Many investors and analysts – present company very much included – have been closely following the historic rally in gold futures and silver futures, but perhaps it’s no coincidence that we’re seeing another metals story developing under the surface just as the tech world’s marquee CES conference is taking place. Precious metals are dominating the headlines for now, particularly amid geopolitical turmoil and a weaker dollar, but it’s become impossible to ignore that industrial metals are also having a robust run. Since robots and rockets aren’t made from hopes and wishes, we may well be in the early innings of a secular commodity bull run.

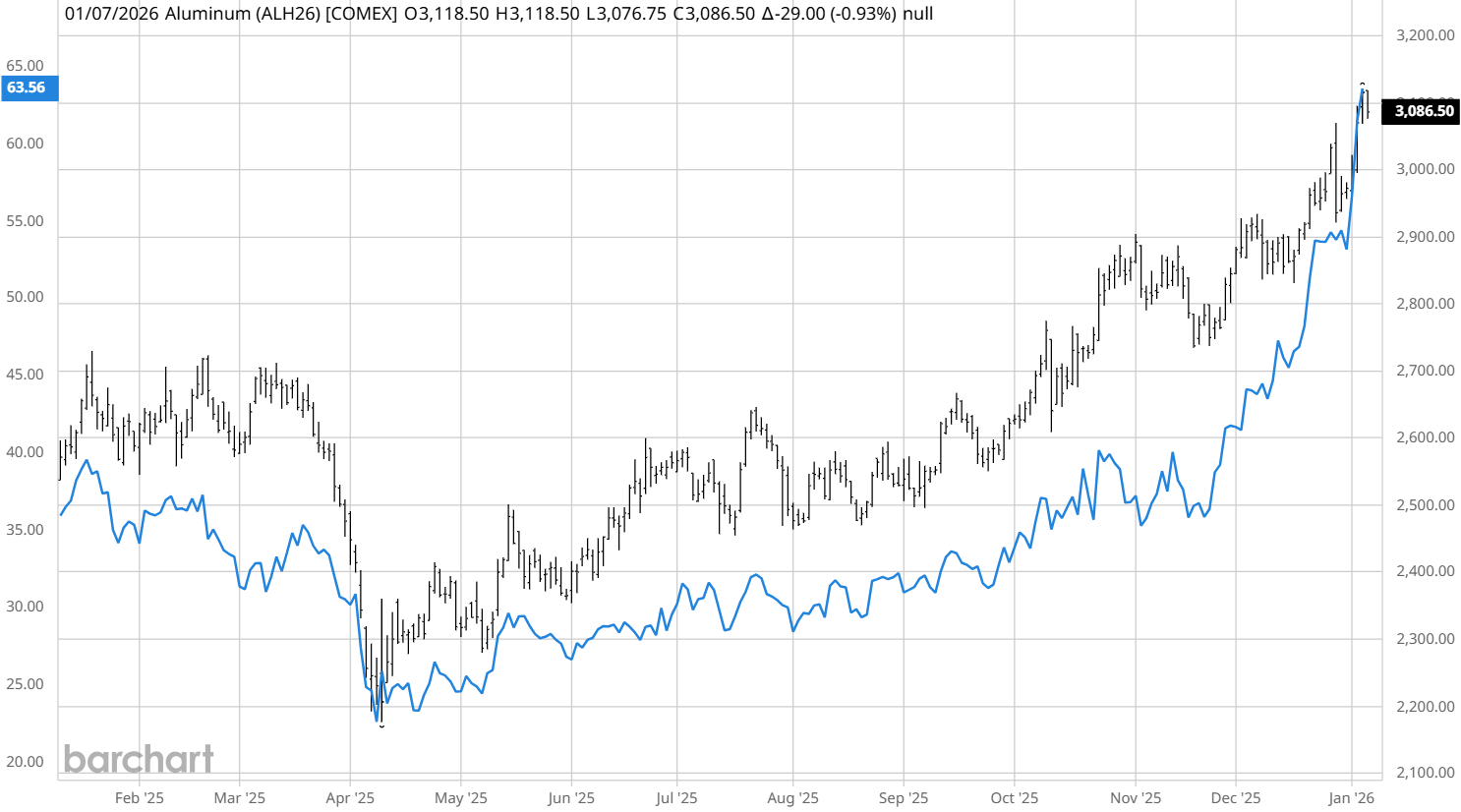

Strength in the materials sector is highlighted by this chart of aluminum alongside major producer Alcoa (AA):

And likewise, steel and steel producers, like Nucor (NUE), are breaking higher.

Copper futures have attracted attention with their own breakout to new highs, putting the spotlight on miners like Freeport McMoRan (FCX).

The caveat, as always, is that the cure for high prices is higher prices. Either consumers will absorb these price increases, or demand will fall as inflation rises.

Investors seeking exposure to base and industrial metals can consider related mining stocks, exchange-traded funds (ETFs), or futures, with the caution that speculating on commodities can carry unexpected risk and volatility, driven by geopolitical events and a host of other variables.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P 500, MidCap 400, and SmallCap 600 Welcome New Members as Indexes Rebalance for 2026

- 'Robots & Rockets Aren’t Made from Hopes & Wishes,' and How the AI Revolution is Shaping the Next Metals Bull Market

- What's Driving the Parabolic Rise in Silver Futures, and How Long Can the Rally Last?

- Betting on Popular 2025 ETFs Could Produce Wicked Results in 2026. Don’t Get Caught Chasing the Hype.