Headquartered in Dallas, Texas, Atmos Energy Corporation (ATO) is a regulated, natural gas-only utility serving more than 3.3 million customers across 1,400 communities in eight Southern states. With a market capitalization of about $27.4 billion, it runs distribution networks alongside proprietary pipeline and storage assets, anchoring its regional energy footprint.

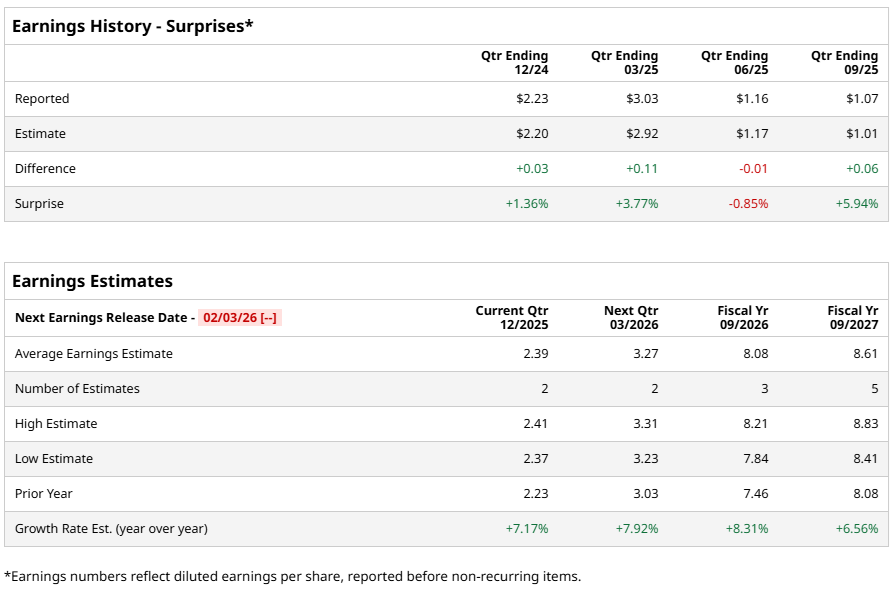

The stability now frames investor attention as Atmos Energy is approaching its fiscal 2026 Q1 earnings scheduled for release on Tuesday, Feb. 3, after market closes. Wall Street expects diluted EPS of $2.39, marking a 7.2% rise from $2.23 in last year’s quarter. Importantly, the company exceeded EPS estimates in three of the past four quarters, while missing in just one.

The near-term outlook feeds directly into longer-range expectations. Analysts model fiscal 2026 diluted EPS of $8.08, reflecting 8.3% year-over-year growth, followed by a further 6.6% increase to $8.61 in fiscal year 2027.

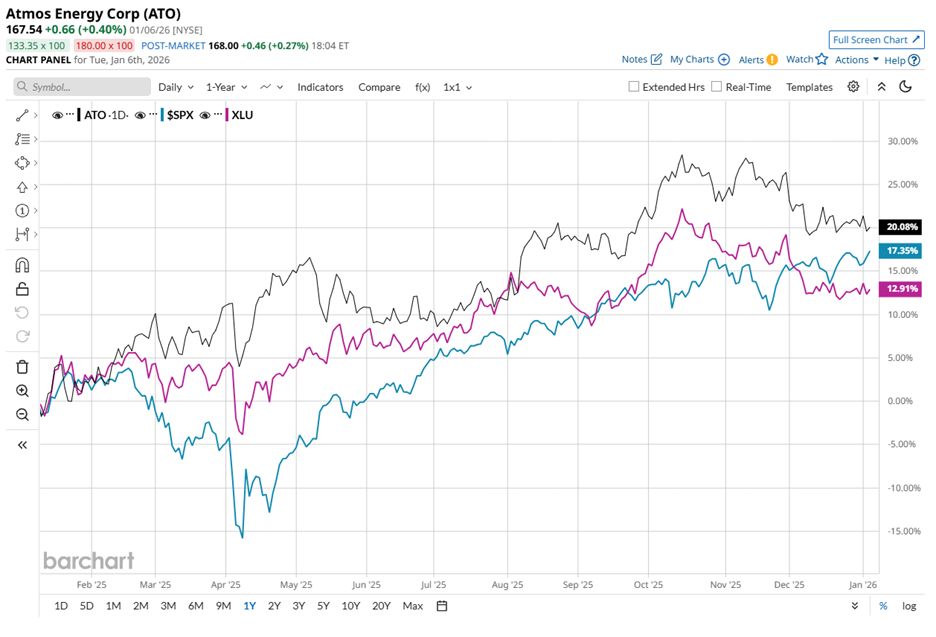

Coming to share-price performance, in the past 52 weeks, ATO stock gained 22.7%, although it remains marginally down on a year-to-date (YTD) basis. By contrast, the S&P 500 Index ($SPX) climbed 16.2% over the 52-week period, while delivering 1.5% gains so far this year.

Relative performance within the sector strengthens the narrative. The State Street Utilities Select Sector SPDR ETF (XLU) jumped 12.6% over the last year and posted modest YTD gains, suggesting Atmos Energy’s stronger annual return stems from company-specific execution rather than sector-wide momentum alone.

Operational delivery reinforced confidence following the latest results. On Nov. 6, 2025, a day after releasing fourth-quarter fiscal 2025 earnings, Atmos Energy’s shares rose 1.7% as EPS reached $1.07, beating analyst estimates of $0.95 and rising 24.4% year over year. Meanwhile, net income increased 30.6% from the prior year's quarter to $175 million.

Together, these quarterly numbers capped a milestone year for the company. For fiscal 2025, Atmos Energy reported diluted EPS of $7.46, up from $6.83 in fiscal 2024, marking its 23rd consecutive year of earnings growth.

Despite this consistency, macro factors have started shaping sentiment. While some firms lifted price targets, Morgan Stanley (MS) downgraded ATO stock to “Equal Weight” from “Overweight” and cut its target to $172 from $182, citing data-center demand, but also cautioning investors about elevated political and regulatory risks during an election year.

Accordingly, Wall Street has assigned ATO stock an overall “Hold” rating, compared with a “Moderate Buy” stance three months earlier, reflecting a more balanced risk-reward view. Of the 14 analysts covering the stock, two maintain “Strong Buy” recommendations while 12 suggest “Hold.”

The mean price target of $176.36 represents potential upside of 5.3%. Meanwhile, the Street-High target of $193 represents a 15.2% gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 'Project Catalyst' Is Coming for This High-Yield Dividend Star. Should You Buy Shares in 2026 to Profit?

- Precious Metals Remain Strong: Why That’s a Red Flag for Stocks Amid Venezuela Tumult

- Will Roku Dominate Streaming Stocks in 2026?

- What's Driving the Parabolic Rise in Silver Futures, and How Long Can the Rally Last?