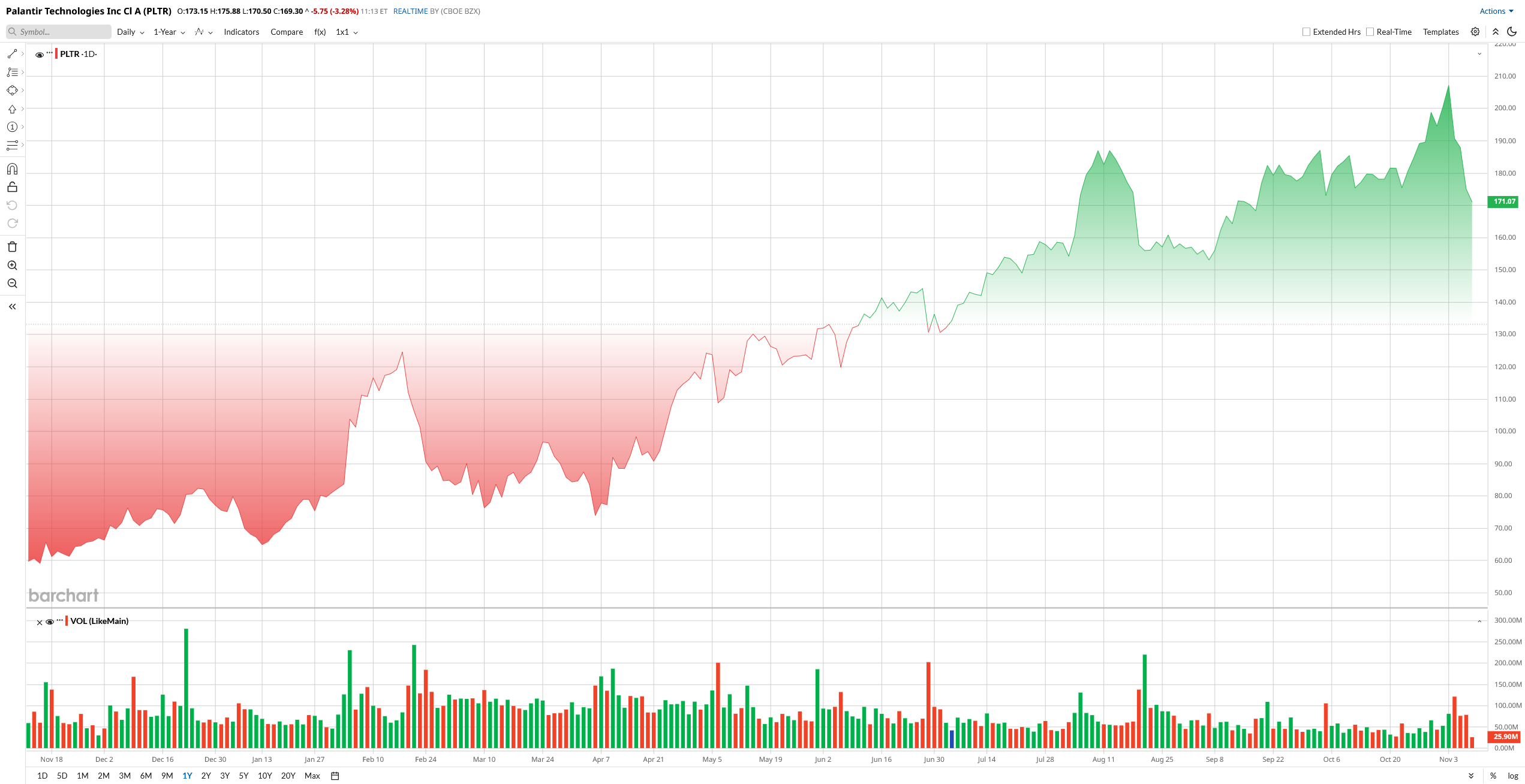

Palantir has been a darling of the artificial intelligence boom, with shares soaring more than 200% over the past year on record earnings and blockbuster government deals. Yet, Burry’s bearish stance has left investors wondering: has Palantir’s rally gone too far, too fast? With valuation multiples at nosebleed levels and growing chatter about an “AI bubble,” Burry’s warning has injected a dose of reality into the euphoria. Here’s what his bold bet could mean for Palantir investors now.

About PLTR Stock

Founded in 2003, Palantir Technologies is a software firm that builds data analytics platforms for government and commercial use. It helps organizations integrate diverse data through products like Foundry and Gotham to support decision-making. Palantir stands at the crossroads of technology and geopolitics, a software powerhouse whose influence spans defense, intelligence, and commerce. Under CEO Alex Karp’s vision, the company has become both a symbol of Western resilience and a strategic asset enabling governments and enterprises to navigate an increasingly multipolar, data-driven world.

Valued at around $415 billion by market cap, PLTR stock has been one of 2025’s standout performers, gaining roughly 130% year-to-date (YTD). However, the stock has entered correction territory over the past week following its Q3 earnings release. Additionally, news of Michael Burry’s bearish bets sparked further selling, with shares down more than 10% in the past five days.

One of the main concerns for investors is that PLTR trades at extreme valuations. Forward price-to-earnings is roughly 380x, versus about 40x for chip star Nvidia (NVDA) and around 30x for Microsoft (MSFT). Its price/sales ratio is similarly sky-high, on the order of 150x compared to tech peers in the single digits.

In short, Palantir’s multiples are stratospheric by any measure. Even after its rally, many analysts say the stock looks expensive relative to the tech sector median.

Michael Burry Bets Against Palantir

Earlier this week, a 13F filing showed that Michael Burry’s Scion Asset Management made a big bearish bet on Palantir, buying put options on 5 million shares worth about $912 million. Burry, who has been warning about an “AI bubble,” took this contrarian stance just as Palantir reported record Q3 results, and the stock still dropped.

Palantir CEO Alex Karp hit back strongly, calling the short bets “batshit crazy” and saying it’s strange to bet against companies “making all the money.” He promised to “dance” when those bets fail.

Wedbush analyst Dan Ives also sided with Karp, calling Burry’s move “a short-term mistake” and saying Palantir’s growing role in AI and defense makes it one of the best-positioned companies in the field.

Palantir Delivers Beat and Raise Quarter

Last week, Palantir handily beat expectations in its third quarter, reporting $1.181 billion in revenue, up 63% from a year earlier and above the roughly $1.09 billion analysts were looking for. This was the second straight quarter north of $1 billion in sales, a sign the company’s momentum is broadening.

U.S. revenue led the charge at $883 million, a 77% jump year-over-year (YoY). That was powered by a huge 121% surge in U.S. commercial sales to $397 million, while U.S. government sales rose 52% to $486 million.

The business is also closing larger deals as well. Palantir booked 204 contracts worth more than $1 million (53 of them above $10 million) and signed a record $2.76 billion in total contract value, up 151%, including $1.31 billion in U.S. commercial deals, which jumped 342%.

Profitability showed through as well. Net income came in at $476 million, about a 40% net margin, versus roughly $144 million a year ago. Adjusted EPS was $0.21, beating the $0.17 consensus.

Cash flow was also strong. Operating cash flow was around $508 million, and adjusted free cash flow was $540 million. The company finished the quarter with about $6.4 billion in cash and short-term securities.

CEO Alex Karp framed the results as proof the company is balancing growth and profit, noting a “114%—our Rule of 40 score” and saying the quarter shows the transformational effect of leveraging AI across its platforms.

As we look ahead, management raised its outlook, setting Q4 revenue at $1.327 billion to $1.331 billion and upping full-year 2025 revenue to $4.396 billion to $4.400 billion, roughly 53% growth, while forecasting adjusted operating income near $2.15 billion.

Analysts Opinion and Final Words

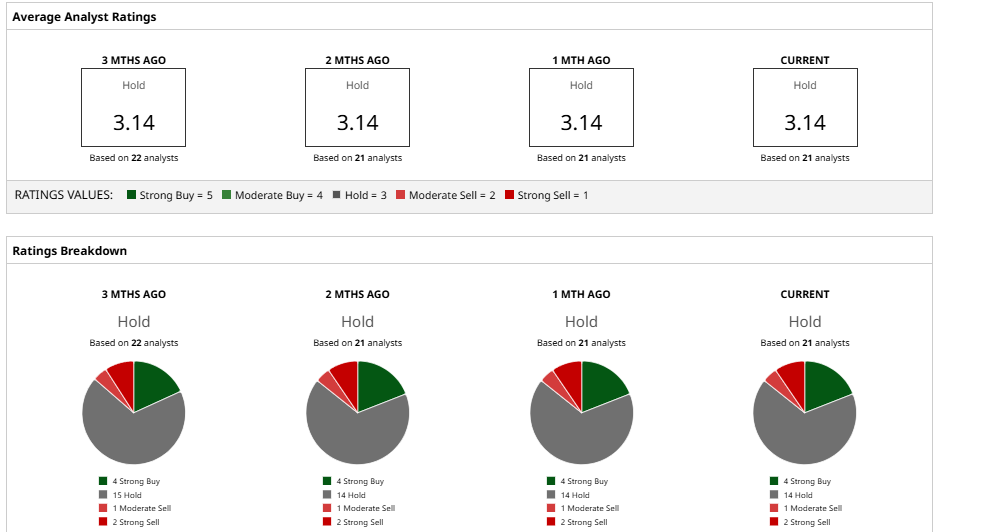

The analyst community is divided on Palantir's take. Morgan Stanley recently maintained its “Equal-Weight” rating on Palantir but lifted its 12-month price target from $155 to $205. Goldman Sachs also stayed “Neutral” but bumped its target from $141 to $180 after Palantir’s strong earnings. Both firms praised the company’s solid execution but cautioned that the stock still looks pricey.

On the bearish side, RBC Capital kept an “Underperform” rating and a much lower $50 target. The firm argued that Palantir’s growth relies heavily on U.S. contracts and warned that demand could slow once its current wave of AI projects is fully rolled out.

Meanwhile, Wedbush remains firmly bullish with an “Outperform” rating and raised its price target to $230, calling Palantir one of the most strategically positioned AI players. Citigroup and Deutsche Bank also raised their targets to the $190 to $200 range following the company’s upbeat results.

Overall, PLTR has a consensus “Hold” rating from 21 analysts. However, its mean price target of $191 suggests about 12% upside potential from here.

In my opinion, Palantir’s fundamentals are robust, with double-digit revenue growth, massive new contracts, and strong cash flow. But its valuation is historically high. However, Palantir’s management is highly confident (emphasizing its “Rule of 40” profitability metric and guidance), and the company continues to win large deals. But it's a reality that Palantir's valuation is too high; however, the recent pullback has opened a small window of opportunity for long-term investors. However, success depends on the execution of its AI strategy and new contract wins.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amid SoftBank Takeover Rumors, Should You Buy, Sell, or Hold Marvell Stock?

- This Robotaxi Stock Just Plunged. Should You Buy the Dip or Stay Far, Far Away?

- Snap Has a $400 Million Catalyst Right Now. Does It Make SNAP Stock a Buy?

- Is McDonald's a Buy? Its Strong FCF Margins Imply MCD Could be 23% Undervalued