While most investors are chasing artificial intelligence (AI) chipmakers, the real backbone of the AI revolution may be chip designer Arm Holdings (ARM). Its chip designs power everything from smartphones to hyperscale data centers, positioning it as a key player of the next decade of AI. After delivering its strongest quarter ever, Arm is set to report its third quarter fiscal 2026 earnings on Feb. 4 after the market closes.

Is this a good opportunity to grab this AI chip stock now?

Valued at $114.5 billion, Arm designs the core processor architectures that power most of the world’s devices. While it doesn’t manufacture chips, it licenses its designs to companies like Apple (AAPL), Nvidia (NVDA), Alphabet's (GOOG) (GOOGL) Google, Microsoft (MSFT), and Qualcomm (QCOM), which then build their own custom chips. Arm generates revenue by charging companies to use its designs and by collecting a royalty on each chip produced with its technology.

Arm Holdings recorded its strongest quarter ever in the second quarter of fiscal 2026, driven by rising demand for AI computing across both edge devices and hyperscale data centers. Royalty revenue hit a record $620 million, up 21% year-over-year, while license revenue increased 56% to $515 million. Annualized contract value grew 28% year-over-year. Adjusted earnings came in at $0.39 per share, above guidance.

Demand for Arm’s compute subsystem technology is accelerating. During the quarter, the company secured three additional CSS agreements, taking the total to 19 licenses spread across 11 different customers. Arm also introduced Lumex CSS, its most sophisticated mobile computing platform so far, designed to support advanced on-device AI features, including real-time language translation, image processing, and intelligent digital assistants. Leading smartphone makers such as OPPO and Vivo are expected to roll out flagship devices powered by this platform later this year.

Strategic Partnerships Strengthen Arm’s Ecosystem

The data center segment continues to be one of Arm’s biggest engines of growth. Its Neoverse platform has passed the milestone of more than one billion processors deployed globally. Leading technology companies — such as Nvidia with its Grace chips, Amazon (AMZN) via AWS Graviton, Google through Axion, and Microsoft with Cobalt — are all developing custom processors built on Arm’s architecture. This broader adoption supports rising royalty streams and further cements Arm’s role in the future of cloud computing.

Arm-powered chips are also expanding their footprint across other industries. Google recently introduced the Pixel 10 smartphone using the Arm-based Tensor G5 chip, delivering up to 2.6x faster performance on Gemini models while doubling energy efficiency compared to earlier generations. Nvidia has started shipping its Arm-based DGX Spark system for AI workloads, and Tesla’s (TSLA) upcoming AI5 processor, also built with Arm, offers up to 40x improvements in AI processing speed. During the quarter, Arm also revealed a major strategic collaboration with Meta aimed at improving AI efficiency across both consumer devices and large-scale data centers through a unified computing platform.

For the third quarter, Arm expects revenue of $1.22 billion, plus or minus $50 million, with adjusted earnings per share (EPS) of $0.41, plus or minus $0.04. Management highlighted that stronger revenue allows the company to step up investment in research and development while continuing to grow profits. Ongoing demand across cloud infrastructure, edge computing, and connected devices reinforces Arm’s long-term vision of making AI accessible everywhere.

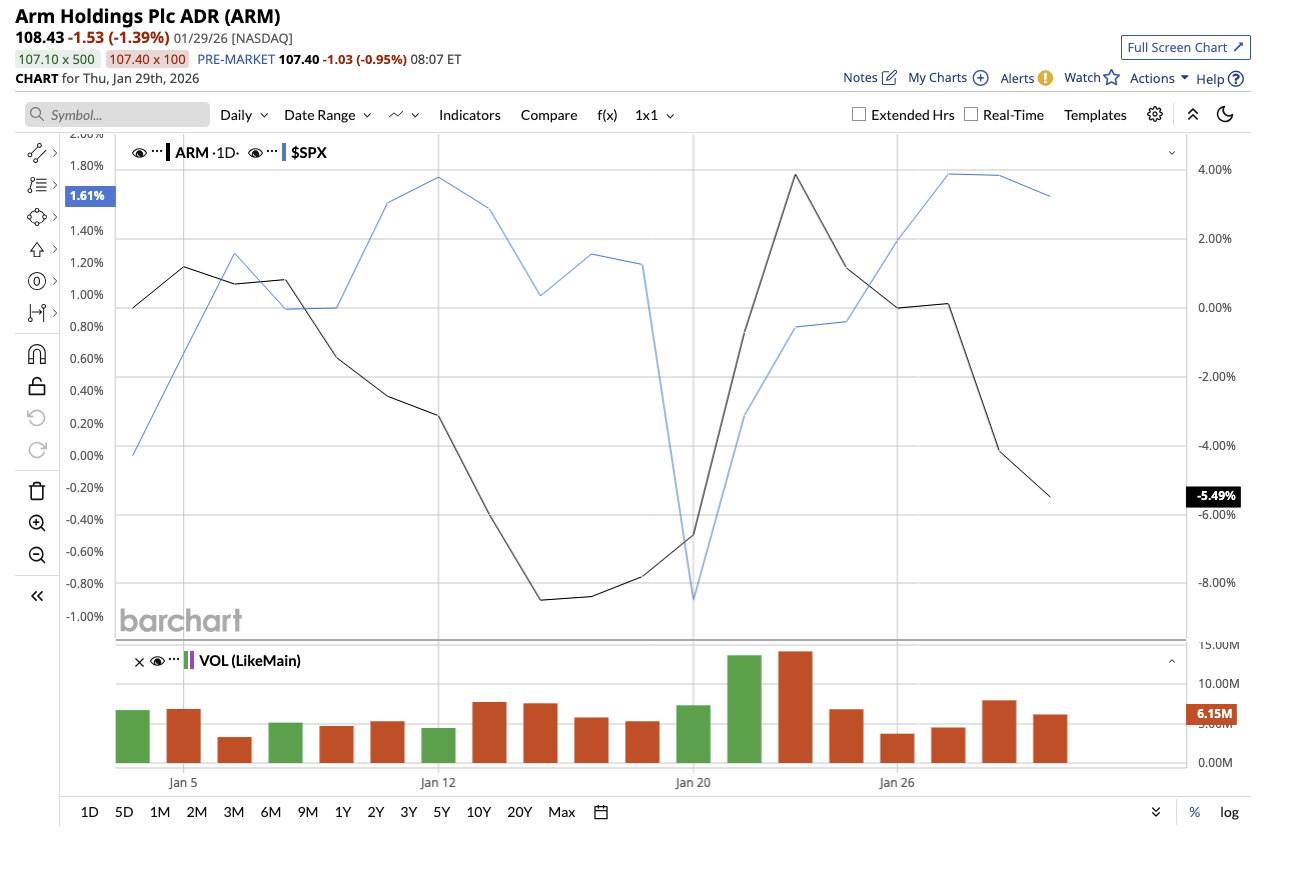

For fiscal 2026, analysts expect Arm’s revenue to increase by 20.9%, alongside by a 5.6% increase in earnings. Currently, ARM stock is valued at a premium of 47x forward earnings, which is expected to increase by 32.3% in fiscal 2027. Arm’s premium valuation reflects investors’ optimism for its long-term prospects. However, investors with a low risk-appetite can wait for a more reasonable entry point.

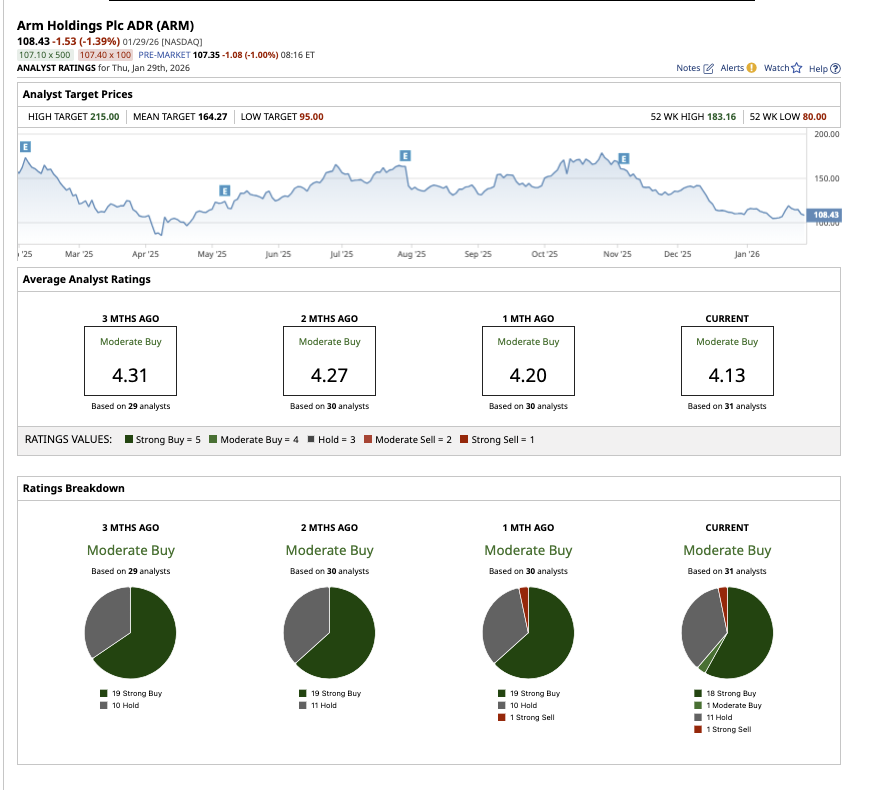

What Does Wall Street Say About ARM Stock?

On Wall Street, ARM stock holds an overall “Moderate Buy” rating. Among the 31 analysts covering the stock, 18 rate it as a “Strong Buy,” one rates it as a “Moderate Buy,” 11 recommend a “Hold,” and one says it is a “Strong Sell.” The stock’s average target price of $164.27 suggests potential upside of 51.5% from current levels, while the highest price estimate of $215 indicates a possible 98.3% rally over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Raised Their CoreWeave Price Target by 40%. Should You Buy CRWV Stock Now?

- Capitalize on Microsoft’s Unusual Options Activity with These Two Bullish Call Strategies

- Here’s How One Trader Screens Stocks to Find Better Covered Call Options Trade Ideas in Minutes

- This AI Chip Stock Could Power the Next Decade. Is It a Buy Ahead of Its Next Earnings Report?