With a market cap of $24.6 billion, STERIS plc (STE) is a global provider of infection prevention products and services, operating through its Healthcare, Applied Sterilization Technologies (AST), and Life Sciences segments. It serves hospitals, healthcare providers, and pharmaceutical manufacturers with a broad portfolio of equipment, consumables, and technical services designed to ensure safety, sterility, and compliance worldwide.

Shares of the Mentor, Ohio-based company have outpaced the broader market over the past 52 weeks. STE stock has returned 13.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.7%. However, shares of the company have declined marginally on a YTD basis, lagging behind SPX's slight rise.

Looking closer, shares of the medical products maker have also outperformed the State Street Health Care Select Sector SPDR ETF's (XLV) 7.4% increase over the past 52 weeks.

Despite reporting better-than-expected Q3 2026 revenue of $1.5 billion on Feb. 4, shares of STE tumbled 7.7% the next day. Gross margin fell 70 basis points year-over-year to 43.9% and EBIT margin declined 40 basis points to 22.9%, while management flagged a $55 million tariff headwind in fiscal 2026 and said the higher end of its $10.15 - $10.30 EPS guidance is unlikely. The selloff was compounded by management’s warning of a second-half slowdown, tough Q4 comparisons in AST capital equipment.

For the fiscal year ending in March 2026, analysts expect STERIS’ adjusted EPS to grow 10.7% year-over-year to $10.21. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

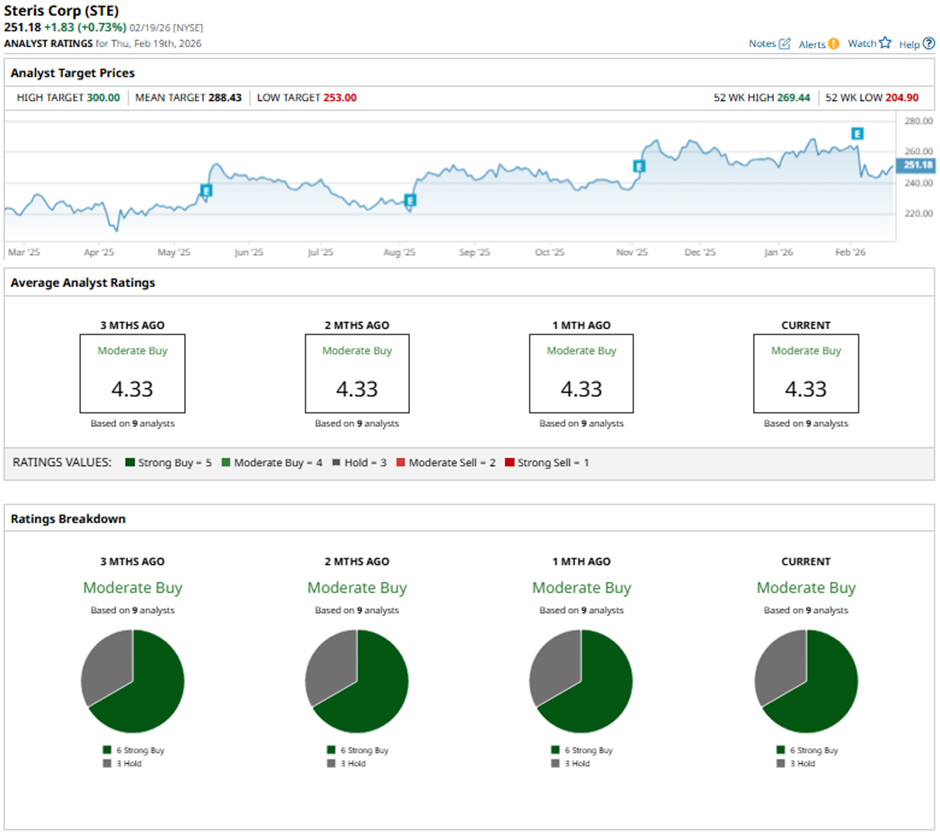

Among the nine analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings and three “Holds.”

On Jan. 31, Piper Sandler analyst Jason Bednar reiterated a “Buy” rating on STERIS and set a price target of $300.

The mean price target of $288.43 represents a premium of 14.8% to STE's current price. The Street-high price target of $300 suggests a 19.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart