Medical device company Integra LifeSciences (NASDAQ: IART) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 3.7% year on year to $382.7 million. On the other hand, next quarter’s revenue guidance of $395 million was less impressive, coming in 5.3% below analysts’ estimates. Its non-GAAP profit of $0.41 per share was 4.9% below analysts’ consensus estimates.

Is now the time to buy Integra LifeSciences? Find out by accessing our full research report, it’s free.

Integra LifeSciences (IART) Q1 CY2025 Highlights:

- Revenue: $382.7 million vs analyst estimates of $381.2 million (3.7% year-on-year growth, in line)

- Adjusted EPS: $0.41 vs analyst expectations of $0.43 (4.9% miss)

- Adjusted EBITDA: $63.61 million vs analyst estimates of $65.34 million (16.6% margin, 2.7% miss)

- The company reconfirmed its revenue guidance for the full year of $1.68 billion at the midpoint

- Management lowered its full-year Adjusted EPS guidance to $2.24 at the midpoint, a 8.9% decrease

- Operating Margin: -4%, down from 11% in the same quarter last year

- Free Cash Flow was -$40.18 million, down from $291,000 in the same quarter last year

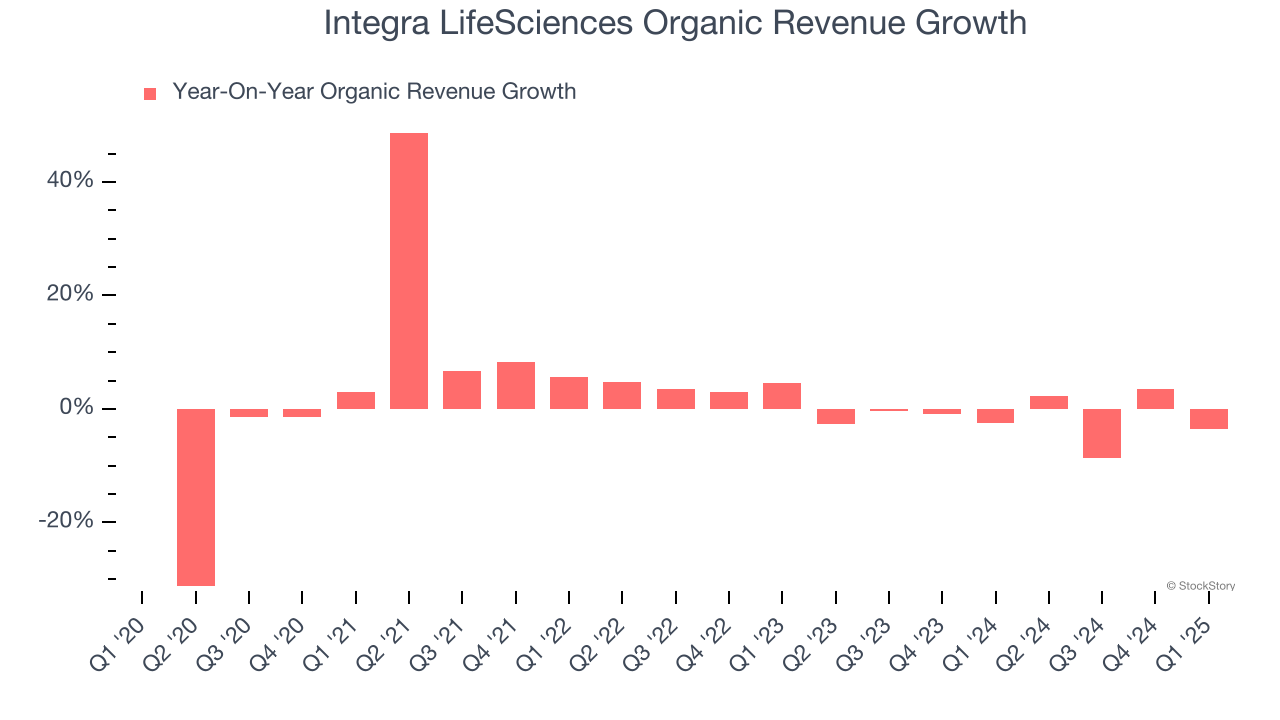

- Organic Revenue fell 3.5% year on year (-2.5% in the same quarter last year)

- Market Capitalization: $1.30 billion

“We remain laser focused on strengthening our quality systems, improving supply reliability, and driving operational excellence. There remains significant work ahead, but we are continuing to put the processes and people in place to execute on our comprehensive Compliance Master Plan and build a foundation for sustainable performance. With the launch of our Transformation and Program Management Office and the addition of key leadership, including in global operations, we are driving improved accountability and execution across the enterprise to deliver meaningful long-term value for patients, customers, and shareholders,” said Mojdeh Poul, president and CE).

Company Overview

Founded in 1989 as a pioneer in regenerative medicine technology, Integra LifeSciences (NASDAQ: IART) develops and manufactures medical technologies for neurosurgery, wound care, and surgical reconstruction, including regenerative tissue products and surgical instruments.

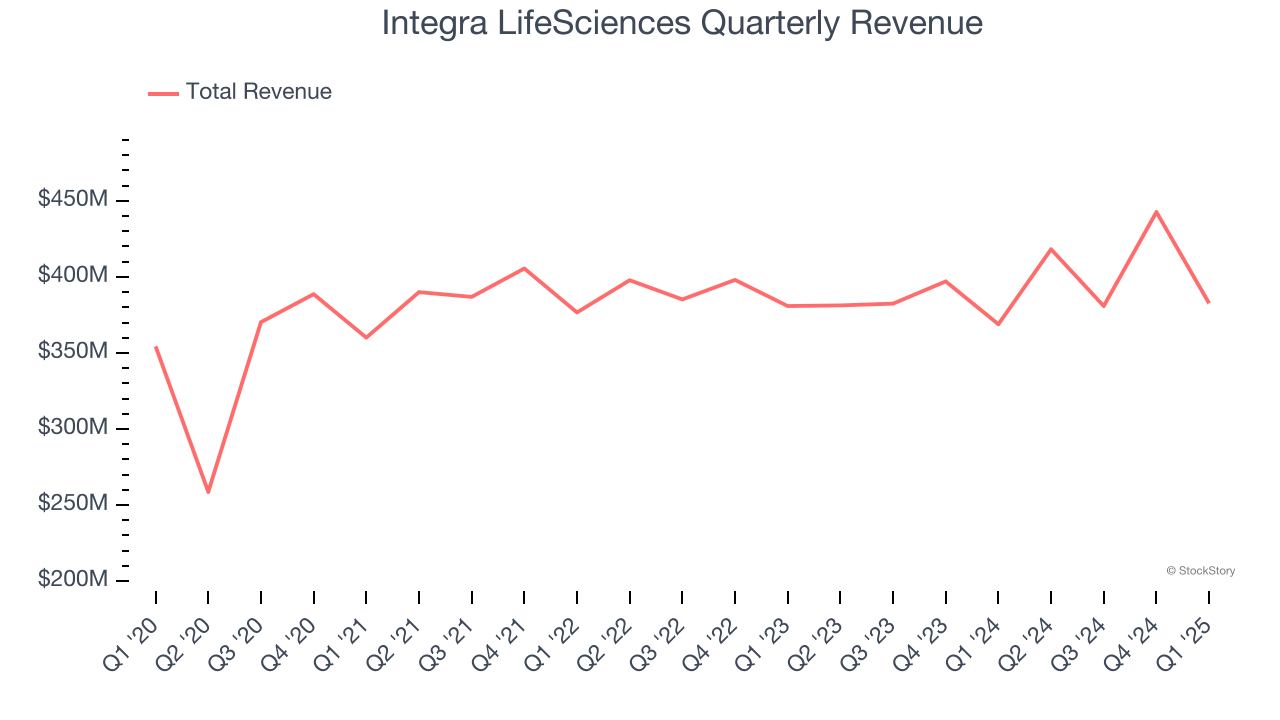

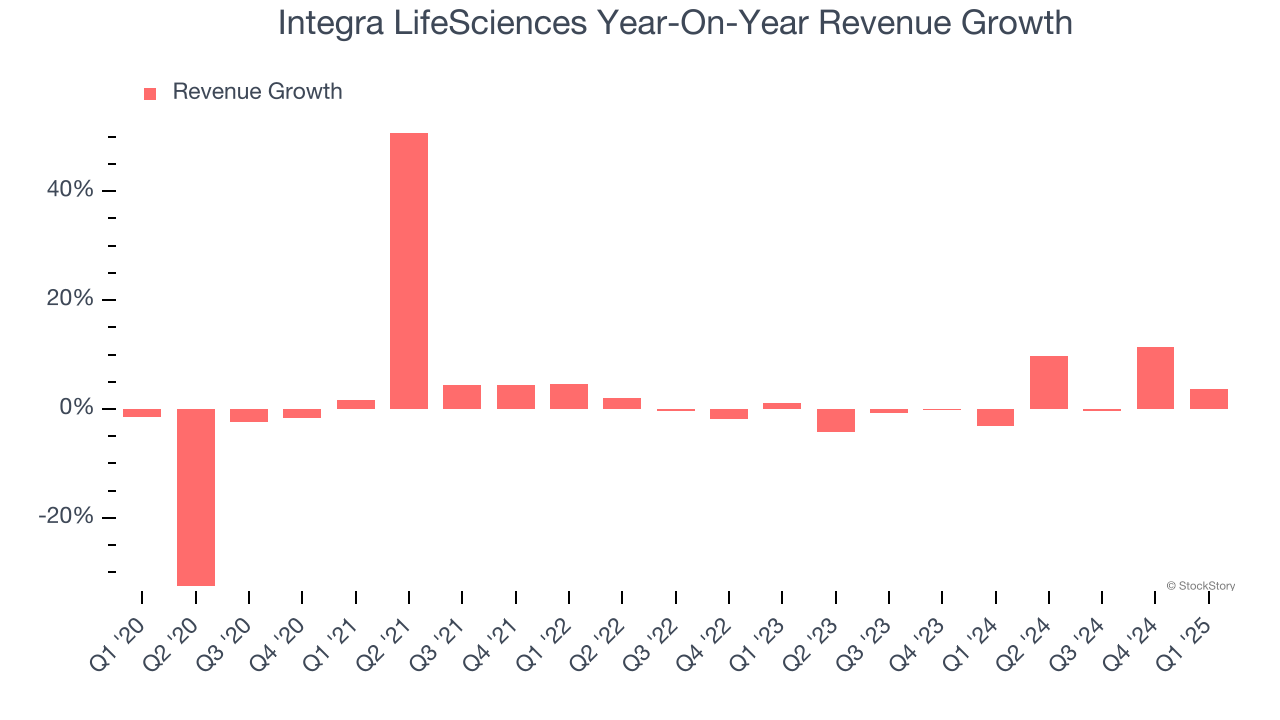

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Integra LifeSciences’s 1.4% annualized revenue growth over the last five years was tepid. This fell short of our benchmarks and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Integra LifeSciences’s annualized revenue growth of 2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

Integra LifeSciences also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Integra LifeSciences’s organic revenue averaged 1.6% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Integra LifeSciences grew its revenue by 3.7% year on year, and its $382.7 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

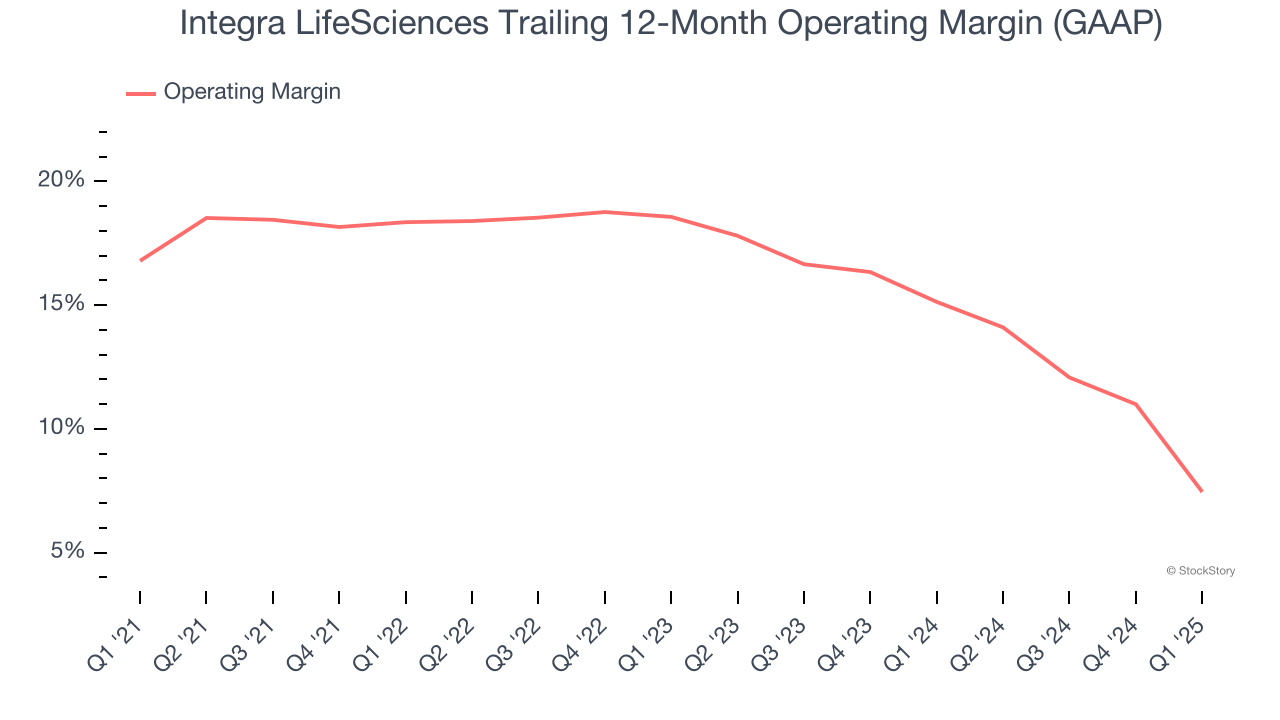

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Integra LifeSciences has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 15.2%.

Looking at the trend in its profitability, Integra LifeSciences’s operating margin decreased by 9.3 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 11.1 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Integra LifeSciences generated an operating profit margin of negative 4%, down 15 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

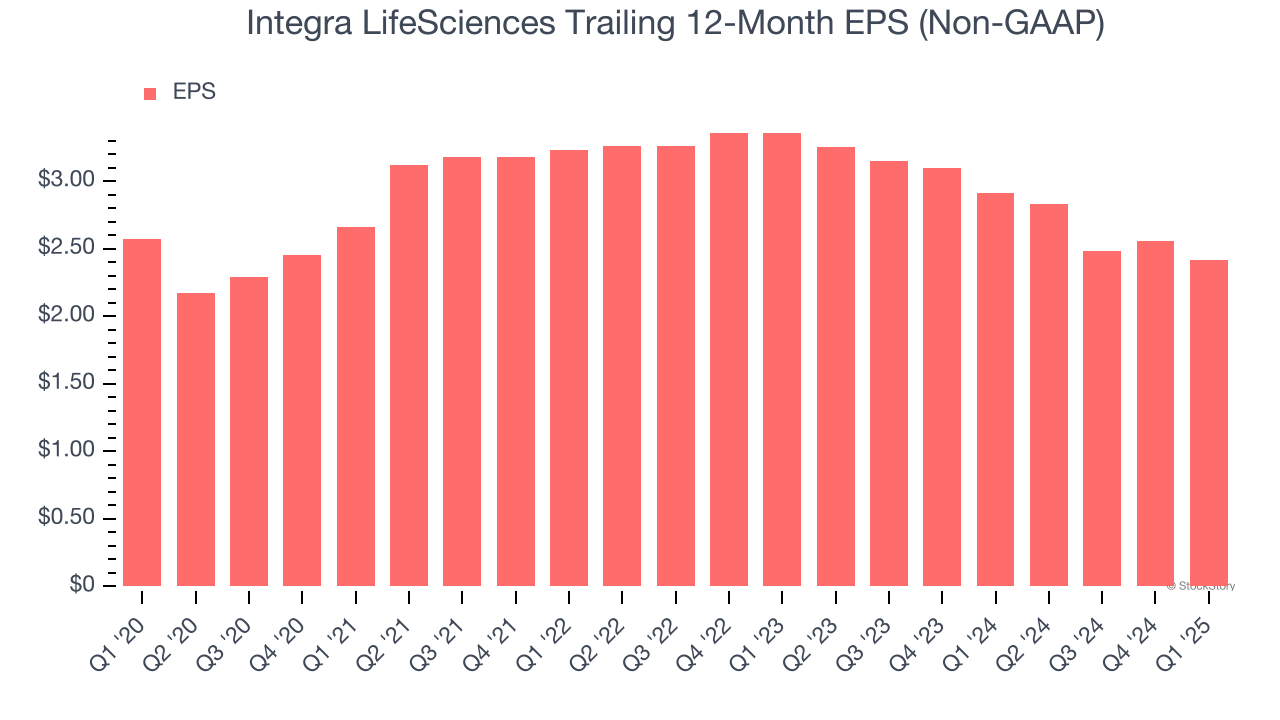

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Integra LifeSciences, its EPS declined by 1.2% annually over the last five years while its revenue grew by 1.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Integra LifeSciences’s earnings to better understand the drivers of its performance. As we mentioned earlier, Integra LifeSciences’s operating margin declined by 9.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Integra LifeSciences reported EPS at $0.41, down from $0.55 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Integra LifeSciences’s full-year EPS of $2.42 to grow 7.2%.

Key Takeaways from Integra LifeSciences’s Q1 Results

It was good to see Integra LifeSciences narrowly top analysts’ organic revenue expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.6% to $16.55 immediately after reporting.

The latest quarter from Integra LifeSciences’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.