Tech earnings season is underway, with roughly 80% of companies topping estimates so far, and AI-related demand continuing to reshape investor expectations, sending fresh buying into chipmakers.

Nvidia (NVDA) sits squarely in that conversation, which is set to report its Q3 earnings on Nov 19. Analysts now expect a “beat-and-raise” quarter as data center demand for its Grace Blackwell and Vera Rubin platforms gains clarity.

Goldman Sachs and other brokers have nudged up forecasts, citing stronger visibility into data center revenue and large-scale OpenAI deployments.

With expectations running high and Wall Street raising estimates into the print, investors are asking the right question: Can Nvidia keep outperforming, or is the bar now simply too high? Here’s what to watch as the chip giant prepares to report.

About NVDA Stock

Founded in 1993, Nvidia is a leading chipmaker best known for its graphics processing units (GPUs) and AI accelerators. Over the years, it has become the backbone of the data center and gaming industries. Today, Nvidia’s GPUs power everything from AI model training and cloud infrastructure to autonomous vehicles, cementing its position as one of the most valuable companies in the world. Recently, Nvidia crossed the $5 trillion market capitalization milestone, a first for any chipmaker.

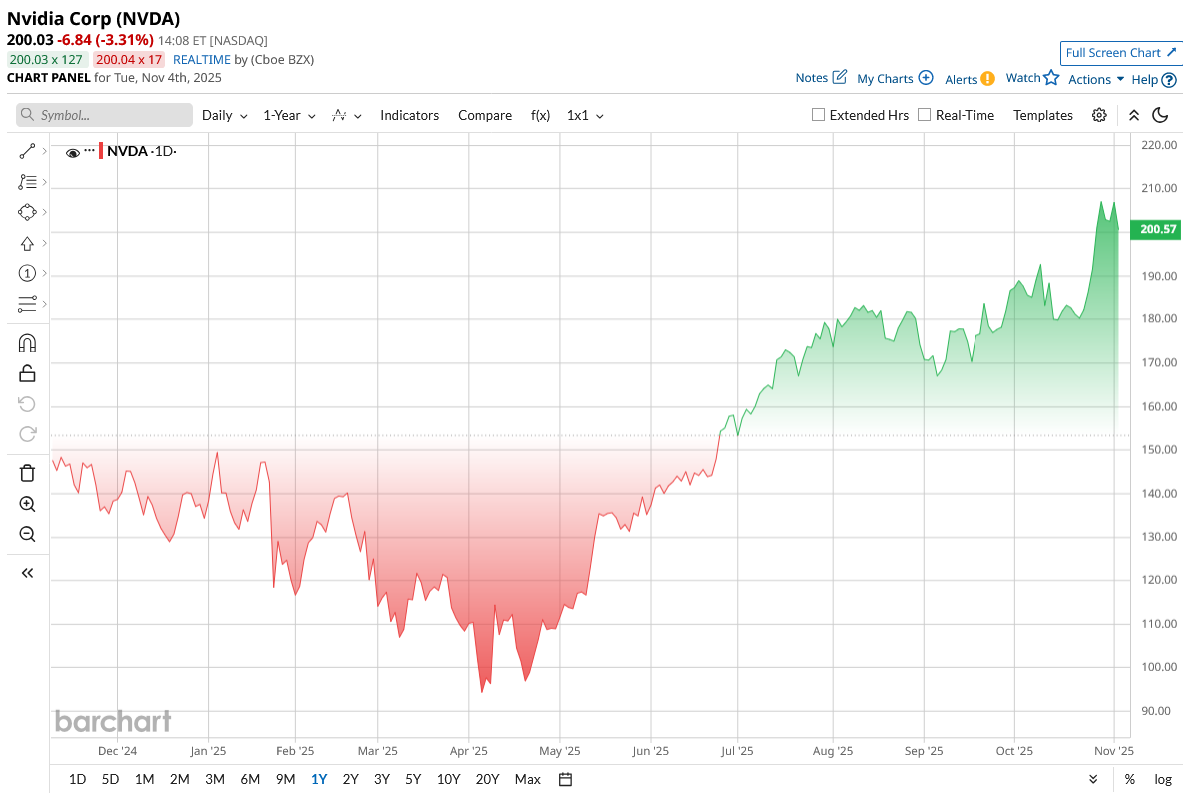

NVDA stock has been a standout performer in the tech rally in 2025, soaring roughly 50% year-to-date (YTD) on the back of booming AI demand. The surge clearly shows an insatiable appetite for its AI chips, as hyperscale data centers continue to pour billions into Nvidia’s newest Blackwell GPUs. The company’s recent GTC conference also reignited investor enthusiasm, which underscores its dominance in the AI hardware landscape.

However, this relentless growth has also driven Nvidia’s valuation to lofty heights. NVDA stock now trades at about 43x forward earnings and 34x forward sales, roughly double the median of its semiconductor peers. By comparison, the S&P 500’s ($SPX) forward P/E sits in the low 20s. That premium shows just how much optimism investors have priced in. While it highlights strong confidence in Nvidia’s growth story, it also leaves little room for disappointment if results fall short.

What Happened and What to Expect

Since early 2023, Nvidia has ridden the AI boom to historic highs. Its revenues tripled in two years. In August 2025, Nvidia’s Q2 results again blew past expectations, driven overwhelmingly by its Data Center business, which grew 56% year-over-year (YoY) to $41.1 billion, about 88% of total sales. Gaming also grew to $4.3 billion, up 49% YoY, but now represents a smaller piece of the AI juggernaut.

Looking ahead, analysts expect this momentum to continue. Nvidia provided Q3 guidance of roughly $54.0 billion in revenue, about 16% higher than Q2, implying another record quarter. It reiterated that this outlook assumes no new H20 GPU shipments to China (recent U.S. export controls). Notably, Morgan Stanley recently raised its FY2026 revenue estimate to $273.2 billion, up from $264.6 billion, and EPS to $6.51, reflecting its updated growth assumptions.

CEO Jensen Huang recently touted the new Blackwell GPU platform as “the AI platform the world has been waiting for” and said demand is “extraordinary.” In short, if Nvidia delivers yet another blowout quarter and potentially hikes guidance, it could push the stock even higher. But any weakness, or hints of slower AI spending, might trigger a pullback given how richly it’s valued.

Recent News and Developments

Nvidia has been quite in the headlines lately by announcing major partnerships. Nvidia announced projects with SK Group and Samsung as an AI factory at the APEC summit in late October. Approximately 50,000 GPUs will be used in these projects to assist in designing and fabricating next-generation chips. As an example, SK Group will develop an artificial intelligence supercomputer factory with 50,000 GPUs to enhance memory-chip design and build digital replicas of its factories. Samsung also declared a 50,000-GPU AI-powered foundry, which would utilize Nvidia's accelerated computing in its chip plantations.

Nvidia also collaborated with Oracle (ORCL) to create the largest AI supercomputer in the U.S. Department of Energy, which will utilize 100,000 Nvidia GPUs in scientific research.

Nonetheless, everything is not going well with the chipmaker. Geopolitical issues persist. U.S. export bans on sophisticated chips to China imply that Nvidia will have virtually zero income in China on its H200 series GPUs in the next several quarters, which can amount to a loss of $2 to $5 billion in just one quarter. In China, Nvidia already established an inventory of H200 of more than 180 million in Q2, and future sales remain scarce. Although these problems were present, the recent news that the demand for Nvidia technology is increasing across the globe can be a good indicator for the coming years.

What Do Analysts Think About NVDA Stock?

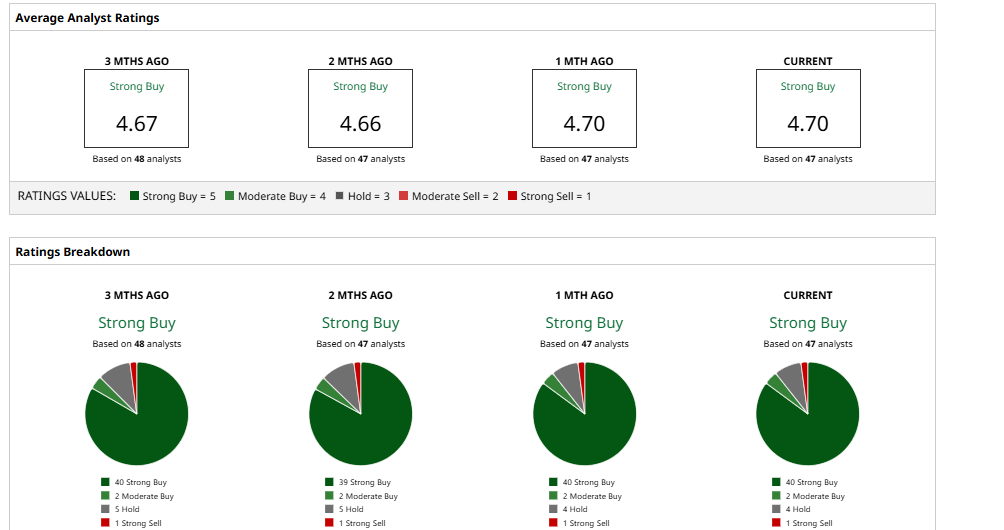

Wall Street remains overwhelmingly bullish on NVDA stock. Goldman Sachs reiterated a “Buy” rating ahead of Q3, lifting its 12‑month target to $240, and explicitly expects another “beat-and-raise” quarter thanks to accelerating data-center deployments.

Morgan Stanley likewise holds an “Overweight” rating, raising its price target to $206 from $200 on Aug. 18, noting undershipped demand and increasing its revenue and EPS forecasts for fiscal 2026 to $273.2 billion and $6.51, respectively.

J.P. Morgan also remains bullish, reiterating “Overweight” with a new target of $215 after Q2 results, pointing to strong AI and hyperscale demand and an improving networking business. Even more aggressive firms like Loop Capital have lifted targets to around $350 and see Nvidia doubling GPU shipments.

Overall, the consensus of 47 analysts in coverage tracked by Barchart is “Strong Buy” with a mean price target of $230.14, indicating that NVDA stock could climb to 11% from current levels.

In the end, although the momentum and pipeline are reported to be robust, not all analysts ignore any hints of supply restraints or a decrease in AI expenditure. Provided that the Nov. 19 earnings are up to the high expectations and projections, the stock may once more rise. However, with the kind of valuation that it is enjoying, a slightly negative news could cause a sudden reversal. Some investors in that case would like to lock in the gain or wait to have a better entry, unlike long-term bulls, who would consider Nvidia's AI leadership and ecosystem deals as reasons for responding to the high price.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart