Vancouver, British Columbia--(Newsfile Corp. - October 7, 2025) - Lode Gold Resources Inc. (TSXV: LOD) (OTCQB: LODFF) ("Lode Gold" or the "Company") is pleased to announce the results of prospecting and soil geochemical exploration work conducted by its subsidiary, Gold Orogen and its joint venture partner Fancamp Exploration Ltd. (TSXV: FNC) on the McIntyre Brook and Riley Brook properties. The McIntyre Brook and Riley Brook properties form a district scale, 445 km² land package located in a highly prospective region for gold and polymetallic mineral discovery, in northern New Brunswick which is held jointly by Gold Orogen and Fancamp Exploration in the Acadian Gold joint venture. The highly encouraging results across three principal target areas on the properties will guide an upcoming drill program planned for the Fall of 2025.

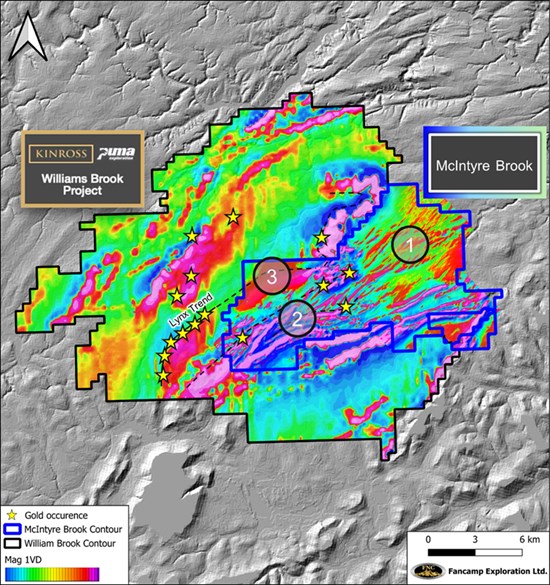

The Acadian Gold joint venture holds one of the largest under-explored claims groups in an emerging gold camp, with two key properties; McIntyre Brook, situated adjacent to Puma Exploration's Williams Brook Project (which holds an option agreement with Kinross Gold), and Riley Brook, a significantly sized property surrounded by claims recently acquired by Kenorland Minerals. Based on recent results, McIntyre Brook demonstrates the hallmarks of a significant gold-copper discovery opportunity.

Prospecting and Soil Geochemical Exploration Highlights

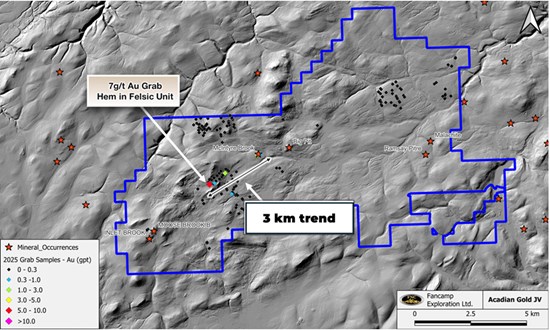

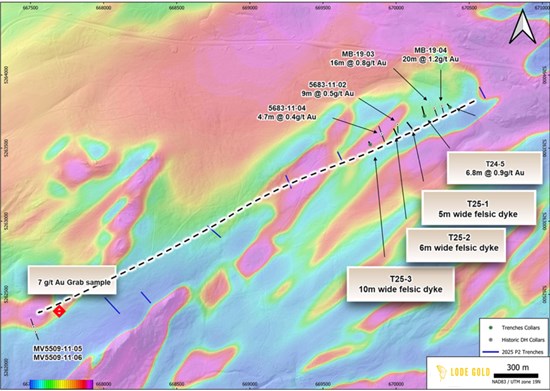

A prospecting and trenching program conducted in May-June of 2025, followed by a soil geochemical survey in July 2025, resulted in the discovery of high-grade rock grab samples extending the known favorable horizon of Area 2 (McIntyre Brook Prospect) to a minimum strike extension of 3 km (Figure 1).

These encouraging recent results, coupled with the results of the 2024 exploration program (Heliborne HeliTEM² survey, prospecting, soil surveys etc.), will direct the planned fall drill program.

Results from the prospecting surveys include high-grade gold assays from grab samples of up to 7.0 grams per tonne gold (g/t Au") (Figure 2).

The assays from selected grab samples from the trenching program show results of up to 6.1 g/t Au and 6.9 g/t Au in trench T25-1 (Figure 2).

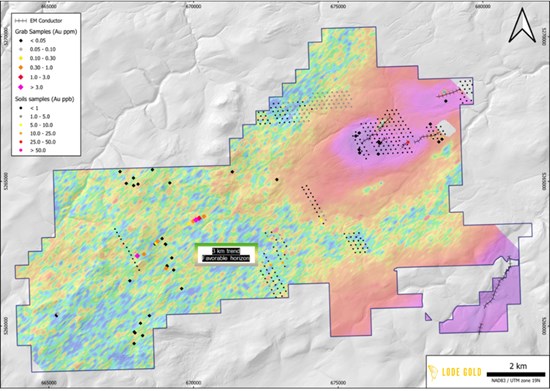

The soil geochemical survey, conducted to fill in over areas not previously covered, continued to prove to be an excellent field vectors to pursue more advanced work in this environment.

The area of Zone 1 is also characterized by a 275 ppb Au stream sediment sample collected downstream from the conductive area. This sample was the highest value returned from the 1981 regional stream sampling program undertaken in the area by the Geological Surveys Branch of New Brunswick.

Figure 1: McIntyre Brook Prospects - (1) EM Zone, (2) McIntyre Brook Prospect and (3) Northwest Area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/269399_070fac7ba4c76ada_004full.jpg

The results of the ongoing exploration program, centered on the 3 principal showings identified at McIntyre Brook (Figure 1), incorporating a comprehensive review of historical data and recent exploration work (refer to press releases dated March 3, 2025, January 20, 2025, and January 20, 2025), confirm the prospectivity for gold mineralization of the (1) Electromagnetic Anomaly ("EM") Zone, (2) McIntyre Brook Prospect and (3) the Northwest Area. The Northwest Area of McIntyre Brook is an area of substantial interest as it lies on strike with Puma Exploration's Williams Brook Lynx showing which reported high-grade drill results including 5.50 g/t Au over 50 metres (refer to hole WB21-02 from Puma Exploration press release dated September 15, 2021). Previous notable findings from the exploration program at McIntyre Brook, including results of trenching and chip channel sampling, confirmed a gold bearing rhyolitic horizon with a strike extension of at least 200-metres with up to 9-metres of thickness, significantly increasing the known surface expression of mineralization identified by historical drilling (refer to press release dated January 20, 2025).

These new results from McIntyre Brook highlighting coincident high-grade rock grab samples, gold-in-soil anomalies and prominent electromagnetic conductors, strongly support the exploration strategy focusing the program on a more refined search space.

"The latest results from McIntyre Brook confirm the exceptional potential of the New Brunswick joint venture will provide quality, high priority targets for systematic drill testing," stated Lode Gold Director, Jon Hill. "The combination of high-grade assays from grab and chip samples, coincident gold-in-soil anomalies, and strong electromagnetic conductors along a 3-kilometre strike length all point to the discovery potential for a robust mineralized system within this rapidly emerging belt."

Figure 2: McIntyre Brook 2025 Soil Geochemical Superimposed on Airborne Magnetometer (1VD) Survey

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/269399_070fac7ba4c76ada_005full.jpg

Figure 3: Acadian Gold McIntyre Brook Prospect featuring 3 km Long Trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/269399_070fac7ba4c76ada_006full.jpg

Figure 4: Area 2 McIntyre Brook Prospect with Best Assay Results and Indicating Extension of Favorable Host Horizon to a Minimum Strike Length of 3 km

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/269399_070fac7ba4c76ada_007full.jpg

Shares for Debt

Further to the Company's news release dated March 7, 2025, the Company has entered a debt settlement with arm's length creditors (the "Creditors") related to a total debt of $229,765 (the "Debt") owing for services provided by the Creditors to the Company and interest. In full satisfaction and settlement of the Debt, the Company will issue 957,355 common shares in the capital of the Company (the "Debt Shares") at a deemed price of $0.24 per share.

The Debt Shares issued in connection with the shares-for-debt transaction, are subject to a hold period expiring four months and one day from the date of issuance. The shares-for-debt transaction remains subject to final approval of the TSX Venture Exchange.

The Creditors are not a related party to the Company as defined by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions. The Company further confirms the issuance of the Debt Shares will not result in the creation of a new Insider or Control Person.

Private Placement

Further to the Company's news release dated September 6, 2025, certain officers and directors of the Company, specifically Wendy T. Chan (CEO & Director), Hashim Ahmed (Director), and David Swetlow (CFO of the Company's subsidiary 1475039 BC Ltd) (collectively, the "Interested Persons") purchase or acquired direction over an aggregate of 1,110,678 Units. The Interested Persons are each considered a "related party" of the Company and the sale of Units under the Offering to the Interested Persons constitutes a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Situations ("MI 61-101"). Following completion of the Offering the Interested Persons hold 1,416,578 common shares in the capital of the Company. The "related party" portion of the Offering was exempt from the minority approval requirement of Section 5.6 and the formal valuation requirement of Section 5.4 of MI 61-101 as neither the fair market value of the "related party" portion of the Offering , nor the fair market of the consideration of the "related party" portion of the Offering exceeded 25% of Lode Gold's market capitalization. A material change report in connection with the Offering was not filed prior to closing.

New Brunswick, Acadian Gold Joint Venture:

The Acadian Gold joint venture, Acadian Gold Corp. ("Acadian Gold"), is an initiative between Lode Gold Inc. and Fancamp Exploration Ltd. for the advancement and exploration of significantly sized, well-located and under-explored mineral assets in New Brunswick. This 50/50 joint venture holds mineral properties located in a highly prospective region for gold and polymetallic mineral discovery, a geologic domain that hosts other gold-focused firms such as Calibre Mining and New Found Gold. Acadian Gold's holdings include the Riley Brook property, a 334.5 km2 land package of mineral claims and 111 km2 of McIntyre Brook mineral claims, which collectively create a dominant land holding on an orogenic belt where other major developers are established and which hosts certain world-class deposits. Acadian Gold is positioned from a strategic perspective as a key player in the region, and holds the potential to be an emerging, district-scale, Au-Cu exploration play with upside potential from a major discovery (refer to press releases dated August 27, 2024 and October 22, 2024).

About Lode Gold Inc.

Lode Gold (TSXV: LOD) is an exploration and development company with projects in highly prospective and safe mining jurisdictions in Canada and the United States.

In Canada, Lode Gold holds exploration properties in the Yukon and New Brunswick. Lode Gold's Yukon assets are located on the southern portion of the prolific Tombstone Belt and cover approximately 99.5 km2 across a 27 km strike. Over 4,500 m have been drilled on the Yukon properties with confirmed gold endowment and economic drill intercepts over 50 metres. Four reduced-intrusive targets (RIRGS) and sedimentary-hosted orogenic gold mineralization have been identified on the Yukon properties.

In New Brunswick, Lode Gold, through its subsidiary 1475039 B.C. Ltd., has created one of the largest land packages in the province with its Acadian Gold joint venture Acadian Gold's holdings span 445 km2 with 44 km of identified strike. It has confirmed gold endowment with mineralized rhyolites.

In the United States, the Company is focused on its advanced exploration and development asset, the Fremont Mine in Mariposa, California. It has a recent 2025 NI 43-101 report and mineral resource estimate ("MRE") that can be accessed here https://lode-gold.com/project/freemont-gold-usa/.

Fremont was mined until a gold mining prohibition was enacted during WWII, when its mining license was suspended. This asset has exploration upside and is open at depth (three step-out holes at 1,300 metres hit structure and were mineralized) and on strike. This is a brownfield project with over 43,000 metres drilled, 23 kilometres of underground workings and 14 adits. The project has excellent infrastructure with close access to electricity, water, state highways, railheads and port.

The Company recently completed an internal scoping study evaluating the potential to resume operations at Fremont based on 100% underground mining. Previously, in March 2023, the Company completed a Preliminary Economic Assessment ("PEA") in accordance with NI 43-101 which evaluated a mix of open pit and underground mining. The PEA and other technical reports prepared on the Company's properties are available on the Company's profile on SEDAR+ (www.sedarplus.ca) and the Company's website (www.lode-gold.com).

Qualified Person

The technical information contained in this press release was reviewed and approved by Gary Wong, P.Eng., Vice President Exploration of Lode Gold Resources Inc., designated as a Qualified Person under National Instrument 43-101.

ON BEHALF OF THE COMPANY

Wendy T. Chan

CEO & Director

Information Contacts:

| Wendy T. Chan CEO info@lode-gold.com +1-(604)-977-GOLD (4653) | Kevin Shum Investor Relations kevin@lode-gold.com +1 (604) -977-GOLD (4653) |

Cautionary Statement Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the use of proceeds, advancement and completion of resource calculation, feasibility studies, and exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company's interpretation of drill results; the geology, grade and continuity of the Company's mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; and currency fluctuations.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269399