PayPal Holdings, Inc. (PYPL) is a leading financial technology company that operates a global digital payments platform connecting merchants and consumers to facilitate online and in-person transactions, money transfers, and various payment services. Headquartered in San Jose, California, PayPal has grown into one of the most widely used payment networks worldwide, serving millions of users and enabling seamless digital commerce. The company’s market cap is around $55.1 billion.

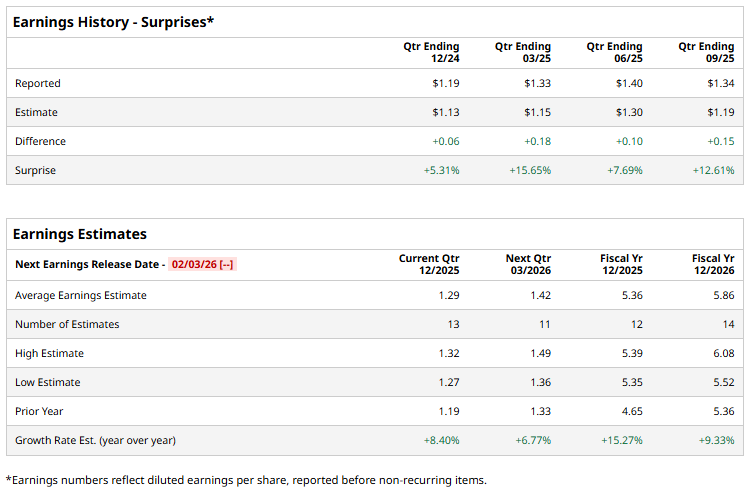

The company is set to unveil its fourth quarter 2025 earnings on Feb. 3, 2026, before market open. Ahead of the event, analysts expect PYPL to report an EPS of $1.29, up 8.4% from the prior-year quarter value of $1.19. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, PayPal’s EPS is expected to come in at $5.36, up 15.3% from $4.65 in fiscal 2024. Plus, in fiscal 2026, its EPS is expected to surge 9.3% year-over-year to $5.86.

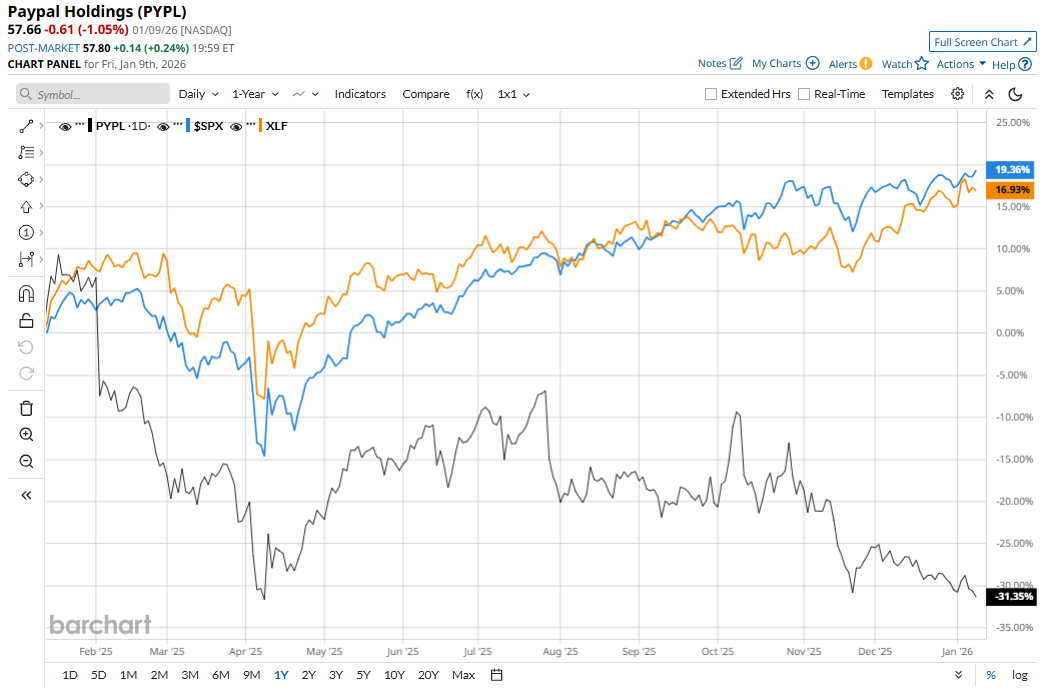

The stock has declined 34.4% over the past 52 weeks, notably underperforming the Financial Select Sector SPDR Fund’s (XLF) 14.9% surge and the S&P 500 Index’s ($SPX) 17.7% gains during the same time frame.

PayPal’s stock has been sliding over the past year largely because of investors’ concerns about slowing growth and increasing competitive pressure in the digital-payments space. In the last reported quarter (Q3 2025), active accounts grew only about 1% year-over-year, while total payment transactions declined 5%, and transactions per active account on a trailing 12-month basis fell 6%, indicating users are transacting less frequently. Also, macroeconomic headwinds like softer consumer spending and tariff-related uncertainties have further weighed on sentiment.

Analysts remain cautious with a “Hold” rating overall. Of the 42 analysts covering the stock, eight recommend a “Strong Buy,” two advise “Moderate Buy,” 27 advocate a “Hold,” one gives a “Moderate Sell,” while four suggest “Strong Sell.” Its average analyst price target is $74.73, indicating a potential upside of 29.6% from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart