Billionaire investor Dan Loeb's prominent hedge fund, Third Point, recently disclosed that in the fourth quarter it had acquired 475,000 shares of a huge electricity producer, Constellation Energy (CEG), for $167.8 million. Given data centers' huge appetite for electricity and Constellation's ability to cater to their needs, CEG looks like a good buy for certain types of investors in particular at this point.

Additionally, CEG looks well-positioned to benefit from Washington's multifaceted views on energy, and the stock's valuation is attractive.

About Constellation Energy

Based in Baltimore, Constellation Energy claims to be “the leading operator of nuclear power plants in the U.S.” Moreover, following the recent closing of its acquisition of Calpine, CEG is now also “the largest owner and operator of both natural gas fired and geothermal power plants” in the country, according to the electricity generator. Cumulatively, the company, which also utilizes hydro, wind, and solar, generates 55 gigawatts of electricity and has “more 24/7, emissions-free electricity than any other company in the nation,” Constellation stated.

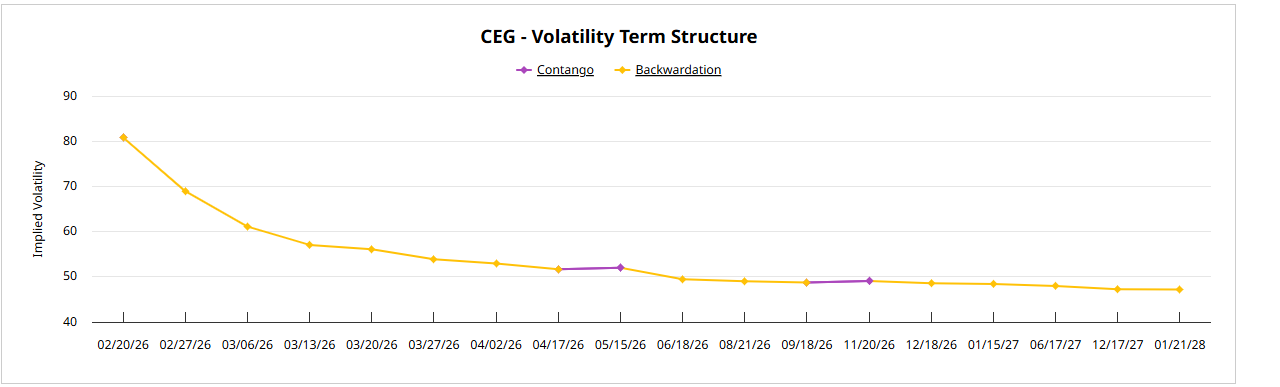

Changing hands at a forward price-earnings ratio of 26.7 times, CEG has a market capitalization of $106.5 billion. Also noteworthy is that its volatility is fairly low.

In the third quarter, the company's sales jumped 7.7% versus the same period a year earlier to $6.57 billion, while its net income soared 10.85% year-over-year (YoY) to $930 million.

A Likely Big Beneficiary of Data Centers' Electricity Thirst

Data centers have a huge appetite for electricity, as they will account for 40% of the increases in electricity demand between now and the end of this decade, Goldman Sachs recently forecast. And importantly, data centers' electricity demand is already significantly pushing up the prices for the commodity, as it became 6.9% more expensive last year and will jump another “6% (for consumers) through 2027,” according to the investment bank. Of course, higher electricity prices have lifted and will continue to boost Constellation's financial results.

Meanwhile, given the firm's high leverage to low-carbon-emitting power in general and nuclear energy in particular, it's very well-positioned to supply a great deal of power to the hyperscalers' data centers.

That's because the hyperscalers generally appear to prefer to power their data centers with electricity derived from those sources. Providing evidence for the latter hypothesis, Microsoft (MSFT) acquired enough electricity generated by renewables to offset all of its demand in 2025, while Meta (META) and Microsoft have launched major nuclear-power initiatives. What's more, Fortune recently reported that “Analysts see Meta as the start of more Big Tech nuclear construction deals.” Further, Amazon (AMZN) reports that it's “investing billions of dollars in nuclear … battery storage and renewable energy projects” globally, while hyperscalers are looking to secure uranium supplies.

And unsurprisingly, Microsoft and Meta have both signed deals to buy significant amounts of power from Constellation.

Well-Positioned to Benefit From Whichever Ways Washington Goes With Energy

The Trump administration has been quite aggressive in seeking to expedite and facilitate the launch of new nuclear facilities, and Constellation, given its expertise in this area, should be able to benefit from its efforts. On the other hand, some prognosticators believe that the Democrats will retake at least the House and perhaps the Senate in November. If that does occur, the party, which tends to back renewable energy most strongly, could pass legislation that will boost wind, solar, and hydro. But since Constellation also has significant exposure to those types of energy, it will be able to benefit meaningfully from any efforts by Democrats to support them.

Valuation and the Bottom Line on CEG Stock

Analysts on average expect the company's earnings per share to climb 7.7% in 2025 and 21.5% in 2026. Moreover, as of last September, CEG expected its EPS, excluding certain items, to expand at a compound annual growth rate (CAGR) of over 10% through 2028.

Given the company's growth and powerful potential, its forward P/E ratio of 26.7 times is quite attractive. In light of the company's large size and relatively low valuation, it's especially attractive for conservative and value investors.

On the date of publication, Larry Ramer had a position in: AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What are the Prospects for Gasoline Prices Going into the 2026 Driving Season?

- 1 Nuclear Energy Stock That Billionaire Dan Loeb Loves Now

- Forget the Endless AI Stock Debate: This Outperforming Sector is the One to Watch Now

- This ETF Is the Defensive Toll Road of the Energy Market. Here's Why I Like It.