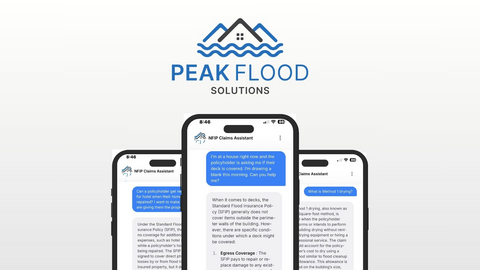

Peak Claims Group, Inc., has officially implemented its Flood Support App across internal teams, including Field Adjusters, QA, and Management. This tool, developed and trained over 24 months, is designed to assist with real-time decision-making during the handling of NFIP flood claims.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250704379126/en/

Powered by proprietary AI driven technology, expert NFIP licensed reviewers, and a nationwide network of boots-on-the-ground professionals, we deliver fully resolved flood claims that are accurate, timely, and settlement-ready—every time.

The Flood Support App uses a custom-trained AI model to help adjusters confidently navigate the strict guidelines imposed by the National Flood Insurance Program (NFIP). The app provides 24/7 scenario-based support, helping reduce documentation errors, improve file accuracy, and shorten cycle times.

Closing the Gaps in NFIP Claims Handling

Flood claims under the NFIP are fraught with challenges:

- Detailed Proof of Loss submissions must be timely, complete, and policy compliant.

- Adjusters must interpret Flood Insurance Policy language precisely.

- Policies often exclude common perils or contain nuanced ICC and building code provisions.

- Private insurers administering these policies must comply with federal FEMA time standards without fear of bad faith litigation, placing the compliance burden heavily on the adjuster.

FEMA has repeatedly flagged quality control failures and documentation inconsistencies in prior catastrophe reviews. Peak’s Flood Support App was developed to reduce these issues before they arise.

A Tool Purpose-Built

Our field adjusters, QA and management now have:

- Instant access to guidance on Proof of Loss and policy interpretations to ensure adherence to the NFIP Claims Manual.

- Step-by-step workflows for Loss Avoidance Measures and ICC provisions.

- Real-time insight into advance payment thresholds and documentation requirements.

- QA checklists integrated with FEMA’s RCQC and Operation Review standards to reduce audit flags.

“Our team spent two years training this model on real NFIP scenarios, with input from experienced federal and private-sector professionals,” said Justin Cook, COO at Peak Claims Group. “It’s a behind-the-scenes tool that sharpens our execution, minimizes human error, and ultimately leads to a better experience for policy holders.”

Built for Accuracy. Designed for Speed.

By giving field adjusters and QA reviewers direct access to expert-level decision support, the app improves file turnaround and reduces the need for rework and supplemental claims. The result: consistent compliance with SFIP regulations and NFIP published guidance, improved trust with carrier partners, and fewer escalations.

Want to Learn More?

While this tool was built for Peak Claims Group’s internal use, we welcome conversations with IA firm peers, insurers and industry partners interested in seeing how it works.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250704379126/en/

Contacts

To request a demonstration, contact: JCook@Peak.Claims