The global semiconductor landscape is undergoing a profound transformation, shifting from a highly centralized model to a more diversified, regionalized ecosystem of innovation hubs. Driven by geopolitical imperatives, national security concerns, economic development goals, and the insatiable demand for advanced computing, nations worldwide are strategically cultivating specialized clusters of expertise, resources, and infrastructure. This distributed approach aims to fortify supply chain resilience, accelerate technological breakthroughs, and secure national competitiveness in the crucial race for next-generation chip technology.

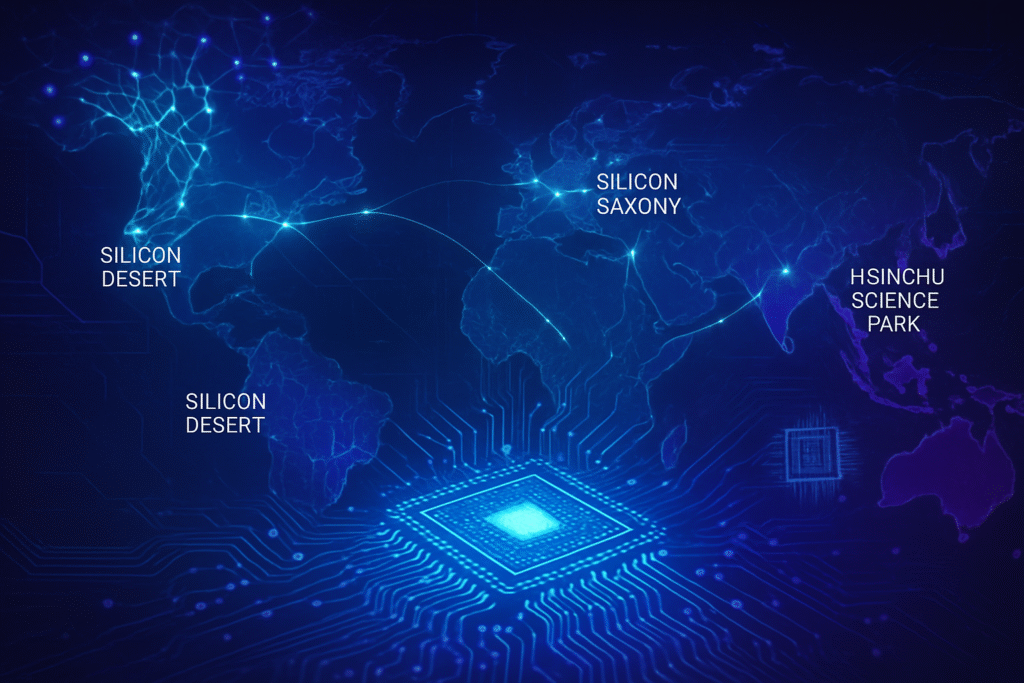

From the burgeoning "Silicon Desert" in Arizona to Europe's "Silicon Saxony" and Asia's established powerhouses, these regional hubs are becoming critical nodes in the global technology fabric, reshaping how semiconductors are designed, manufactured, and integrated into the fabric of modern life, especially as AI continues its exponential growth. This strategic decentralization is not merely a response to past supply chain vulnerabilities but a proactive investment in future innovation, poised to dictate the pace of technological advancement for decades to come.

A Mosaic of Innovation: Technical Prowess Across New Chip Hubs

The technical advancements within these emerging semiconductor hubs are multifaceted, each region often specializing in unique aspects of the chip value chain. In the United States, the CHIPS and Science Act has ignited a flurry of activity, fostering several distinct innovation centers. Arizona, for instance, has cemented its status as the "Silicon Desert," attracting massive investments from industry giants like Intel (NASDAQ: INTC) and Taiwan Semiconductor Manufacturing Co. (TSMC) (NYSE: TSM). TSMC's multi-billion-dollar fabs in Phoenix are set to produce advanced nodes, initially focusing on 4nm technology, a significant leap in domestic manufacturing capability that contrasts sharply with previous decades of offshore reliance. This move aims to bring leading-edge fabrication closer to U.S. design houses, reducing latency and bolstering supply chain control.

Across the Atlantic, Germany's "Silicon Saxony" in Dresden stands as Europe's largest semiconductor cluster, a testament to long-term strategic investment. This hub boasts a robust ecosystem of over 400 industry entities, including Bosch, GlobalFoundries, and Infineon, alongside universities and research institutes like Fraunhofer. Their focus extends from power semiconductors and automotive chips to advanced materials research, crucial for specialized industrial applications and the burgeoning electric vehicle market. This differs from the traditional fabless model prevalent in some regions, emphasizing integrated design and manufacturing capabilities. Meanwhile, in Asia, while Taiwan (Hsinchu Science Park) and South Korea (with Samsung (KRX: 005930) at the forefront) continue to lead in sub-7nm process technologies, new players like India and Vietnam are rapidly building capabilities in design, assembly, and testing, supported by significant government incentives and a growing pool of engineering talent.

Initial reactions from the AI research community and industry experts highlight the critical importance of these diversified hubs. Dr. Lisa Su, CEO of Advanced Micro Devices (NASDAQ: AMD), has emphasized the need for a resilient and geographically diverse supply chain to support the escalating demands of AI and high-performance computing. Experts note that the proliferation of these hubs facilitates specialized R&D, allowing for deeper focus on areas like wide bandgap semiconductors in North Carolina (CLAWS hub) or advanced packaging solutions in other regions, rather than a monolithic, one-size-fits-all approach. This distributed innovation model is seen as a necessary evolution to keep pace with the increasingly complex and capital-intensive nature of chip development.

Reshaping the Competitive Landscape: Implications for Tech Giants and Startups

The emergence of regional semiconductor hubs is fundamentally reshaping the competitive landscape for AI companies, tech giants, and startups alike. Companies like NVIDIA (NASDAQ: NVDA), a leader in AI accelerators, stand to benefit immensely from more localized and resilient supply chains. With TSMC and Intel expanding advanced manufacturing in the U.S. and Europe, NVIDIA could see reduced lead times, improved security for its proprietary designs, and greater flexibility in bringing its cutting-edge GPUs and AI chips to market. This could mitigate risks associated with geopolitical tensions and improve overall product availability, a critical factor in the rapidly expanding AI hardware market.

The competitive implications for major AI labs and tech companies are significant. A diversified manufacturing base reduces reliance on a single geographic region, a lesson painfully learned during recent global disruptions. For companies like Apple (NASDAQ: AAPL), Qualcomm (NASDAQ: QCOM), and Google (NASDAQ: GOOGL), which design their own custom silicon, the ability to source from multiple, secure, and geographically diverse fabs enhances their strategic autonomy and reduces supply chain vulnerabilities. This could lead to a more stable and predictable environment for product development and deployment, fostering greater innovation in AI-powered devices and services.

Potential disruption to existing products or services is also on the horizon. As regional hubs mature, they could foster specialized foundries catering to niche AI hardware requirements, such as neuromorphic chips or analog AI accelerators, potentially challenging the dominance of general-purpose GPUs. Startups focused on these specialized areas might find it easier to access fabrication services tailored to their needs within these localized ecosystems, accelerating their time to market. Furthermore, the increased domestic production in regions like the U.S. and Europe could lead to a re-evaluation of pricing strategies and potentially foster a more competitive environment for chip procurement, ultimately benefiting consumers and developers of AI applications. Market positioning will increasingly hinge on not just design prowess, but also on strategic partnerships with these geographically diverse manufacturing hubs, ensuring access to the most advanced and secure fabrication capabilities.

A New Era of Geopolitical Chip Strategy: Wider Significance

The rise of regional semiconductor innovation hubs signifies a profound shift in the broader AI landscape and global technology trends, marking a strategic pivot away from hyper-globalization towards a more balanced, regionalized supply chain. This development is intrinsically linked to national security and economic sovereignty, as governments recognize semiconductors as the foundational technology for everything from defense systems and critical infrastructure to advanced AI and quantum computing. The COVID-19 pandemic and escalating geopolitical tensions, particularly between the U.S. and China, exposed the inherent fragility of a highly concentrated chip manufacturing base, predominantly in East Asia. This has spurred nations to invest billions in domestic production, viewing chip independence as a modern-day strategic imperative.

The impacts extend far beyond mere economics. Enhanced supply chain resilience is a primary driver, aiming to prevent future disruptions that could cripple industries reliant on chips. This regionalization also fosters localized innovation ecosystems, allowing for specialized research and development tailored to regional needs and strengths, such as Europe's focus on automotive and industrial AI chips, or the U.S. push for advanced logic and packaging. However, potential concerns include the risk of increased costs due to redundant infrastructure and less efficient global specialization, which could ultimately impact the affordability of AI hardware. There's also the challenge of preventing protectionist policies from stifling global collaboration, which remains essential for the complex and capital-intensive semiconductor industry.

Comparing this to previous AI milestones, this shift mirrors historical industrial revolutions where strategic resources and manufacturing capabilities became focal points of national power. Just as access to steel or oil defined industrial might in past centuries, control over semiconductor technology is now a defining characteristic of technological leadership in the AI era. This decentralization also represents a more mature understanding of technological development, acknowledging that innovation thrives not just in a single "Silicon Valley" but in a network of specialized, interconnected hubs. The wider significance lies in the establishment of a more robust, albeit potentially more complex, global technology infrastructure that can better withstand future shocks and accelerate the development of AI across diverse applications.

The Road Ahead: Future Developments and Challenges

Looking ahead, the trajectory of regional semiconductor innovation hubs points towards continued expansion and specialization. In the near term, we can expect to see further massive investments in infrastructure, particularly in advanced packaging and testing facilities, which are critical for integrating complex AI chips. The U.S. CHIPS Act and similar initiatives in Europe and Asia will continue to incentivize the construction of new fabs and R&D centers. Long-term developments are likely to include the emergence of "digital twins" of fabs for optimizing production, increased automation driven by AI itself, and a stronger focus on sustainable manufacturing practices to reduce the environmental footprint of chip production.

Potential applications and use cases on the horizon are vast. These hubs will be instrumental in accelerating the development of specialized AI hardware, including dedicated AI accelerators for edge computing, quantum computing components, and novel neuromorphic architectures that mimic the human brain. This will enable more powerful and efficient AI systems in autonomous vehicles, advanced robotics, personalized healthcare, and smart cities. We can also anticipate new materials science breakthroughs emerging from these localized R&D efforts, pushing the boundaries of what's possible in chip performance and energy efficiency.

However, significant challenges need to be addressed. A critical hurdle is the global talent shortage in the semiconductor industry. These hubs require highly skilled engineers, researchers, and technicians, and robust educational pipelines are essential to meet this demand. Geopolitical tensions could also pose ongoing challenges, potentially leading to further fragmentation or restrictions on technology transfer. The immense capital expenditure required for advanced fabs means sustained government support and private investment are crucial. Experts predict a future where these hubs operate as interconnected nodes in a global network, collaborating on fundamental research while competing fiercely on advanced manufacturing and specialized applications. The next phase will likely involve a delicate balance between national self-sufficiency and international cooperation to ensure the continued progress of AI.

Forging a Resilient Future: A New Era in Chip Innovation

The emergence and growth of regional semiconductor innovation hubs represent a pivotal moment in AI history, fundamentally reshaping the global technology landscape. The key takeaway is a strategic reorientation towards resilience and distributed innovation, moving away from a single-point-of-failure model to a geographically diversified ecosystem. This shift, driven by a confluence of economic, geopolitical, and technological imperatives, promises to accelerate breakthroughs in AI, enhance supply chain security, and foster new economic opportunities across the globe.

This development's significance in AI history cannot be overstated. It underpins the very foundation of future AI advancements, ensuring a robust and secure supply of the computational power necessary for the next generation of intelligent systems. By fostering specialized expertise and localized R&D, these hubs are not just building chips; they are building the intellectual and industrial infrastructure for AI's evolution. The long-term impact will be a more robust, secure, and innovative global technology ecosystem, albeit one that navigates complex geopolitical dynamics.

In the coming weeks and months, watch for further announcements regarding new fab constructions, particularly in the U.S. and Europe, and the rollout of new government incentives aimed at workforce development. Pay close attention to how established players like Intel, TSMC, and Samsung adapt their global strategies, and how new startups leverage these regional ecosystems to bring novel AI hardware to market. The "New Silicon Frontiers" are here, and they are poised to define the future of artificial intelligence.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.