Meta Platforms (META) will release its fourth-quarter financial results on Wednesday, Jan. 28. Over the past three months, Meta shares have fallen about 10%, trailing the broader market and reflecting growing concerns about the company’s near-term profit outlook.

Operationally, Meta’s core business continues to perform well. The company is seeing steady growth in active users and engagement across its family of apps, and advertising revenue remains resilient. These fundamentals reflect the durability of Meta’s social media platforms and their key role in driving advertising revenue.

However, the stock’s recent underperformance is due to Meta’s aggressive investment, particularly in artificial intelligence (AI). The company is ramping up capital expenditures to expand its AI infrastructure and capabilities, a strategy management views as critical for long-term competitiveness. In the short term, though, this elevated spending has raised concerns about margin pressure and earnings volatility. Those worries are amplified by broader market fears that the AI sector may be entering an investment bubble.

Despite the concerns, Meta’s AI initiatives are already showing tangible benefits. Its AI recommendation systems are becoming more effective at delivering relevant, high-quality content, boosting user engagement in turn. Higher engagement supports ad impressions and pricing, helping offset some of the financial impact of increased investment. This dynamic suggests that while costs are rising, Meta is also strengthening the engine that drives its core revenue.

Ahead of earnings, derivative traders are pricing in a post-earnings move of 5.7% in Meta stock in either direction for options expiring Jan. 30. The expected swing is smaller than Meta’s average post-earnings move of 7.1% over the past four quarters. Note that Meta shares tumbled 11.3% following its third-quarter earnings report.

Meta’s Q4 Earnings Outlook: What Investors Should Watch

Meta enters the fourth quarter with strong momentum, driven by steady growth in users across its family of apps, which is likely to boost its advertising revenue. In the third quarter, Meta’s Family of Apps generated $50.8 billion in revenue, a 26% increase year-over-year. Nearly all of that came from advertising, which reached $50.1 billion, also up 26% year-over-year.

That momentum is expected to carry into Q4. Management has guided for total revenue between $56 billion and $59 billion, implying year-over-year growth of 16% to 22%. Advertising is expected to be the primary growth engine, supported by higher engagement and continued demand.

A key driver behind this outlook is the rising number of ad impressions served across Meta’s apps. User growth and deeper engagement, particularly on video, are driving this trend. Video is a major growth area, with time spent on Instagram video up more than 30% year-over-year in the third quarter. As video consumption across Meta’s platforms increases, Reels has grown into a business with an annual revenue run rate exceeding $50 billion. At the same time, ongoing improvements to Meta’s recommendation systems should become increasingly effective as more AI-generated content flows through its ecosystem.

Pricing is also expected to work in Meta’s favor. Average ad prices are likely to rise compared with last year, reflecting strong advertiser demand and better ad performance. The higher impression volumes and improved pricing positions Meta for another solid quarter of top-line growth.

That said, earnings growth is expected to be more restrained than revenue growth. Wall Street expects Meta to post earnings of $8.15 per share, representing a modest 1.6% increase year-over-year. Notably, Meta has a track record of beating expectations, outperforming consensus EPS estimates in each of the past four quarters, including a nearly 10% beat in Q3.

The Bottom Line

Meta’s core business remains strong, led by user growth, engagement, and strong advertising demand. These catalysts provide a solid revenue foundation. The company’s AI investments, while weighing on short-term earnings growth, are already driving improvements in content relevance, engagement, and ad performance.

Thus, if Meta delivers revenue beat and reiterates confidence that AI-driven efficiency gains will increasingly offset higher costs, the stock could regain momentum despite modest EPS growth. Conversely, any signal that capex will accelerate further without a clearer path to margin stabilization could prolong investor caution.

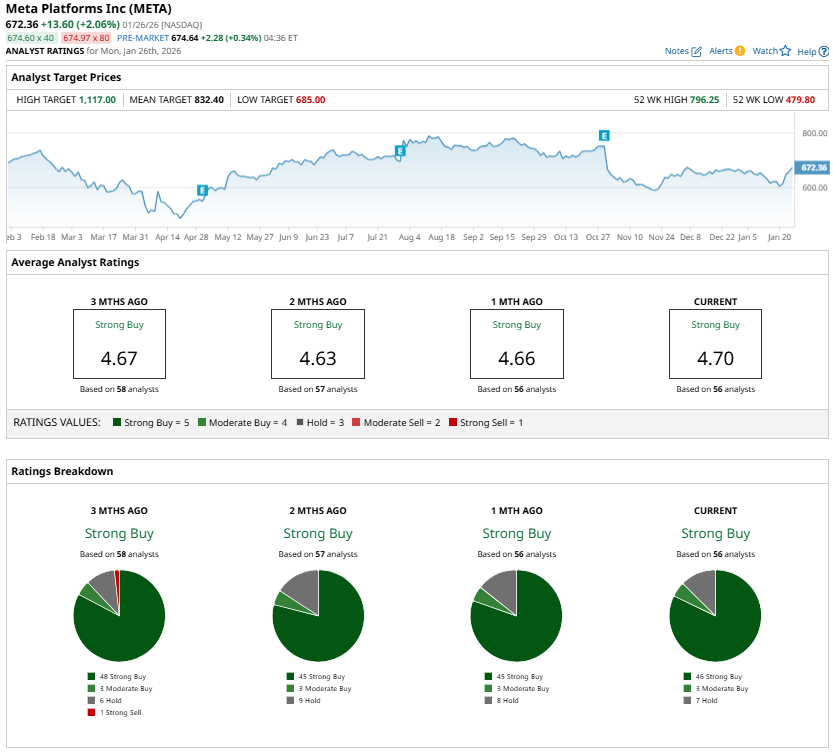

Meanwhile, analysts maintain a “Strong Buy” consensus rating on Meta stock ahead of the Q4 earnings report.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Raytheon's Strong Free Cash Flow and FCF Margin Could Push RTX Stock Higher

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?