Tiger Global Management, the New York-based billionaire investor Chase Coleman-led hedge fund and venture powerhouse, is making headlines again with an aggressive pivot into the newly public Wealthfront Corporation (WLTH), signaling strong conviction in the long-term growth of digital wealth management.

In its latest 13F filing, Tiger Global notably boosted its WLTH holdings, even as it trimmed positions in several legacy tech giants such as NVIDIA Corporation (NVDA), Amazon.com (AMZN) and Microsoft Corporation (MSFT), underscoring a strategic reallocation toward high-growth fintech opportunities. The hedge fund loaded up 15.16 million shares of Wealthfront in the fourth quarter of 2025.

Wealthfront, the automated investment and financial platform that priced its IPO at $14 per share in December 2025 and raised roughly $486 million, has quickly emerged as a bellwether for the robo-advisor segment. This resulted in an initial valuation of around $2 billion. Even prior to going public, Tiger Global was already among Wealthfront’s largest pre-IPO shareholders, owning roughly 20% of the company following prior funding rounds.

Tiger Global’s growing WLTH position highlights a broader thematic bet on the transformation of wealth management through automation and expanding product suites. Let’s dig deeper.

About Wealthfront Corporation Stock

Wealthfront Corporation is a financial technology company specializing in automated digital wealth management and investment services. Headquartered in California, the firm pioneered the robo-advisor model that leverages software to deliver low-cost, algorithm-driven investment portfolios, cash management products, and financial planning tools tailored to tech-savvy investors.

Wealthfront completed its initial public offering on the Nasdaq Global Select Market in December 2025 and currently stands at a market cap of $1.4 billion.

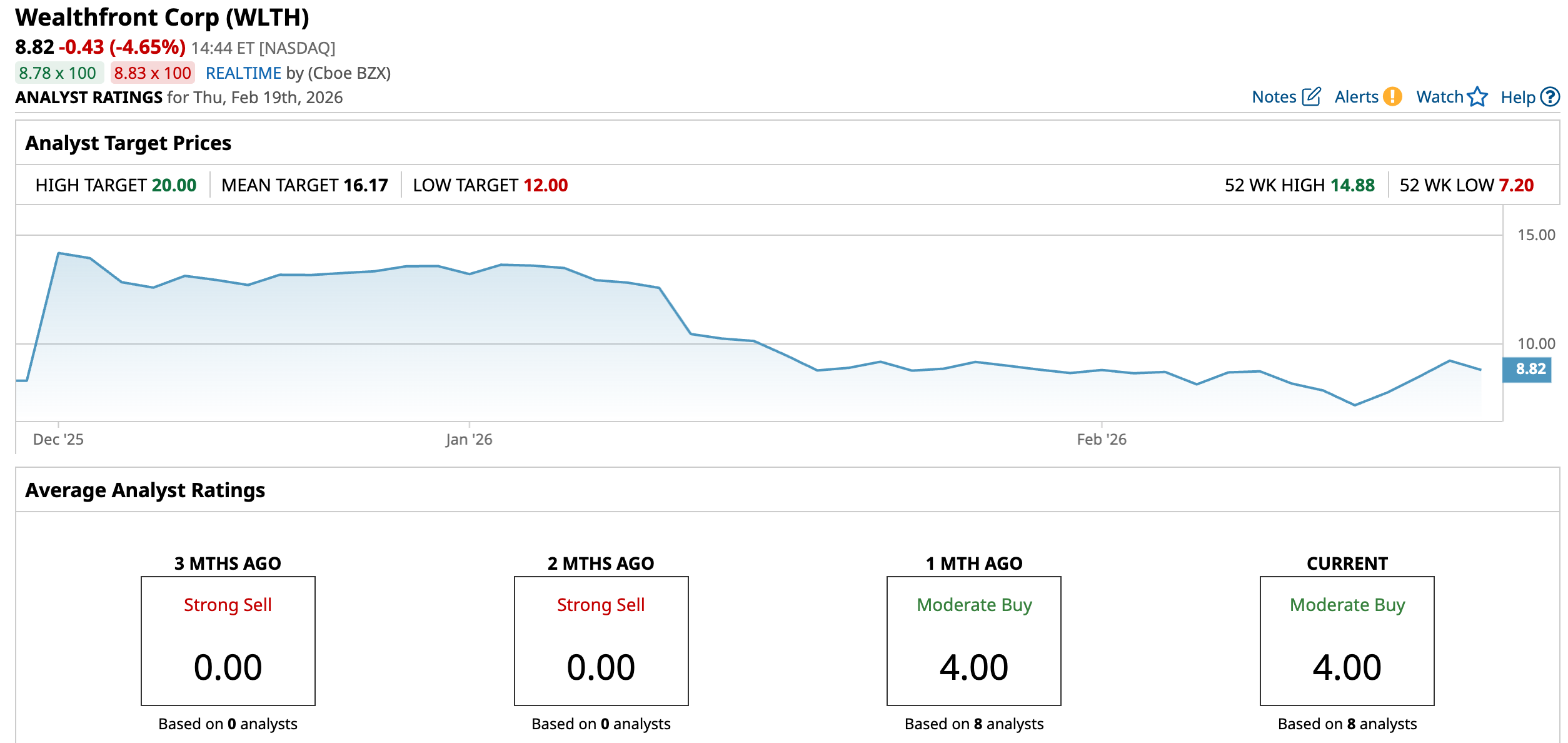

But since its IPO, the stock performance has been notably uneven, reflecting both broader market volatility and company-specific headwinds.

In the weeks following the listing, WLTH exhibited a downward trend, trading below the IPO price amid soft earnings results and strategic disclosures that tempered investor enthusiasm. Early January 2026 quarterly results showed significant net deposit outflows compared to the prior year and sparked a roughly 16.8% one-day drop in share price on Jan. 13 as markets digested the news.

Wealthfront’s stock is currently trading significantly below its debut level, with as much as 34.5% decline year-to-date (YTD) and closing yesterday's session at $8.90, underscoring investor caution.

However, institutional interest from marquee investors such as Tiger Global Management has lent renewed support to WLTH’s share performance in the last few sessions. The stock surged 9.3% on Feb. 17 and 9% on Feb. 18.

WLTH currently trades at a premium of 3.85 times forward sales compared to the sector median of 2.90 times.

Mixed Q3 Financial Results

Wealthfront Corporation reported its third quarter fiscal 2026 financial results on Jan. 12, covering the period ended Oct. 31, 2025, marking its first earnings release as a publicly traded company.

According to the company’s disclosures, WLTH delivered record quarterly revenue of $93.2 million, representing about 16% year-over-year (YOY) growth, while net income increased modestly to $30.9 million, up roughly 3% compared to the prior year, and total platform assets climbed about 21% to a record $92.8 billion. However, the net income margin contracted to 33% from 37% a year earlier as higher expenses and operational investments weighed on profitability. The company reported EPS of $0.21, compared with $0.22 in the same quarter a year earlier.

Also, monthly net deposit activity was a notable weakness, reversing from $874 million of inflows a year earlier to a net outflow of $208 million for December 2025.

On the other hand, adjusted EBITDA grew 24% YOY to $43.8 million with an expanded adjusted EBITDA margin of 47%, up from 44% in Q3 2025.

Analysts forecast a loss per share for the full year of fiscal 2026 of $0.41, a significant 100% decline YOY, but again rise by 212% to an EPS of $0.46 in 2027.

What Do Analysts Expect for Wealthfront Stock?

Last month, Keefe, Bruyette & Woods reiterated its “Outperform” rating and $16.50 price target on Wealthfront Corporation following the company’s fiscal Q3 2026 results, despite trimming its fiscal 2027–2028 AEBITDA and EPS estimates by 2–3% due to softer-than-expected net deposits.

On the other hand, KeyBanc Capital Markets maintained its “Sector Weight” rating on Wealthfront Corporation with a $13 fair value, following Wealthfront’s first quarterly report as a public company.

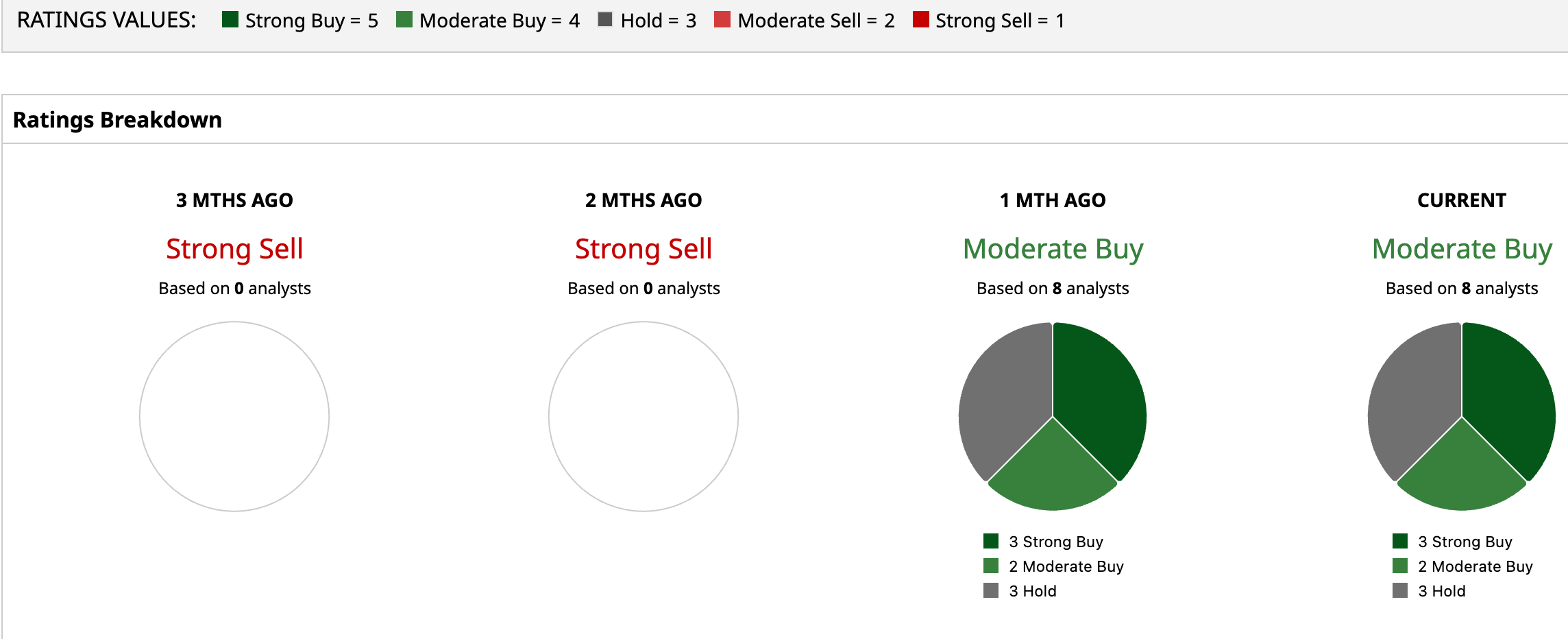

Overall, WLTH has a consensus “Moderate Buy” rating. Of the eight analysts covering the stock, three advise a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining three analysts are on the sidelines, giving it a “Hold” rating.

WLTH has an average analyst price target of $16.17, indicating an upside of 83%, while the Street-high target price of $20 suggests that the stock could rally as much as 126.8%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Apple Tests AI Devices, Should You Buy AAPL Stock Here?

- Klarna Stock Is Deeply Oversold After Ugly Earnings Plunge. Should You Buy the Dip in KLAR Here?

- As Microsoft Extends 20% OpenAI Deal, Is the Bull Case for MSFT Stronger Here?

- 2 Tech Bets Cathie Wood is Quietly Trimming Right Now: Should You Too?