With a market cap of $40.7 billion, Martin Marietta Materials, Inc. (MLM) is a leading natural resource–based building materials company supplying aggregates, cement, ready-mixed concrete, asphalt, and paving services to infrastructure, nonresidential, and residential construction markets in the U.S. and internationally. It also produces magnesia-based chemical products and dolomitic lime used in steelmaking, environmental applications, and soil stabilization.

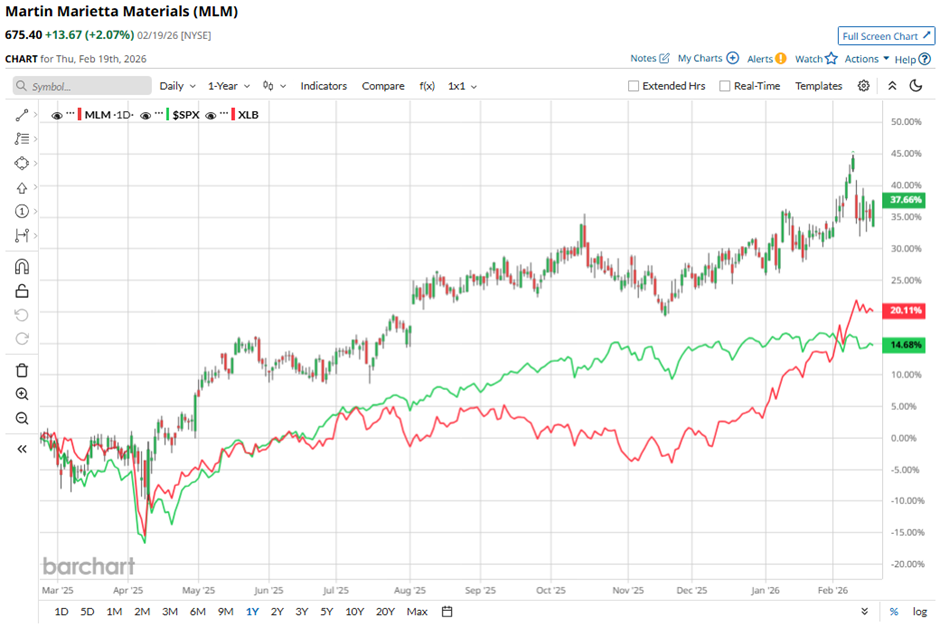

Shares of the Raleigh, North Carolina-based company have outperformed the broader market over the past 52 weeks. MLM stock has increased 29.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.7%. Moreover, shares of the company have risen 8.5% on a YTD basis, outpacing SPX's marginal return.

Looking closer, shares of the seller of granite, limestone, sand and gravel have exceeded the State Street Materials Select Sector SPDR ETF's (XLB) 17.5% surge over the past 52 weeks.

Shares of Martin Marietta Materials tumbled 6.6% after the company reported Q4 2025 results on Feb. 11 as full-year earnings from continuing operations dropped 45% to $990 million and operating earnings fell 42% to $1.44 billion, largely due to the reclassification of the Midlothian cement business into discontinued operations. While 2025 revenue rose 9% to a record $6.15 billion and adjusted EBITDA increased 17% to $2.07 billion, total EPS declined significantly to $18.77 from $32.41. Additionally, the company’s 2026 guidance implied only low single-digit aggregate volume growth.

For the fiscal year ending in December 2026, analysts expect Martin Marietta's EPS to grow 26.1% year-over-year to $20.60. The company's earnings surprise history is mixed. It has exceeded the consensus estimates in one of the last four quarters while missing on three other occasions.

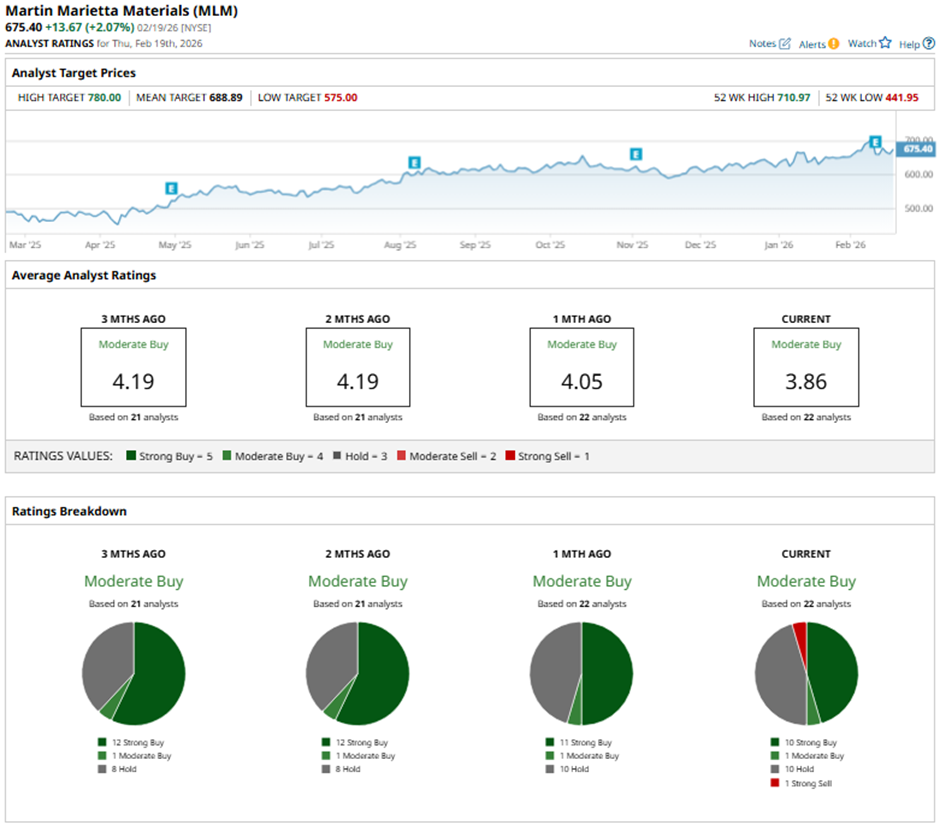

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.”

On Feb. 17, Morgan Stanley analyst Angel Castillo raised the price target on Martin Marietta Materials to $706 while maintaining an “Overweight” rating.

The mean price target of $688.89 represents a nearly 2% premium to MLM’s current price levels. The Street-high price target of $780 suggests a 15.5% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Says MP Materials Stock Can Gain More Than 30% From Here. Should You Buy MP Stock?

- Anthropic’s CEO Warns Humans Face a ‘Critical Test as a Species’ as AI Ramps Up. What’s Behind the Stark Message?

- Down 24% in 2026, Where Is Palantir Stock Headed Next and Should You Buy PLTR Here?

- As Meta and Nvidia Announce a Huge, Multi-Year Partnership, Which Is the Better Stock to Buy?